Why I’d buy these high-performing bank stocks

Every portfolio should have at least one banking share in it, believes analyst Rodney Hobson, who also argues that sector ratings are still quite modest.

23rd July 2025 09:48

Banks have got the reporting season for American companies off to a cracking start. While that has been reflected in a surge in share prices in the sector, there could be still further upside to go.

In addition, the threats from President Donald Trump towards Jerome Powell, head of the Federal Reserve Board, have abated. Powell is quite rightly resisting pressure to reduce US interest rates prematurely, as Trump wishes him to do, which would disrupt the American economy and squeeze the wide spread between borrowing and lending rates that favours banks.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Also, American banks are unlikely to suffer particularly from any overseas ill-feeling caused by Trump’s international grandstanding.

As it happens, the banks have actually benefited from the uncertainty caused by the President’s global economic battleground. Never believe the old adage that markets hate uncertainty. It is the sight and sound of money being switched in haste that drives the markets.

Trading desks have been rebalancing portfolios to manage risks, creating a surge in equities trading, while dealmaking is back in favour, giving a boost to investment banking. Even so, ratings of banking shares are still quite modest.

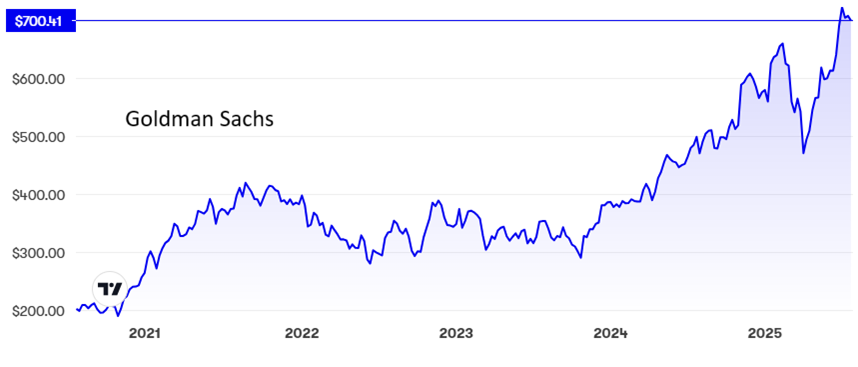

The Goldman Sachs Group Inc (NYSE:GS) set the tone by beating expectations with a 22% rise in second-quarter profits to $3.7 billion, accompanied by a raised dividend and another round of share buybacks. Profits were a good 10% better than analysts had forecast.

The only downside in Goldman’s figures was a 3% drop in revenue from the asset and wealth management arm, where trading is usually more stable than in trading and investment banking.

Source: interactive investor. Past performance is not a guide to future performance.

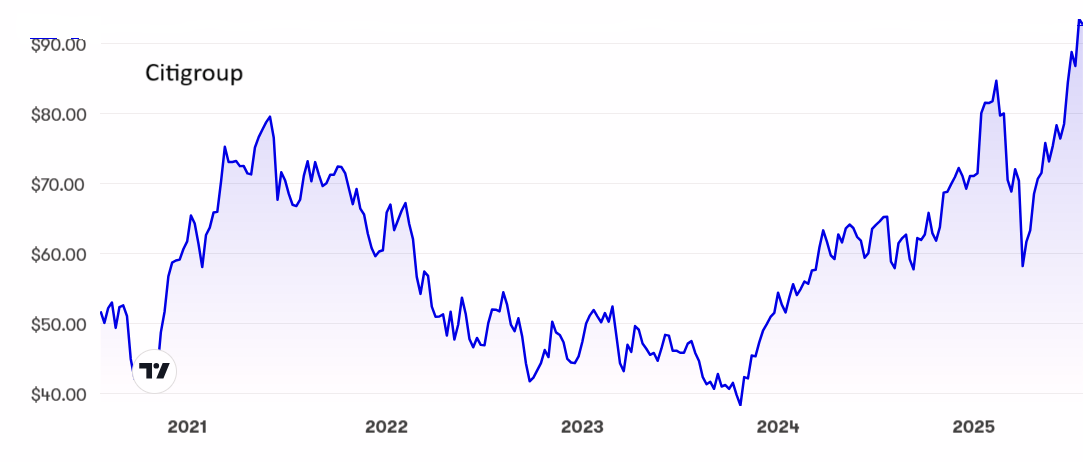

Citigroup Inc (NYSE:C) reported rises of 15% in investment banking revenue, thanks to a revival in corporate activity, and 16% in market activity, but the really encouraging point was that all five parts of the business did better. Net income improved 25% to just over $4 billion on revenue up 8.2% to $21.7 billion.

Source: interactive investor. Past performance is not a guide to future performance.

A similar story emerged at JPMorgan Chase & Co (NYSE:JPM), where revenue in markets surged 15% as Trump’s policies created turmoil in equity and fixed income markets. Investment banking revenue rose by a more modest but still impressive 9%.

Investors should not worry about falls of 10% in group revenue and 17% in net income. Last year’s second quarter was boosted by a $7.9 billion gain from selling shares in credit card operator Visa Inc Class A (NYSE:V). Stripping out the Visa sale and a tax credit this time, underlying profits were up 3.5%. Underlying revenue was also higher.

Later this year JPMorgan will raise its dividend for a second time in a year, taking the total in the fourth quarter to 20% more than in 2024.

Source: interactive investor. Past performance is not a guide to future performance.

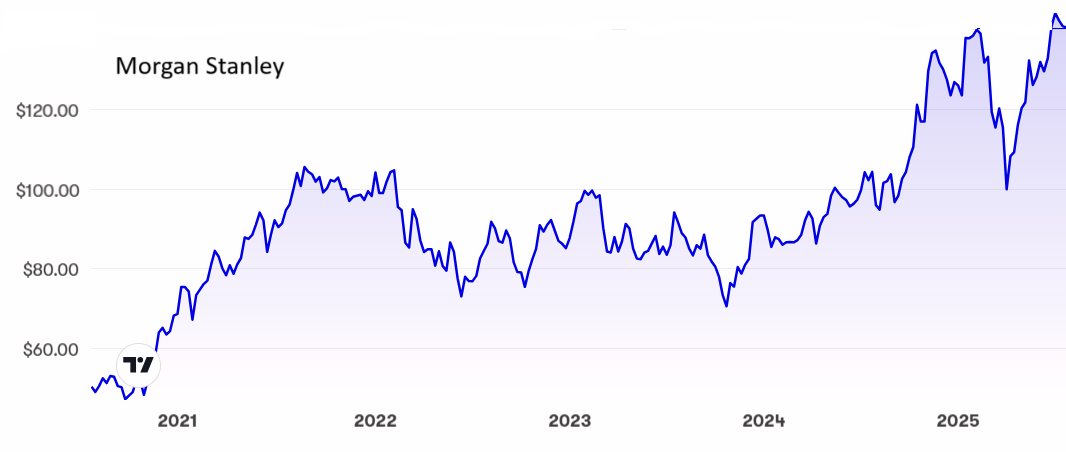

Morgan Stanley (NYSE:MS) increased net income by 15% to $3.5 billion on revenue 12% higher at $16.8 billion. Again, strong performance in the markets business was reported. The dividend rose 8% to $1.

Source: interactive investor. Past performance is not a guide to future performance.

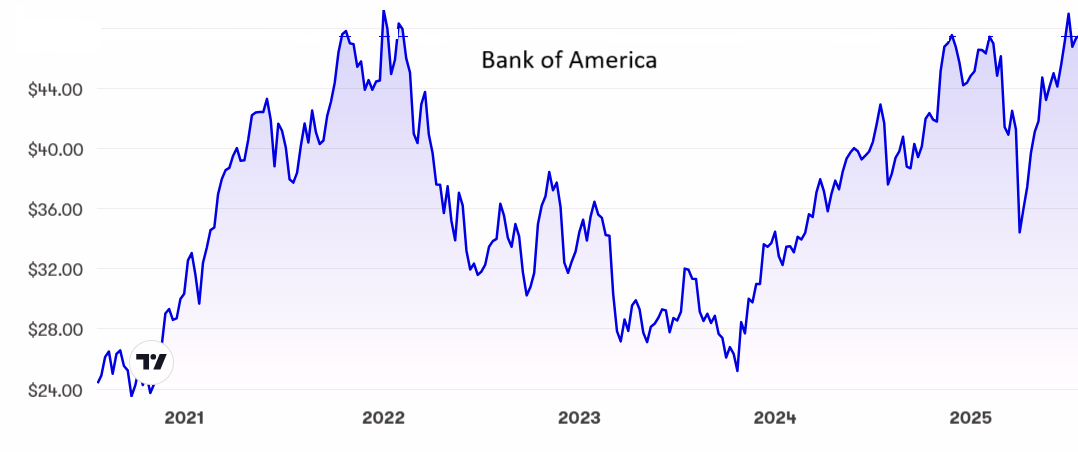

Bank of America Corp (NYSE:BAC) was slightly less upbeat despite reporting revenue up 15% to $5.4 billion, a record for the second quarter but fractionally below expectations and a little below the first quarter. The bank is worried about the possible impact of any interest rate cuts this autumn.

Source: interactive investor. Past performance is not a guide to future performance.

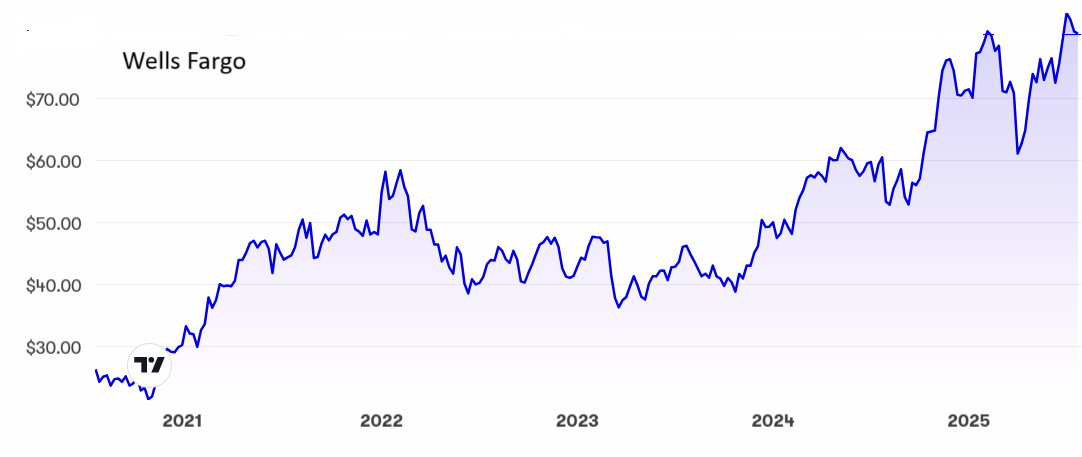

Wells Fargo & Co (NYSE:WFC) hit the least pleasing note. Revenue was up only 0.6% to $20.8 billion, and the bank lowered its guidance for net interest income after a decline of 1.8% caused by lower interest rates for floating rate assets and changes to the mix of deposits. More encouraging was a 12% rise in net income to $253 million, not to mention a proposed 12.5% rise in the dividend starting in the current quarter.

Source: interactive investor. Past performance is not a guide to future performance.

Goldman shares have more than doubled from below $300 to a new high just over $700 in less than two years. Yet the price/earnings (PE) ratio is still only 16.4, hardly challenging for such a class act. The yield is admittedly undersized at 1.7% despite the quarterly payout being increased from $3 a share to $4. Further rises will come.

Citigroup shares have also hit a new peak at $94, having also more than doubled from below $40 in October 2023. The PE is even lower at 13.8 while the yield is rather better at 2.4%.

JP Morgan shares have been on the rise since September 2022 and, at just shy of $300, they could soon be worth three times as much as they were in the trough. The PE is currently 15 and the yield 1.8%. Neither figures suggest that the shares are overvalued.

- Don’t chase AI – back the companies using it best

- Here’s where professional investors are piling in

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Morgan Stanley stands at $140, double the $70 recorded in late 2023. With a PE of 16 and a yield of 2.6% it looks as attractive as others in the sector.

Bank of America is only back to where it was at the start of 2022 with the shares bumping up against a ceiling just below $50. At $47.50 the PE is 13.8 and the yield 2.2%.

Wells Fargo shares have topped $80, where the PE is 13.9 and the yield just under 2%. They were under $40 several times in 2022 and 2023.

Hobson’s choice: Every portfolio should have at least one banking share in it, so if you are into this sector already there is no obvious reason to take profits yet. Goldman is still a buy although more cautious investors may wish to hold back in the hope of buying into a dip. They may well wait in vain.

The same advice applies to Citigroup, only more so, and also to JPMorgan and to Morgan Stanley.

Bank of America looks unlikely to be going anywhere. It will be hardest hit if interest rates do fall. With shares near a peak, this could be a good time to sell.

Potentially the least attractive American bank is Wells Fargo despite it finally putting some negative legacy issues behind it, most recently with the lifting of restrictions imposed by regulators in 2018 after a fake accounts scandal. Wells Fargo has disappointed before and rates no more than a hold when there are so many more attractive prospects in the sector.

However, those seeking to make quick profits on stock market swings should note that Wells Fargo is the most volatile stock in the sector.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks