Stockwatch: has this FTSE 100 sector rally gone up in smoke?

Analyst Edmond Jackson urged investors to hold on for the ride, and these high-yielding stocks have repaid his faith in spades. Here’s what he thinks of them now.

14th February 2025 12:11

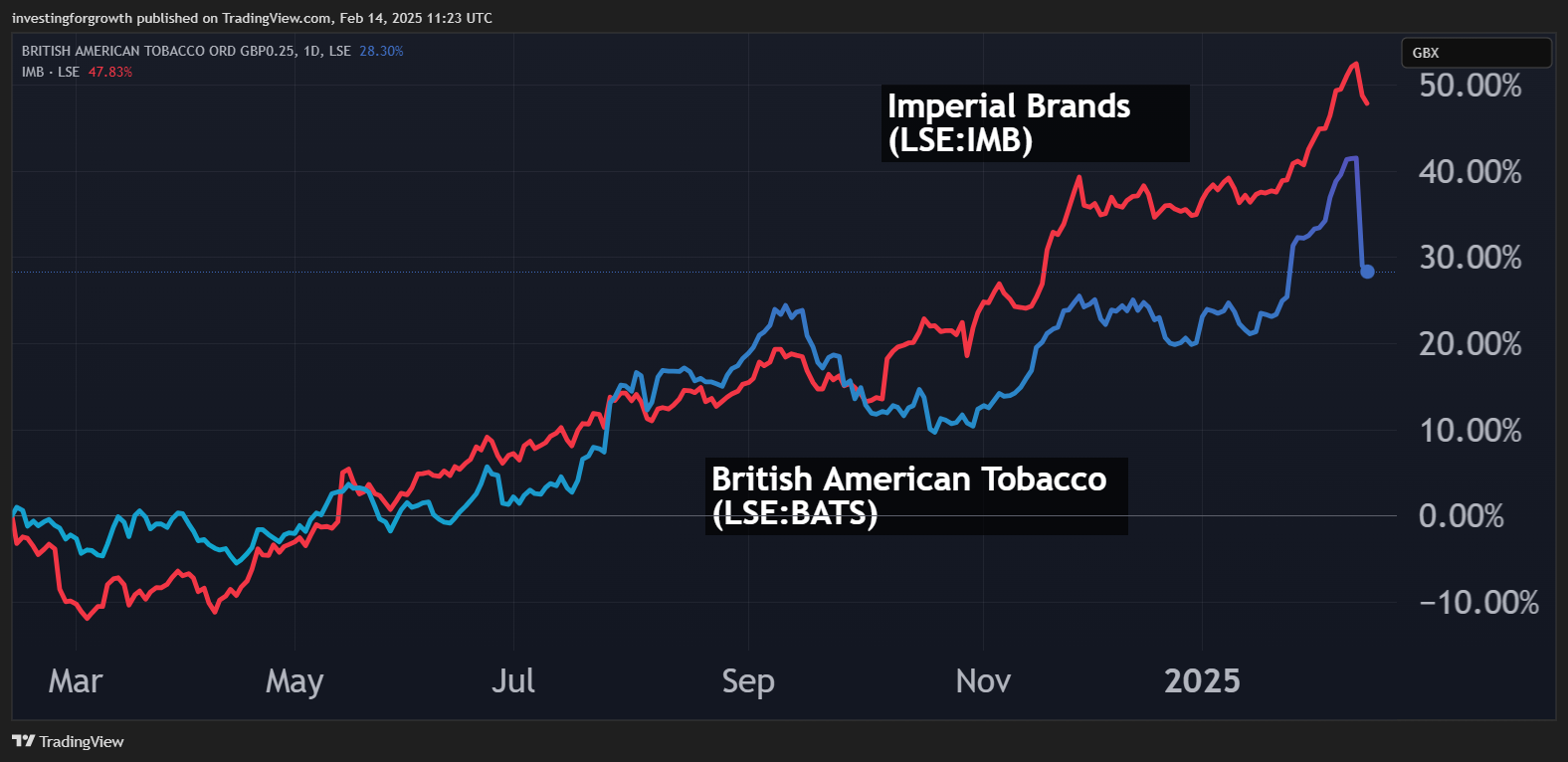

Last September, I examined curiosity over how smoking stocks had been burning bright since mid-April. Imperial Brands (LSE:IMB) was up 33% and British American Tobacco (LSE:BATS) 29% - a tad ironic given that BAT is the better forward-looking operation with a stronger international share in vaping or “new categories” as it reports.

I reasoned that the market had twitched over an accumulation of fears – such as the UK government adopting the world’s toughest smoking ban – that meant these stocks festered at a 20-year low for Imperial and 14 years for BAT. Dividend yields had looked plenty robust for quite some years – BAT offering 10.8% at its low and Imperial 9.3% – with strong cover in terms of cash flow generated by these behemoths. Interest rates were also starting to fall.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

I concluded with “hold” stances given the essentials of the smoking industry: traditional “combustibles” trading being pretty flat, partly due to their cost but also social restrictions; and various governments doing their best to limit youth addiction to vaping. In the market, smoking stocks are a tug of war between greed when yields look attractive, and fear when investors are reminded of challenges the industry faces.

Yesterday came a moment of truth and yet another example of how market pricing, even in FTSE 100 stocks, is not necessarily to be trusted.

BAT fell 9% to around 3,100p in response to 2024 annual results, and Imperial 2.5% to around 2,800p in sympathy. This followed a rally from April 2024 that suddenly accelerated three weeks ago. Effectively, it is a mean reversion to approximate trend lines, with Imperial still looking a tad overbought. With a 30 September fiscal year, its results had been received well.

Source: TradingView. Past performance is not a guide to future performance.

What has disrupted sentiment towards BAT especially?

Currency translations provided some headwinds, but overall, trawling through the numbers and a complex statement is a reminder how a giant like this is struggling to grow at all, when you also consider global inflation at around 3%, and who knows what next as tariff wars kick off.

Revenue of £25.87 billion is slightly behind consensus for £26.11 billion, although adjusted earnings per share of 362.5p is slightly ahead of 362.2p expected. Also, the total dividend of 240.24p represents a 7.8% trailing yield and it’s fair to assume an 8% yield in respect of 2025.

But it’s worth remembering that selective gilts or other fixed-income products yield around 5% without the risks faced by the smoking industry.

Divestment of operations in Russia and Belarus has been a well-known factor, hence a 5.2% drop in group revenue at current exchange rates was no surprise.

More vitally, it remains a guess whether the new categories segment – up 8.9% on an adjusted organic basis to £3.42 billion, albeit 2.5% growth on a reported basis and below – can in due course, at least substitute any decline from traditional “combustibles”. While their revenue is said to have “increased” 0.1%, this is effectively a 3% slip in inflation-adjusted terms. It also conveys a business at saturation level in the sense that a 5.3% overall price rise in combustibles has met with 5.2% lower volume.

Normalised operating profit is marginally 0.2% lower at constant currency, mitigated by margin improvement, but there is a 74% hike in “other operating expenses” to over £13 million after 2023 already saw £28.6 million charged for depreciation, amortisation and impairment (partly for divesting Russia and Belarus). This latest charge likely includes a £6.2 billion exceptional charge to resolve Canadian litigation, but despite a highly detailed results statement, I can find no breakdown of the £13 million.

Furthermore, higher taxation in Bangladesh and Australia reminds us how smoking product companies are up against governments trying to limit youth smoking. The CEO expressing hope that the Trump administration will tackle sales of illegal disposable vapes has not been enough on this occasion to counterbalance fears.

Net finance costs are down from £1,895 million to £1,098 million and pre-tax profit is rescued by £1,900 million contributions from associates and joint ventures, up from £585 million.

And so 2025 guidance appears a slight downgrade by way of 1% revenue growth and adjusted operational profit growth of 1.5% to 2.5% (although that’s below inflation).

British American Tobacco - financial summary

Year-end 31 Dec

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 13,104 | 14,130 | 19,564 | 24,492 | 25,877 | 25,776 | 25,684 | 27,655 | 27,283 | 25,867 |

| Operating margin (%) | 34.0 | 32.2 | 151 | 38.2 | 34.8 | 38.1 | 39.8 | 38.1 | -57.3 | 10.6 |

| Operating profit (£m) | 4,453 | 4,554 | 29,547 | 9,358 | 9016 | 9,820 | 10,234 | 10,523 | -15,625 | 2,736 |

| Net profit (£m) | 4,290 | 4,648 | 37,485 | 6,032 | 5,704 | 6,400 | 6,801 | 6,666 | -14,367 | 3,068 |

| Reported earnings/share (p) | 230 | 249 | 1,360 | 260 | 247 | 273 | 289 | 294 | -645 | 138 |

| Normalised earnings/share (p) | 234 | 239 | 251 | 284 | 316 | 328 | 317 | 326 | 377 | 68.9 |

| Operating cashflow/share (p) | 253 | 247 | 261 | 449 | 393 | 426 | 423 | 442 | 497 | 455 |

| Capital expenditure/share (p) | 32.3 | 36.1 | 47.7 | 41.1 | 35.6 | 32.9 | 32.4 | 28.9 | 27.0 | 27.3 |

| Free cashflow/share (p) | 221 | 211 | 213 | 408 | 357 | 394 | 391 | 413 | 470 | 428 |

| Dividend/share (p) | 154 | 169 | 100 | 195 | 203 | 210 | 216 | 218 | 231 | 236 |

| Covered by earnings (x) | 1.5 | 1.5 | 13.6 | 1.3 | 1.2 | 1.3 | 1.3 | 1.4 | -2.8 | 0.6 |

| Return on total capital (%) | 19.8 | 16.3 | 23.6 | 7.2 | 7.4 | 8.0 | 8.4 | 7.8 | -15.2 | 2.7 |

| Net Debt (£m) | 15,003 | 17,276 | 45,649 | 44,259 | 42,243 | 40,088 | 35,933 | 38,590 | 33,897 | 31,440 |

| Net assets per share (p) | 263 | 439 | 2,649 | 2,853 | 2,786 | 2,732 | 2,924 | 3,371 | 2,350 | 2,247 |

Source: historic company REFS and company accounts.

Shifts in perception between ‘total return’ and ‘income’

As share price charts on BAT and Imperial gained upward momentum last year, performance-conscious investors – and fund managers seeking liquidity – jumped on the bandwagon. Single-figure price/earnings (PE) multiples backed by high single-digit yields and strong cash flow, helped create a sense of security.

The “total return” argument has now taken a hit, showing how growth is always a component of investment value – “growth and value, joined at the hip” as Warren Buffett has expressed it.

The likely reason that BAT is finding support at around 3,090p is a dividend yield of around 8% covered around 1.5x by earnings and likely more by cash flow this year.

- 16 UK stocks least likely to be impacted by Trump tariffs

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Comparing the income statement with balance sheet explicates this contrast in worries about growth versus dividend income strength – with buybacks also a means to prop earnings per share.

BAT’s profit outcome is a concoction of moving parts that gnaw at confidence in growth, whereas despite net cash from operations easing 5% to £10,125 million (despite a 29% reduction in tax paid), the modest investment needs of this industry has meant ample cash to apply as £5,213 million dividends, £698 million buybacks and a £4,826 million cut to borrowings. Year-end net cash has still increased by £587 million to £5,104 million.

Strength of cash flow explains why £31,653 million net debt – representing 63% net gearing - is more “interest cost nuisance” than major financial risk. Mind that such gearing is based on negative net tangible assets of £44,281 million due to £94,276 million intangibles. Decide for yourself if the brands are worth so much, or focus on what they earn.

For what credit rating agencies are worth, one is a “stable” outlook at grade BBB. I tend to think the key question regarding BAT’s debt is whether interest rates have to stay higher than expected if trade tariffs drive fresh inflation. Another cost to weigh besides regular “exceptionals” that keep manifesting.

Mild profit warning in ‘2025 to be second-half weighted’?

This is always something to be alert for in company statements. A cynical view is the outlook weakening with management vainly extending a carrot about later on. In fairness, 2024 did see such a split as the second half benefited from new categories’ innovation and US investment. It’s unclear how trade tariffs could affect the medium-term scenario, if they kick off globally.

There are consequently enough checks on the “growth going forward” case here, to suspect that BAT’s chart is going to be more sideways-volatile in 2025, and what use is an 8% yield (pre-tax) if you can see this wiped off capital value in a day?

It’s not clear whether the new US government’s enthusiasm for pro-business and deregulation will mean opportunities help to offset hurdles being put in place elsewhere.

While skepticism is probably the best overall stance on smoking stocks, overall I would not adjust my stance to “sell”. BAT and Imperial will still have a role as part of income portfolios, and I begin to wonder if a mega-merger might be sensible industry consolidation. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks