Two legendary tech stocks moving with the times that rate a buy

They’ve been around longer than most and are now at the leading edge of AI and cloud computing. Analyst Rodney Hobson explains why he likes them. He also gives an update on Tesla.

30th July 2025 08:01

The new and exciting are always likely to catch the eye in the age of new and exciting technology. Sometimes, however, the old and staid can be a more attractive proposition when they manage to adapt to changed circumstances.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

One information technology services company that has been around a long time is International Business Machines Corp (NYSE:IBM). Indeed, IBM goes all the way back to mechanical technology and pieces of paper, which perhaps accounts for why it is still not widely regarded as a share for the future. Yet IBM is heavily involved in the development of AI, and it is this part of the business that is accelerating with a book that has topped $7.5 billion.

IBM produced excellent figures for the second quarter and promptly raised its outlook for the full year. The quarterly dividend edges up from $1.67 to $1.68, a tiny raise but a step in the right direction.

Second-quarter revenue increased 7.7% to almost $17 billion with net income soaring 20% to $2.2 billion. Free cash flow also improved. All figures beat expectations, as did those for the rather more disappointing first quarter.

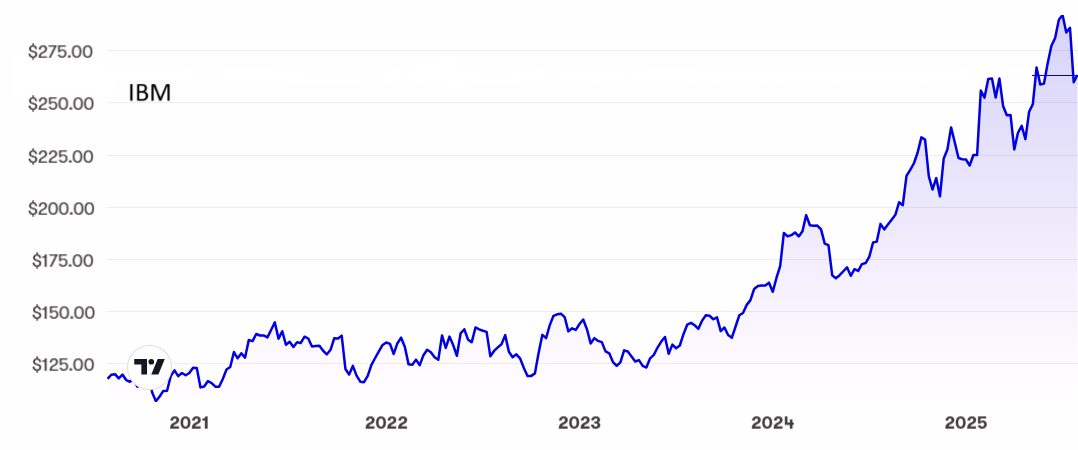

IBM shares have done well since the middle of 2023, when they were only $120, but they have come off a recent peak above $290. They now stand at $262, where the price/earnings (PE) ratio at 45 is demanding for the market as a whole but quite low for an American tech stock. The yield at 2.5% is much better than most stocks listed in New York.

Source: interactive investor. Past performance is not a guide to future performance.

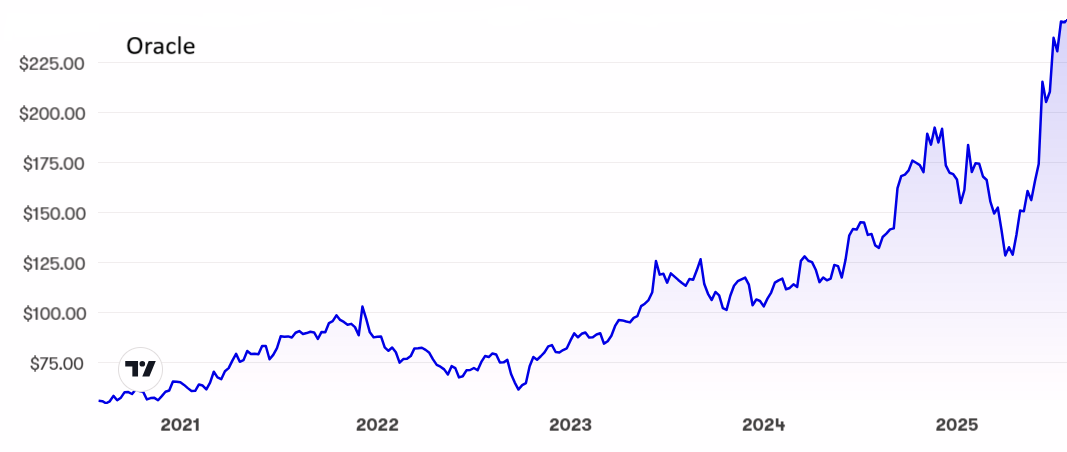

Perhaps investors looking to buy into AI and cloud storage have been distracted by the meteoric performance of Oracle Corp (NYSE:ORCL) since Easter, with the shares doubling from $120 to nearly $250.

Oracle used to be a database software provider, but like IBM it has moved with the times and is now at the leading edge of AI and cloud computing.

Also like IBM, Oracle has raised forecasts, saying high demand for AI services in its database software and hosting facilities will push sales in 2025-26 to $67 billion, $10 billion more than previously thought.

- Here’s where professional investors are piling in

- ii view: Verizon dials earnings growth hopes higher

This update is mainly down to the winning of massive contracts, including an order for “all available cloud capacity” and another worth $30 billion a year from June 2028. Oracle is also involved in US President Donald Trump’s Stargate project building advanced data centres to support the development of AI systems.

The PE ratio is now 57, and although there is a dividend, the yield is only about 0.7%. The only fear is that the company outgrows itself and management cannot cope but there is no sign of that happening yet.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: There should be a floor for IBM shares at $260 so the downside looks limited. I recommended the stock at $191 in March last year and again just below $250 in May this year. The shares are higher but the buy status remains.

The best chance to buy into Oracle has clearly gone but the shares have clear momentum, so they are still a buy. Cautious investors may prefer to hold off and hope to buy on a dip but that may well not happen any day soon.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Where to invest in Q3 2025? Four experts have their say

Update: Investors who failed to take my warnings about Tesla Inc (NASDAQ:TSLA) seriously should read Keith Bowman’s excellent and always balanced analysis of its latest quarterly results, which showed a steep fall in revenue, with profits down 16%. Despite the overall opinion of analysts who cover the stock being “strong hold”, there really is no merit in sticking with this unfolding nightmare. The company says the next few quarters could be tough. You can say that again.

The shares are now just under $330, having recovered most of the sharp drop that accompanied the results. I first advised selling at $340 and repeated the advice at around $300. The continued resilience of the shares is quite extraordinary. Sell now rather than wait for reality to dawn.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks