Shares for the future: star stock might be good value now

At their cheapest since 2023 following last month’s profit warning, this could be just a blip, thinks analyst Richard Beddard who keeps this former high-flyer in his top 10.

14th February 2025 15:00

Renew Holdings (LSE:RNWH) maintains our infrastructure. Its services are needed through thick and thin to keep the lights on, the trains running, and the traffic flowing. Now it has hit a bump in the road, the shares might also be good value.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Scoring Renew Holdings: bump in the road

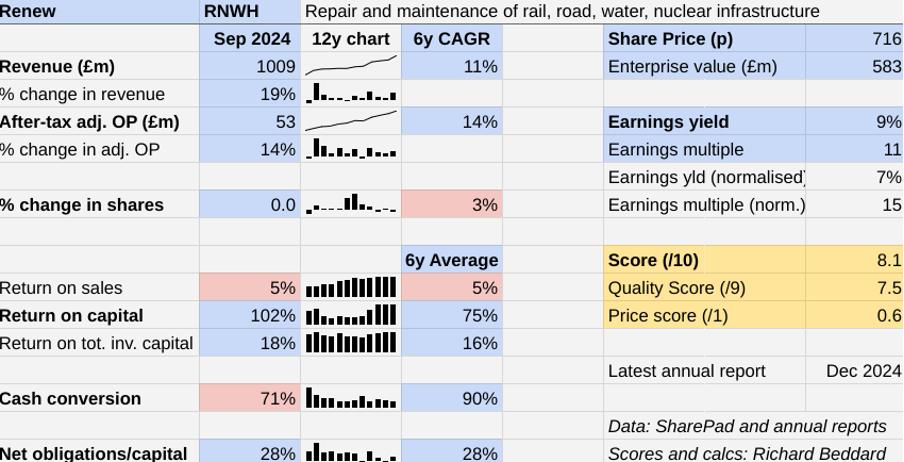

That bump is not visible in the results for the year to September 2024, in which Renew achieved double digit revenue and profit growth.

The Past (dependable) [3]

- Profitable growth: Double-digit revenue and profit growth [1]

- Strong finances: Decent average cash conversion, modest obligations [1]

- Through thick and thin: Lowest RoC (return on capital) 25% in 2019 [1]

I have chosen to calculate growth rates and average profitability over a period of just six years, starting in 2019 because the company changed significantly around that time.

In 2018 it disposed of Forefront and acquired QTS. Loss-making Forefront was a failed acquisition from 2014. It installed and maintained gas mains. QTS is a successful acquisition, the company’s biggest ever, which augmented its already sizable Rail business.

Renew has been highly profitable and grown strongly.

At 71%, cash conversion in 2024 was near the low end of its historic range. Net financial obligations have ticked up to the long-term average because of this and three modest acquisitions during the year.

In January, Renew warned rail activity had slowed. Profit in 2025 is likely to be lower than anticipated, although still higher than it was in 2024 thanks to the company’s booming Water division and acquisitions.

- 19 financially robust companies to own in 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Industry sources have linked the profit warning to a deterioration in Network Rail’s finances, which means the owner and operator of Britain’s rail infrastructure is spending less in the first year of the latest “Control Period”.

Control Periods are five-year funding and planning cycles. Renew says it started this Control Period with a broader geographic reach and a wider range of services than it did the previous one. Based on past experience, it expects business to pick up later in the cycle to meet committed levels of spending.

The Present (distinctive) [2.5]

- Discernible business: Infrastructure maintenance and renewal, legacy building claims [0.5]

- With experienced people: Experienced board [1]

- That creates value for customers: Skilled workforce, innovative equipment [1]

Renew has changed shape over the years. In 2024 it disposed of Walter Lilly, the last remaining element of a building division that traced its origins back more than 200 years.

Since 2006, when Renew changed its name from Montpelier, the company’s strategy has focused on engineering services. That is maintaining, repairing and renewing infrastructure in four markets, Rail, Infrastructure (highways and wireless telecom), Energy (nuclear, electricity, wind) and Environment (water).

Frustratingly, Renew does not divulge how much revenue or profit it earns from each market, but Rail is probably the most important. Renew has made large Rail acquisitions, and it is the largest provider of maintenance and renewals services to Network Rail, the owner and operator of Britain’s railway, which is probably its biggest customer, responsible for 40% of revenue.

Renew’s rail businesses manage rail assets, pin soil and rocks to embankments, control vegetation, put up fences, clear and maintain drains, and provide electrification services. The company helps with nuclear waste treatment, reprocessing, decommissioning and decontamination. It is the second-largest provider of road restraint systems in England (aka crash barriers) and works for 10 of the 12 combined waste and water companies.

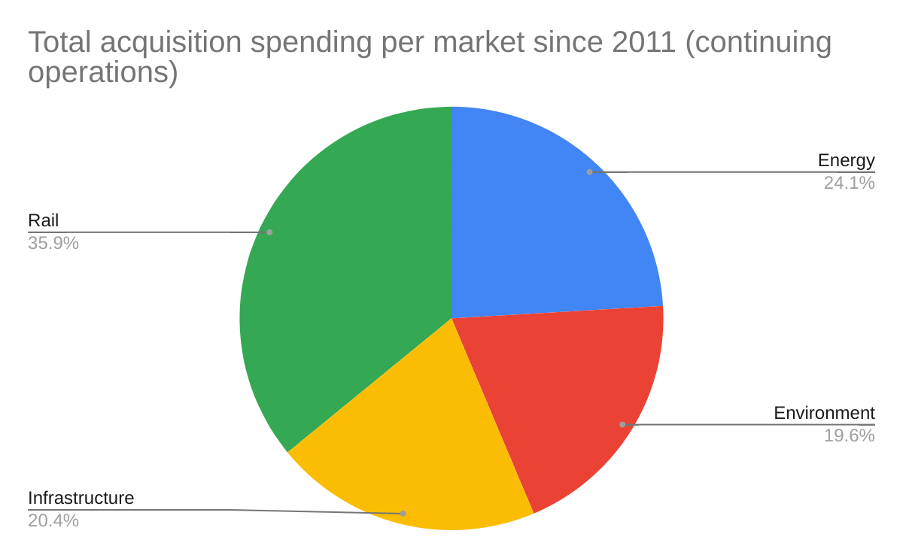

We can get an impression of its broad-based expansion from its spending on acquisitions.

Sources: annual reports and company announcements.

Of a total of about £330 million in acquisition spending since 2011, Renew has spent most heavily on Rail, although its most recent acquisitions have been in Energy and Environment segments.

This may reflect a desire to reduce its dependence on its major customer, and opportunities in these sectors due to electrification and the growth of renewable energy.

Maintenance and repair is a labour intensive rather than capital-intensive business, giving Renew the opportunity to differentiate itself by training and motivating engineers

While profit margins are fairly modest, they have been stable because they are routine activities required for the smooth operation of infrastructure. The short-term nature of individual contracts awarded under framework agreements also gives the company the ability to adjust pricing in line with labour and material costs.

More important than individual contracts is the company’s reputation. Although no other customers are individually responsible for more than 10% of revenue, they are sizable and Renew identifies major project loss as the most significant risk facing the business. On top of the loss of revenue, the company is exposed to legal claims relating to defects that persist for many years from old contracts.

Companies recognise liabilities known as provisions to account for the likely cost of these claims. This year Renew increased the provision relating to Allenbuild, a building contractor it disposed of more than a decade ago by £3.5 million. This brought the total provision for discontinued operations to over £10 million.

The company is unlikely to have to pay the whole provision in a single year. In 2024, the cash cost of claims was about £1 million. This is not much compared to the more than £50 million of cash flow Renew can earn in a single year, but the company says the likelihood of historical claims has increased. These claims can include cladding, which have resulted in major reassessments of historical costs at other builders.

Overseeing Renew's flourishing is chief executive Paul Scott. He has worked for the company for 22 years. He was engineering services director from 2014 to 2016 before his appointment to the top job. Sean Wyndham-Quin became chief financial officer in 2017.

Their tenure coincides with prosperity, perhaps resulting from the tighter focus on engineering services and astute acquisitions.

The Future (directed) [2]

- Addressing challenges: Large projects, large customers [0.5]

- With coherent actions: Diversification through acquisition [1]

- That reward all stakeholders fairly: Focus on training and retention [0.5]

The results show Renew’s long exit from riskier and less-profitable construction in favour of engineering services has been a success. It has not come at a high price. If we include the unamortised cost of acquisitions in capital employed, Renew earned 18% return on total invested capital in 2014.

The acquisitions give Renew new capabilities and customers often in different regions. Except for QTS, they were funded by Renew’s own cash flows and modest debt.

Of the company's acquisitions in 2024, Excalon provides high-voltage infrastructure to local electricity networks, a new market, and Route One is a specialist bridge engineer. It joins Carnell, one of Renew’s highways infrastructure businesses.

Renew acquired Full Circle after the year end. Its £50 million purchase price makes it the company’s second-biggest acquisition after QTS. Big acquisitions can be risky, but £50 million corresponds roughly to a year’s free cash flow (before tax), so I would still put Full Circle in the affordable category.

Full Circle is Renew’s first overseas acquisition. It repairs, maintains and monitors onshore wind turbines from a control centre at its headquarters in the Netherlands. Although the company operates in European countries, 75% of its revenue is generated from UK wind farms.

Besides acquisitions, Renew has three growth levers. These make the most of its growing capabilities, through training and retaining its 4,400-strong workforce, the use of innovative equipment, and collaboration between its independent but complementary subsidiaries.

The focus on maintenance and renewal, which is less risky than large capital projects, modest acquisitions, and the nurturing of the company’s own assets, primarily its employees, makes Renew an attractive proposition.

However, since employee retention is a strategic growth driver, I think employee retention should be a key performance indicator, and the company should divulge the statistic in the annual report. It does not.

The annual report mentions a plethora of training schemes and some of the larger subsidiaries have good ratings on Glassdoor, a recruitment site.

The price (discounted?) [0.6]

- Yes. A share price of 716p values the enterprise at about £583 million, 15 times normalised profit.

A score of 8.1/10 implies Renew is a good long-term investment.

It is ranked 8 out of 40 shares in my Decision Engine.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Manufactures tableware for restaurants and eateries |

10.0 | ||

|

2 |

Imports and distributes timber and timber products |

9.0 | ||

|

3 |

Supplies kitchens to small builders |

8.7 | ||

|

4 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.6 | ||

|

5 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

6 |

Distributor of protective packaging |

8.4 | ||

|

7 |

Manufactures computers, battery packs, radios. Distributes components |

8.3 | ||

|

8 |

Renew |

Repair and maintenance of rail, road, water, nuclear infrastructure |

8.1 | |

|

9 |

Manufacturer of scientific equipment for industry and academia |

8.1 | ||

|

10 |

Designs recording equipment, loudspeakers, and instruments for musicians |

8.0 | ||

|

11 |

Flies holidaymakers to Europe, sells package holidays |

7.8 | ||

|

12 |

Operates tenpin bowling and indoor crazy golf centres |

7.6 | ||

|

13 |

Manufactures/retails Warhammer models, licences stories/characters |

7.4 | ||

|

14 |

Manufactures vinyl flooring for commercial and public spaces |

7.4 | ||

|

15 |

Sells hardware and software to businesses and the public sector |

7.4 | ||

|

16 |

Distributes essential everyday items consumed by organisations |

7.3 | ||

|

17 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.3 | ||

|

18 |

Manufactures filters and filtration systems for fluids and molten metals |

7.3 | ||

|

19 |

Whiz bang manufacturer of automated machine tools and robots |

7.2 | ||

|

20 |

Online marketplace for motor vehicles |

7.1 | ||

|

21 |

* |

Surveys and distributes public opinion online |

7.1 | |

|

22 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.0 | ||

|

23 |

Sources, processes and develops flavours esp. for soft drinks |

6.9 | ||

|

24 |

Acquires and operates small scientific instrument manufacturers |

6.9 | ||

|

25 |

Sells promotional materials like branded mugs and tee shirts direct |

6.8 | ||

|

26 |

Online retailer of domestic appliances and TVs |

6.8 | ||

|

27 |

Manufactures natural animal feed additives |

6.7 | ||

|

28 |

Translates documents and localises software and content for businesses |

6.5 | ||

|

29 |

Supplies vehicle tracking systems to small fleets and insurers |

6.4 | ||

|

30 |

Retails clothes and homewares |

6.3 | ||

|

31 |

Manufactures military technology, does research and consultancy |

6.2 | ||

|

32 |

Publishes books, and digital collections for academics and professionals |

5.9 | ||

|

33 |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.8 | ||

|

34 |

Manufactures sports watches and instrumentation |

5.5 | ||

|

35 |

Manufactures power adapters for industrial and healthcare equipment |

5.5 | ||

|

36 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.5 | ||

|

37 |

Makes marketing and fraud prevention software, sells it as a service |

5.4 | ||

|

38 |

Runs a network of self-employed lawyers |

4.9 | ||

|

39 |

Develops and manufactures hygiene, baby, and beauty brands |

4.4 | ||

|

40 |

Manufactures specialist paper, packaging and high-tech materials |

3.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard holds many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks