Share Sleuth: what I sold, cut, and bought in record trading day

Richard Beddard describes making five trades as a day like no other since the Share Sleuth portfolio was launched nearly 16 years ago.

6th August 2025 08:16

Monday 28 July was a trading day like no other since I started the Share Sleuth portfolio nearly 16 years ago. While I normally restrict myself to one trade, and occasionally two, this time I traded five times.

I had unfinished business with three shares, a runaway success to contend with, and a need to chip away at the portfolio’s growing cash mountain.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Liquidating: Victrex, Treatt and RWS

Let us deal with the unfinished business first. In June, I deleted seven shares from the Decision Engine: those with the lowest-quality scores, amounting to six or less out of nine.

The Decision Engine scores, which guide the size trades in the Share Sleuth portfolio, are the sum of the quality score and a price score. Since the maximum score for price is one, a share that scores six or less for quality can never achieve a score of more than seven.

The number seven is significant because it defines what I consider to be “good value”. Above seven, a share is of sufficient quality and sufficiently cheap to add to the portfolio. A score of between seven and five is fair value.

Since a share with a quality score of six or less cannot achieve a higher score than seven no matter how low the share price goes, technically it is ineligible for new investment.

- Stockwatch: time to lock in profits on these three shares?

- The stock paying half of all FTSE 100 dividend income in August

Three of the shares I deleted were in the Share Sleuth portfolio. They were Victrex (LSE:VCT), Treatt (LSE:TET) and RWS Holdings (LSE:RWS). They were very small holdings and since their scores were too low to justify raising them above the portfolio’s minimum holding size of 2.5% of its total value, I should have liquidated them when I traded in June.

|

# |

company |

description |

score |

qual |

price |

ih% |

h% |

|

- |

Treatt |

Sources, processes and develops flavours esp. for soft drinks |

6.0 |

1.0 |

0.0% |

0.8% | |

|

- |

Victrex |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

6.0 |

1.0 |

0.0% |

1.1% | |

|

- |

RWS |

Translates documents and localises software and content for businesses |

5.5 |

1.0 |

0.0% |

1.2% |

Notes: score is the sum of quality and price scores, ih% is the ideal holding size (which is based on the score), h% is the actual holding size prior to any trades.

I did not trade them, because the portfolio was already awash with cash, and I focused on shares I could add.

Victrex, Treatt, and RWS were such small holdings, their combined value of 3.1% was just over the minimum trade size of 2.5% of the total value of Share Sleuth. Trading all three was a single trade in value terms.

Treatt was the only successful trade of the three. Despite the plunge in its share price since 2022, ShareScope tells me the holding made a near 300% return, which is over 14% annualised.

Success came because I reduced the portfolio’s holding at an auspicious time, just before traders began to lose confidence in Treatt.

Past performance is not a guide to future performance.

Share Sleuth’s Victrex holding lost about 20%, or just over 2% annualised over nearly a decade. I saved the portfolio from greater losses by reducing it in 2022, before most of the damage was done.

Past performance is not a guide to future performance.

The RWS trade was a disaster. It lost 65% of its value in short shrift, an annualised loss of 26%.

Past performance is not a guide to future performance.

All three companies had profitable histories. They were also spending lots of money to support new strategies. Treatt and Victrex invested in new and improved factories and RWS in acquisitions to diversify and improve its machine learning capabilities.

Despite the investments, profits have dwindled at all three. The increase in capital invested has also reduced return on capital. I underestimated the time these strategic pivots would take to pay off, and maybe the risks involved.

On top of these trades, I had two more to make...

Reducing Cohort

The first was Cohort (LSE:CHRT), another trade delayed last month. Cohort makes defence technology. It is a longstanding portfolio member, a good business in a fashionable industry.

But Cohort’s high share price gave it a price score of -2.3. It is the bottom-ranked share with a score of 5.2, approaching a score I consider to be expensive (5.0). Yet Share Sleuth has a large holding worth 6.7% of its total value. The Decision Engine’s suggested holding size is a fraction of the portfolio’s minimum holding size of 2.5% of its total value.

These are all good reasons to reduce or liquidate the portfolio’s holding in Cohort. In addition, Cohort’s directors sold shares worth nearly £10 million in July.

- Stockwatch: how far can this smoking rally go?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

I do not normally take much notice of director sales because they may not be motivated by the prospects of the business or the share price at all. I like to make my own decisions.

However, concerted selling in large quantities could be telling us the directors also agree the shares are pricey and it is a good time to take money off the table.

If I were to follow the Decision Engine’s suggestion to the letter, I would reduce Cohort to a 0.4% holding. A holding of that size is too small to be meaningful.

I tend to cut quality companies down to size. That size being the portfolio’s minimum holding size of 2.5% of the portfolio’s total value.

|

# |

company |

description |

score |

qual |

price |

ih% |

h% |

|

30 |

Goodwin |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

8.0 |

-2.3 |

1.4% |

5.1% | |

|

31 |

Quartix |

Supplies vehicle tracking systems to small fleets and insurers |

7.5 |

-1.8 |

1.3% |

4.7% | |

|

33 |

Cohort |

Manufactures military technology, does research and consultancy |

7.5 |

-2.3 |

0.4% |

6.7% |

Notes: score is the sum of quality and price scores, ih% is the ideal holding size (which is based on the score), h% is the actual holding size prior to any trades.

So far, Cohort has been a great trade for Share Sleuth. According to ShareScope, it has returned 519%, which is over 15% annualised.

Past performance is not a guide to future performance.

I decided not to reduce holdings in Goodwin (LSE:GDWN) and Quartix Technologies (LSE:QTX). They were also highly priced, but the holdings were smaller. Had I reduced them by 2.5% of the portfolio’s value, the minimum trade size, they would have been smaller than the minimum holding size.

Adding Oxford Instruments

These liquidations and reductions released a lot of cash. Since my goal is to keep the Share Sleuth portfolio nearly fully invested in shares, I decided not to wait until next month to start mopping it up.

In Oxford Instruments (LSE:OXIG), I had an obvious investment candidate. I scored the share in July. Its score is eight, its rank is sixth and it is under-represented in the portfolio.

Past performance is not a guide to future performance.

I have more than doubled the size of the portfolio’s holding by adding shares worth about £5,000, which is also about the minimum trade size.

|

# |

company |

description |

score |

qual |

price |

ih% |

h% |

|

4 |

Focusrite |

Designs recording equipment, loudspeakers, and instruments for musicians |

7.0 |

1.0 |

6.0% |

1.6% | |

|

6 |

Oxford Instruments |

Manufactures scientific equipment |

7.0 |

1.0 |

6.0% |

2.3% | |

|

11 |

Hollywood Bowl |

Operates tenpin bowling and indoor crazy golf centres |

7.5 |

0.3 |

5.7% |

0.0% | |

|

12 |

Anpario |

Manufactures natural animal feed additives |

7.0 |

0.8 |

5.6% |

2.2% |

Notes: Score is the sum of quality and price scores, ih% is the ideal holding size (which is based on the score), h% is the actual holding size prior to any trades.

I considered Focusrite (LSE:TUNE), which had the same score, and Hollywood Bowl Group (LSE:BOWL), which would be a new holding. Since I scored those companies, though, I have tweaked my methodology and I have less confidence in their scores.

The top 10 shares excluded from the table were all close to their ideal holding sizes. They are Latham (James) (LSE:LTHM), Thorpe (F W) (LSE:TFW), Howden Joinery Group (LSE:HWDN), Dewhurst Group (LSE:DWHT), Bunzl (LSE:BNZL), Macfarlane Group (LSE:MACF) and Solid State (LSE:SOLI).

Trades

This month there are so many trades, I've put them in a table.

|

Share |

Trade |

# shares |

price |

fees |

value |

|

Treatt |

Liquidation |

763 |

207.83p |

£10.00 |

£1,574 |

|

Victrex |

Liquidation |

292 |

715.88p |

£10.00 |

£2,080 |

|

RWS |

Liquidation |

2,790 |

89p |

£10.00 |

£2,473 |

|

Cohort |

Reduction |

535 |

£14.94 |

£10.00 |

£7,981 |

|

Oxford Instruments |

Addition |

264 |

£18.81 |

£34.83 |

£5,001 |

Notes: Prices are actual prices quoted by a broker. Fees include £10 broker fee and stamp duty where applicable.

Share Sleuth performance

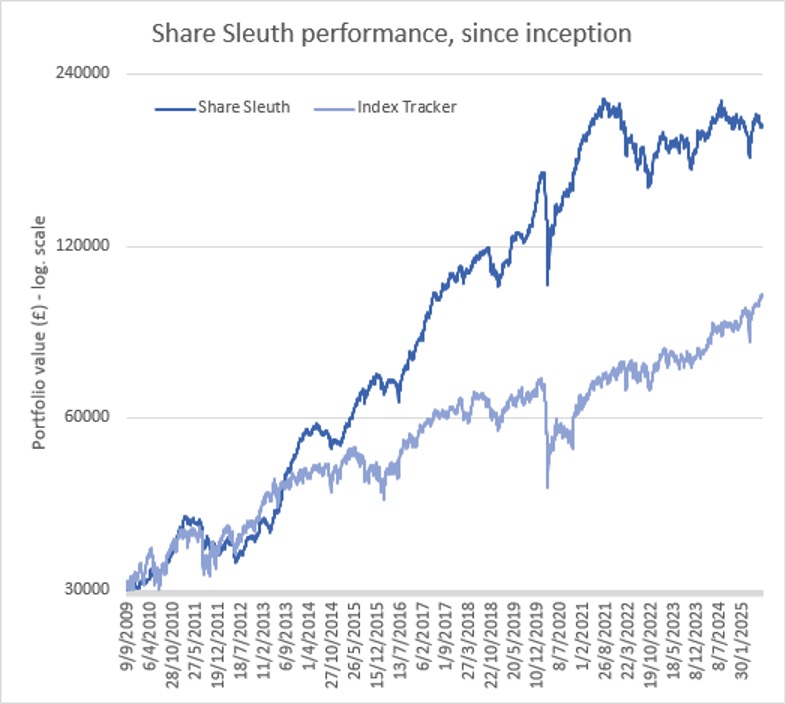

At the close on 1 August, Share Sleuth was worth £193,078, 544% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £97,628, an increase of 225%.

Past performance is not a guide to future performance.

After dividends paid during the month from Advanced Medical Solutions Group (LSE:AMS), Anpario (LSE:ANP), Renew Holdings (LSE:RNWH), and RWS, Share Sleuth’s cash pile is £17,816.

The minimum trade size, 2.5% of the portfolio’s value, is £4,827.

|

Share Sleuth |

Cost (£) |

Value (£) |

Return (%) | ||

|

Cash |

17,816 | ||||

|

Shares |

175,262 | ||||

|

Since 9 September 2009 |

30,000 |

193,078 |

544 | ||

|

Companies |

Shares |

Cost (£) |

Value (£) |

Return (%) | |

|

AMS |

Advanced Medical Solutions |

1,965 |

4,503 |

3,950 |

-12 |

|

ANP |

Anpario |

1,124 |

4,057 |

4,271 |

5 |

|

BMY |

Bloomsbury |

845 |

3,203 |

4,018 |

25 |

|

BNZL |

Bunzl |

417 |

9,798 |

9,341 |

-5 |

|

CHH |

Churchill China |

1,495 |

17,228 |

6,279 |

-64 |

|

CHRT |

Cohort |

326 |

1,118 |

4,551 |

307 |

|

DWHT |

Dewhurst |

938 |

6,754 |

7,434 |

10 |

|

FOUR |

4Imprint |

116 |

2,251 |

4,118 |

83 |

|

GAW |

Games Workshop |

66 |

4,116 |

10,778 |

162 |

|

GDWN |

Goodwin |

133 |

3,112 |

11,491 |

269 |

|

HWDN |

Howden Joinery |

1,476 |

10,371 |

12,723 |

23 |

|

JET2 |

Jet2 |

456 |

250 |

7,323 |

2,829 |

|

LTHM |

James Latham |

1,150 |

14,437 |

12,938 |

-10 |

|

MACF |

Macfarlane |

7,689 |

10,011 |

7,658 |

-24 |

|

OXIG |

Oxford Instruments |

505 |

10,044 |

9,029 |

-10 |

|

PRV |

Porvair |

906 |

4,999 |

6,795 |

36 |

|

QTX |

Quartix |

3,285 |

7,296 |

8,837 |

21 |

|

RNWH |

Renew Holdings |

689 |

4,902 |

5,684 |

16 |

|

RSW |

Renishaw |

234 |

6,227 |

6,798 |

9 |

|

SCT |

Softcat |

326 |

4,992 |

5,196 |

4 |

|

SOLI |

Solid State |

5,009 |

6,033 |

8,390 |

39 |

|

TFW |

Thorpe (F W) |

4,362 |

9,711 |

14,569 |

50 |

|

TUNE |

Focusrite |

2,020 |

14,128 |

3,091 |

-78 |

Notes

July 28: Liquidated Treatt, Victrex and RWS. Reduced Cohort. Added to Oxford Instruments

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £193,078 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £97,628 today

Objective: To beat the index tracker handsomely over five-year periods

Source: ShareScope, close on 1 Aug 2025

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks