Shares for the future: now is a good time to own this stock

This profitable and well-managed company’s share price is low relative to past earnings, and trading should improve. It’s why analyst Richard Beddard thinks it’s probably a good long-term investment.

5th July 2024 15:26

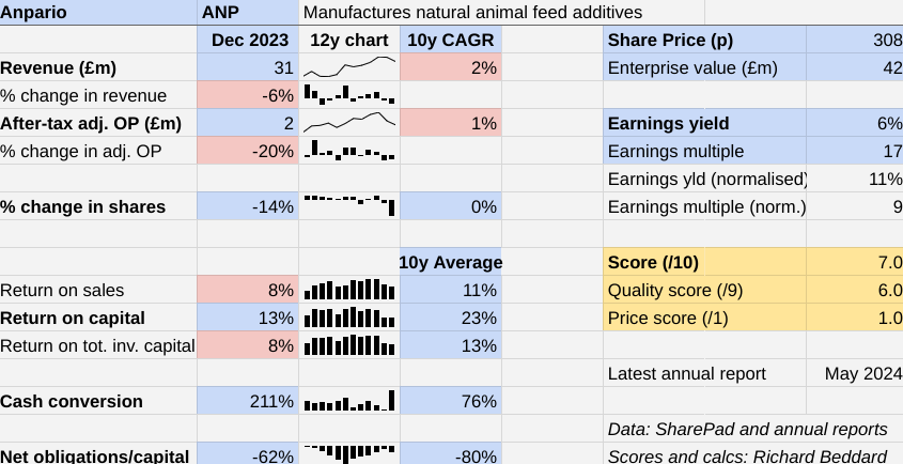

A second successive year of lower revenue and profit have made animal feed additive manufacturer Anpario (LSE:ANP)’s financial history look rather ordinary.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Scoring Anpario: after a difficult two years....

Farmer’s profit margins had already been squeezed by high feed and energy costs, when the cost-of-living crisis hit last year and we reduced the amount of meat that we eat.

The Past (dependable) [2.5]

- Profitable growth: Difficult to gauge [0.5]

- Strong finances: very [1]

- Through thick and thin: Lowest return on capital 13% (2023) [1]

Producers cut production rather than lose money, used less feed, and sought to reduce input costs by choosing cheaper feed additives.

In turn, suppliers reduced prices. These unholy trading conditions were aggravated by high inventories, a legacy of the prior year’s supply shortages, which means customers could satisfy some of their needs from their own stock.

Demand for Anpario’s more commoditised feed additives, among them Mycotoxin binders and Acid Based Eubiotics (ABEs) fell sharply.

Mycotoxin binders combine with poisons produced by mould in animal feed and render it indigestible. ABEs alter the animal gut chemistry killing bugs such as salmonella.

Revenue from these products declined 23% in the year to 2023, and profit margins fell too.

- Share Sleuth: the double trade that cleared my cash pile

- Best UK stocks, sectors and markets in first half of 2024

In response to these problems and ongoing outbreaks of diseases like African Swine Fever and Avian Influenza, Anpario reduced its workforce, principally production roles. It further automated its factory, and focused sales on its unique “value added” products, which grew.

Since it was able to liquidate excess stock held in the aftermath of the pandemic due to supply shortages, one number, cash conversion, moved in the right direction.

Net cash would have improved from already high levels too, were it not for a £9 million tender to buy back shares during the year.

Recovery started in the last quarter of the year as volumes rose and efficiencies kicked in, and the improvement has continued into the current financial year.

However, the single forecast available in SharePad suggests that in the year to December 2024, profitability will still be some way shy of 2019, the last year before the pandemic, and even further behind peak revenue and profit in 2021.

The Present (distinctive) [2]

- Discernible business: Unique natural animal feed additives [0.5]

- With experienced people: Yes [1]

- That creates value for customers: More productive animals (at a cost) [0.5]

Anpario makes specialised animal feed additives. Its “value added” phytogenics are natural growth promoters that work by making animals more healthy.

They are more expensive alternatives to antibiotic growth promoters, which are to various extents banned or regulated in many parts of the world because of their role in increasing resistance to antibiotics in humans.

Its “value added” product portfolio includes Orego-Stim, Optomega and pHorce.

The principal ingredient of Orego-stim is natural oregano oil, which has antibiotic and parasiticidal properties. The company’s research shows chickens fed Orego-stim produce more meat and lay more eggs. Optomega is an omega3 supplement derived from sustainable fish oil or algae, which improves the fertility of cows and increases milk yields, for example. It may also reduce methane output, which is a greenhouse gas. pHorce is a blend of acids carried into the animal gut in a unique matrix. Once there, it kills viruses, bacteria and fungi.

Sales of these added value products increased 15% to 54% of total revenue in 2023. The growth is impressive but also emphasises just how vulnerable the rest of the range is to competition.

Chief executive Richard Edwards has led Anpario since 2006, initially by acquiring new products and subsequently by establishing a global distribution network with its own offices in the major and often far-flung meat producing regions of North and South America and Asia.

Finance director Marc Wilson joined the company in 2010 and was promoted in 2021. Anpario says it values long-service and his promotion may be indicative of its policy to train and promote from within.

The Future (directed) [1.5]

- Addressing challenges: Global distribution, capricious markets, climate change [0]

- With coherent actions: More control of distribution, diversification, sustainability [0.5]

- That reward all stakeholders fairly: Modest executive pay, environmental credentials, employee focus [1]

Anpario is the product of a series of acquisitions, a process chief executive Richard Edwards once compared to climbing a mountain. Following each acquisition, the company pauses for breath while it integrates it.

But despite having the financial resources to keep its buy and build strategy, Anpario has not acquired another feed additive manufacturer since Meriden in 2012.

Since then it has integrated the businesses under the single Anpario brand, and built a global distribution network by selling the science. The company's people and distributors use trial studies to persuade farmers that its products make animals healthier and more productive.

The magnitude of this task should not be underestimated. Anpario is a small business. It earned £31 million revenue in 2023 and employed an average of 115 people.

The company’s biggest animal market is poultry, but it is also selling newer products in the aquaculture and ruminant markets and talking to pet food manufacturers.

This period of mostly organic growth has coincided with slower growth.

Picking a probable low year as the end of our measuring period is mean, but that is where we are. Over the last decade, Anpario has grown revenue at a Compound Annual Growth Rate of 2%. Profit has grown at 1% CAGR.

Being more generous, we can measure growth from the same start year to peak revenue and profit in 2021. Over the seven years to that year, revenue had grown 5% CAGR and profit 10%.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- 18 FTSE 100 stocks about to return billions in dividend income

Given the susceptibility of farmers’ profitability to input prices, fluctuations in consumer prosperity, and disease, I can only imagine more, but perhaps less extreme, ups and downs in future.

Revenue could be accelerated by acquisitions, but only if Anpario can find businesses that meet its suitability and valuation criteria. The fact that it has tried, but not succeeded for more than 10 years, suggests that opportunities may be thin on the ground.

Small family-owned businesses rarely come to market, and Anpario tells me they are often snapped up by private equity buyers with fat wallets.

Looking further ahead, there is another complication. Meat farming is a major emitter of greenhouse gases.

Anpario can help reduce emissions because healthy animals are more productive and belch less methane, and it is striving to find sustainable sources of raw materials.

But it is not clear to me that Anpario would be a net beneficiary should governments act to suppress meat production (the Danish government is introducing legislation) or encourage less consumption.

For all of these reasons: capricious markets, a stalled acquisition programme, and climate risk, my sense of how big and prosperous Anpario might be in 10 years’ time is weak.

The price (discounted?) [1]

- Yes. A share price of 308p values the enterprise at about 308p, 9 times normalised profit.

Now is probably a good time to own Anpario shares. The share price is low relative to past earnings, and trading should improve.

A score of 7 out of 10 indicates that Anpario is probably a good long-term investment because the company is profitable and well managed, but it may well be an uphill struggle nevertheless.

It is ranked 20 out of 40 shares in my Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Auto Trader Group (LSE:AUTO), Oxford Instruments (LSE:OXIG), and Bloomsbury Publishing (LSE:BMY) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

I am phasing this system out in favour of re-scoring companies when the facts change or my opinion does mid-term.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Manufactures tableware for restaurants and eateries |

9.9 | ||

|

2 |

Designs recording equipment, loudspeakers, and instruments for musicians |

9.0 | ||

|

3 |

Supplies kitchens to small builders |

8.6 | ||

|

4 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

5 |

Distributor of protective packaging |

8.4 | ||

|

6 |

? |

Manufacturer of scientific equipment for industry and academia |

8.1 | |

|

7 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.0 | ||

|

8 |

Surveys and distributes public opinion online |

8.0 | ||

|

9 |

Whiz bang manufacturer of automated machine tools and robots |

7.9 | ||

|

10 |

Manufactures filters and filtration systems for fluids and molten metals |

7.8 | ||

|

11 |

Imports and distributes timber and timber products |

7.8 | ||

|

12 |

Distributes essential everyday items consumed by organisations |

7.7 | ||

|

13 |

Manufactures/retails Warhammer models, licences stories/characters |

7.7 | ||

|

14 |

? |

Develops and manufactures hygiene, baby, and beauty brands |

7.5 | |

|

15 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.5 | ||

|

16 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.4 | ||

|

17 |

Sources, processes and develops flavours esp. for soft drinks |

7.4 | ||

|

18 |

Online retailer of domestic appliances and TVs |

7.3 | ||

|

19 |

Translates documents and localises software and content for businesses |

7.0 | ||

|

20 |

Anpario |

Manufactures natural animal feed additives |

7.0 | |

|

21 |

Manufactures vinyl flooring for commercial and public spaces |

6.8 | ||

|

22 |

Sells promotional materials like branded mugs and tee shirts direct |

6.8 | ||

|

23 |

Operates tenpin bowling and indoor crazy golf centres |

6.7 | ||

|

24 |

Supplies vehicle tracking systems to small fleets and insurers |

6.7 | ||

|

25 |

Sells hardware and software to businesses and the public sector |

6.6 | ||

|

26 |

Flies holidaymakers to Europe, sells package holidays |

6.6 | ||

|

27 |

Repair and maintenance of rail, road, water, nuclear infrastructure |

6.4 | ||

|

28 |

Manufactures specialist paper, packaging and high-tech materials |

6.4 | ||

|

29 |

Retails clothes and homewares |

6.4 | ||

|

30 |

Online marketplace for motor vehicles |

6.3 | ||

|

31 |

Manufactures rugged computers, battery packs, radios. Distributes electronics |

6.2 | ||

|

32 |

Makes marketing and fraud prevention software, sells it as a service |

6.2 | ||

|

33 |

Manufactures military technology, does research and consultancy |

6.2 | ||

|

34 |

Manufactures sports watches and instrumentation |

6.0 | ||

|

35 |

Acquires and operates small scientific instrument manufacturers |

5.8 | ||

|

36 |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.6 | ||

|

37 |

Manufactures power adapters for industrial and healthcare equipment |

5.5 | ||

|

38 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.4 | ||

|

39 |

Publishes books, and digital collections for academics and professionals |

5.3 | ||

|

40 |

Runs a network of self-employed lawyers |

4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Anpario and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks