Stockwatch: a recovering finance stock at a discount

Medium-term guidance implies a lot more upside for this bank share, and analyst Edmond Jackson is backing management’s actions and valuation. A chart pattern is also compelling.

2nd August 2024 11:37

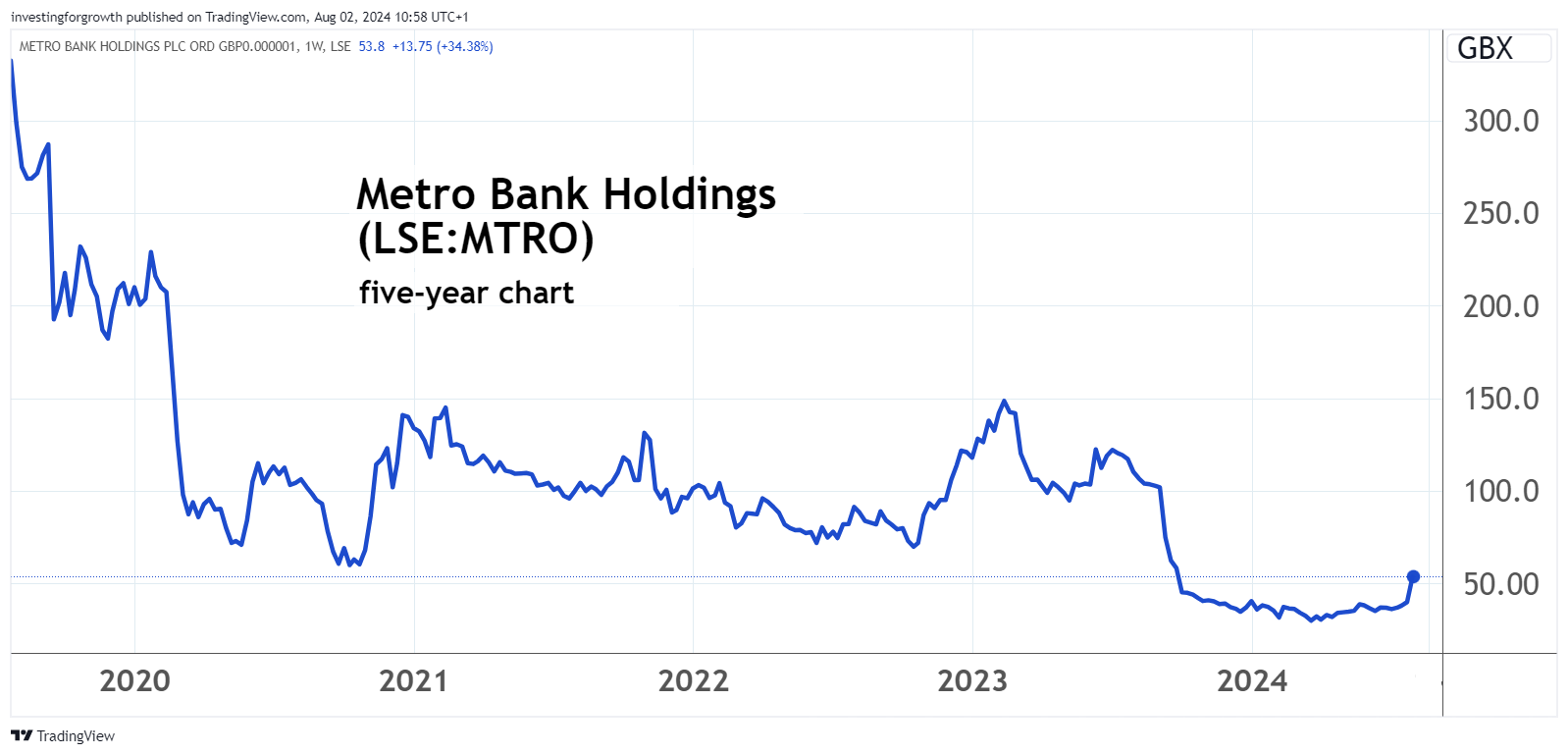

After jumping over 40% after publishing its latest interim results, has Metro Bank Holdings (LSE:MTRO) finally broken with a history of woe, such that a 60% discount to net tangible assets can continue to close?

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Launched in 2010 as an early “challenger bank” to the big four UK names, Metro Bank floated in 2016 at 2,000p a share and doubled in market value over two years. Significantly due to past management’s hubris, the share price then plunged from 4,018p to below 300p by autumn 2019, reaching 90p during the market’s Covid slump.

Source: TradingView. Past performance is not a guide to future performance.

Metro only bottomed last March below 30p and started this week at 40p – hitting 55p after its results and currently sitting at 53p. Yet considering the pattern of October 2023 to now, it shows an extended “bowl”, which chart analysts usually interpret as a turning point for sentiment. It suggests investors liable to sell already have, and confidence is starting to build:

Source: TradingView. Past performance is not a guide to future performance.

Along the way, this stock has traded at a tantalising circa 90% discount to tangible net assets, nowadays 60% due to a dilutive equity-raising at 30p last November. This value metric does vary among banks, mind. Barclays (LSE:BARC) trades at a 50% discount while NatWest Group (LSE:NWG) is at 6%.

- Barclays is preferred UK bank share after this profits beat

- Lloyds Bank shares downgraded as NatWest tipped to top £4

I succumbed to Metro prematurely with a speculative “buy” stance at 96p in January 2022, which I retained that November at around 80p after three directors bought £208,000 worth at up to 90p. A third-quarter 2022 update also cited a return to both statutory and reported profit in September, ahead of guidance for the first quarter of 2023. But last year proved a contrast, the second half impacted by speculation about Metro’s capital position that led to a £325 million debt/equity-raise. Perhaps the ultimate lesson is how long turnarounds can take.

Medium to longer-term guidance appears dramatically raised

Last Wednesday’s interim results anticipated profitability in the fourth quarter of this year. Yet medium-term guidance – if it can be trusted – implies a lot more upside for Metro shares.

Numbers for the six months to 30 June offer no cheer: the like-for-like underlying pre-tax loss reduced from £33 million to £27 million, the statement propped by assurance that loan quality is improving while costs are cut. The recent loss has resulted from paying depositors more to attract funds in the fourth quarter of 2023.

But the 26 July sale of a residential mortgage portfolio to NatWest Group for up to £2.4 billion cash helps favour a tilt to profitability. It is said to reduce risk-weighted assets by £824 million and boost lending capacity as the bank re-focuses on higher-yielding commercial loans and specialist mortgages. The CEO talks of Metro becoming “a specialist lender of choice in niche and under-served markets” – which is interesting so long as it’s not “sub-prime”, which at some point meets with recession.

The key takeaway is guidance on “ROTE”. Unhelpfully, Metro does not specify what is meant by this, among five acronyms in the results highlights alone, but it can only be return on tangible equity.

This is indicated at “mid-to-upper single digits” in respect of 2025, double digits in 2026 and mid-to-upper teens thereafter. Partly it appears because management is so confident it can raise the net interest margin (difference between income from loans and money paid to depositors) to improve to 2.5% this year, 3.25% in 2025 and 4% in 2026.

Since Metro’s balance sheet has tangible book value of £922 million, a circa 7% median return as guided for 2025 implies £65 million net profit and earnings per share (EPS) just shy of 10p. This compares with recent consensus for £40 million and EPS near 6p, figures now rising as upgrades follow. If fair, it implies a forward price/earnings (PE) ratio of 5.4x, although Metro remains a way from paying dividends.

More significantly, and if management is roughly right, a median 17% return on equity in two years or so implies EPS just over 23p – or a PE of only 2.3x.

Metro Bank - financial summary

Year end 31 Dec

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 120 | 195 | 294 | 404 | 422 | 434 | 420 | 531 | 669 |

| Operating profit (£m) | -56.8 | -17.2 | 18.7 | 40.6 | -131 | -311 | -245 | -70.7 | 30.5 |

| Operating margin (%) | -47.3 | -8.8 | 6.4 | 10.0 | -31.0 | -71.8 | -58.3 | -13.3 | 4.6 |

| Net profit (£m) | -49.2 | -16.8 | 10.8 | 27.1 | -183 | -302 | -248 | -72.7 | 29.5 |

| Reported earnings/share (p) | -61.3 | -21.8 | 12.6 | 28.3 | -124 | -175 | -144 | -42.2 | 13.4 |

| Normalised earnings/share (p) | -53.0 | -17.2 | 13.9 | 31.6 | -89.6 | -122 | -116 | -34.6 | 0.1 |

| Operating cashflow/share (p) | 680 | 1,522 | 2,670 | 160 | -1,109 | 604 | 1,655 | -687 | 284 |

| Capital expenditure/share (p) | 99.1 | 186 | 198 | 235 | 135 | 63.8 | 47.0 | 30.7 | 17.2 |

| Free cashflow/share (p) | 581 | 1,336 | 2,471 | -75.1 | -1,244 | 552 | 1,608 | -718 | 267 |

| Cash (£m) | 282 | 500 | 2,212 | 2,472 | 2,989 | 2,993 | 3,568 | 1,956 | 3,891 |

| Net debt (£m) | 280 | 153 | -2,091 | -1,879 | -1,807 | -1,870 | -2,542 | -899 | 1,772 |

| Net assets (£m) | 407 | 805 | 1,097 | 1,403 | 1,583 | 1,289 | 1,035 | 956 | 1,134 |

| Net assets per share (p) | 507 | 1,001 | 1,240 | 1,440 | 918 | 748 | 600 | 554 | 169 |

Source: historic company REFS and company accounts

Improving housing market ought to help

While management’s objective is for mortgage lending to drop to around 30% of loans by early 2029 versus commercial lending around 70%, mortgages have lately constituted 64%. So it is at least encouraging in the short term how yesterday lender Nationwide cited housing market confidence improving – as implied by annual house price inflation of 2.1% in July against 1.5% in June.

This represents the fastest rises since the trough of December 2022, post the infamous UK mini-budget, but obviously affordability of homes and mortgages needs considering too. An ongoing uncertainty both for mortgage and commercial loan demand is the effect of Labour budgets. We wait to see how tax rises might affect people, whether chiefly it is on inheritance tax and capital gains, and whether it has a minimal effect on the home buyers that Metro is geared towards. What will be the broader effect on the UK economy and business? Bank shares are always significantly a play on this, Metro being UK-focused.

- The taxes Labour might hike in its first Budget

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Investors besides voters have largely swallowed Labour’s claims as to “creating growth”, and the prospect for equities is benign due to “stability” in the offing. But already, various infrastructure spending – a key means to growth – is under the cosh. If stealth taxes and council tax rises conflate, it would affect consumer spending. The ambitious middle class will also be stung by VAT on school fees.

I find it premature to cast verdict on UK prospects until we see the cut of Labour’s jib from the Autumn Budget and its effects thereafter; certainly to be specific on what returns on assets a bank can generate.

Yet I still see the balance of probability having changed in favour of upside for Metro’s equity, due to management’s actions and its discount to assets.

Last November’s capital-raise looks a key turning point

A key reason I was deterred to write positively on Metro last November was a 12% coupon exacted on the debt element and what that implied for perception of risk and management.

Yet it secured confidence for depositors at a crucial time when various banks were competing hard for funds. Metro’s joining the party with a high-interest rate account campaign has helped keep deposits stable at £15.7 billion. It does, however, show that banks sometimes need to “invest” in their offering (quite like supermarkets say they do in low prices) to stay competitive. Metro effectively incurred dilution to maintain its loan-to-deposit ratios.

It has all meant Metro lagged many other stock re-ratings this year, including major UK banks which soared from February. With risk appetite generally increased of late, as UK equities started finally to close on global ratings, Metro has joined others responsive to positive updates. More promise than proof still seems involved here.

Targeting fair value thus remains tricky as so much rests on the validity of guidance. Metro has no precedent for the kind of returns management anticipate, nor a dividend record – in contrast with long-established banks and also mid-cap Paragon Banking Group (LSE:PAG), which offers a 5.2% yield around 775p.

Yet I think it appropriate to draw attention to Metro and maintain “buy”. Management’s initiatives stand a fair chance of generating results that the market is starting to price for.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks