Three sums exploring how personal finances might change post-Budget

ii reveals the potential financial impact of some of the key announcements.

5th November 2024 10:00

Now that the dust has settled a bit after one of the most change-making Budgets in recent history, interactive investor has crunched some numbers to illustrate the potential financial impact of some of the key announcements.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Capital gains tax (CGT)

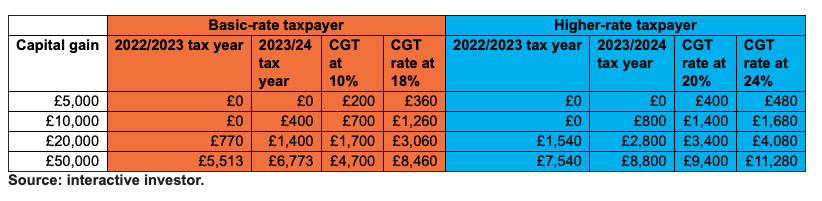

- Basic-rate taxpayer: The CGT rate on gains made above the £3,000 tax-free threshold has increased from 10% to 18% for basic-rate taxpayers.

This translates to a CGT liability of £360 on capital gains of £5,000 — up from £200 under the 10% CGT rate. On gains of £10,000, £20,000, and £50,000, the CGT liability would increase to £1,260, £3,060, and £8,460, respectively.

No CGT was payable on £5,000 in the 2022-23 tax year when the CGT allowance was £12,300, or in the 2023-24 tax year when the allowance was cut to £6,000.

The tax charge could be even higher if the taxpayer has other income that would push them into a higher tax bracket. Here, gains and income beyond the £50,270 higher-rate tax threshold may be chargeable at a higher rate.

- Higher-rate taxpayer: The CGT rate on gains made above the £3,000 tax-free threshold has increased from 20% to 24% for higher-rate taxpayers.

This means that the CGT liability on a gain of £5,000 is now £480 (under the new 24% CGT rate), up from £400 under the 20% rate.

On gains of £10,000, £20,000, and £50,000, the CGT liability would increase to £1,680, £4,080, and £11,280, respectively.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “The CGT regime is unrecognisable from how it was a mere two years ago. The CGT allowance was cut and then hacked again and is now less than a quarter of the level in the 2022-23 tax year. The increase in capital gains rates is the latest blow.

“The new status quo in the CGT regime means that capital gains tax planning has taken on a new level of importance. Shifting investments into tax wrappers such as ISAs and pensions, which protect future gains and dividends from the clutches of tax, has never been more valuable. Investors are also likely to explore ways of mitigating the CGT liability, such as spreading gains across two or more tax years, using losses to offset gains, and transferring assets to their spouse.”

Inheritance planning

- The chancellor announced a series of changes affecting the inheritance tax regime. One of the key announcements is that pensions will be included as part of inheritance tax calculations from April 2027.

- Assuming an estate has no nil rate bands available to reduce the IHT pension tax, pension pots will be liable for the full 40% IHT tax rate.

- This would mean a pension pot valued at £100,000 at death would be worth £60,000 once the 40% IHT charge has been deducted. The IHT charge on a £250,000, £500,000, and £1 million pot would be £100,000, £200,000, and £400,000, respectively.

|

Pension pot at death |

IHT liability |

Pension pot remaining |

|

£100,000 |

£40,000 |

£60,000 |

|

£250,000 |

£100,000 |

£150,000 |

|

£500,000 |

£200,000 |

£300,000 |

|

£1,000,000 |

£400,000 |

£600,000 |

Assumes the estate has no nil rate bands (used up by the value of a residential property for example) available to reduce the IHT pension tax. Source: interactive investor.

Myron Jobson says: “Building up a sizeable pension pot to shield assets from inheritance tax has been a cornerstone of retirement planning in the post-pension freedom era. Bringing pensions into IHT calculations could force many savers to tear up their meticulously crafted retirement plans, which involve using other assets for income and leaving pension savings untouched for as long as possible to be passed on to their loved ones tax-free.

“The move would also result in a double whammy of taxation for beneficiaries: first through inheritance tax on the pension’s value and then through income tax on the amount they withdraw from the pension.

“The change will not be implemented until April 2027, so there is still ample time for the policy to be ironed out, but the move is likely to result in a paradigm shift in retirement planning. Savers might increasingly give a living inheritance and draw down their pension pots during their lifetime, rather than preserving them for inheritance purposes. Previously, it made sense to draw income from pensions last – now people will need to revisit their retirement plans and may change the order of how they access their assets.”

Extra national insurance (NI) burden on employers

From next April, employers will have to pay NI at 15%, up from 13.8%, with the threshold at which employers start paying NI on salaries dropping from £9,100 to £5,000.

The change means that an employer would be paying an additional £746 a year in NI per employee earning £20,000. On an employee salary of £35,000, £50,000, and £80,000, the additional annual NI burden would be £926, £1,106, and £1,466, respectively.

|

Salary |

Current NI liability |

NI liability From April 2025 |

Extra NI liability |

|

£20,000 |

£1,504 |

£2,250 |

£746 |

|

£35,000 |

£3,574 |

£4,500 |

£926 |

|

£50,000 |

£5,644 |

£6,750 |

£1,106 |

|

£80.000 |

£9,784 |

£11,250 |

£1,466 |

Source: interactive investor

Myron Jobson says: “A lot of the discussion leading up to the Budget centred around what constitutes ‘working people.’ Regardless of your definition, the Budget announcements are likely to impact every type of worker. The additional tax burden on employers could trigger a trickle-down effect, where the need to manage elevated expenses forces companies to tighten their payroll budgets. This could result in employers reducing planned pay increases or scrapping them altogether.

“This move could encourage employers to lean on the existing salary sacrifice regime, which is a win-win benefit that allows workers to lower their taxable income enough to avoid being ensnared by tax traps such as the High-Income Child Benefit Charge. It also allows employers to reduce their National Insurance tax burden.

“The measure could also have a significant impact on a different yet equally important group of working people: freelancers and contractors who operate through an umbrella company to act as an intermediary between them and their clients.

“In most cases, the umbrella company employs a freelancer/contractor and pays their wages through PAYE. As such, the increase in NI for employers threatens to reduce the take-home pay for hundreds of thousands of freelancers. While any tax hikes may be passed down to the end client, this might not always be an option for freelancers in competitive sectors.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks