A tech stock to buy and one I’d sell

With the Consumer Electronics Show under way in Las Vegas, analyst Rodney Hobson identifies a big name where the possibilities are considerable, and another with ‘daunting fundamentals’.

8th January 2025 09:11

The big US tech companies had a great past year but that is heavily reflected in their share prices, with several reaching astronomical ratings. A number of perceptive interactive investment customers have been buying into smaller but still large operators in the sector, and they could be on the right track.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

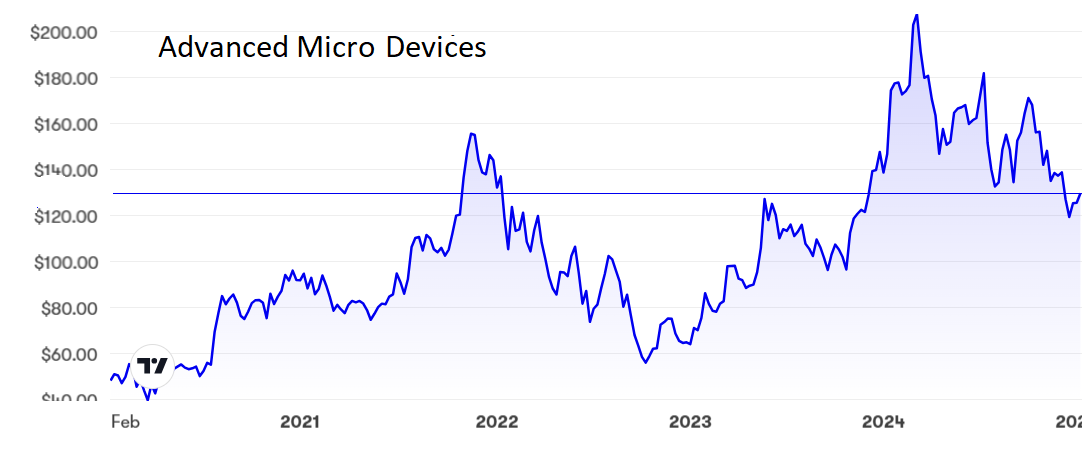

Advanced Micro Devices Inc (NASDAQ:AMD) got off to a bad start last year by downgrading guidance, allocating the blame to a weaker personal computer market. Things have been looking up since then, but the shares are still at a depressed level.

In October it unveiled a wide range of new products and innovations in a perhaps belated attempt to benefit from the soaring demand for artificial intelligence products. This offers far more scope than boring personal computers, where there is admittedly recurring demand but plenty of suppliers.

AMD now rightly sees data centres and AI as “significant growth opportunities”, and it claims to be building strong momentum for its processors with a growing number of customers. New processors will, it believes, deliver a record-breaking performance for data centres of all kinds. It has scored a coup with its Ryzen AI PRO 300 series processors powering new Microsoft Corp (NASDAQ:MSFT) laptops.

More innovative processors are lined up for the second half of 2025 but, in the meantime, AMD decided to put the run-up to the Consumer Electronics Show in Las Vegas to good use. It has just unveiled an expanded range of processors for AI in personal computers and further offerings for business users.

Its processors will power new Dell Pro computers for commercial use. This is likely to be the start of a major collaboration withDell Technologies Inc Ordinary Shares - Class C (NYSE:DELL) that could prove to be really big for AMD.

More such announcements are likely in the days ahead as AMD aims for a proliferation of its AI devices.

- My favourite share for 2025

- The US stocks you were buying in 2024

- My share tips’ performance in 2024 and what I’d do with them now

The shares peaked just above $200 in March last year as AMD benefited from the surge in tech stocks on the Nasdaq exchange. However, when it dawned on investors that there are strugglers as well as winners in every sector, the stock followed a downward trajectory to a low of $120. There have been several dead cat bounces along the way, so the recent recovery to $130 could be another false dawn or a sign that the worst is over.

The price/earnings (PE) ratio is still in triple figures and there is no dividend, nor is there likely to be one in the next few years as cash is devoured in expanding the business. This is definitely not a stock for dividend seekers and an awful lot has to be taken on trust

Source: interactive investor. Past performance is not a guide to future performance.

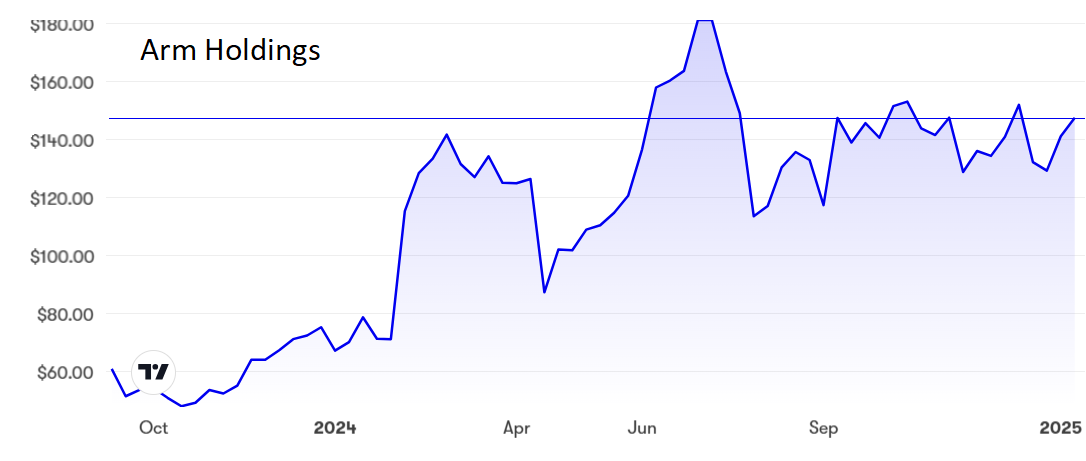

Also popular with British investors is ARM Holdings ADR (NASDAQ:ARM), which is hardly surprising as the company was originally listed in London but decided that it would be loved more in New York.

The shares were listed on Nasdaq at $60.75 in September 2023 and have spent most of the ensuing months above that level. The peak was $181 last July but the stock seems to be settling just below $150.

- US stock market outlook 2025: sectors to own and avoid

- Europe stock market outlook 2025: looking over the cliff edge

Again, there is no dividend and the PE is even more staggering at 240.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: AMD still has much to prove and the newly unveiled promise has to be turned into reality. Nonetheless, the possibilities are considerable and if orders start to roll in the flow could quickly turn into an avalanche. Buy up to $140, where there could be resistance. However, if that ceiling is broken then the shares should power to at least $160.

Given the daunting fundamentals I cannot recommend buying Arm. On balance I would sell and seek better prospects in the sector.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks