Stockwatch: should you own Nvidia at an all-time high?

Hot on the heels of its latest results, analyst Edmond Jackson gives his view on the AI chip firm and a potentially multi-trillion-dollar AI industry.

22nd November 2024 09:51

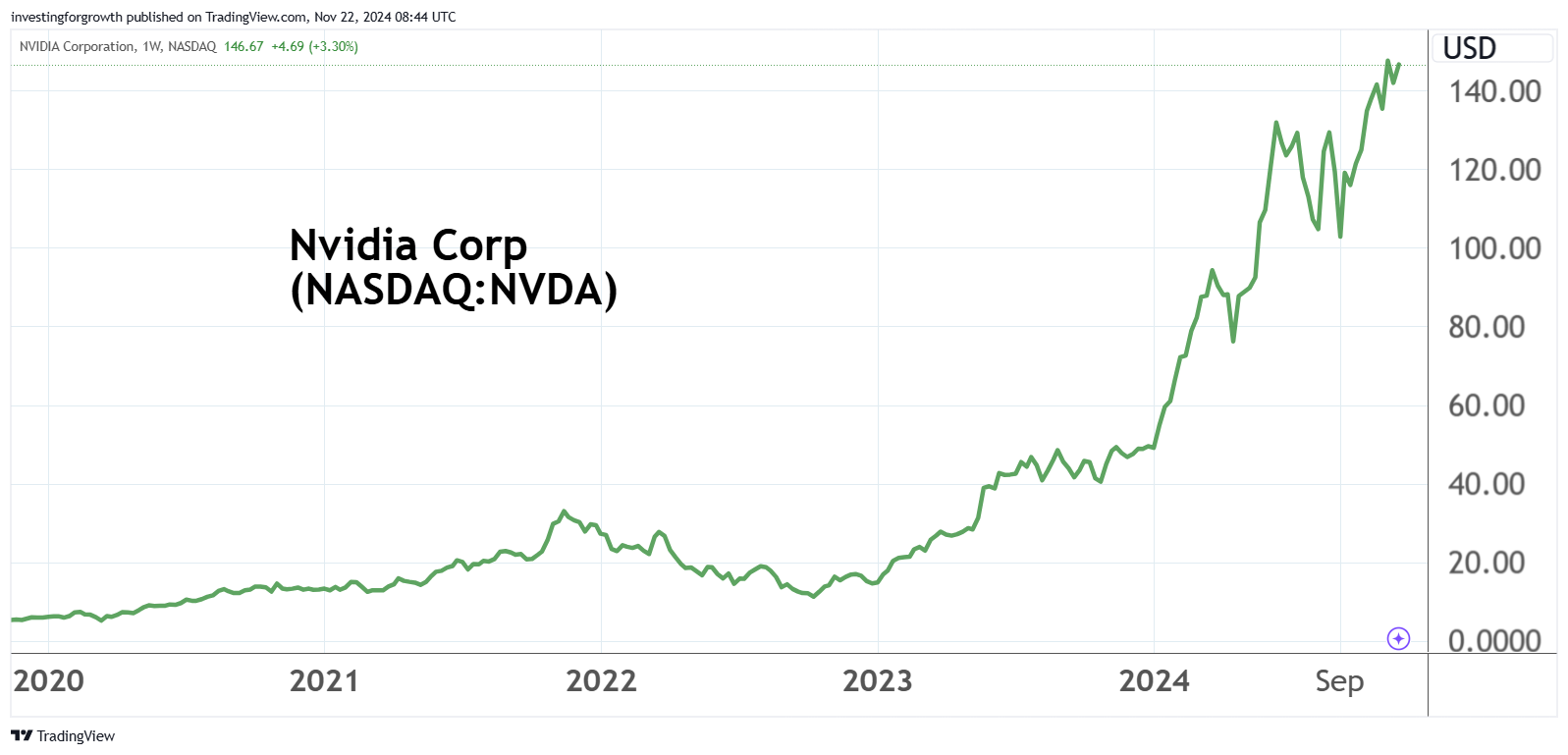

Having surpassed Apple Inc (NASDAQ:AAPL) as the world’s most highly valued listed company only a month ago, shares in NVIDIA Corp (NASDAQ:NVDA) are having an interesting wobble.

Quarterly updates from this artificial intelligence (AI) microchip group seem to attract increasing intensity of emotion, which is none too surprising given they took off like a rocket post the launch of Chat GPT towards the end of 2022. That was originated by privately held OpenAI, another of Elon Musk’s creations, but Nvidia provides the bedrock for an AI revolution under way, by way of the chips.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Buying US Shares in UK ISA

Investors learned from hard experience in mining booms long ago that the best companies to be with are the ones that provide the picks and shovels.

Source: TradingView. Past performance is not a guide to future performance.

In extended trading after release of third-quarter results last Wednesday, the stock fell 5% then recovered. It did the exact same yesterday, down 5% in early dealings but closed 0.5% ahead at $146.7. In the short term, I think holders can take encouragement from this given that it shows profit-taking being tested yet instantly overcome.

Any profit-taking is being quickly absorbed. For example, and just before the results release, it was disclosed that Bridgewater Associates – founded by billionaire Ray Dalio – had sold 1.8 million Nvidia, or 27% of their holding. Dalio has quite a cult following but Nvidia’s looks stronger.

- ii view: Nvidia misses very highest of forecasts

- Scottish Mortgage explains why it has reduced Nvidia

The relevance for investors goes much wider. AI has been a strong factor behind a circa 80% rise in the Nasdaq index since early 2023. Nvidia is perceived as an important leader both in industrial and stock market terms, hence investors are sensitive to any change, even simply in the rate of growth. Its doubling of revenues for AI microchips this year is unique for such size of company in global context.

Parallels with ARM Holdings remain apposite

When I drew attention to Nvidia as a “buy” in June 2023 as it tested $40 (before a 10-for-one stock split) it was very significant because I sensed another microchip behemoth on the public scene, like when ARM Holdings ADR (NASDAQ:ARM) demerged from Acorn Computers and floated in 1998. It clearly had potential as the default choice for chips in a huge range of consumer devices.

ARM shares experienced huge volatility and a status change, along the way to being a $140 billion (£111 billion) company on Nasdaq. I recall it trading at well over 100x earnings towards the peak of the 1998-2000 tech-stock bubble; then it crashed as that bubble burst. Its underlying financial strengths, however, meant that as another tech cycle got going from end-2002, it once again became a leader in another bull market. ARM was taken over by a Japanese conglomerate for £23 billion in 2016, then re-floated on Nasdaq in September 2023.

- Revealed: how high the S&P 500 could go in 2025

- A Trump trade, an obvious buy and a riskier stock idea

So, even if Nvidia becomes more volatile in due course, bear in mind ARM’s example over 25 years and more. Claims were made that this company would eventually succumb to competition, yet its value has broadly continued to strengthen. Obviously, and as Apple has found, as you become the world’s largest company the mathematics of growth is a high hurdle.

AI is also at a highly vigorous stage of acceptance globally, as companies rush to benefit from its service and productivity benefits. Nvidia’s Hopper and Blackwell graphics processing units (GPUs) are used industry-wide to train language models and create the new AI landscape.

A conventional sense for investment value has been limiting

Two months after my buy idea and an 18% rise to $468, I moderated my view on the stock to “hold”, but also to “buy material drops” in August 2023 following Nvidia’s second fiscal quarter 2024 numbers. My sense was not to chase a near-term substantial paper gain higher, yet there have never been any real drops, and the stock has more than trebled from $40 (split-adjusted). Meanwhile, the trailing price/earnings (PE) multiple is down from around 200x to below 60x.

Obviously, one needs to be careful not simply to assume therefore “buy at any price”, but I see a lot more genuine substance in Nvidia’s rating than froth.

Satisfactory third quarter albeit some doubts

Revenue of $35.1 billion was a near 6% beat on consensus of $33.2 billion, 17% up on the previous quarter and 94% on the third quarter of 2023. Data centre revenue – the growth engine – rose to $30.8 billion versus $29.1 billion expected, 17% up on the previous quarter and 112% up year-on-year. This platform helps customers accelerate their computing ability with fewer more powerful insights – a key aspect to productivity improvement. Most of the group’s other businesses also beat revenue expectations.

Earnings per share (EPS) of 81 cents were an 8% beat on 75 cents expected.

NVIDIA Corp - third-quarter fiscal 2025, summary

to 27 Oct

| GAAP: $ million | Q3 FY24 | Q2 FY25 | Q3 FY25 | Q/Q | Y/Y |

| Revenue | 18,120 | 30,040 | 35,082 | Up 17% | Up 94% |

| Gross margin | 74.0% | 75.1% | 74.60% | Down 0.5% | Up 0.6% |

| Operating expenses | 2,983 | 3,932 | 4,287 | Up 9% | Up 44% |

| Operating income | 10,417 | 18,642 | 21,869 | Up 17% | Up 110% |

| Net income | 9,243 | 16,599 | 19,309 | Up 16% | Up 109% |

| Diluted earnings per share $ | 0.37 | 0.67 | 0.78 | Up 16% | Up 111% |

| Guidance for fourth quarter | Revenue of $37.5 billion, plus or minus 2% | ||||

| fiscal 2025 | Gross margin around 73%, plus or minus 50 basis points | ||||

| Operating expenses around $4.8 billion | |||||

| Other income around $400 million |

Source: Nvidia newsroom.

Fourth-quarter revenue is now guided at $37.5 billion which would represent a 70% increase on 2023 and is 11% ahead of recent consensus. If you want to be picky, market sentiment has got used to Nvidia delivering sizeable beats, and the recent range of expectations goes up to $41 billion, hence the guidance is a downgrade to extent of beats.

When a growth stock fails to respond positively to earnings beats, this can signal a flagging bull market – in the sense that people likely to own the stock already do, and enough of those are edgy, looking for potential flaws as reason to secure profits.

- Terry Smith: two reasons why I haven't bought Nvidia

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

So, “technically”, yes, there is reason to be steeled for a correction, especially if the story on fundamentals shifts adversely at all.

As for being “priced for perfection” (the saying goes), Nvidia is, however, on around 60x trailing earnings versus more like 220x for ARM currently, and I recall ARM typically trading well over 40x most of the early noughties.

Watch performance by new products and competition

New products and competition appear crux issues both in the short and medium term.

A highly anticipated new Blackwell chip, alleged to run 30x faster, has experienced over-heating issues and thus put a first-quarter 2025 launch in doubt – potentially disappointing big customers. Unless promptly resolved, it looks able to disrupt stock sentiment also.

Nvidia – for now anyway – still enjoys market dominance to an extent that I am unaware ARM has matched. It has 95% of the AI accelerator market followed by Advanced Micro Devices Inc (NASDAQ:AMD), with around a 10% share and Intel Corp (NASDAQ:INTC) with a negligible 1% despite its past dominance of central processors for PCs and traditional data centres.

There is emerging rivalry, although it’s unclear quite whether it genuinely challenges Nvidia. Privately held Cerebras Systems offers chips with a different architecture, hence it’s tricky for any layperson (if not specialist, as yet) to judge take-up. Cerebras’ wafer-scale technology is said to enable faster connections and lower power consumption, with significantly less memory. But while that could cut energy costs, it may involve significantly slower processing.

- Will US shares really return 3% a year for the next decade?

- How to protect yourself against a major tech correction

From its latest filing for a public listing, Cerebras’ revenues are growing strongly – up 220% to near $79 million in 2023 – albeit from a small base. It also struck a near $78 million loss in that year’s first half, which eased only to $67 million in first-half 2024. Even so, a $250 million fundraising in 2021 valued it at over $4 billion.

Rain AI is an early stage chip developer promoted by Sam Altman, CEO of OpenAI. Rain AI’s processors allegedly surpass Nvidia’s for energy efficiency and power, although quite ironically OpenAI uses accelerators from Nvidia besides processors from Advanced Micro Devices. Rain definitely needs watching.

There remains a case simply to lock in for the ride. Nvidia can afford to lose some market share yet remain dominant. Founder Jensen Huang asserted in the latest release that he expects computing power behind AI to increase “a million-fold” over the next decade, creating a multi-trillion-dollar AI industry. You have to decide whether AI is more a phase or revolution leading to greater things. Also, by concluding with a “hold” stance, I’m conscious that I am repeating my August 2023 conclusion, which proved overcautious.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks