Taking advantage of 25% discount in Hong Kong markets

There’s an anomaly that exists which can mean you get to buy the same company on the same terms but at a big discount. Analyst John Ficenec explains how it’s done.

30th July 2025 11:34

Double-digit returns could be on offer for adventurous investors in Hong Kong-listed shares. We take a closer look at one of the strongest capital markets this year and show why there is every reason it could offer strong returns in the second half of the year as trade tensions cool, and China backs a record number of companies seeking to raise capital.

- Invest with ii: Buy & trade Hong Kong shares | Interactive investor Offers | Open a Trading Account

The Shanghai mystery

What if I had a company worth £100 - in the right hand I held a share certificate that would cost £125, in the left hand a share certificate that would cost £100, which would you choose? No tricks, same company, same economic rights, same dividend income, just a straight up 25% discount. That’s what is currently happening in Asian markets where the same company listed in Shanghai trades at a different price to its dual listing in Hong Kong.

The A-share premium

It’s a quirk of international finance that means some of the biggest tech and financial institutions in the world trade at different prices. What we’re talking about here is that the price of the A-shares on the Chinese mainland trade at a premium to its dual H-share listing in Hong Kong, something called the AH premium. In modern finance, and given the ease of capital flows, that should be impossible.

Fungibility

It’s true that there is one difference, namely that A-shares and H-shares are not fungible. For example, a £10 note is fungible with two £5s, or ten £1 coins. In that respect the two shares aren’t exchangeable, but in every other respect of shareholder economic rights they are one and the same.

Chinese puzzle

On the face of it, there’s no reason for this difference to exist. Academics have applied mathematics, market theory and statistics to try and come up with an answer and the best they could conclude was that it exists because it’s always been there. However, there are several explanations that are slightly more nuanced and subjective than maths that go some way to understanding why it exists.

- Funds and trusts four pros are buying and selling: Q3

- Should you invest when markets are at all-time highs?

China has a centralised and controlled approach to financial markets. Some of the largest financial institutions are state owned. To support its mainland markets these pension providers and insurance giants have been encouraged to buy A-shares. On top of this there are currency controls and restrictions on foreigners holding A-shares. All this can create a sort of onshore liquidity pressure where the domestic reinvestment into A-shares drives up prices at the expense of the off-shore H-share listing. It’s not proven, but it makes sense.

Hong Kong problem child

It’s safe to say that China has struggled to decide quite what to do with Hong Kong. The former British colony was handed back in 1997, and with it came one of the largest, most successful and vibrant capital markets in the world. The Hang Seng main market is about the same size as London at around the £4.5 trillion mark, and one of the top 10 capital markets in the world sitting behind only the US, Europe, China and Japan.

But this sat somewhat uncomfortably with a centrally controlled political, financial and capital system under the Chinese Communist Party in Beijing. You could even ask the question why did China need Hong Kong at all? Surely better to just let it wither away and quietly be taken over by Shanghai, rather than the headache of running a market with different laws and a population used to different rules.

In the end, China opted for something of a workaround by granting Hong Kong its own Special Administrative Region status, with a degree of autonomy under the Basic Law that forms something of a constitution, or what is known as the one country, two systems model.

Teething trouble and umbrellas

The shift to complete Chinese sovereignty while operating a legal and corporate framework based on 150 years of colonial case law and institutions hasn’t been without its problems. In 2014, this broke out into the umbrella demonstrations.

Against this backdrop of uncertainty China opened the Stock Connect system in late 2014 which allowed Hong Kong investors to access Chinese mainland A-shares for the first time. The money flooded in as Hong Kong investors chased the returns on offer from rapid Chinese growth, driving the AH premium to a peak of around 50% in 2015.

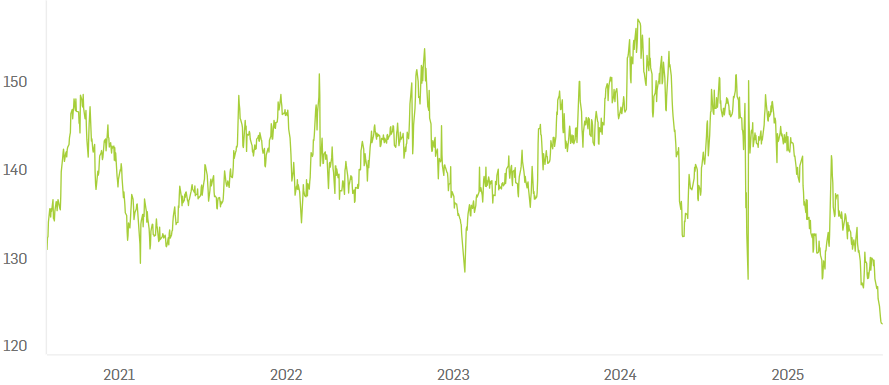

More recently, the AH premium has been closing rapidly, and this offers a chance for double-digit returns as experts believe there is every reason the gap will close throughout the second half of 2025. The Hang Seng has tracked the AH premium through a stock index since 2007 and it has ranged between 3% to 50%, averaging 27%. It started 2025 at around a 40% premium and has dropped rapidly to around 25% for very good reason.

Hang Seng Stock Connect China AH Premium Index

Source: Hang Seng Indexes. Measures the absolute price premium (or discount) of A shares over H shares for the largest and most liquid mainland China companies with both A-share and H-share listings (AH Companies). Past performance is not a guide to future performance.

Trump, tariffs and turmoil

Trump’s election last year and tariff announcements in April this year have rocked global markets. When combined with the US Treasury restrictions on investment in China, Hong Kong and Macau, implemented in October 2024, it’s difficult to view it as anything other than squarely aimed at starving the Chinese tech industry of capital.

The US controls almost half the world’s capital, according to recent research from Deutsche Bank so, with that restricted, then China needs a replacement and fast.

The Hongs of the Pearl River

It’s no accident that Hong Kong sits on the mouth of the great Pearl River delta, downstream from Guangzhou and the birthplace of the 13 Hongs, or trading houses that were the gateway for European merchants to the riches of the Qing Dynasty.

Via a slightly circuitous route, this brings us back to the small island of Hong Kong just off the coast of China and its position in the world. Far from being a headache, Hong Kong now offers a ready-made solution to China’s search for new capital to fund growth as it looks to move away from reliance on the US and the dollar.

Elephant in the room

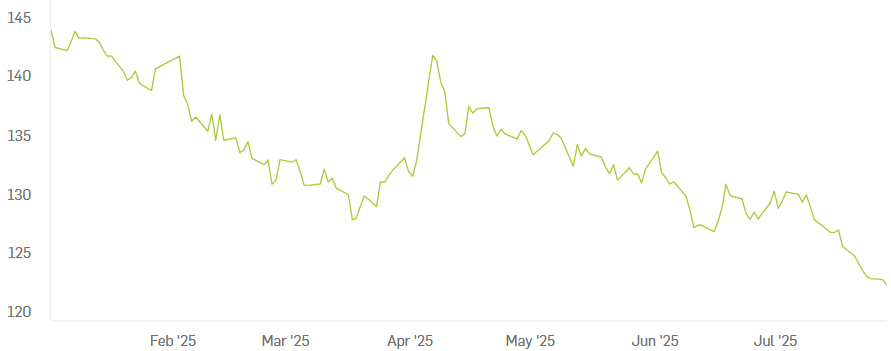

The big question with Hong Kong has always been what does China want to do with it? Trump’s first round of tariffs in 2018 knocked the Hang Seng off all-time highs, and the index is still lower more than seven years later. Chinese markets fared little better, with the Shanghai index largely going sideways since 2018 as fears over growth and trade wars weighed on investor sentiment.

It now looks pretty clear what the role is for Hong Kong. China is intent on kickstarting the capital market to encourage foreign investment. While no official announcement has been made, investors on the mainland have been piling into H-shares. The amount invested from mainland China into Hong Kong during the first six months already exceeds the whole of last year. Chinese investors recently made up almost half the daily stock turnover on the Hang Seng, up from around 30% a year ago, according to data from the Stock Connect system.

- Where to invest in Q3 2025? Four experts have their say

- Chinese brands are challenging Western rivals – and investor assumptions

In a speech in Hong Kong earlier this year, Pan Gongsheng, the governor of the People’s Bank of China, said he supported Chinese companies listing and raising capital in Hong Kong and would allow greater foreign reserves to be held here to underpin the market. While not going as far as an explicit backstop to the Hang Seng, China is certainly giving its full backing.

China’s financial regulator has also announced measures to force state-backed insurers and mutual funds to invest 30% of any new premiums in A-shares to drive a recovery in the market. This measure was also followed by the January launch of the Deep Seek chat bot, which was a clear statement of intent about China’s position in the nascent artificial intelligence (AI) industry. China has been clear that it wants to lead the world in AI within the next five years.

Green shoots

The Hang Seng index has responded to the coordinated action in predictable style by jumping almost 30% higher so far this year, breaking through the psychologically important 25,000 level only last week. The premium of A-shares over H-shares has subsequently tumbled to its lowest level for five years.

Source: Hang Seng Indexes. Hang Seng Stock Connect China AH Premium Index measures the absolute price premium (or discount) of A shares over H shares for the largest and most liquid mainland China companies with both A-share and H-share listings (AH Companies). Past performance is not a guide to future performance.

The concern that all the good news is already priced in is fair, but we have to remember that Hong Kong is recovering from a low base. The Hang Seng is back roughly where it was five years ago.

Source: TradingView. Past performance is not a guide to future performance.

Value play

There is much to like about the fundamentals of Hong Kong. The main index - the Hang Seng - had a modest price/earnings (PE) ratio of 12.1 times at the end of June and offers a dividend yield of 3.4%. The index as a whole is well balanced with the top five sectors being financials 33%, consumer discretionary 25%, technology 19%, energy 4% and telecoms 4%.

The top five names are also well known, with banking giant HSBC Holdings (LSE:HSBA) making up 8% of the index, Tencent Holdings Ltd (SEHK:700), the owner of social media platform WeChat and popular game Fortnite, 8%, online retailer Alibaba Group Holding Ltd Ordinary Shares (SEHK:9988) 7%, mobile phone maker Xiaomi Corp Class B (SEHK:1810) 7%, and China Construction Bank Corp Class H (SEHK:939) 6%.

- Why the negative reaction to HSBC's first-half results?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

What’s interesting is what could happen during the next six months. The IPO and listing market in Hong Kong was one of the strongest in the world in the first half of 2025 and the IPO pipeline has reached a record high of 190, according to data from the Hong Kong Stock Exchange, as companies seek secondary listings and look to recapitalise. A large number of them are tech companies that need funds for growth.

The other factor is the improving outlook on international trade. The US recently signed a trade deal with Japan, and with the European Union over the weekend. Meanwhile, progress on China sounds promising. Treasury Secretary Scott Bessent said that “we’re in a very good place with China”. At the very least, the lower tariff levels have been agreed to be rolled forward.

“We think the peak trade risk has already passed, and China’s economy has been more resilient than many had expected,” said Yi Xiong, Deutsche Bank’s chief economist, China.

Attractive options

For the adventurous investor, it might be a niche trade worth investigating further. The options are to either buy directly into popular names such as Tencent, Alibaba, Xiaomi, Ping An Insurance (Group) Co. of China Ltd Class H (SEHK:2318), and Baidu Inc (SEHK:9888).

There are some tech-focused trackers such as HSBC Hang Seng Tech ETF GBP (LSE:HSTC) or funds like Barings Hong Kong China I GBP Acc.

With the full backing of China, appealing fundamentals and some eye-catching returns on offer, allocating to Hong Kong might be an attractive way into a trade agreement between the US and China.

John Ficenec is a freelance contributor and not a direct employee of interactive investor.

Currency changes affect international investments, and this can decrease their value in sterling. If you're unsure about investing, please speak to an authorised financial adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks