Two stocks to buy at discount prices

This pair has been affected by Trump’s tariff policy, but analyst Rodney Hobson thinks they’re cheap enough now to be a decent recovery play.

11th June 2025 07:33

American retailers are starting to get twitchy about the possible impact of the Trump tariffs on the supply of goods they sell, especially as there are mixed signals on the US economy. Jobs figures showed that employment is holding up remarkably well, with more people than expected finding employment so far this year, but the shrinking of the economy in the first quarter cannot be ignored.

President Donald Trump tried to blame the contraction on President Joe Biden, but that excuse is wearing a bit thin given the flurry of economic activity that has characterised the Trump Administration in its first few weeks. We have to learn to live with a more quixotic approach to governing – and so too do the retailers.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Department store Macy's Inc (NYSE:M) has lowered its guidance for profits for this financial year because it is unsure what impact higher tariffs will have on consumer demand. Chief executive Tony Spring pointed out that higher prices from higher tariffs had little if any impact in the first quarter but were already creeping in by the end of May, albeit slowly. This is ominous, since the full impact of increased tariffs was delayed by heavy stockpiling at the start of 2025. After all, there was plenty of warning of the storm to come.

Macy’s sources about a fifth of its goods from China, the object of Trump’s major ire. It now faces the disruption of finding suppliers in other countries – which may still be subject to tariffs, albeit lower ones - and where possible renegotiating deals with existing suppliers.

Net sales for the three months to 3 May were down 5.1% to $4.6 billion even after allowing for store closures, although this was slightly better than analysts feared. Net income slumped 39% to $38 million, and the company itself has reduced full-year guidance from at least $2.05 a share to at most $2 and possibly as little as $1.60.

The main problem is the core Macy’s brand, where sales have fallen for 12 consecutive quarters. The group plans to concentrate on its better-performing Bluemercury beauty and skincare products and its Bloomingdale’s luxury goods outlets.

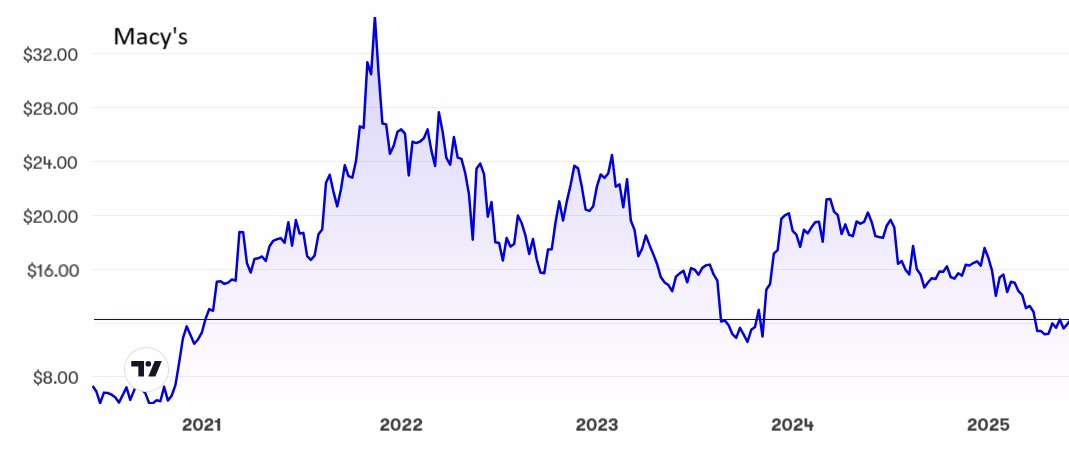

Source: interactive investor. Past performance is not a guide to future performance.

Macy’s is not the only US retailer to be warning of tough times ahead. Abercrombie & Fitch Co Class A (NYSE:ANF) also lowered annual profit expectations although there was considerable consolation in record first quarter net sales, up 8% to $1.1 billion in the quarter to 3 May, with increased sales in all regions. Alas, net earnings were down from $2.14 to $1.59 a share, as operating margins shrunk from 12.7% to 9.3%.

Last month Walmart Inc (NYSE:WMT) warned that higher tariffs would translate into higher prices, starting in May and becoming more pronounced. This was despite Walmart’s ability as the largest retailer in the world to push down supply costs, benefit from technical innovations and run an efficient supply and distribution chain.

- 10 actionable trading signals for week beginning 9 June 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Macy’s shares almost touched $35 in 2021 but have been on the slide since, despite possible bid interest in 2023. They look to have bottomed out around $11 as they did last year and currently stand at $12.34, where the price/earnings (PE) ratio is only 6.2 while the yield is a tempting 5.7%.

Abercrombie was $188 a year ago but has fallen heavily this year and is now $81, having bottomed at $71. The PE is only slightly higher than Macy’s at 8.1 but there is no yield to offer consolation.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: In December 2023, Macy’s was subject to a buyout offer at just under $20 and I advised investors to hold on for better. The offer was revised up twice to reach $24.80 but that was as good as it got and talks with the Macy’s board were discontinued the following July. At half the putative bid price there is more than enough bad news factored in. Buy for recovery.

Abercrombie stock should also continue to recover but it has many stores in Canada where anti-American feeling is highest. It just about rates a buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks