Where to invest in Q2 2025? Four experts have their say

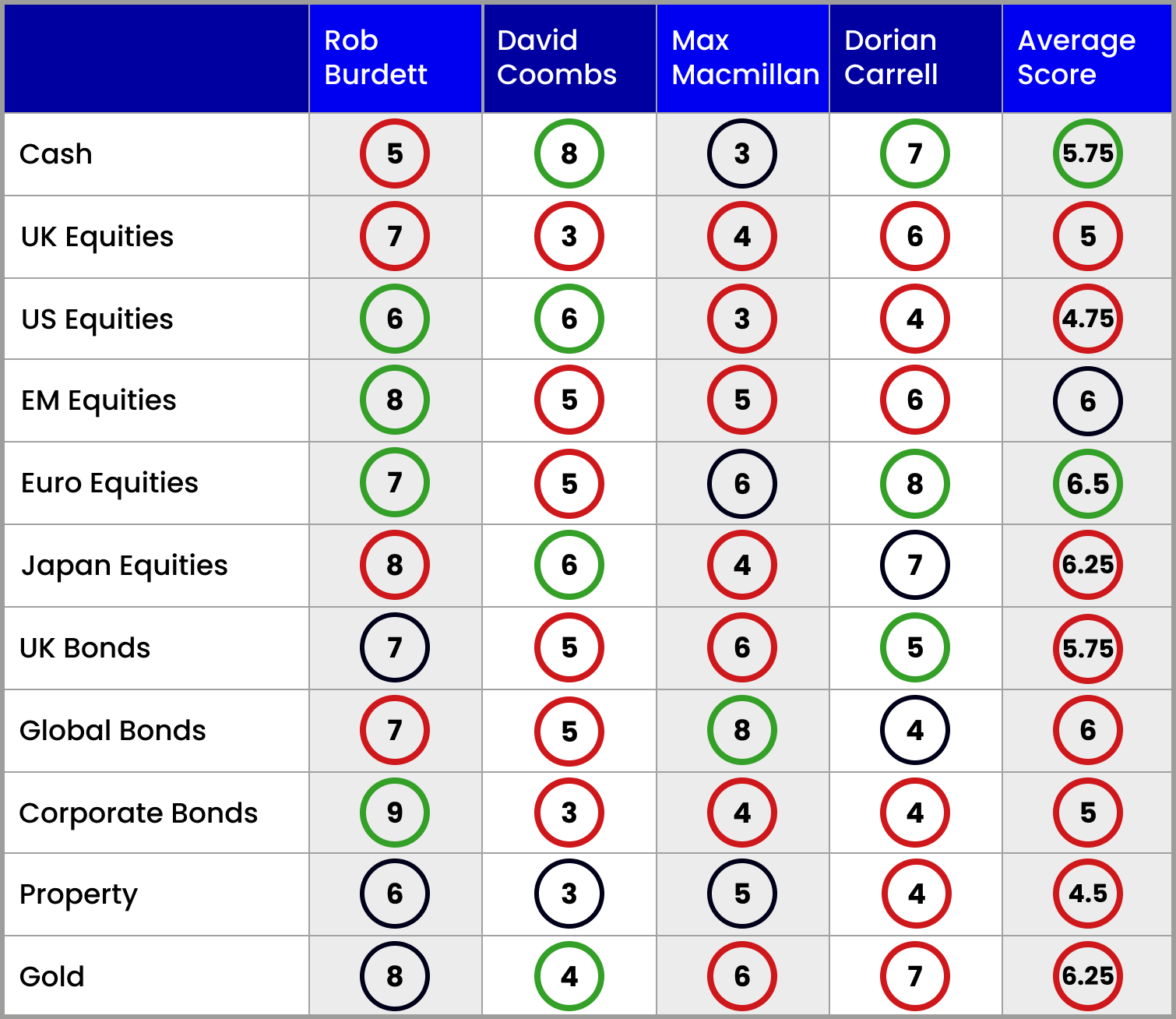

Our panellists have turned more bearish across all the major asset classes, but one equity region has been upgraded.

25th April 2025 09:20

“May you live in interesting times”, the so-called Chinese curse, sums up the current state of financial markets.

President Donald Trump’s Liberation Day shock launch of his new tariffs’ regime sent Wall Street into a nosedive. One week later, the S&P 500 index had sunk below 5000 - some 1200 points below its mid-February peak. Trump then pressed the pause button on tariffs for 90 days to help the market make a partial recovery.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

But the mood has changed dramatically in the three months since our panel of asset allocators last reviewed their stances. Back then, we were wondering when Wall Street would hit a peak. Now we're wondering where the bottom might be as conditions remain extremely volatile.

Golden returns

Reflecting all this has been the rise and rise of the gold price - the ultimate traditional safe haven in times of turbulence where a number of central banks have been adding to their holdings.

Three of the four panel members have played gold well and remain overweight although Max Macmillan at Aberdeen has cut his score from eight to six. “Valuations now look a bit overstretched,” he says. Dorian Carrell at Schroders agrees: “Gold does look very expensive now but because there is so much uncertainty around I will keep my score at seven.”

David Coombs at Rathbones admits he got his timing on gold wrong and sold out too soon. He now raises his score from two to four.

The volatility of Wall Street has been the key feature of markets so far in April. At the worst point on 8 April, the S&P 500 had lost 20% of its value from its earlier all-time high, while the technology-weighted Nasdaq index lost nearly a quarter of its value from its pre-Christmas peak to its low point before Trump’s 90-day tariff pause.

Naturally the panel are all anxious about the immediate prospects for US equities. But neither Coombs nor Rob Burdett at Nedgroup Investments are prepared to go underweight (with a score of five being neutral). Coombs has increased his score from five to six. “When we get to the endgame on tariffs, I believe the US economy will be in a far better place and the position of the US consumer will be stronger,” he says.

Market setbacks tend to be buying opportunities

Burdett likes to offer the comfort he reads into previous “gut-wrenching” market setbacks.

“During the financial crisis between 2007 and 2009 the S&P 500 halved in value,” he points out. “Since then it has increased in value sixfold. We have to remember that when conditions are very difficult, that is when the foundations of good investment returns are built.”

Burdett points out that all the major setbacks in equities in the past few years - the financial crash, the European debt crisis, the Covid pandemic and the Russian invasion of Ukraine - “have all turned out to be buying opportunities”.

While Burdett admits that we are “going through a very uncomfortable phase and have probably not yet seen the bottom of the market”, he's cutting back his cash score from seven to five to re-invest in equities.

- Funds and trusts four pros are buying and selling: Q2 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Such optimism is certainly not shared by Carrell nor Macmillan. Carrell cuts his score for US equities from six to four, while Macmillan cuts his score in half to three. Wall Street now has the lowest average rating of all the equity sectors in our quarterly survey at 4.75. It is a very unusual position and reflects both the higher ratings for shares on Wall Street than elsewhere and the clouds of uncertainty created by tariff and trade wars.

Macmillan makes no bones about where he stands on the outlook for US shares. He says: “We had a 20% correction on the tariffs announcement and then a 10% recovery on the tariffs pause. But we think this is the first phase of a prolonged bear market.” He thinks it will be accompanied by a decline in America’s economic outlook as the tariff turbulence plays out.

Carrell, meanwhile, is concerned that the Trump regime will try to stimulate the US economy later this year. “That will only increase the risk of more inflation,” he says.

Panel divided on UK equity market

Again with UK equities there is a division of opinion on the outlook as both Burdett and Carrell raise their scores to overweight positions. But both Macmillan and Coombs remain underweight.

Carrell describes the FTSE 100 index as “a port in a storm” with its preponderance of global players in such sectors as finance, natural resources, pharmaceuticals and aerospace. He scores a six for that index but would trim his score for more domestic shares. “Valuations are already low and there is every prospect of interest rate cuts,” he says.

Burdett raises his UK equities score from six to seven because he believes the economy is “close to the bottom”. He is convinced the crisis-hit Labour government “will soon be doing more things like cutting welfare bills they never thought they would be doing”.

Both Coombs and Macmillan take an opposite stance on UK equities. “Rachel Reeves has lost the bond market,” Coombs claims as he retains a lowly score of three. Macmillan has cautiously cut his score from five to four and agrees that the UK outlook “does look very difficult at present”.

Unloved Europe gains more support

European equities have now emerged as the panel’s favourite sector with an average score of 6.5. Burdett has raised his score from five to seven, while Dorian Carrell has trimmed back from nine to eight. Nobody is underweight the sector. “Valuations and expectations are very low for European equities,” Carrell claims.

But he points out that the European Central Bank has again shown it has the flexibility to cut interest rates, while Trump rails against his own central bank for not doing so.

- Ian Cowie: a half-price trust winning from Europe’s defence revival

- Is ‘unfashionable’ market now a place for investors to shop?

The recent weakness of the US dollar has helped win panel support for emerging market equities. As always, there are complaints that it's hard to treat these markets as a single asset class.

“Going into the tariff turbulence, valuations in emerging markets were generally nowhere near as high as on Wall Street,” says Coombs. “So, they are a mixed bag in performance terms but mostly have held up much better than the US, Europe and Japan.”

Japan is now predicted to be one of the first to agree a trade deal with the US. The Tokyo market took a pasting in late March and early April and although the tariff pause triggered a recovery, the Nikkei 225 index shows a fall this year as steep as Wall Street. Burdett maintains his score at eight, while both Coombs and Carrell have edged their scores higher.

Bonds marked down

Government bonds have not lately proved to be much of a hedge against weaker equity markets, so neither Coombs nor Carrell show much enthusiasm. Both Macmillan and Coombs have cut their scores for UK bonds. But Macmillan has lifted his score for global bonds to 8. Rob Burdett adjusts in the opposite direction, raising his UK bonds' score from six to seven, but offsetting that with a cut in the global bonds' score from eight to seven.

While the rest of the panel remain firmly underweight in corporate bonds, Burdett boosts his score from eight to nine. “The weakness of the market is a buying opportunity,” he claims. “I would probably buy shorter-dated stocks in this sector as they give you greater comfort that you are going to get your capital back.”

Earlier enthusiasm for property has faded and now only Burdett has an overweight score. But even he has cut back from eight to six. “In the present climate, business will be looking at fixed costs and putting off deals to sign up for a new office,” he says.

Note: the scorecard is a snapshot of views for the second quarter of 2025. How the panellists’ views have changed since the first quarter of 2025: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett has been a professional fund buyer for more than three decades.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at Aberdeen.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks