A seriously undervalued $60bn stock

This company has significantly outperformed its closest rival over the past few months, and it is now analyst Rodney Hobson’s favourite stock in this sector.

13th November 2024 08:13

Two policy areas look likely to dominate the agenda when Donald Trump resumes the Presidency of the United States in January: tariffs and oil exploration. Trump has pledged to raise tariffs to protect American industry and to ramp up oil drilling. Both policies could help US car manufacturers.

Ford Motor Co (NYSE:F) looks to be doing pretty well on the sales front already. Total vehicle sales increased 15% to 172,756 in October compared with the same month last year, with the biggest rise coming in hybrids, which were up 39%.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

However, there were a couple of black spots. Car sales slumped 27% and electric vehicle sales also slipped at a time when various governments are demanding that showrooms try to make their contribution to saving the environment. Trump will not let this bother his administration unless his new best friend Elon Musk, owner of electric vehicle maker Tesla Inc (NASDAQ:TSLA), makes a nuisance of himself. See Keith Bowman’s analysis of Tesla ii view: Tesla stock rockets on bullish 2025 outlook

Ford further worried investors by revealing that although revenue rose 5.5% to $46.2 billion in the third quarter, net income fell 25% to $900 million. Full-year earnings are likely to be at the bottom end of somewhat optimistic previous guidance, with electric vehicles continuing to lose money. Given that Ford has a higher inventory level than normal – 91 days supply compared with a target of no more than 60 days – there is a serious danger that prices will have to be reduced to clear stock.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- The sectors the pros are watching after US election

There are also worries that cash flow is being squeezed by higher capital expenditure, raising concerns that the dividend will be reduced. Hence the yield of 5.5%, quite high for American stocks.

Yet management remains positive, especially in the light of the strength of the core truck business. It will take time but by this time next year we should be seeing the benefits of investments

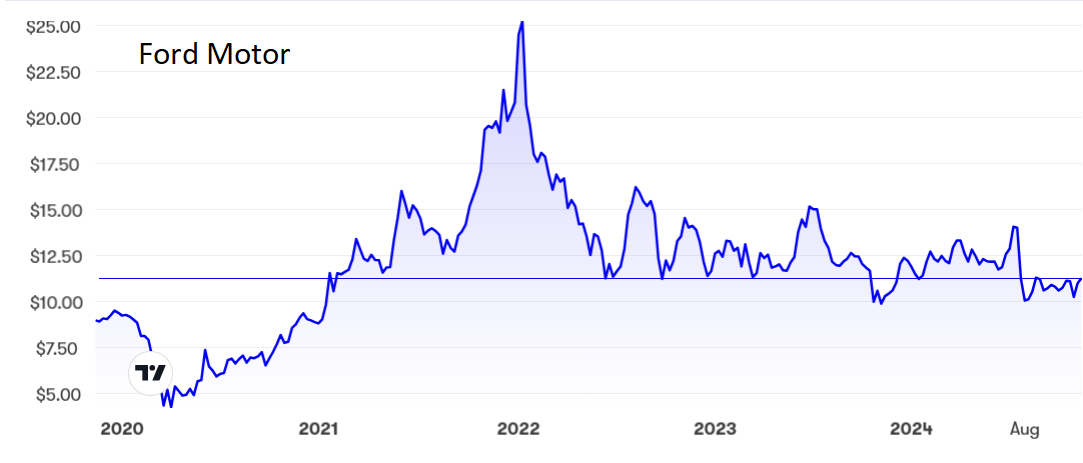

Source: interactive investor. Past performance is not a guide to future performance.

There are far more positive signs at General Motors Co (NYSE:GM), which is gaining market share and, in contrast to Ford, is increasingly enthusiastic about electric vehicles. Revenue rose 11% to $28.8 billion in the third quarter, well ahead of analysts’ expectations, as higher prices held, although net profit disappointingly slipped 0.3%.

Sales even improved in China, a problem market for many manufacturers in recent months, although that could change in the new year if tit-for-tat tariffs become the norm when President Trump takes over.

However, it is the balance between traditional vehicles and electric ones that is exciting at GM. Thanks to judicious investment, its assembly plants are flexible and the long-awaited turnaround in its fortunes looks to be underway.

Net income for the full year is now confidently expected to clearly beat the $10.1 billion achieved in 2023, with a transition from losses to operating profits in electric vehicles coming closer as GM takes its share of the US electric vehicles market into double figures. The aim is to make 200,000 such vehicles this year.

- Costco: a stock you might want to own in bulk

- A US small caps rebirth?

- Tech favourites hitting headlines in record year for S&P 500

Chief executive Mary Barra points to improvements in the distance that electric vehicles can cover between charges and to a reduction in the cost of battery cells.

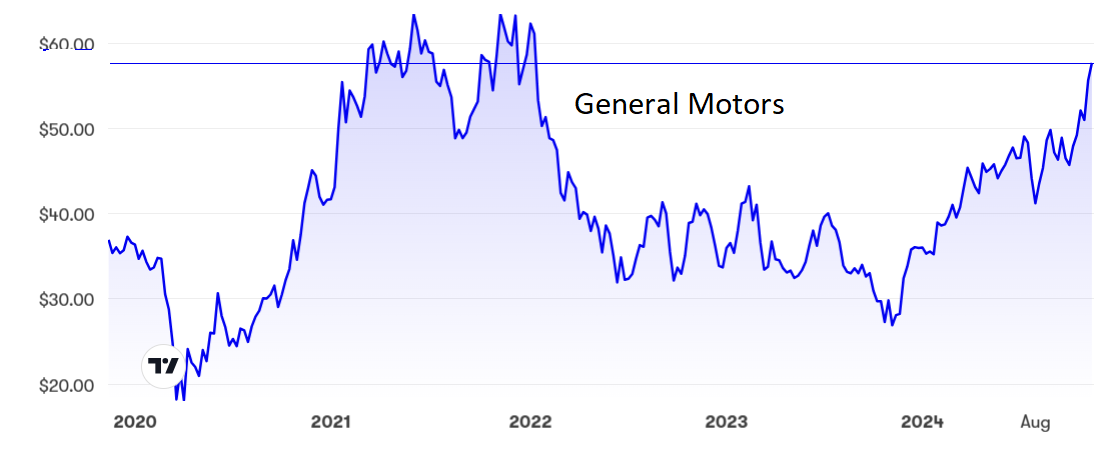

GM shares have been on the rise since dropping below $30 in November last year and look to be pushing towards $60, which they broke above in 2021 and again in 2022. The price/earnings (PE) ratio is still very low at 6.15 but so is the yield at just under 0.8%. Ford shares have been moving sideways between $10 and $15 and seem to be settling at $11, where the PE is 12.8.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: GM looks seriously undervalued even after the recent share price rise, so although the yield is unattractive, the shares are a buy. The Ford chart shows a ceiling forming at a level that was a floor a couple of years ago and are unlikely to move higher. The yield just about makes this a hold. This is a reversal of my view in May, when I preferred Ford, but investors must take account of changes in companies’ fortunes.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks