Why I was right to be ‘ludicrously optimistic’ about this stock

This has been a hugely successful tip for analyst Rodney Hobson, with the company’s 12-month share price performance on a par with Nvidia. Here’s what he’d do now.

12th February 2025 07:57

When a company performs a share split, it is always good news for its shareholders. This happens when the share price has already reached such high levels that the price has become cumbersome, but the company is very confident that the upward trajectory will continue.

Such a scenario happened at Broadcom Inc (NASDAQ:AVGO), which has been riding the crest of the technology wave on Nasdaq, with considerable justification given its stellar performance in a growing, albeit competitive and highly challenging sector.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

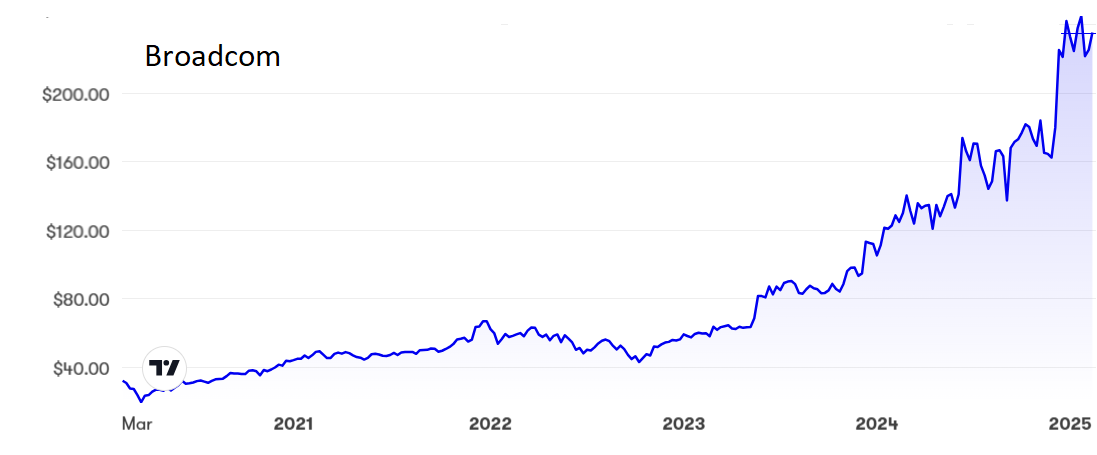

Most US share splits are in the ratio of five for each share held but semiconductor and software manufacturer Broadcom went for an ambitious 10-for-one split last July after the shares hit $1,170, and pulled it off. Despite a couple of dips later that summer, the shares have moved well ahead of the post-split price equivalent of $170 and are now up to $230.

Source: interactive investor. Past performance is not a guide to future performance.

The most recent results, for the final quarter to 5 November, were highly encouraging and were accompanied by an increase in the dividend. Net revenue leapt 51% to $14 billion, with the semiconductor arm leading the way. Net income rose 23% to $4.3 billion, putting earnings per share at 90 cents.

This was a better performance than earlier in Broadcom’s financial year, when revenue was well ahead, but profits slipped.

The improvement is likely to continue into the current year. Chief financial officer Kirsten Spears expects revenue to be up 22% year on year in the three months that have just ended, accompanied by the strong cash flow that characterised last year.

The dividend was raised 11% to a well covered 59 cents for the last three months of financial year 2024, with a target of $2.36 for the current full year. That implies no increase over the next 12 months, which looks unduly pessimistic.

The current yield is only 0.9% despite the recent dividend increase, although that is better than a lot of American technology companies. The price/earnings ratio at 182 is factoring in phenomenal growth.

- 10 hottest ISA shares, funds and trusts

- Stockwatch: should you buy the drop in Nvidia?

- ii view: investors gobble up McDonald’s after Q4 results

Hobson’s choice: I first tipped Broadcom at $300, the equivalent of only $30 after the share split, six years ago and again at $477 (£47.70). Last June, after the shares had doubled in the previous 12 months, I rated them a buy up to $2,000 (£200).

I worried at the time that I was being ludicrously optimistic, but that level has been reached and surpassed.

If you are in, hold on. Even if the shares fall back this company still has momentum. However, the valuation is very rich, so those seeking a way in should hope for a dip, treating $200 as a floor rather than a potential ceiling.

Update: It is two years since motorcycle maker Harley-Davidson Inc (NYSE:HOG) peaked at $50 and looked as if it could rev higher, but I got cold feet and advised those thinking of buying to hold off. Thank goodness I did – though I cannot claim to have foreseen how difficult life would become for this iconic name.

High inflation and interest rates have hit sales of what is seen by many as a luxury item, while younger riders are choosing modern, less expensive machines from other manufacturers.

Sales of Harley bikes slumped 13% in the final quarter of 2024, and the company swung from a $26 million profit in the same quarter of 2023 to a $117 million loss this time on revenue down 35% at $688 million. This is a far cry from hopes at the start of last year that sales would rise 1.5% over 12 months.

Harley shares are now down to $26, having lost 13% in less than a month. The shares may not have finished falling yet and they rate no better than hold. Do not be tempted to buy for recovery just now.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks