Results could be positive catalyst for this health stock

The argument for buying these shares is stronger now than when he tipped them in March, believes overseas investing expert Rodney Hobson. Here’s why.

10th July 2024 09:04

An important step has been taken in extracting healthcare group Johnson & Johnson (NYSE:JNJ) from a costly and distracting legal battle. Meanwhile, the company has been securing its future, giving shareholders hope that results on 17 July will be a turning point for the share price.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The big bugbear is the long-discontinued talcum-based powder products that have prompted unproven claims that they caused cancer. Despite denials of any wrongdoing by J&J, the group has rightly recognised that a lengthy fight through the expensive lottery of the American legal system is not a great idea.

It has now finally agreed a $700 million settlement with 42 states and the District of Columbia to settle allegations that it misled customers. New York state will receive $44 million of the settlement in four instalments over three years, which at least spreads the pain for J&J.

This is far from the end of the story. A proposed $8.9 billion settlement proposed by J&J in April last year that would have resolved all claims with payments spread over 25 years was rejected by a judge but J&J continues to seek a full and final settlement. Here’s hoping.

Meanwhile, the company has been taking steps to ensure that it has a solid immediate future.

The latest news is that its Tremfya antibody has shown good results in treating moderate to severe Crohn’s disease and an application for approval has gone to the US Food & Drug Administration (FDA) to add to a similar application for use of the drug for colitis. This potential breakthrough is important for J&J to cement its status as a world leader in immunology.

Separately, the FDA has given approval for an extension to an already existing use of robotic-assisted treatment for knee problems that allows surgeons to operate without a CT scan. This procedure will increase the number and safety of knee replacement operations in difficult-to-see areas.

There are also hopeful signs for J&J’s amivantamab treatment to tackle lung cancer tumours in combination with other drugs, with indications that it may be safer than existing rival treatments.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Why income investors should buy America

- Funds, trusts and shares to look beyond the ‘Magnificent Seven’

It is vital for any drug company to have this kind of pipeline on the go. When patents for existing products run out, sales tend to drop off a cliff and new drugs that pass earlier tests can fail at later stages.

In corporate deals, J&J has paid $1.25 billion in cash for a company called Yellow Jersey, formerly owned by a Swiss biotech company, which holds the rights to an antibody that treats dermatitis. This promises to become the leading treatment for the most common inflammatory skin disease.

It has also completed the $13 billion acquisition of Shockwave Medical, a California-based medical device company specialising in developing technology to treat coronary artery disease.

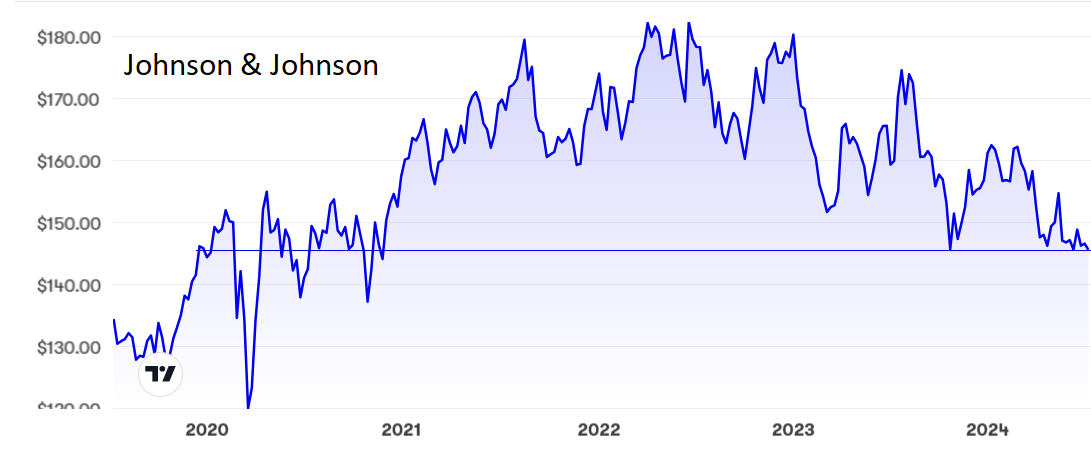

J&J shares have topped $180 several times over the past four years but that talcum powder spat continues to weigh on sentiment and the current level is $147, just above where there has been a floor since last October.

Source: interactive investor. Past performance is not a guide to future performance.

The price/earnings ratio is 21.6, implying that investors fear there is some scope for a further easing of the share price, but the yield at 3.3% offers some compensation.

Hobson’s choice: In March, I suggested that J&J was the sort of share you could safely put in an ISA for the long term. The shares have slipped back a little since then but the argument for buying is similarly a little stronger. There is admittedly some risk with pharmaceutical stocks, but this company has a range of health technology products that mitigate the risk. The downside looks very limited and the shares could move sharply higher if the next set of results are as good as the last ones.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks