Stockwatch: does share’s big discount and 9% yield outweigh risks?

Analyst Edmond Jackson examines this mid-cap’s risk/reward profile in the wake of half-year results.

8th August 2025 11:44

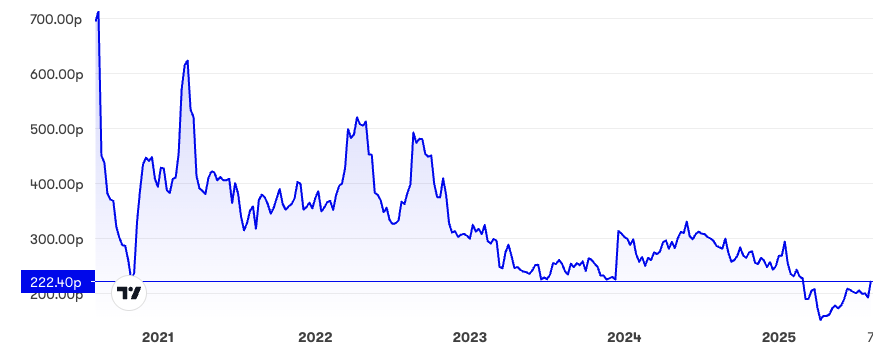

Yesterday’s 9% surge in Harbour Energy (LSE:HBR), the circa £3 billion oil and gas exploration and production group, stood out on a chart that has shown a big decline since the supposed “transformative” acquisition of Wintershall Dea production assets early last year.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

The shares had, however, jumped 17% initially over 240p in response to interim results, then traded steadily down to 222p.

Source: interactive investor. Past performance is not a guide to future performance.

On the face of it, Harbour offers outstanding value

This is a sound, well-established group in terms of operational risk/reward, producing 445,000 to 475,000 barrels of oil equivalent per day from mainly Norway, but also the UK, Germany, Argentina and North Africa. Its last major acquisition in early 2024 has meant higher revenues, lower-cost production and a big weighting to gas.

Perhaps if you are an older investor like me, you recall small-cap Premier Consolidated Oilfields, which became mid-cap Premier Oil, and by 2021, the means by which Harbour gained a UK listing via a reverse takeover.

Yes, Harbour’s 30 June balance sheet involves $5.1 billion (£3.8 billion) goodwill and $5.9 billion “other intangibles” in context of $26.5 billion non-current assets and $6.4 billion net assets. But a group whose history since founding in 2014 is acquisitions-driven is going to bear accumulated goodwill (the price paid over net tangible assets) and exploration acreage justifiably has intangible value (if subject to a write-down if unsuccessful).

A £4.8 billion equivalent net asset value implies market value is exactly two-thirds of this. Meanwhile, and if medium-term consensus forecasts are realistic, net profit over $500 million in 2025, and also 2026, imply a modest forward price/earnings (P/E) multiple around 9x.

Assuming dividends around 27 cents a share, the prospective yield would be 9% and growing. Moreover, and despite heavy capital expenditure, Harbour is a phenomenal cash generator, hence such dividends should be covered several times over by free cash flow, hence the announcement yesterday of a $100 million share buyback programme to 31 March 2026.

The interim results reinforce this scenario, citing a free cash flow upgrade amid strengthened margins. Annual production guidance is marginally upgraded to 460,000 to 475,000 barrels of oil equivalent per day, also the 2025 free cash flow outlook from $0.9 billion to $1.0 billion.

As contributions from Wintershall Dea assets have kicked in, first-half revenue leapt from $1.9 billion to $5.3 billion and free cash flow from $0.4 billion to $1.4 billion. However, due to deferred tax associated with changes to the UK fiscal regime, also $0.2 billion net foreign exchange losses, [and] there was a reported $0.2 billion interim loss.

- Is it time to sell this FTSE 100 high-flyer?

- Share Sleuth: what I sold, cut, and bought in record trading day

That the annual profits and P/E scenario require substantial adjustments and questionable “normalisation” offer first clues as to why Harbour shares trade at an apparent material discount.

Despite their rise from 192p last Friday, the current 222p price represents a 38% discount to 360p/share for $4.2 billion Harbour equity issued in early 2024 as part-consideration for the Wintershall Dea assets. This is still a remarkable fall even if Harbour shares are up 45% from last April’s all-time low of 153p after US “reciprocal tariffs” were declared.

Often in such situations, a debt overhang constrains market equity value from truly reflecting intrinsic value. Harbour did not assume further debt in early 2024, existing Wintershall Dea bonds were transferred, with the 30 June balance sheet showing $5.1 billion longer-term debt contributing to $3.6 billion net debt, hence gearing of 56%, which is manageable given the enlarged group’s cash flow strength. The company’s website shows credit rating agencies around “BBB” for its longer-term bonds.

Harbour Energy - financial summary

Year end 31 Dec

reporting in US$

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover ($ million) | 1,585 | 2,414 | 3,479 | 5,390 | 3,715 | 6158 |

| Operating margin (%) | 28.7 | -28.5 | 18.4 | 47.1 | 25.1 | 26.8 |

| Operating profit ($m) | 455 | -687 | 640 | 2,541 | 932 | 1,648 |

| Net profit ($m) | 164 | -778 | 101 | 8.2 | 45.0 | -93.0 |

| Reported earnings per share (cents) | 343 | -2,208 | 11.6 | 162 | 5.6 | -10.0 |

| Normalised earnings per share (cents) | 397 | 34.4 | 39.3 | 150 | 24.5 | 19.5 |

| Operating cash flow per share (cents) | 2,455 | 3,896 | 185 | 343 | 266 | 148 |

| Capital expenditure per share (cents) | 535 | 1,697 | 73.8 | 70.1 | 99.1 | 122 |

| Free cash flow per share (cents) | 1,921 | 2,199 | 111 | 273 | 167 | 26.0 |

| Cash ($m) | 198 | 668 | 741 | 581 | 456 | 950 |

| Net debt ($m) | 2,704 | 1,655 | 2,800 | 1,482 | 821 | 5,071 |

| Net asset value ($m) | 1,132 | 1,067 | 474 | 1,021 | 1,553 | 6,251 |

| Net assets per share (cents) | 2,721 | 2,306 | 51 | 121 | 202 | 370 |

Source: company accounts

So, are decommissioning costs the elephant in the room?

Harbour’s modestly volatile-downwards chart over five years compares with Shell (LSE:SHEL)’s modestly volatile-upwards one, so in terms of an industry benchmark something is awry with Harbour’s strategy.

I take an Occam’s razor view – in seeking an essential hypothesis – but believe that it is the consequence of “scavenging” for oil & gas assets behind Harbour’s development. I recall this working well, for example, in the 1990s when smaller companies such as Clyde Petroleum and Dana Petroleum bought and honed assets from the “majors”. But what we see on Harbour’s balance sheet is an accumulation of $7.4 billion de-commissioning liabilities classed as a provision under long-term liabilities.

Such is the crux - why are “scavenger” type assets are being sold at all, with vendors reckoning they pose rising risk to their overall value, and having better projects to prioritise; whereas specialist buyers often believe they are skilled at extending lifespans, hence the basis of a trade between both sides.

The joint vendors of Wintershall Dea were German chemical giant Basf SE (XETRA:BAS) and investment group LetterOne. So, yes, you could say BASF might well shed “non-core” assets, and a financial investor would often take profits and reinvest rather than hold long term – especially if a buyer manifests.

But even before this deal, Harbour reported $4.3 billion decommissioning liabilities at the end of June 2023, versus reserve life of just six years on a proven and probable “2P” basis. Wintershall Dea’s accounts had shown $2 billion, [even if it was] unclear what might relate to Russian assets that were not in the deal.

- Stockwatch: time to lock in profits on these three shares?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Note 15 to the interim accounts affirms $7.4 billion liabilities where, mercifully, only 5% are near term. “The payment dates are uncertain and based on economic assumptions of the fields concerned.” I am chiefly concerned that we are looking at a relatively short asset life compared, say, if they were 16 years or longer.

To properly understand Harbour’s risk/reward profile therefore requires a high degree of specialist skill, if not inside information, to discern whether and to what extent the financial returns can outweigh overall liabilities (including debt retirement) and the timing of meeting them. Maybe this happens at teach-ins for industry analysts, but that sounds like giving price-sensitive insights if not information to a select group.

Properly, the accounts – with not even an analyst’s presentation on the company’s website – should give a breakdown of asset life and expected returns versus de-commissioning costs, but I suspect that it is just too complex and uncertain.

It is the nature of the beast how Harbour shares are steeped in this dilemma, with scope to take contrasting views as to net present value (discounting the future stream of net cash flows) representing intrinsic value.

At least in terms of disclosed short positions, there is now only AQR Capital Management, which very slightly edged up its short to 0.50% of the issued share capital as of 25 March, while GLG Partners reduced from 0.57% to 0.49% in mid-June. Although for a £3 billion company, there could be myriad short trades below the 0.50% disclosure threshold. GLG is highly experienced but it is also possible that they now sense downside has extended far enough and, indeed, an aspect of short-closing is now aiding upside.

A highly speculative verdict

Depending on your risk appetite, it’s possible to compare and classify Harbour variously, with less financial-debt risk than small-cap Tullow Oil (LSE:TLW) and more strategic clarity than BP (LSE:BP.) even. Its de-commissioning liabilities and proven/probable reserves’ lifespan make it impossible to reliably assert intrinsic value here, meaning some extent of discount to a rough approximation is going to persist.

Quite what endgame is involved is uncertain. Ideally, E&P businesses hone themselves as attractive takeover targets, but Harbour is effectively a graveyard for game-ending assets. That might rule out the shares for some.

It does appear, however, that operationally things are coming together well, so long as management sweats the assets for a few years, than piles on another demanding takeover.

Much therefore also depends on oil & gas prices, where a slump could be catastrophic versus the de-commissioning liabilities.

But with President Donald Trump turning the screws on Russia via sanctions on India for buying Russian oil, superpower politics look medium-term supportive for energy prices.

I therefore conclude with an overall modest “buy” stance at 228p as of today. You must appreciate this involves pretty high and unquantifiable risks. The shares may also interest chartists and respond to trends given that the challenge to define intrinsic value leaves them open to sentiment shifts.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks