Stockwatch: time to begin averaging into this sector

These stocks have done little for investors over the past few years, but analyst Edmond Jackson thinks the market is starting to price in potential benefits of lower interest rates.

12th July 2024 11:25

The sector has traded weakly this year, but responsiveness to yesterday’s US inflation date implying interest rate cuts ahead, shows cyclical recovery potential.

Amid generally resilient corporate reporting lately, it is notable how mid-cap international recruiter PageGroup (LSE:PAGE) has this week produced a nasty profit warning. Recruiters can be quite a forward indicator of the wider economy, so I would always pay attention. But currently it looks chiefly like the late stage of (effects of) higher interest rates, and this macro situation may be about to turn.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Trading became tougher through the second quarter such that net fee income – recruiters’ performance benchmark – fell 15% at the reported level and 12% at constant currency. The outlook is also weak. The company warned: “new jobs registered and the number of interviews softened during the quarter and client confidence remained low”.

The upshot is that 2024 operating profit guided around £60 million versus £119 million last year and £196 million in 2022 – below even the £70 million achieved during Covid in 2020.

PageGroup - financial summary

Year end 31 Dec

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 1,065 | 1,196 | 1,372 | 1,550 | 1,654 | 1,305 | 1,644 | 1,990 | 2,010 |

| Operating margin (%) | 8.5 | 8.4 | 8.6 | 9.2 | 8.9 | 1.3 | 10.3 | 9.9 | 5.9 |

| Net profit (£m) | 66.2 | 72.1 | 83.1 | 104 | 103 | -5.7 | 118 | 139 | 77.1 |

| Reported earnings/share (p) | 21.1 | 23.1 | 26.4 | 32.4 | 32.2 | -1.8 | 37.0 | 43.5 | 24.3 |

| Normalised earnings/share (p) | 21.3 | 23.1 | 26.4 | 32.4 | 32.2 | -1.7 | 37.0 | 44.5 | 26.7 |

| Return on capital (%) | 39.5 | 39.3 | 40.8 | 42.1 | 33.5 | 4.3 | 38.7 | 43.2 | 29.5 |

| Operating cash flow/share (p) | 26.3 | 28.4 | 27.4 | 28.3 | 48.9 | 42.9 | 46.7 | 57.9 | 48.3 |

| Capex/share (p) | 4.8 | 8.1 | 6.7 | 8.0 | 8.2 | 7.1 | 8.9 | 9.9 | 9.9 |

| Free cash flow/share (p) | 21.5 | 20.3 | 20.8 | 20.3 | 40.7 | 35.8 | 37.8 | 48.0 | 38.4 |

| Ordinary dividend per share (p) | 11.5 | 12.0 | 12.5 | 13.1 | 13.7 | 0.0 | 15.0 | 15.7 | 16.4 |

| Special dividend per share (p) | 16.0 | 6.4 | 12.7 | 12.7 | 12.7 | 0.0 | 26.7 | 26.7 | 15.9 |

| Covered by earnings (x) | 0.8 | 1.3 | 1.0 | 1.3 | 1.2 | 0.0 | 0.9 | 1.0 | 0.8 |

| Cash (£m) | 95.0 | 92.8 | 95.6 | 97.7 | 97.8 | 166 | 154 | 131 | 90.1 |

| Net assets per share (p) | 68.0 | 75.6 | 82.6 | 97.0 | 98.7 | 96.1 | 103 | 107 | 93.3 |

Source: historic company REFS and company accounts.

An identical 15% income slide, like-for-like, is conveyed by mid-cap Hays (LSE:HAS), which cites longer-than-normal “time to hire” amid low levels of confidence. June saw an “exit rate” of minus 18% which can seem a bit odd versus latest data showing how the UK economy grew 0.4% in May. Hays does, however, derive nearly a third of its income from Germany. Perhaps “white-collar” professional recruitment is suffering everywhere currently due to the high salary commitments involved amid a cost-control drive.

In a similar vein, permanent recruitment bore the brunt, down 20% versus 12% for temporary.

- Hays still perilously close to 10-year low after Q4 results

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

No optimism is offered by Hays about the near term, but it has not guided profit expectations down like PageGroup, which intends to “broadly hold fee earners at existing levels to ensure we are well-placed to take advantage of opportunities as sentiment and confidence improve”. Perhaps that involves short-term cost which compromises profit.

Yet the market is seeing through this gloom, both stocks rising 5% yesterday as US inflation data met expectations to fall.

Read-across to US Federal Reserve governor remarks this week

Ironically, PageGroup has seen regions normally associated with vigour, hit hardest. Asia Pacific is down 20%, accentuated by China plunging 29% as post-Covid recovery remains weak. The US is down 19% despite its economy generally perceived as resilient.

It encapsulates why the US Federal Reserve governor Jerome Powell’s narrative has shifted this week, in testimonies: “The central bank faces a cooling jobs' market as well as persistently high prices,” he said. Higher interest rates are having an effect to curb inflation, yet it remains above the 2% target and “elevated inflation is not the only risk we face...cutting rates too late or too little could unduly weaken economic activity and employment”.

Chiefly why US equities rallied on Wednesday was Powell’s next remark: “We will not wait for 2% inflation to start cutting rates”, (from a two-decade high of 5.3%). It shows how stock markets are prone to react swifter to expectations for interest rates than corporate earnings, although you could say the two are linked anyway.

The market is seeing through to better times. Meanwhile, recruiters are classic cyclicals – these two with scope to recover much better earnings like in past years. But both also offer meaningful ordinary dividend yields – likely in the order of 4-5% - well-backed by cash reserves even if cash generation gets compromised in the second half of 2024 by lower profit.

Risk/reward profiles start to look interesting on a two-year view

My sense is that such yields limit further downside in the short term, while there is scope to capture better fee income and margin in the medium to long term. The spoiler is that trading goes from bad to worse, but is that realistic unless some global black swan appears?

Now – or at least soon – they could be in a classic cyclical trough.

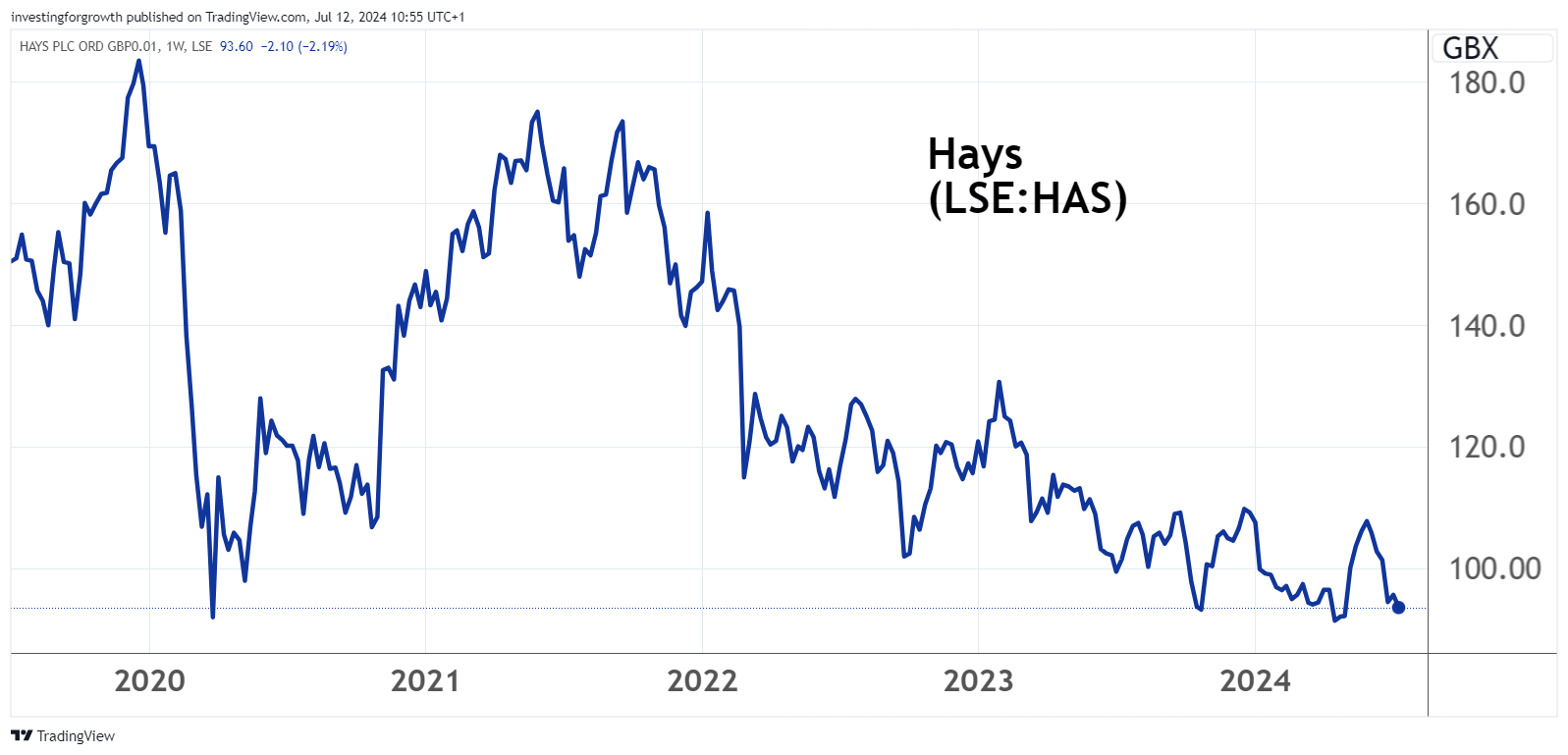

At 94p, Hays shares have just recovered from below their March 2020 Covid low after a three-year downtrend from 175p in mid-2021. Otherwise, the stock has visited lows in a 70p range only seen in relation to the great financial crisis of 2008 and late 2011 when stability of the eurozone was in doubt.

Source: TradingView. Past performance is not a guide to future performance.

The chief uncertainty is guessing near-term earnings, otherwise with £152 million cash at end-2023, a circa 3p dividend as per consensus should not even require £50 million hence looks secure.

Earnings per share are expected to halve to 4.4p in this latest year to June then regain 5.6p in 2025 (albeit only the Covid 2020 level), hence a forward price/earnings (PE) ratio in the high teens looks justified for the recovery potential as shown by Hays’ historic capability:

Hays - financial summary

Year ended 30 Jun

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 3,697 | 3,678 | 3,843 | 4,231 | 5,081 | 5,753 | 6,071 | 5,930 | 5,648 | 6,589 | 7,583 |

| Operating margin (%) | 3.4 | 3.8 | 4.2 | 4.2 | 4.1 | 4.2 | 3.9 | 1.6 | 1.7 | 3.2 | 2.6 |

| Reported earnings/share (p) | 5.1 | 6.0 | 7.3 | 8.4 | 9.5 | 11.3 | 11.0 | 3.1 | 3.6 | 9.1 | 8.5 |

| Normalised earnings/share (p) | 5.1 | 6.2 | 7.4 | 8.4 | 9.5 | 11.3 | 12.2 | 5.7 | 3.4 | 9.3 | 8.5 |

| Cash flow/share (p) | 5.0 | 6.7 | 9.0 | 7.0 | 9.2 | 11.1 | 11.5 | 23.1 | 0.4 | 10.1 | 10.2 |

| Capex/share (p) | 0.8 | 0.8 | 0.9 | 1.1 | 1.5 | 1.8 | 2.2 | 1.7 | 1.1 | 1.4 | 1.8 |

| Free cash flow/share (p) | 4.2 | 5.9 | 8.1 | 5.9 | 7.7 | 9.3 | 9.3 | 21.4 | -0.7 | 8.7 | 8.4 |

| Dividend per share (p) | 2.5 | 2.5 | 2.7 | 2.8 | 3.0 | 3.8 | 4.0 | 0.0 | 1.2 | 2.9 | 3.0 |

| Covered by earnings (x) | 2.1 | 2.5 | 2.8 | 3.0 | 3.3 | 3.0 | 2.8 | 0.0 | 3.0 | 3.2 | 2.8 |

Source: historic company REFS and company accounts.

This shows a growth profile from 2013 to 2019, disrupted since by lower income and margin, but nothing catastrophic can happen with cyclical contractors on wafer-margins.

Both these companies have a culture of special dividends, which to me is a canny way of raising/cutting the payout without conveying the impression of a volatile ordinary dividend. This tactic seems to have worked until 2023 although it’s tricky to assume “specials” will be sustained in 2024. But looking further out, it is reason to consider starting to accumulate the stocks now.

- eyeQ: share crash could be buying opportunity

- Three new ‘buy’ tips and some ‘abnormally cheap’ stocks

PageGroup has so far tried to maintain specials despite 2023 annual results falling on 2022 and the total payout uncovered by earnings, hence year-end cash declining from £131 million to £90 million. Last year’s total 32.3p a share payout constitutes a 7.6% yield on the current 424p share price.

The company’s long history of generous special dividends is likely why its chart does not show a decline as might be implied for example by the latest trading update. Enough shareholders are content to ride this episode through:

Source: TradingView. Past performance is not a guide to future performance.

A £60 million operating profit guided for 2024 seems a very big drop relative to net fee income down 15% recently, but hints at operational gearing. Also, the largest item on the end-2023 balance sheet was £380 million trade receivables – representing fees and salaries (of personnel placed) invoiced to clients, but not yet paid. Payment times should be improving, with temporary recruitment (which has a shorter collection period) being more resilient than permanent, but this is a factor able to affect profit.

Respecting also how Page’s taxation rates tend to be in the region of 30% (possibly reflecting different jurisdictions) net profit might only be £39-40 million, implying earnings per share around 12p – hence a PE multiple in mid-30s with the stock at 424p. To some, that will be plenty high enough to make them wait for better times, though others may see it as fleeting.

A case to begin averaging into recruiters

You could wait for next reported numbers to look bad, yet the prospect is essentially known from both companies guiding for a weaker near-term outlook. Yesterday’s 5% rise in these recruiters shows the market starting to price in potential benefits of lower interest rates on companies’ hiring. Unless markets hit turbulence, I suspect this macro factor will prevail over company-specific fears.

I cite Hays and PageGroup as leading examples to apply a “buy” rating. You could also find other and smaller plays in the sector – for example Robert Walters (LSE:RWA) – as worth investigating.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks