Share Sleuth: trading resumes with a top-up

Trump trade tariff uncertainty left Richard Beddard sitting on his hands for a spell, but now he’s back in action and has added to a holding in the portfolio.

12th June 2025 15:29

My last trade in the Share Sleuth Portfolio was on 26 March when I liquidated holdings in Garmin Ltd (NYSE:GRMN) and Celebrus Technologies (LSE:CLBS).

Since then, I’ve been temporarily incapacitated by events. I’ve been trying to work out whether increasing barriers to trade diminish the appeal of the many manufacturers and distributors in the portfolio.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Sitting on my hands is becoming a habit during uncertain times. I sat on them in the early months of the Covid pandemic, I didn’t know what to do then either.

It feels wrong. When I added each of the portfolio’s shares, I thought they would individually prosper through thick and thin. Consequently, I feel I should be a buyer when share prices are low.

Prevaricating is forgivable though. Sometimes we need time to digest really big events to work out what, if anything, to do about them. My ruminations are ongoing and will be reflected in the scores I give shares, but I’m ready to resume trading.

My scoring system, The Decision Engine, guides trades in the Share Sleuth portfolio. It scores four criteria. Three relate to the “quality” of a business: how successfully it has made money, how big the risks are, and how coherently the firm’s strategy addresses them.

The maximum score for each criteria is 3, giving a maximum quality score of 9. A share’s score is the combination of this quality score and its price score (maximum 1, minimum -3), which gives a total out of 10.

- Winter fuel payment U-turn and the new tax cliff edge

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Recently, I marked shares in the Decision Engine that score 6 or less out of 9 for quality ready for deletion. There are three of these shares in the Share Sleuth portfolio and my intention is to liquidate these holdings. Then I can invest the proceeds in businesses I deem to be of higher quality.

|

# |

company |

description |

score |

% |

|

23 |

*Victrex* |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

1.2% | |

|

24 |

*Treatt* |

Sources, processes and develops flavours esp. for soft drinks |

1.1% | |

|

32 |

*RWS* |

Translates documents and localises software and content for businesses |

1.3% |

Click a share’s score to see a breakdown. # is the share’s rank out of 40, % is the value of the holding as a proportion of the total value of Share Sleuth.

These are not obviously bad businesses, but they are to my mind speculative.

They are not the only shares in the portfolio that are at risk. Three more shares, all of them good-quality businesses, are verging on being overpriced according to the Decision Engine algorithm. The “fair value” range is between 5 and 7, and they are closer to 5:

|

# |

company |

description |

score |

% |

|

37 |

Goodwin |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.1 | |

|

39 |

Cohort |

Manufactures military technology, does research and consultancy |

6.2 |

Click a share’s score to see a breakdown. # is the share’s rank out of 40, % is the value of the holding as a proportion of the total value of Share Sleuth.

The holdings in these businesses are larger because they have performed well. My aim is to hold good-quality businesses for the long term, so I’m more likely to reduce their size to the minimum holding size of 2.5% of the total value of the portfolio than liquidate them.

Because of March’s liquidations and dividend payments, the portfolio was awash with over £18,000 in cash last Tuesday when I sat down to trade, so I didn’t liquidate or reduce any of these holdings.

Cash in the Share Sleuth portfolio earns no interest. To keep the portfolio invested for the long term, I needed to add to holdings nearer the top of the Decision Engine table:

|

# |

company |

description |

score |

% |

|

1 |

James Latham |

Imports and distributes timber and timber products |

6.5% | |

|

2 |

FW Thorpe |

Makes light fittings for commercial and public buildings, roads, and tunnels |

6.7% | |

|

3 |

Dewhurst |

Manufactures pushbuttons and other components for lifts and ATMs |

4.1% | |

|

4 |

Churchill China |

Manufactures tableware for restaurants etc. |

5.1% | |

|

5 |

Howden Joinery |

Supplies kitchens to small builders |

6.4% | |

|

6 |

Oxford Instruments |

Manufacturer of scientific equipment for industry and academia |

2.3% | |

|

7 |

Renishaw |

Whiz bang manufacturer of automated machine tools and robots |

3.3% | |

|

8 |

Focusrite |

Designs recording equipment, loudspeakers, and instruments for musicians |

2.1% | |

|

9 |

Bunzl |

Distributes essential everyday items consumed by organisations |

2.3% | |

|

10 |

Solid State |

Assembles electronic systems (e.g. computers and radios) and distributes components |

4.9% |

Click a share’s score to see a breakdown. # is the share’s rank out of 40, % is the value of the holding as a proportion of the total value of Share Sleuth.

Five of these shares, Latham (James) (LSE:LTHM), Thorpe (F W) (LSE:TFW), Churchill China (LSE:CHH), Howden Joinery Group (LSE:HWDN) and Solid State (LSE:SOLI) are already substantial holdings, close to their ideal holding sizes (as defined in the explainer linked at the bottom of this page).

That puts Dewhurst Group (LSE:DWHT), Oxford Instruments (LSE:OXIG), Renishaw (LSE:RSW), Focusrite (LSE:TUNE), and Bunzl (LSE:BNZL) in the frame for investment.

Except for Bunzl, my scores predate the escalation of tariffs and increased barriers to global trade since April. That makes me cautious because all these shares except Bunzl are manufacturers and I wonder how they will adapt to the new trading environment.

I scored Bunzl in the white heat of President Trump’s “Liberation Day”, so I’m more confident that I’ve incorporated the risks into its score.

- Sector Screener: two FTSE 100 stocks to deliver share price gains

- Insider: directors exploit share crash at these three companies

Bunzl is a global distributor that mostly sources locally. The company seems more concerned about the outlook for the US economy, its biggest geographical market, than the prospect of tariffs breaking its business model.

I’m not saying Bunzl will be unscathed by events, but it has ridden out recessions before and I think it probably will next time there is one.

Along with Oxford Instruments and Focusrite, Bunzl is one of the most under-represented shares in the Share Sleuth portfolio. That’s to say the holding size (2.3% of the total value of the portfolio) is significantly below the ideal holding size (5.8% of its total value).

Adding more Bunzl

The letter “b” indicates the addition of Bunzl shares to the portfolio. Past performance is not a guide to future performance.

As usual, I slept on the decision. Then, on Wednesday 11 June I added 216 shares to the portfolio’s holding in Bunzl.

The actual price, quoted by a broker, was just under £23.38, which cost £5,084.60 after deducting £10 in lieu of fees and £25.25 in lieu of stamp duty.

It’s a modest trade, the minimum 2.5% of the portfolio’s total value, but I’m back in action.

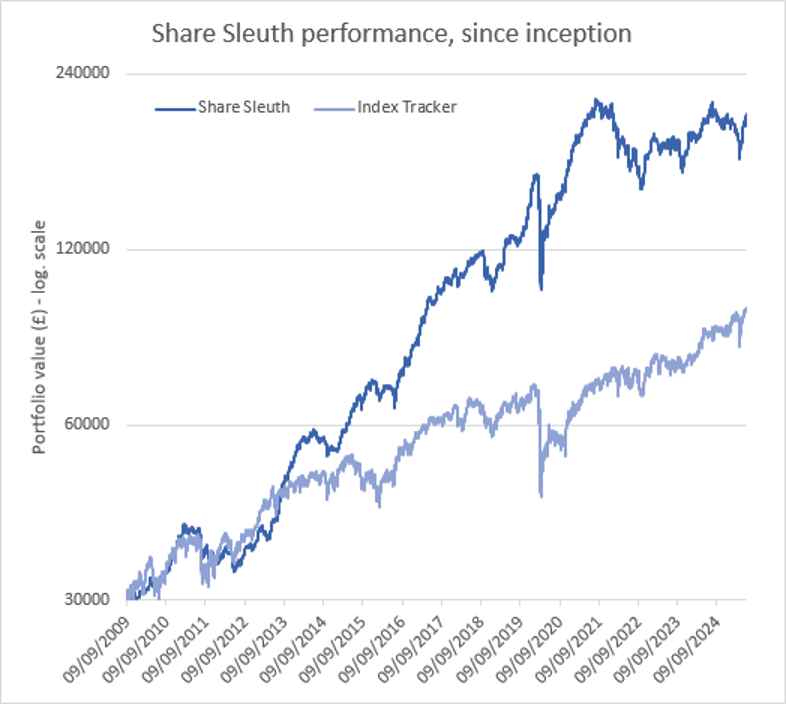

Share Sleuth performance

At the close on 10 June, Share Sleuth was worth £203,638, 579% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth 95,413, an increase of 218%.

Past performance is not a guide to future performance.

After the addition of more shares in Bunzl and dividends paid during the month from 4imprint Group (LSE:FOUR), Churchill China, Focusrite, Games Workshop Group (LSE:GAW), Howden Joinery, Porvair (LSE:PRV), and Softcat (LSE:SCT), Share Sleuth’s cash pile is £13,231.

The minimum trade size, 2.5% of the portfolio’s value, is about £5,100.

|

Share Sleuth |

Cost (£) |

Value (£) |

Return (%) | ||

|

Cash |

13,231 | ||||

|

Shares |

190,407 | ||||

|

Since 9 September 2009 |

30,000 |

203,638 |

579 | ||

|

Companies |

Shares |

Cost (£) |

Value (£) |

Return (%) | |

|

AMS |

Advanced Medical Solutions |

1,965 |

4,503 |

4,225 |

-6 |

|

ANP |

Anpario |

1,124 |

4,057 |

4,833 |

19 |

|

BMY |

Bloomsbury |

845 |

3,203 |

4,301 |

34 |

|

BNZL |

Bunzl |

417 |

9,798 |

9,741 |

-1 |

|

CHH |

Churchill China |

1,495 |

17,228 |

9,942 |

-42 |

|

CHRT |

Cohort |

861 |

2,813 |

12,571 |

347 |

|

DWHT |

Dewhurst |

938 |

6,754 |

8,254 |

22 |

|

FOUR |

4Imprint |

116 |

2,251 |

4,031 |

79 |

|

GAW |

Games Workshop |

66 |

4,116 |

10,659 |

159 |

|

GDWN |

Goodwin |

133 |

3,112 |

10,480 |

237 |

|

HWDN |

Howden Joinery |

1,476 |

10,371 |

12,922 |

25 |

|

JET2 |

Jet2 |

456 |

250 |

8,869 |

3,448 |

|

LTHM |

James Latham |

1,150 |

14,437 |

12,938 |

-10 |

|

MACF |

Macfarlane |

3,533 |

5,005 |

4,222 |

-16 |

|

OXIG |

Oxford Instruments |

241 |

5,043 |

4,565 |

-9 |

|

PRV |

Porvair |

906 |

4,999 |

7,429 |

49 |

|

QTX |

Quartix |

3,285 |

7,296 |

8,344 |

14 |

|

RNWH |

Renew Holdings |

689 |

4,902 |

5,726 |

17 |

|

RSW |

Renishaw |

234 |

6,227 |

6,353 |

2 |

|

RWS |

RWS |

2,790 |

9,199 |

2,505 |

-73 |

|

SCT |

Softcat |

326 |

4,992 |

6,060 |

21 |

|

SOLI |

Solid State |

5,009 |

6,033 |

9,768 |

62 |

|

TET |

Treatt |

763 |

1,082 |

2,167 |

100 |

|

TFW |

Thorpe (F W) |

4,362 |

9,711 |

13,086 |

35 |

|

TUNE |

Focusrite |

2,020 |

14,128 |

4,060 |

-71 |

|

VCT |

Victrex |

292 |

6,432 |

2,356 |

-63 |

Notes

June 11: Added shares in Bunzl

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £203,638 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £95,413 today

Objective: To beat the index tracker handsomely over five-year periods

Source: ShareScope, close on Tuesday 10 June 2025.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks