Share Sleuth: it pained me to sell this winner that made 700%

Richard Beddard explains why he’s waved goodbye to a successful stock he’s held since 2013. He also added to an existing holding that’s the most under-represented share in the portfolio.

8th January 2025 09:01

With a cash balance of just over £10,000, and a minimum trade size of almost exactly £5,000, the Share Sleuth portfolio had the firepower to finish 2024 with a bang.

It could easily afford more of an existing holding, or a new one.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Adding Softcat

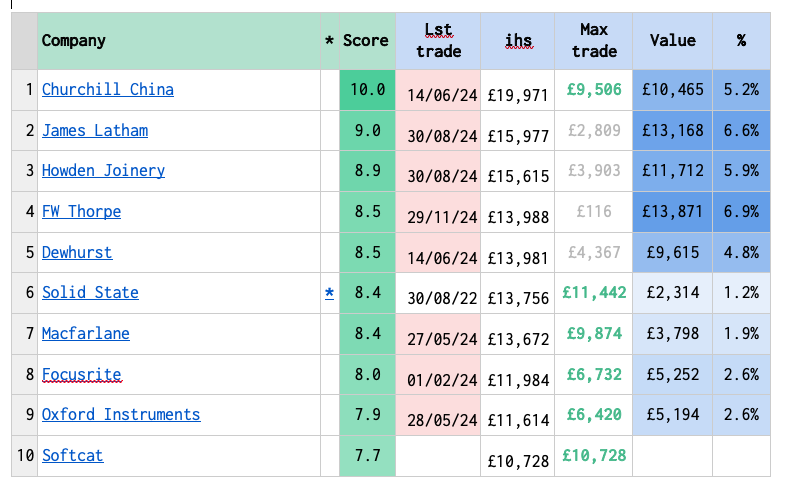

The table below shows the shares with the 10 highest scores according to my Decision Engine on the day I set aside for trading.

The top five, Churchill China (LSE:CHH), Latham (James) (LSE:LTHM), Howden Joinery Group (LSE:HWDN), Thorpe (F W) (LSE:TFW) and Dewhurst Group (LSE:DWHT), are among the biggest holdings in the portfolio. This precludes all but Churchill China from new investment.

Adding more shares in the other four shares at the minimum trade size (set at 2.5% of the portfolio’s value) would increase the size of the holdings above their ideal holding sizes (which are determined by their scores).

All the top five, indeed eight of the top 10, were also ruled out of contention because I have traded them in the last year, although I could have made an exception for Focusrite (LSE:TUNE) (rank 8, score 8.0), which I last traded 11 months ago.

Solid State (LSE:SOLI) (rank 6, score 8.4) and Softcat (LSE:SCT) (rank 10, score 7.7) were prime candidates for investment though.

Solid State, an electronic equipment manufacturer and component distributor, is the most under-represented share in the Share Sleuth portfolio. The Decision Engine calculates its ideal holding size is £13,756, but the value of the holding is only £2,314, leaving a difference (Max trade) of £11,442.

I first added Solid State shares in September 2009, but liquidated the holding in September 2011.

I added the shares again in July 2016, augmented that holding in July 2018, and the portfolio has held the shares in diminishing number ever since. I reduced the holding’s size in February 2019, May 2021 and August 2022.

Those reductions, and the fact that the share price fell off a precipice last October, are the reasons the portfolio’s Solid State holding is so small.

The sell-off in Solid State in 2024 was provoked for a similar reason to a sell-off in 2016.

Source: ShareScope. “b” stands for buy and “s” stands for sell

In 2016, Solid State lost a large contract to supply offender tags to the Ministry of Justice. In 2024, another government department, the Ministry of Defence, put a programme on hold that Solid State is supplying with communications equipment.

The sell-off in 2016 gave me the opportunity to build up the portfolio’s holding in Solid State, so perhaps the same will be true in 2025.

Solid State thinks orders will resume after the conclusion of the Strategic Defence review this summer, but profit will be much lower than expected in the financial year ending in March 2024, and in the year ending March 2025.

The asterisk next to Solid State in the table indicates that I re-scored the share after the bad news, to better account for the risk that large orders are sometimes delayed or fall through.

The score is, therefore, up-to-date. There was nothing stopping me adding more shares, except Softcat…

There was nothing to stop me adding IT reseller Softcat (score 7.7, rank 10) either. I scored it less than two months ago. It would be a new holding, so the difference between £0 and an ideal holding size of £10,728 makes the share the second most under-represented share in the portfolio after Solid State.

I think I will do both trades, but this month I decided on Softcat. I have admired the company’s people-focused business model for years.

To my mind, Solid State’s shares are good value even if it loses the communications order, but since we are unlikely to hear anything definitive about the order until summer there is probably no great hurry to build the holding back up.

Removing Tristel

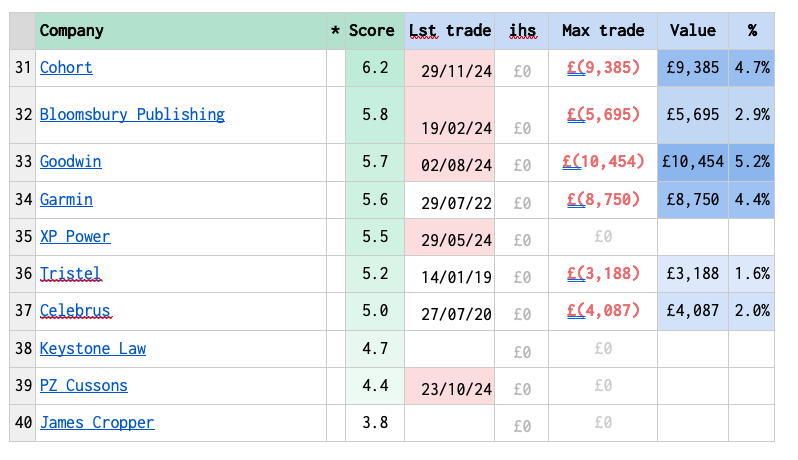

The bottom 10 shares of the 40 scored and ranked in the Decision Engine table included all the system’s “sell” recommendations (as well as two shares the portfolio no longer holds, XP Power and PZ Cussons, and two it has never owned, Keystone Law and James Cropper).

The six holdings look fully valued to me because their high share prices weigh heavily on their scores. All six have scores below 6.25, which equates to an ideal holding size of 2.5% of the total value of the portfolio. The portfolio’s minimum trade size is 2.5%.

Since I do not want lots of tiny holdings that are unlikely to have much impact on performance, the Decision Engine sets the ideal holding size for these shares to zero and nudges me to liquidate them.

- Wild’s Winter Portfolios 2024: riskier portfolio outperforms Wall Street

- Insider: boss deals in Raspberry Pi shares

Cohort (LSE:CHRT), Bloomsbury Publishing (LSE:BMY), and Goodwin (LSE:GDWN) are technically ineligible for trading because I have traded them in the last year.

But Garmin Ltd (NYSE:GRMN) (score 5.6, rank 34), Tristel (LSE:TSTL) (score 5.2, rank 36) and Celebrus Technologies (LSE:CLBS) (score 5.0, rank 37) are in the firing line.

At 1.6% of the portfolio’s total value, Tristel, the maker of hospital disinfectant, was a sub-scale holding, the second smallest after Solid State.

It pained me to liquidate Tristel because the product is unique and the business is prosperous. But the price is high, and the score, which I updated in December precludes me from adding to the holding.

Source: ShareScope. “b” stands for buy and “s” stands for sell.

Tristel has been a tremendous investment. It joined Share Sleuth in 2013 and I reduced the holding in 2015 and 2019. ShareScope tells me the Tristel investment returned 697%, an annual return of nearly 19%.

I will continue to score Tristel, and maybe one day the Decision Engine will nudge me to add it back to the portfolio.

Celebrus is also sub-scale and consequently also at risk. It is only worth 2% of the portfolio’s total value.

Making the trades

On Thursday 29 December 2024, I liquidated 750 Tristel shares, the portfolio’s entire holding.

The price to sell was 4.20p, which raised £3,140 after deducting £10 in lieu of fees.

I also added 326 shares in Softcat, at a price of £15.21p. The total cost was £4,993 including £10 in fees and nearly £25 in stamp duty.

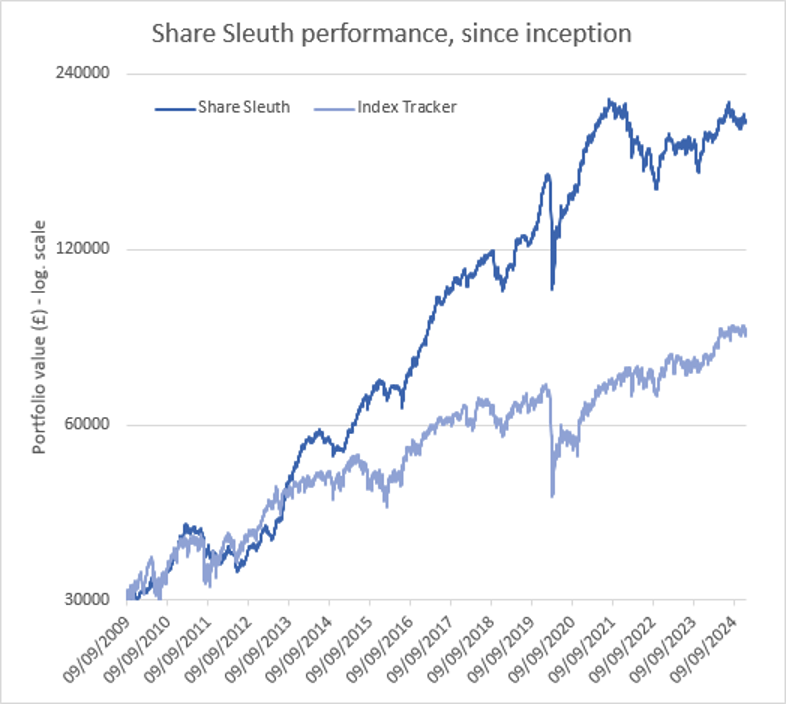

Share Sleuth performance

At the close on Friday 3 January 2025, Share Sleuth was worth £198,548, 562% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth 87,652, an increase of 192%.

Past performance is not a guide to future performance.

After the trades and dividends paid during the month from Bunzl (LSE:BNZL), Garmin, Renishaw (LSE:RSW), and Tristel, Share Sleuth’s cash pile is £8,576.

The minimum trade size, 2.5% of the portfolio’s value, is £4,964.

|

Share Sleuth |

Cost (£) |

Value (£) |

Return (%) | ||

|

Cash |

8,476 | ||||

|

Shares |

190,072 | ||||

|

Since 9 September 2009 |

30,000 |

198,548 |

562 | ||

|

Companies |

Shares |

Cost (£) |

Value (£) |

Return (%) | |

|

AMS |

Advanced Medical Solutions |

1,965 |

4,503 |

3,777 |

-16 |

|

ANP |

Anpario |

1,124 |

4,057 |

4,215 |

4 |

|

BMY |

Bloomsbury |

845 |

3,203 |

5,678 |

77 |

|

BNZL |

Bunzl |

201 |

4,714 |

6,565 |

39 |

|

CHH |

Churchill China |

1,495 |

17,228 |

10,465 |

-39 |

|

CHRT |

Cohort |

861 |

2,813 |

10,418 |

270 |

|

CLBS |

Celebrus |

1,528 |

3,509 |

4,126 |

18 |

|

DWHT |

Dewhurst |

938 |

6,754 |

9,474 |

40 |

|

FOUR |

4Imprint |

116 |

2,251 |

5,597 |

149 |

|

GAW |

Games Workshop |

100 |

4,571 |

13,240 |

190 |

|

GDWN |

Goodwin |

133 |

3,112 |

10,480 |

237 |

|

GRMN |

Garmin |

53 |

4,413 |

8,794 |

99 |

|

HWDN |

Howden Joinery |

1,476 |

10,371 |

11,557 |

11 |

|

JET2 |

Jet2 |

456 |

250 |

6,968 |

2,687 |

|

LTHM |

James Latham |

1,150 |

14,437 |

13,283 |

-8 |

|

MACF |

Macfarlane |

3,533 |

5,005 |

3,851 |

-23 |

|

OXIG |

Oxford Instruments |

241 |

5,043 |

5,061 |

0 |

|

PRV |

Porvair |

906 |

4,999 |

6,396 |

28 |

|

QTX |

Quartix |

3,285 |

7,296 |

5,125 |

-30 |

|

RSW |

Renishaw |

234 |

6,227 |

7,675 |

23 |

|

RWS |

RWS |

2,790 |

9,199 |

4,955 |

-46 |

|

SCT |

Softcat |

326 |

4,992 |

4,955 |

-1 |

|

SOLI |

Solid State |

1,780 |

1,028 |

2,448 |

138 |

|

TET |

Treatt |

763 |

1,082 |

3,556 |

228 |

|

TFW |

Thorpe (F W) |

4,362 |

9,711 |

13,304 |

37 |

|

TUNE |

Focusrite |

2,020 |

14,128 |

5,050 |

-64 |

|

VCT |

Victrex |

292 |

6,432 |

3,060 |

-52 |

Notes

2 January: Removed Tristel (TSTL), added Softcat (SCT)

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £198,548 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £87,652 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 3 January 2025.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s New Year 2025 explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks