Stockwatch: an income stock about to generate capital growth?

Believing we should be alert for shares offering attractive yield with strong asset-backing and contained financial risk, analyst Edmond Jackson looks at this interesting mid-cap share.

8th July 2025 12:04

What should we make of the conundrum that is Primary Health Properties (LSE:PHP)? This mid-cap has just pipped Kohlberg Kravis Roberts (who only last week clinched Spectris (LSE:SXS)) in a takeover contest for peer company Assura (LSE:AGR) – supposedly creating the UK’s eighth-largest real estate company with a portfolio of assets worth over £6 billion.

Owning purpose-built healthcare facilities, which are then let out to GPs and other healthcare personnel, and with a strong public sector emphasis, both shares are sometimes described as a “gilt proxy” in that security of income and capital should be much higher than an industrial equity. Moreover, healthcare facilities should also have attractive risk/reward characteristics relative to other UK commercial property, especially if further tax hikes beckon.

- Invest with ii: Open a Low Cost SIPP | What is a SIPP | Interactive investor Offers

PHP management emits quite a siren song for this combination with Assura. It calls it “a compelling strategic and financial rationale, earnings-accretive for both shareholders... [with] improved ability to benefit from a rising rents’ outlook after significant increases in construction costs in recent years...an expected strong investment-grade credit rating that will deliver future value and underpin the group’s progressive dividend policy.” In summary, “a powerful platform with greater scale, income and valuation growth potential, also lower cost of capital”.

Yet this £1.3 billion company is the second most-shorted share on the London stock market after addiction drugs group Indivior Ordinary Share (LSE:INDV) with 6.5% of its issued share capital loaned out. The total will probably be higher since short sellers only have to disclose their position once it reaches 0.5%. Furthermore, five of these shorts only just recently raised their trades – four to over 1.0%, including one over 1.6%. Short-trading thoroughly contradicts the impression of fundamentals, so how should we reconcile all this?

Primary Health Properties - financial summary

Year end 31 Dec

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 121 | 139 | 146 | 154 | 170 | 182 |

| Operating profit (£m) | 7.1 | 173 | 183 | 73.3 | 87.3 | 104 |

| Net profit (£m) | -71.3 | 112 | 140 | 56.3 | 27.3 | 41.4 |

| Operating margin (%) | 5.9 | 124 | 126 | 47.6 | 51.4 | 57.5 |

| Reported earnings/share (p) | -6.5 | 8.7 | 9.8 | 2.2 | 1.9 | 2.8 |

| Normalised earnings/share (p) | 2.1 | 8.4 | 13.5 | 1.8 | 1.8 | 2.8 |

| Operational cashflow/share (p) | 8.6 | 8.7 | 9.8 | 8.2 | 9.2 | 9.3 |

| Capital expenditure/share (p) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Free cashflow/share (p) | 8.6 | 8.7 | 9.8 | 8.2 | 9.2 | 9.3 |

| Return on total capital (%) | 0.3 | 6.6 | 6.6 | 2.6 | 3.2 | 4.1 |

| Cash (£m) | 143 | 104 | 33.4 | 29.1 | 3.2 | 3.5 |

| Net debt (£m) | 1,125 | 1,114 | 1,246 | 1,274 | 1,323 | 1,338 |

| Net assets (£m) | 1,229 | 1,414 | 1,500 | 1,482 | 1,424 | 1,376 |

| Net assets per share (p) | 101 | 108 | 113 | 111 | 107 | 103 |

Source: company accounts.

A steady evolution of total shareholder return

PHP’s progress has appeared so slow over a decade and more that I lost interest. Last time I wrote about it was in October 2013 and December 2014, when I was overall positive at equivalent prices of 82p and 89p after adjusting for a four-for-one share split in November 2015.

In 2013, the company was proclaiming its 17th successive year of dividend increases against a prospective yield around 6%. Net tangible assets along with profits were projected to resume growth. Very little capital expenditure seemed required, hence operational cash flow could largely be returned to shareholders. For conservative investors, what was there not to like?

I should add, I have also been aware of PHP since its early years as a listed small-cap from the mid-1990s, then trading around 25p.

On a 30-year view, there has been steady capital appreciation and sometimes the shares have traded at a premium to tangible book value, whereas currently they are at 0.94x. If consensus forecasts are fair – for dividends per share of 7.0p in respect of 2025 and 7.2p for 2026 – then the yield is rising to 7.4% at the current share price of 96.5p. This, together with synergies of the Assura takeover, meant PHP’s board considered it fit to improve their cash-and-shares terms to fend off KKR.

- eyeQ: this FTSE 100 dividend stock is cheap

- Insider: FTSE 100 chief buys big for second time in two weeks

Obviously, we will need to see how pro-forma numbers pan out for this combination, yet PHP and its advisers should have satisfied themselves of its logic, both to sustain modest dividend growth and improve capital prospects.

A critique would be that PHP hopes this deal will rescue growth credentials that have otherwise worn thin – with the balance sheet already looking somewhat strained.

The 2024 results looked like they needed some pep, with net rental income and adjusted earnings per share (EPS) up a modest 2.9%, and a 3.0% rise in the dividend hoovering up virtually all the earnings. Year-end net gearing was around 97%, the income statement showing net finance costs swiping 45% of £103 million operating profit.

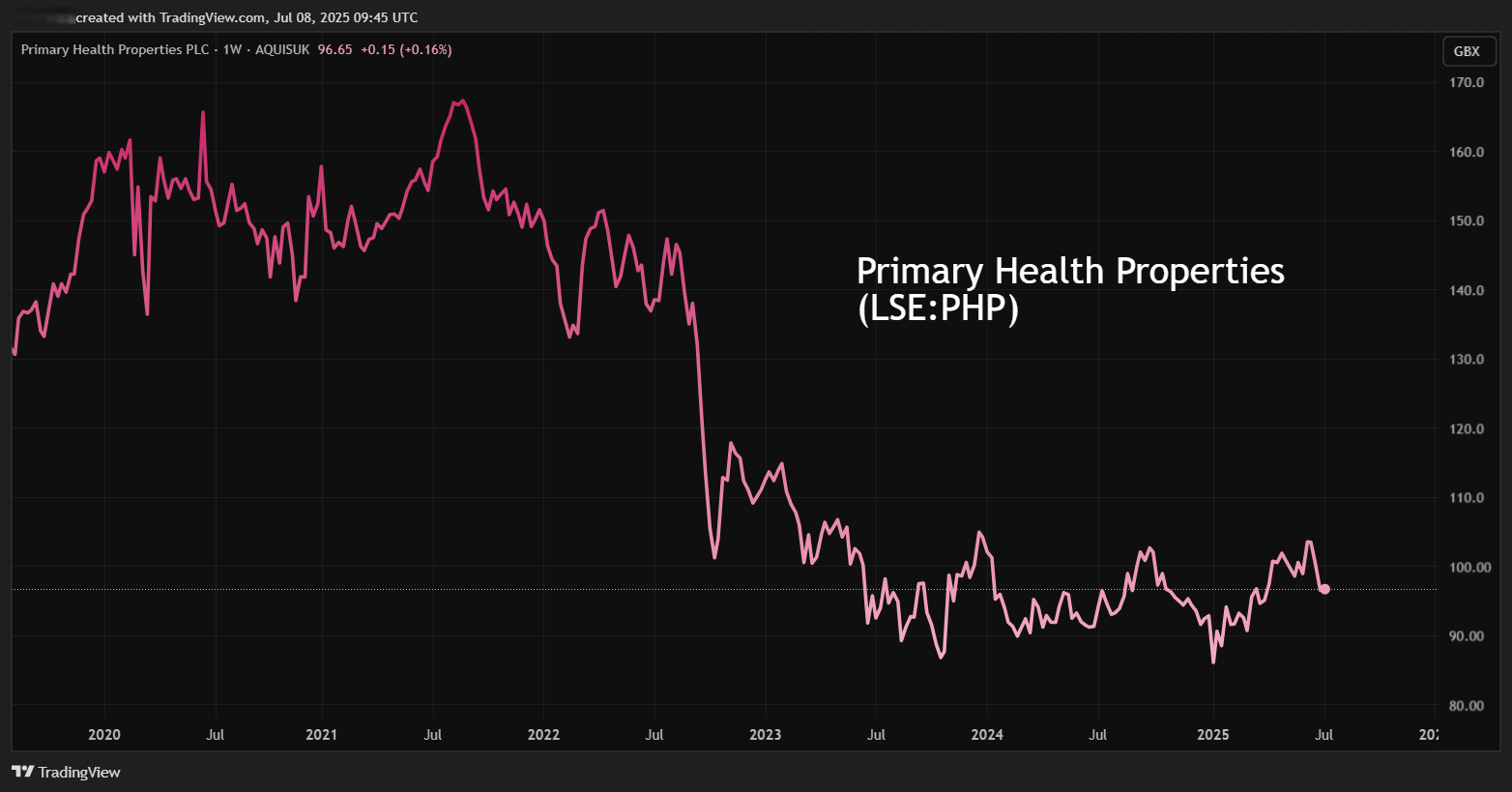

True, the business model looks more reliable for yield than an industrial equity or regular commercial property. But the share price chart’s reversion to levels 10 years ago after a de-rating in the last five, says something needs to happen if total shareholder return is any kind of objective.

Source: TradingView. Past performance is not a guide to future performance.

Enlarged debt profile is key question for financial risk

The decision by PHP’s board and its advisers to trump KKR’s terms, can be seen as justified conceptually because, unlike a private equity owner, a property management group can exact synergies when increasing scale.

PHP is offering a cash-and-shares mix valuing Assura at around 55p per share (according to fluctuations in PHP’s market price) if also factoring in various dividend commitments, versus KKR having 52.1 per share in cash as its best and final offer on 11 June. This compares with Assura’s last reported net asset value of 49.4p, hence a slight premium compared to some of the REIT takeovers manifesting lately. Yet PHP was unlikely to get its offer recommended without doing so; indeed its own shares traded at a small premium when I drew attention to them a decade ago.

- Shares for the future: this company deserves more credit

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

It involves a fresh £1,225 million unsecured loan in respect of the cash element, which compares with £1,338 million net debt for PHP at end 2024; also £1,575 million net debt on Assura’s last reported balance sheet. The offer document references asset disposals. We have yet to see what that is, but say around £4 billion net debt is a reasonable short to medium-term prospect, it would appear over twice combined net assets of £1.8 billion.

PHP proclaims a “compelling strategic and financial rationale...earnings-accretive for both shareholders”, and reported reactions from Assura’s institutional holders are positive. I would still like to see more pro-forma detail of the financial structure of the combined group. Might this have driven short sellers’ motivation lately?

Yet PHP was being actively shorted before this combination with Assura was mooted, despite PHP’s circa 7p per share dividend looking robust. Mind how the shares dipped on 3 July due to going ex-dividend rather than it being some verdict on the deal.

Note also, the Competition & Markets Authority (CMA) has until 18 July to decide whether to investigate the transaction. You could find a parallel between Aviva (LSE:AV.) and Direct Line Insurance Group, which the CMA has just approved. Yes, it may limit competition somewhat, yet benefits may arise for consumers from the synergies arising.

Alleged inflection point in the business cycle

A key reason I write today is PHP having updated yesterday in respect of its first half-year to 30 June, citing “improving rental growth and stabilisation in yields which underpin valuation growth, further evidencing an inflection point in the cycle”.

Yields of 5.25% on the healthcare assets do appear supported by a 10-year health plan for England just published, with the government committed to strengthening the NHS - especially a transition to modern primary care facilities in local communities.

This PHP/Assura combination happening in such a context would appear to capitalise on these twin benefits, yet there is raised debt plus a motivated raft of short sellers. Given that PHP shares seem unlikely to rally in the near term, I tend to think more time is available to assess how the combined balance sheet may look.

I conclude with a “hold” stance for now, but with the prospect of UK consumer shares souring (last week’s warning from Greggs (LSE:GRG) being a portent) and US tariffs constraining industrials, we should be alert for shares offering attractive yield with strong asset-backing and financial risk contained. Can PHP/Assura prove so, as a more convincing “buy”?

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks