Shares for the future: cheap stock keeps top 10 place

Despite a profits warning and poor financial performance in 2025, analyst Richard Beddard’s score for this company is only a half-point downgrade. Here’s why.

1st August 2025 15:00

We cannot say we were not warned. In November, Solid State (LSE:SOLI) told us it would earn much less revenue and profit in the year to March 2025 than it had expected to, which was already considerably less than it had earned in 2024.

The final result was slightly better than forecasts, which it later released with half-year results in December.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Solid State in numbers: long-term perspective

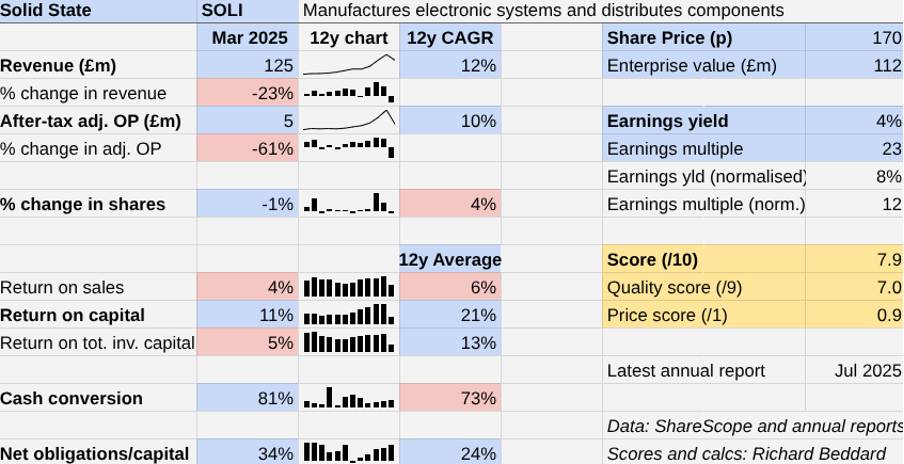

Nevertheless, the headlines are shocking. Revenue fell 23% and adjusted after tax operating profit fell 61%.

Yet Solid State has not given up all the gains of the past. The company earned a lot more revenue and a little more profit than it did in 2020, the last pre-pandemic year.

Remarkably, even though the period ends with a precipitous decline, the company has grown revenue and profit at 10 and 12% compound annual growth rate (CAGR) respectively over the last 12 years. Return on Capital was 11%, seriously below par but still respectable.

Solid State assembles electronic systems like radios, antennas, rugged computers, and battery power packs. It specialises in equipment for harsh and secure environments. It also distributes electronic components.

These two divisions complement each other. The Components division provides Systems with broader market insight. Systems can get Components involved in projects at the design stage. The company has two ways to engage with the same customers.

It aims to be a trusted partner for sourcing, and by providing test and measurement and production facilities.

The customers are blue-chip manufacturing companies serving the industrial, defence, medical and transport sectors. Think Renishaw (LSE:RSW), Airbus SE (EURONEXT:AIR) and Philips Healthcare.

2025 looks bad partly because 2022, 2023 and 2024 were extraordinarily good. In 2022 and 2023, Solid State made hay as customers stockpiled due to shortages after the pandemic. It also won large communications equipment orders from NATO, which resulted in a £33 million revenue and £9 million profit windfall in 2024.

Profit margins halved because the cost of operating Solid State’s factories and warehouses is largely fixed, and the company incurred costs investing in its manufacturing facilities.

Excluding the windfall revenue and adjusting for foreign exchange movements, Solid State says “underlying” revenue fell 2.5% in 2025. This decline was due to an industrial slowdown and continued destocking after the pandemic boom.

- Stockwatch: how far can this smoking rally go?

- The stock paying half of all FTSE 100 dividend income in August

The impact was strongest in the Components division and Custom Power, which is in the Systems division.

Custom Power is Solid State’s battery business named after a US firm Solid State acquired in 2022. Solid State has written off part of its investment in the business and merged it with its UK battery operation.

2025 would have been better, but another £19 million communications equipment order that should have been fulfilled in 2025 was delayed by the UK Strategic Defence Review. It is being fulfilled now.

This series of unfortunate events and misadventures has revealed a strength, and a weakness in Solid State. It is capable of winning really big contracts and fulfilling them at short notice. But this makes profitability much less predictable.

The company expects to earn £8.1 million adjusted operating profit in 2026 (pre-tax), which is a 35% improvement on the £6 million it achieved in 2025. It is being helped by the fulfilment of the delayed communications order, and the order book at Custom Power is growing again.

Beyond 2026, Solid State’s “vision” is that the core business will again achieve the levels of revenue and profit it achieved in 2024 by 2030. Further windfalls would be icing on the cake.

In hindsight, the growth of 2022, 2023 and 2024 was unsustainable. Revenue grew nearly 150%, and profit grew over 200% in three years. That kind of growth is more than adequate spread over a decade, especially if there is also icing on the cake.

But there is a hitch, it hasn't happened yet. And perhaps another one. Solid State tells me the icing on the cake would come in the form of new orders as different user groups in the armed forces upgrade their kit.

Adoption is not guaranteed, but the installed base has already grown considerably and that means more revenue from support and replacement orders in future, which will be chalked up to the underlying business. As the underlying business grows, the impact of big new equipment orders should moderate somewhat in comparison.

Scoring Solid State: filling its facilities

Solid State intends to achieve its vision by filling its factories. When there is spare capacity, overheads drag more on profitability. When the factories are humming, overheads drag less.

In 2025 Solid State increased the capacity of its Antenna facility in Leominster, and right at the beginning of the new financial year this April it opened a new integrated systems manufacturing facility in Tewkesbury.

The integrated systems it makes there are military-grade rugged computer consoles, comprising displays, keyboards, and embedded computers. The company anticipates more demand for this equipment as the Strategic Defence Review ushers in more defence spending and favours UK manufacturing.

- Insider: a £100k bet on FTSE 250 stock at 18-month low

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Antenna sales may get a boost now Solid State has acquired Q-Par USA, Steatite Antenna’s distributor in the US. Antennas and complex systems earn high-profit margins, which explains the investments.

To counter some of the volatility in defence orders, Solid State wants to grow its medical business. In 2025, it contributed 12% of revenue. Like defence, handling and assembling medical equipment must be done in safe, secure facilities which requires multiple accreditations. The products remain in use for a long time.

The Pacer subsidiary in Weymouth is already certified to manufacture medical devices, and the company is seeking accreditation for its battery facilities too.

The Q-Par acquisition was very small, and so probably not very risky. The same is true of another, Gateway Electronic Components, a company Solid State acquired in 2022 for its Components division.

Gateway furthered two other aspects of Solid State’s strategy. It broadened the Component’s division’s range by adding magnetic components, and added an own brand, which Solid State says earn higher margins. Own brands also allow it to source outside China and Taiwan. Increasingly, it is turning to India as a second source.

Unfortunately, Custom Power, Solid State’s flailing acquisition was not small and through a combination of bad luck and perhaps also bad judgment, it looks mistimed and mispriced.

With a £32.9 million price tag, Custom Power was by far Solid State’s biggest acquisition, and it was also its first overseas acquisition. When the board was asked during a full-year results presentation what the company had learned, one of the directors replied candidly that Custom Power and Solid State weren’t speaking the same language. Management was replaced, no doubt with people who did.

Largely because of Custom Power, Solid State’s Return on Total Invested Capital (ROTIC) was only 5% in 2025. This measure includes the value of acquisitions at cost and implies that the company is not yet earning an adequate return on its acquisition spend.

Although Solid State says small “bolt-on” acquisitions are less risky in the current market environment, it is probably also constrained by its weaker than usual financial position. I do not think we can rule out the possibility of another large acquisition in time.

|

Solid State |

SOLI |

Manufactures electronic systems and distributes components |

30/07/2025 |

7.9/10 |

|

How capably has Solid State made money? |

2.0 | |||

|

Under its long-term CEO Solid State has grown revenue and profit through acquisition and investment at single digit CAGRs net of the growth in the share count, despite a collapse in revenue and profit in 2025. Return on Capital is generally strong, and cash flow is decent for a growing capital-intensive firm. | ||||

|

How big are the risks? |

2.0 | |||

|

Lumpy defence contracts and cyclical industrial markets can affect Solid State's performance dramatically. It has a significant but not alarming level of financial obligations. Solid state is acquisitive, and did not earn an adequate ROTIC in 2025. | ||||

|

How fair and coherent is its strategy? |

3.0 | |||

|

Solid State wants to grow its medical business, which shares many of the characteristics of defence with less volatility. It is developing and acquiring its own component brands and assembling more complex systems to increase margins and broaden its range. Solid State's employee retention was 89% in 2025. | ||||

|

How low (high) is the share price compared to normalised profit? |

0.9 | |||

|

Low. A share price of 170p values the enterprise at £112 million, about 12 times normalised profit. | ||||

|

A score of 7.9/10 indicates Solid State is a good long-term investment. | ||||

|

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

My score this year is only a half-point downgrade because of its poor financial performance in 2025 and the impact on long-term growth rates.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Goodwin (LSE:GDWN) and Volution Group (LSE:FAN) have published full-year results, and I expect to rescore them when they publish their annual reports.

Games Workshop Group (LSE:GAW) and Latham (James) (LSE:LTHM) have published annual reports and are due to be re-scored.

|

0 |

company |

description |

score |

|

1 |

James Latham |

Imports and distributes timber and timber products | |

|

2 |

Howden Joinery |

Supplies kitchens to small builders | |

|

3 |

FW Thorpe |

Makes light fittings for commercial and public buildings, roads, and tunnels | |

|

4 |

Focusrite |

Designs recording equipment, loudspeakers, and instruments for musicians | |

|

5 |

Dewhurst |

Manufactures, distributes and fits lift components | |

|

6 |

Oxford Instruments |

Manufactures scientific equipment | |

|

7 |

Renishaw |

Whiz bang manufacturer of automated machine tools and robots | |

|

8 |

Bunzl |

Distributes essential everyday items consumed by organisations | |

|

9 |

Solid State |

Manufactures electronic systems and distributes components |

7.9 |

|

10 |

Hollywood Bowl |

Operates tenpin bowling and indoor crazy golf centres | |

|

11 |

Macfarlane |

Distributes and manufactures protective packaging | |

|

12 |

Anpario |

Manufactures natural animal feed additives | |

|

13 |

Porvair |

Manufactures filters and laboratory equipment | |

|

14 |

James Halstead |

Manufactures vinyl flooring for commercial and public spaces | |

|

15 |

Renew |

Repair and maintenance of rail, road, water, nuclear infrastructure | |

|

16 |

Jet2 |

Flies holidaymakers to Europe, sells package holidays | |

|

17 |

YouGov |

Surveys and distributes public opinion online | |

|

18 |

Bloomsbury Publishing |

Publishes books and educational resources | |

|

19 |

Churchill China |

Manufactures tableware for restaurants etc. | |

|

20 |

Softcat |

Sells hardware and software to businesses and the public sector | |

|

21 |

Games Workshop |

Manufactures/retails Warhammer models, licences stories/characters | |

|

22 |

Advanced Medical Solutions |

Manufactures surgical adhesives, sutures and dressings | |

|

23 |

Judges Scientific |

Manufactures scientific instruments | |

|

24 |

Auto Trader |

Online marketplace for motor vehicles | |

|

25 |

DotDigital |

Provides automated marketing software as a service | |

|

26 |

4Imprint |

Customises and distributes promotional goods | |

|

27 |

Dunelm |

Retailer of furniture and homewares | |

|

28 |

Volution |

Manufacturer of ventilation products | |

|

29 |

Keystone Law |

Operates a network of self-employed lawyers | |

|

30 |

Quartix |

Supplies vehicle tracking systems to small fleets and insurers | |

|

31 |

Goodwin |

Casts and machines steel. Processes minerals for casting jewellery, tyres | |

|

32 |

Tristel |

Manufactures disinfectants for simple medical instruments and surfaces | |

|

33 |

Cohort |

Manufactures military technology, does research and consultancy |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Solid State and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks