Stockwatch: should you buy this recovery story?

Analyst Edmond Jackson examines turnaround potential for a stock with past prestige experiencing a China-inspired rally.

27th September 2024 11:56

Is Burberry Group (LSE:BRBY) coming into focus as a potential recovery “buy”, or are short-sellers currently playing a strong hand?

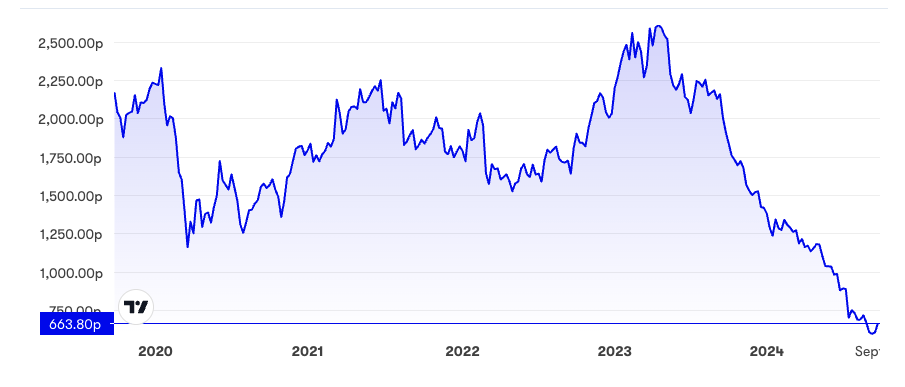

Yesterday, the mid-cap stock jumped 9% to 664p, and this morning the price is up a further 5% to about 700p; which starts to look significant on the chart after a gently rising trend from a 571p low on 10 September.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

This is part of a wider bounce for luxury goods shares after China surprised financial markets with the extent of its economic stimulus. A swoon in Chinese buyers of “luxury” has been a significant factor although Burberry has wider challenges.

A 15 July first-quarter update to end-June shocked the market by citing “deepened weakness” and the potential for a first-half operating loss; dividends being suspended for the full year to March 2025 even. “We are taking decisive action to rebalance our offer to be more familiar to Burberry’s core customers while delivering relevant newness,” the firm said. Actions, including cost savings, were, however, aiming to “start to deliver an improvement in our second half”.

The stock has fallen steeply since a 2,570p high in April 2023, back to levels seen in early 2010. It fell out of the FTSE 100 this month and there is unlikely to be another update until mid-November interim results to 30 September.

Source: interactive investor. Past performance is not a guide to future performance.

Consensus anticipates a slump from £270 million net profit last year, to around £40 million in the March 2025 year, although this masks quite some divergence. This week, UBS downgraded its price target to 410p in the expectation of losses not only this year but in 2026, versus a recent consensus for 2026 net profit over £130 million and earnings per share (EPS) around 40p, hence a forward price-to-earnings (P/E) around 17x.

Scope for contrasting bull/bear interpretations

A dilemma with relying on consensus figures is that some analysts may heed guidance which endeavours to present a respectable face: anticipating, as per the interim outlook, an improvement in the second half to March 2025 (due to management actions including cost-cutting).

There is scope for a sceptical view given the uncertainty over how new fashion collections are received, also the wider trend in “luxury” spending. Yet this also can involve an aspect of bias, say, if a broker is seeking hedge-fund business on the short side.

In truth, key variables driving Burberry’s dynamics are very hard to predict.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Trading Strategies: one of UK’s biggest firms tipped to keep growing

Meanwhile, short-selling over the 0.5% disclosure threshold shows 4.2% of the issued equity out on loan with three funds increasing their shorts, while Marshall Wace trimmed its very slightly on 24 September – albeit still a material, near 1.8% position.

Implicitly, these traders reckon on a scenario similar to UBS’s; that turnaround is going to take longer than management thinks, while luxury spending remains pressured.

Their call has been good: since this circa 4% short position materialised early last January, the stock has fallen over 50%. Yet short sellers quite often do not manage to reverse their trades before stocks are in a new bull trend.

Buyers can argue the price/sales ratio (market cap relative to annual revenue) is now only around 0.8 times and if management can wrest back anything near the 20% operating margins that pertained around 2021 to 2023, Burberry’s earnings snapback will be sharp.

Burberry Group - financial summary

Year-end 30 March

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 2,720 | 2,633 | 2,344 | 2,826 | 3,094 | 2,968 |

| Operating margin (%) | 16.1 | 7.2 | 22.2 | 19.2 | 21.2 | 14.1 |

| Operating profit (£m) | 437 | 189 | 521 | 543 | 657 | 418 |

| Net profit (£m) | 339 | 122 | 376 | 396 | 490 | 270 |

| Reported EPS (p) | 81.7 | 29.8 | 92.7 | 97.8 | 126 | 73.7 |

| Normalised EPS (p) | 85.2 | 103 | 58.7 | 91.6 | 120 | 78.4 |

| Return on total capital (%) | 25.8 | 7.4 | 18.6 | 18.8 | 23.0 | 16.6 |

| Operating cashflow/share (p) | 99.1 | 111 | 146 | 173 | 193 | 138 |

| Capex/share (p) | 26.6 | 36.4 | 28.3 | 39.8 | 46.1 | 56.8 |

| Free cashflow/share (p) | 72.5 | 75.1 | 118 | 133 | 147 | 81.4 |

| Dividend per share (p) | 42.5 | 11.3 | 42.5 | 47.0 | 61.0 | 61.0 |

| Covered by earnings (x) | 1.9 | 2.6 | 2.2 | 2.1 | 2.1 | 1.2 |

| Cash (£m) | 875 | 929 | 1,261 | 1,222 | 1,026 | 441 |

| Net debt (£m) | -837 | 538 | 101 | 179 | 460 | 1,154 |

| Net assets/share (p) | 354 | 300 | 384 | 407 | 405 | 322 |

Source: company accounts.

New top management adds to the intrigue

Joshua Schulman, a new CEO effective from last July, briefly led US fashion brands group Michael Kors after he turned around Coach, a fashionable American leather goods group.

He talks of widening Burberry’s customer base with lower-priced items; and indeed, if you look, for example, at cashmere scarves, is there really a vigorous market in the £200 to £800 price range – simply to show off a brand – when perfectly adequate cashmere can be bought below £100? Online searches can generate plenty of discounting also, below £50 currently.

Moreover, there is an alleged “star” designer, Daniel Lee, who made his debut with collections for last September, although it's hard to track his results amid very significant macro influences. Annual group revenue to 30 March eased 4% but was hampered by tough trading in Asia-Pacific and the US.

- Insider: director spends £100k on shares at 15-year low

- Will Labour make these big changes to the state pension?

The potential for a talented head of creative to have far-reaching effect is shown by Christopher Bailey, who joined Burberry in 2001, shortly before its flotation. He catalysed quite a golden era, departing in 2018, since when there has been quite some churn: two heads of design and two CEOs.

Quite whether history offers much precedent given that there appears to be substantially more choice in fashion nowadays. But re-iterating my regular theme of “mean-reversion”: Burberry does not need to be making net profit over £300 million like in four of the last six years; simply half that would generate EPS of 42p, hence a forward P/E of 16x.

Lack of yield and a weaker balance sheet, imply an edgy ‘hold’

It would be more comforting to accumulate shares at this point, if there was reasonable yield protection versus downside risk.

The table shows earnings cover for the dividend typically over twice and free cash flow per share often better than earnings; so if they can recover, there is potentially a yield prize here, potentially to lock in around 5% if the business recovers to sustainably better performance.

Unfortunately and regarding the prime concern now – limiting downside risk – it seems highly speculative to assume anything about dividends given that they are suspended for the full March 2025 year.

Earnings uncertainty aside, there has been some deterioration in the balance sheet over recent years, with nearly £1,200 million lease liabilities as global stores expanded, alongside £380 million debt; alongside which, cash reduced in the last financial year from £1,026 million to £441 million.

The March 2024 annual cash flow statement showed dividends requiring £233 million, but there was also a consistent £400 million shares bought back (continuing a trend since flotation that has reduced share capital by 28%). With investment up to £231 million and net cash from operations down a third to £506 million, the context was looking less good even before a shock first quarter of the new financial year.

Net assets fell 25% to £1,154 million, equivalent to 322p a share, with a modest 23% comprising intangibles.

Yet to be a convincing takeover candidate

Despite Burberry’s past prestige and this modest intangibles figure, assets are worth what they can earn. Management at Burberry has been relatively fluid the past few years, the two quite-new bosses in focus for what they can achieve.

While it looks opportune for a predator to strike now – the stock hard-hit, holders weary and the board unable yet to offer comfort – it would truly be a speculative move to pay, say, around 1,000p a share. Takeovers can be very disruptive, such a lurch could be self-defeating in the near term before Burberry’s revenues and cash flows are improved. Key staff might leave.

This stock has jumped 23% in a fortnight, chiefly due to a turnaround in expectations regarding China, although it remains to be seen, what the latest stimulus measures will be on the back of interest rate cuts.

It really boils down to your risk appetite. I want to see evidence that Burberry’s marketing is refreshed and up to the challenge; it has looked hemmed, nothing too special in terms of products, yet high prices.

If autumn collections are well-received and the story at interims is able to strike a note of progress on revenue and cost-cutting, the risk/reward profile tilts to “buy”. In the meantime, I would not be inclined to chase this China-inspired rally. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks