Shares for the future: a FTSE 250 stock in top half of my list

A recent change of leadership and risks faced by this business have done nothing to reduce analyst Richard Beddard’s faith in the company. He still thinks it’s likely a good long-term investment.

12th July 2024 15:23

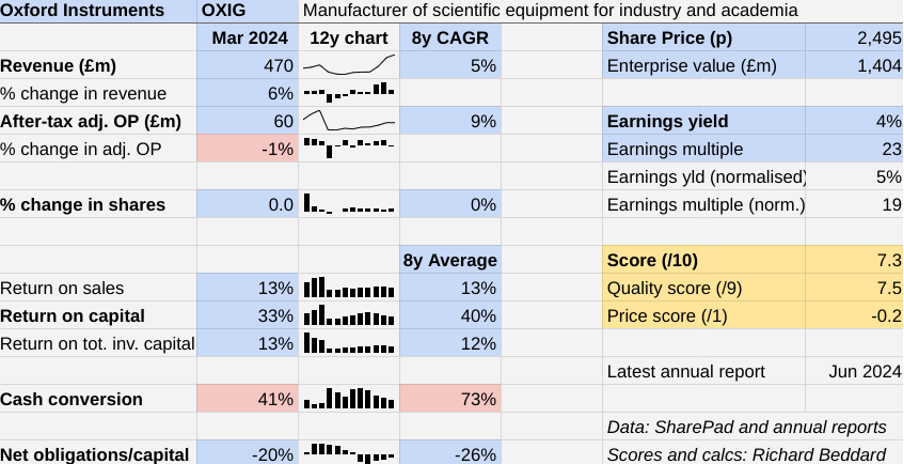

When I evaluated Oxford Instruments (LSE:OXIG) last year, two risks were at the forefront of my mind: a change of management and trade with China, which vies with the US as Oxford Instruments’ biggest market.

Richard Tyson, the incoming chief executive, arrives from TT Electronics, an acquisitive business, but Oxford Instruments has a chequered history when it comes to buying other businesses. Its purchases had mired it in debt by the middle of the last decade.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Ian Barkshire, the chief executive Mr Tyson replaced, turned Oxford Instruments around by focusing the company’s strategy on the businesses it had acquired rather than buying more.

The self-reliant strategy had a marked impact on profitability. Adjusted profit grew at a compound annual growth rate (CAGR) of 15% between 2016 and 2023, while Barkshire was in charge, although revenue grew at a more sedate 5% CAGR.

The source of Oxford Instruments’ profitability is the niche high-tech companies it owns. But niches can be hard to grow, and I feared the new chief executive might turn to acquisitions again, as the primary method of growth.

Oxford Instruments makes equipment to help scientists and technicians analyse and manipulate materials at the smallest scales, camera equipment at the heart of scanning electron microscopes, atomic force microscopes, compound semiconductor manufacturing equipment, and cryogenic environments that house quantum computers, for example.

Last year, it was already clear that increasing geopolitical tension and economic rivalry between Western countries and China would impact the quantum business, a small but high risk, high reward part of the company.

- Stockwatch: time to begin averaging into this sector

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

A year on, we know a little bit more. Oxford Instruments has acquired two firms and it has withdrawn from selling quantum computing products in China due to export restrictions.

On the face of it, my fears have been realised. The new chief executive has already made twice as many acquisitions as his predecessor. And his first set of results includes a 1% reduction in adjusted profit.

Scoring Oxford Instruments: evolution not revolution

It may be too early to write him off, though. The small reduction in profit was outside the company’s control, the result of losses in the quantum business after £23 million in orders were removed from the order book.

The Past (dependable) [3]

- Profitable growth: 5% CAGR revenue growth, 9% profit growth [1]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest RoC 24% in 2017 [1]

The other concerning statistic in Oxford Instruments’ results for the year to March 2024 is cash conversion, which has been sub-par for three consecutive years.

There are mostly good reasons for the company’s thirst for cash. Predominantly it has been holding high levels of safety stock to ensure it can supply customers during the unstable inflationary period we have gone through. It has built a new compound semiconductor systems manufacturing facility in Bristol, and it is expanding its microscopy and camera facility in Belfast.

These are investments in customer relationships and capacity respectively, and should yield higher cash flow in future.

However, the company was wrong-footed by a decline in orders in its optical imaging businesses due to customer overstocking, and also the elimination of quantum-related orders in China, which left it with higher than anticipated levels of stock.

Hopefully Oxford Instruments will shift this stock in the current year, improving cash flow. Its order book is strong and, without providing specifics, the company has expressed confidence in its performance in the current year.

The Present (distinctive) [2.5]

- Discernible business: Niche high-tech subsidiaries [1]

- With experienced people: new CEO, experienced CFO [0.5]

- That creates value for customers: Tools that move science forward [1]

Although Barkshire has gone, the executive team that restored Oxford Instruments to stable, profitable growth is still half there in the form of chief financial officer Gavin Hill. He joined the month after Barkshire in 2016.

The Horizon strategy they oversaw put the emphasis on market intimacy (making sure the company’s products were relevant) and restless innovation. The strategy increased the level of R&D at Oxford Instruments to 8-9% of revenue and focused it on products with broad research or manufacturing applications, rather than bespoke products.

One of the products going mainstream is an etch and deposition system designed for compound semiconductor research, which the company has developed into a volume manufacturing technology. Compound semiconductors, made from more than one element, are more powerful than the ubiquitous silicon chip.

This is the reason why Oxford Instruments has tripled its manufacturing capacity with the new facility in Bristol.

The Future (directed) [2]

- Addressing challenges: China is 27% of sales [0.5]

- With coherent actions: Investment, acquisitions [0.5]

- That reward all stakeholders fairly: Engaged employees [1]

I found the annual report for 2024 reassuring. There is no big strategic shift. The chair’s statement honours the Horizon strategy for “building the strong foundations from which we move forward today”.

Tactically, Oxford Instruments has responded to the export restrictions by reducing the headcount at the quantum business and refocusing it on the US and Europe. In China, it is focusing sales on less-sensitive markets like battery and materials analysis.

Despite the lost orders, Oxford Instruments earned 27% of revenue in China, making it the biggest geographical market in 2024. It overtook the US, which brought in 24% of revenue.

The company says it has a healthy pipeline of business in China, but we cannot rule out the possibility of further complications in the trading relationship with the UK, which makes me cautious about the prospects there.

Strategically, Oxford Instruments is drawing a line between Advanced Technologies and Imaging and Analysis, which from this year will be the two segments it reports.

- Stockwatch: four stocks to back a UK building boom

- Three new ‘buy’ tips and some ‘abnormally cheap’ stocks

This restructuring groups businesses making established technologies together in an Imaging and Analysis division. These are microscopy equipment, cameras, analytical instruments and associated software. They have much in common and will benefit by working together and sharing costs.

Oxford Instruments’ comments on the quantum business show it is a different kind of business. As well as the export restrictions, the company lists other complications: operational challenges, long project timelines and the associated uncertainty that goes with technologies at the forefront of science.

The company is grouping it with other businesses that require a more individual approach in an Advanced Technologies divisions. They are the compound semiconductor systems business, and X-ray tubes. These subsidiaries need more independence to address unique challenges, and get closer to specific customers.

Advanced Technologies contributed about 30% of Oxford Instruments’ revenue in 2024 on a pro-forma basis, but unsurprisingly produced very little profit. This should improve now the company has refocused the quantum business and the new semiconductor facility is operational.

Otherwise, the annual report talks of protecting and enhancing core strengths, including maintaining its commitment to R&D spending at 8-9% of revenue, a promise to put the customer first and increase collaboration and accountability.

Its new mission is to “accelerate the breakthroughs that create a brighter future for our world”.

- The Income Investor: two FTSE 100 stocks where dividends count

- The Analyst: Dzmitry Lipski’s investment insights

Selective acquisitions remain part of the strategy, and although there are already more acquisitions under the new management, neither have radically changed the business.

First Lighting is a scientific camera manufacturer that will be folded into Oxford Instruments’ Andor subsidiary.

FemtoTools makes tools used in electron and Raman microscopy.

Like First Lighting it will find its home in the more homogeneous Imaging and Analysis division, in line with its policy to acquire new capabilities for it.

The total cost of the two acquisitions is likely to be around one year’s cash flow at the suppressed level of 2024.

Tyson has only been chief executive since last October. It is far too early to draw more than tentative conclusions about his impact, but the new divisional structure seems sensible and the acquisitions do not look risky.

Employees have not walked out. Staff turnover remains respectable at 9% and employee engagement is also the same as it was in 2023, at 78%.

The price (discounted?) [-0.2]

- No. A share price of £24.95 values the enterprise at about £1.4 billion, 19 times normalised profit.

A score of 7.3 out of 10 indicates Oxford Instruments is probably a good long-term investment.

It is ranked 16 out of 40 shares in my Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Bloomsbury Publishing (LSE:BMY), Auto Trader Group (LSE:AUTO), and Marks Electrical Group Ordinary Shares (LSE:MRK) have all published annual reports and are due to be re-scored.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Manufactures tableware for restaurants and eateries |

9.8 | ||

|

2 |

Designs recording equipment, loudspeakers, and instruments for musicians |

9.0 | ||

|

3 |

Supplies kitchens to small builders |

8.6 | ||

|

4 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

5 |

Distributor of protective packaging |

8.3 | ||

|

6 |

Whiz bang manufacturer of automated machine tools and robots |

7.9 | ||

|

7 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

7.9 | ||

|

8 |

Surveys and distributes public opinion online |

7.8 | ||

|

9 |

Imports and distributes timber and timber products |

7.7 | ||

|

10 |

Manufactures filters and filtration systems for fluids and molten metals |

7.7 | ||

|

11 |

Manufactures/retails Warhammer models, licences stories/characters |

7.7 | ||

|

12 |

Distributes essential everyday items consumed by organisations |

7.6 | ||

|

13 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.5 | ||

|

14 |

Online retailer of domestic appliances and TVs |

7.4 | ||

|

15 |

Sources, processes and develops flavours esp. for soft drinks |

7.4 | ||

|

16 |

Oxford Instruments |

Manufacturer of scientific equipment for industry and academia |

7.3 | |

|

17 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.2 | ||

|

18 |

Translates documents and localises software and content for businesses |

7.0 | ||

|

19 |

Sells hardware and software to businesses and the public sector |

7.0 | ||

|

20 |

Manufactures natural animal feed additives |

7.0 | ||

|

21 |

Manufactures vinyl flooring for commercial and public spaces |

6.8 | ||

|

22 |

Operates tenpin bowling and indoor crazy golf centres |

6.7 | ||

|

23 |

Sells promotional materials like branded mugs and tee shirts direct |

6.7 | ||

|

24 |

Flies holidaymakers to Europe, sells package holidays |

6.6 | ||

|

25 |

Retails clothes and homewares |

6.6 | ||

|

26 |

Supplies vehicle tracking systems to small fleets and insurers |

6.5 | ||

|

27 |

Manufactures specialist paper, packaging and high-tech materials |

6.4 | ||

|

28 |

Repair and maintenance of rail, road, water, nuclear infrastructure |

6.4 | ||

|

29 |

Online marketplace for motor vehicles |

6.3 | ||

|

30 |

Manufactures rugged computers, battery packs, radios. Distributes electronics |

6.2 | ||

|

31 |

Makes marketing and fraud prevention software, sells it as a service |

6.1 | ||

|

32 |

Manufactures military technology, does research and consultancy |

6.1 | ||

|

33 |

Manufactures sports watches and instrumentation |

6.0 | ||

|

34 |

Acquires and operates small scientific instrument manufacturers |

5.7 | ||

|

35 |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.7 | ||

|

36 |

Manufactures power adapters for industrial and healthcare equipment |

5.5 | ||

|

37 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.4 | ||

|

38 |

Publishes books, and digital collections for academics and professionals |

5.2 | ||

|

39 |

Runs a network of self-employed lawyers |

4.5 | ||

|

v Frozen v | ||||

|

? |

Develops and manufactures hygiene, baby, and beauty brands |

7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Shares marked with a question mark are more speculative.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks