Shares for the future: speculative small-cap with a compelling model

Companies analyst Richard Beddard delivers his verdict on this firm, where despite numbers being encouraging, two things unnerve him.

15th August 2025 15:00

I was in two minds about reviewing Keystone Law Group Ordinary Shares (LSE:KEYS) in full this year. The very high share price, novelty of the business model and lack of experience with law intimidated me when I scored it in January 2024, and it has languished near the bottom of the Decision Engine table since then.

Having updated my Decision Engine with subsequent results, I may have a better appreciation of what makes Keystone special.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Keystone Law: platform business

Keystone Law serves the mid-market, the 200-odd law firms smaller than the top 15, but big enough to supply a wide range of legal services mainly to small and medium-sized enterprises. Their combined income is about £10 billion.

Traditionally, law firms are organised as partnerships. The senior lawyers own and operate the firm sharing in its profits and liabilities.

Legal changes in the first decade of this century spawned alternatives to the traditional partnership, allowing law firms to list on the stock market and adopt different business models.

James Knight, Keystone’s chief executive, founded the firm in 2002 to pioneer a dispersed business model. Most of the lawyers that work for Keystone are self-employed or work for its self-employed principals (senior lawyers).

Keystone is a platform that provides the services senior lawyers need to operate independently, except for the legal training and client base they bring from their old jobs working for more traditional law firms.

It supplies a brand, insurance and legal support from a small team of junior lawyers. It facilitates collaboration, bills customers, and distributes payments to the lawyers, less Keystone’s cut.

- The Income Investor: upbeat dividend prospects at FTSE 100 stock

- Shares for the future: how I navigated my trading dilemma

Although they are self-employed, Keystone lawyers sometimes work in teams and refer work to each other. Keystone Law pays its lawyers 60% of the fees it collects plus 15% if they recruit the client.

The upside for lawyers is they control how much work they do, get to focus on the law rather than management and organisational politics and, Keystone Law says, they get paid more for their work.

Keystone says it treats lawyers like clients, hence it believes it is the happiest law firm in the country. Sadly it does not publish its annual lawyer survey but it says feedback is “overwhelmingly positive”.

Pay though, is variable, which is the price of freedom from the partnership structure, which confers status but puts the onus on the partner to drum up businesses to justify their position.

This set-up also benefits Keystone Law because it does not bear the fixed costs associated with swanky offices and salaries, PAYE and national insurance, holiday and sick pay. Consequently when there is less demand for legal services, Keystone’s profit should be less sensitive to lower fee income than at a traditional law firm bearing these costs.

Keystone Law: it’s the people, stupid

Lawyers are not born self-employed. They are trained in traditional law firms and some of them choose to strike out with a dispersed firm such as Keystone Law in search of independence or work-life balance.

Growth, therefore, depends on recruitment, which has come in spurts. In recent years traditional law firms have awarded eye-popping pay rises to recruit and retain staff during busy post-Covid years.

This bidding war for lawyers is unsustainable. Keystone believes it will take only a small softening in demand for the high cost bases of traditional law firms to cause problems.

In the short term though, it has diminished the supply of lawyers seeking to escape.

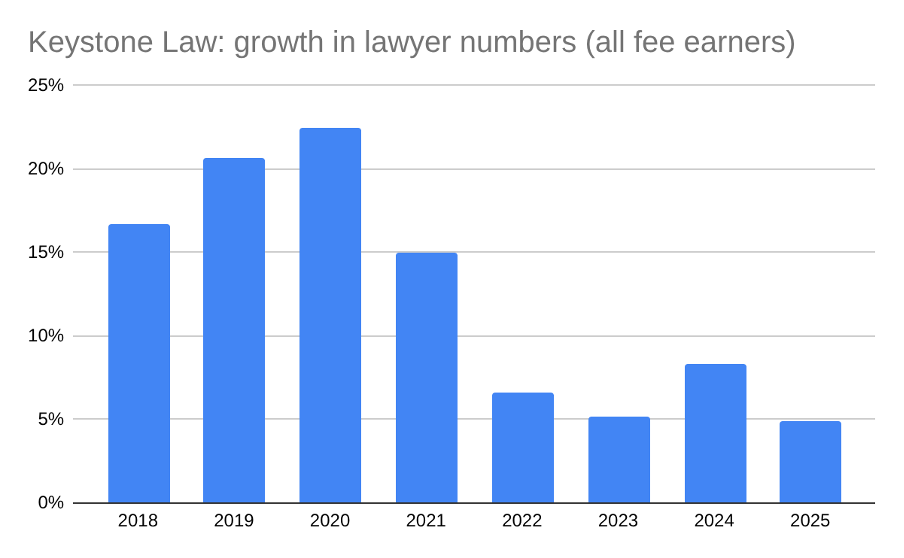

Source: Keystone Law annual reports

Keystone’s annual growth rate in lawyer numbers has fallen from near 20% growth in the first four years after the company floated to single-digit growth in the subsequent four-year period.

Two decades after its founding, Keystone is no longer unusual. More than 3,500 lawyers work for 50 law firms structured as platforms. They vary in calibre, size and in terms of the services they offer.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Insider: directors back heavily sold FTSE 100 firm

Keystone’s advantage is that it is one of the biggest and most established full-service dispersed law firms. Knight is intensely relaxed about copycats. According to an article in Legal Futures, he has said: “We are very happy for this movement – as long as we remain the stand-out leader…then that is a very good position for us to be in.”

He may be confident because the proliferation of competitors further legitimises the model. Having recruited high-quality lawyers and figured out how to get them working together, Keystone Law is more attractive to high-quality applicants.

The company reports that it recruits over a quarter of new principals from the UK office of a large US law firm or a top 25 UK firm. It has 207 lawyers ranked in a leading legal directory, compared to 65 in 2019. Dozens of video interviews with Keystone’s lawyers on its website reveal their impressive CVs.

Scoring Keystone Law: future shock?

As things stand, the business model looks compelling, but two things unnerve me: the self-employed status of the lawyers and the fact that in future much legal work might be done by computers.

The self-employed status of Keystone’s lawyers differentiates the business, which is in turn determined by the law. Should the law change, the lawyers could be deemed employees, foisting the cost of employment on to Keystone. I don’t know how likely this is, but the rules regarding contractors have been changed before.

Keystone also says its technology platform differentiates the business, without telling us any more about it. On artificial intelligence (AI_, it is equally circumspect saying “the delivery of real-life solutions within the business is in its infancy”.

It’s probably a good thing the company is not making grandiose claims about a much-hyped technology, but it would be reassuring to read about what those real-life solutions are, or are likely to be.

|

Keystone Law |

KEYS |

Operates a network of self-employed lawyers |

13/08/2025 |

6.8/10 |

|

How capably has Keystone Law made money? |

3.0 | |||

|

Under its founder and chief executive profit and revenue has grown at double-digit CAGRs by recruiting more self-employed lawyers to its platform. Keystone Law was one of the pioneers of this model 20 or so years ago, which lowers costs and gives lawyers more freedom. | ||||

|

How big are the risks? |

2.0 | |||

|

The self-employed status of Keystone's lawyers could change. AI may commodify some legal work. Lawyer recruitment has slowed but Keystone is still growing lawyer numbers adequately during a period of escalating pay at traditional law firms. | ||||

|

How fair and coherent is its strategy? |

2.5 | |||

|

A better work-life balance encourages lawyers to join dispersed law firms. The simple fee model and the number and quality of Keystone's lawyers encourages high-quality applicants, reinforcing its reputation as a premium full-service law firm. The company should tell us more about its technology platform. | ||||

|

How low (high) is the share price compared to normalised profit? |

-0.7 | |||

|

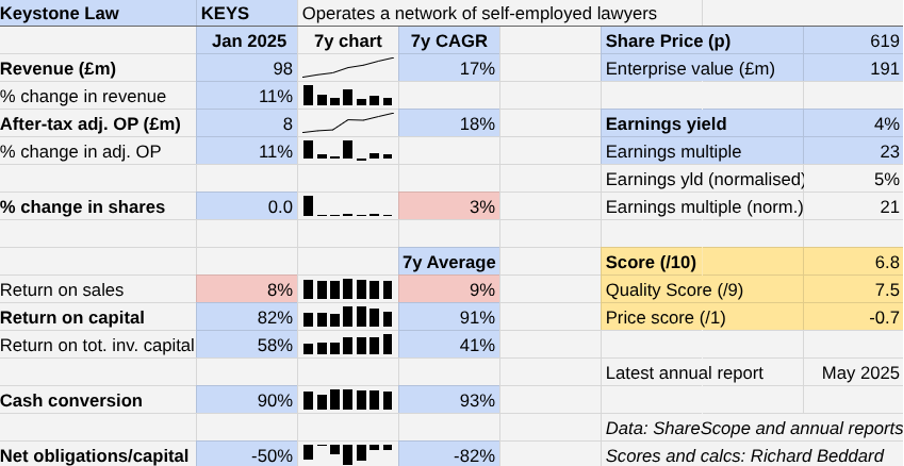

High. A share price of 619p values the enterprise at £191 million, about 21 times normalised profit. | ||||

|

A score of 6.8/10 indicates Keystone Law is a somewhat speculative investment. | ||||

|

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

Keystone by the numbers

Keystone’s numbers in the seven years since it floated are very encouraging.

We need to be cautious about the near 20% CAGR in revenue and profit because that is heavily influenced by the first year in the series, the low double-digit growth of the year to January 2025 is more typical of the other years.

In terms of profitability and cash conversion, Keystone has performed excellently too.

23 Shares for the future

Here’s the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Games Workshop Group (LSE:GAW), Latham (James) (LSE:LTHM) and Jet2 Ordinary Shares (LSE:JET2) have published annual reports and are due to be re-scored.

|

company |

description |

score |

qual |

price |

ih% | |

|

1 |

FW Thorpe |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.5 |

0.1 |

7.3% | |

|

2 |

James Latham |

Imports and distributes timber and related products |

7.5 |

1.0 |

7.0% | |

|

3 |

Howden Joinery |

Supplies kitchens to small builders |

8.0 |

0.5 |

6.9% | |

|

4 |

Focusrite |

Designs recording equipment, loudspeakers, and instruments for musicians |

7.0 |

1.0 |

6.0% | |

|

5 |

Oxford Instruments |

Manufactures scientific equipment |

7.0 |

1.0 |

6.0% | |

|

6 |

Bunzl |

Distributes essential everyday items consumed by organisations |

7.5 |

0.5 |

5.9% | |

|

7 |

Solid State |

Manufactures electronic systems and distributes components |

7.0 |

0.9 |

5.9% | |

|

8 |

Macfarlane |

Distributes and manufactures protective packaging |

7.0 |

0.9 |

5.8% | |

|

9 |

Renishaw |

Whiz bang manufacturer of automated machine tools and robots |

7.5 |

0.4 |

5.7% | |

|

10 |

Jet2 |

Flies holidaymakers to Europe, sells package holidays |

7.5 |

0.3 |

5.7% | |

|

11 |

Porvair |

Manufactures filters and laboratory equipment |

8.0 |

-0.2 |

5.5% | |

|

12 |

Hollywood Bowl |

Operates tenpin bowling and indoor crazy golf centres |

7.5 |

0.3 |

5.5% | |

|

13 |

Anpario |

Manufactures natural animal feed additives |

7.0 |

0.7 |

5.5% | |

|

14 |

James Halstead |

Manufactures vinyl flooring for commercial and public spaces |

7.0 |

0.7 |

5.4% | |

|

15 |

Renew |

Repair and maintenance of rail, road, water, nuclear infrastructure |

7.5 |

0.2 |

5.4% | |

|

16 |

Softcat |

Sells hardware and software to businesses and the public sector |

8.0 |

-0.5 |

5.1% | |

|

17 |

Bloomsbury Publishing |

Publishes books and educational resources |

7.5 |

0.0 |

5.0% | |

|

18 |

Churchill China |

Manufactures tableware for restaurants etc. |

6.5 |

1.0 |

5.0% | |

|

19 |

YouGov |

Surveys and distributes public opinion online |

7.5 |

0.0 |

5.0% | |

|

20 |

Games Workshop |

Designs, makes and distributes Warhammer. Licences IP |

9.0 |

-1.6 |

4.9% | |

|

21 |

Judges Scientific |

Manufactures scientific instruments |

7.5 |

-0.3 |

4.5% | |

|

22 |

Advanced Medical Solutions |

Manufactures surgical adhesives, sutures and dressings |

6.5 |

0.7 |

4.3% | |

|

23 |

4Imprint |

Customises and distributes promotional goods |

8.0 |

-0.9 |

4.1% | |

|

24 |

DotDigital |

Provides automated marketing software as a service |

6.5 |

0.4 |

3.8% | |

|

25 |

Auto Trader |

Online marketplace for motor vehicles |

8.0 |

-1.1 |

3.8% | |

|

26 |

Keystone Law |

Operates a network of self-employed lawyers |

6.8 |

7.5 |

-0.7 |

3.7% |

|

27 |

Dunelm |

Retailer of furniture and homewares |

8.0 |

-1.5 |

3.1% | |

|

28 |

Volution |

Manufacturer of ventilation products |

8.0 |

-1.5 |

2.9% | |

|

29 |

Quartix |

Supplies vehicle tracking systems to small fleets and insurers |

7.5 |

-1.8 |

2.5% | |

|

30 |

Cohort |

Manufactures military technology, does research and consultancy |

7.5 |

-1.9 |

2.5% | |

|

31 |

Goodwin |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

8.0 |

-2.5 |

2.5% | |

|

32 |

Tristel |

Manufactures disinfectants for simple medical instruments and surfaces |

7.5 |

-2.0 |

2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks