20%-plus returns over one month for top funds in this sector

Saltydog Investor runs through last month's top-performing funds, which all come from the same sector.

8th October 2024 09:24

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

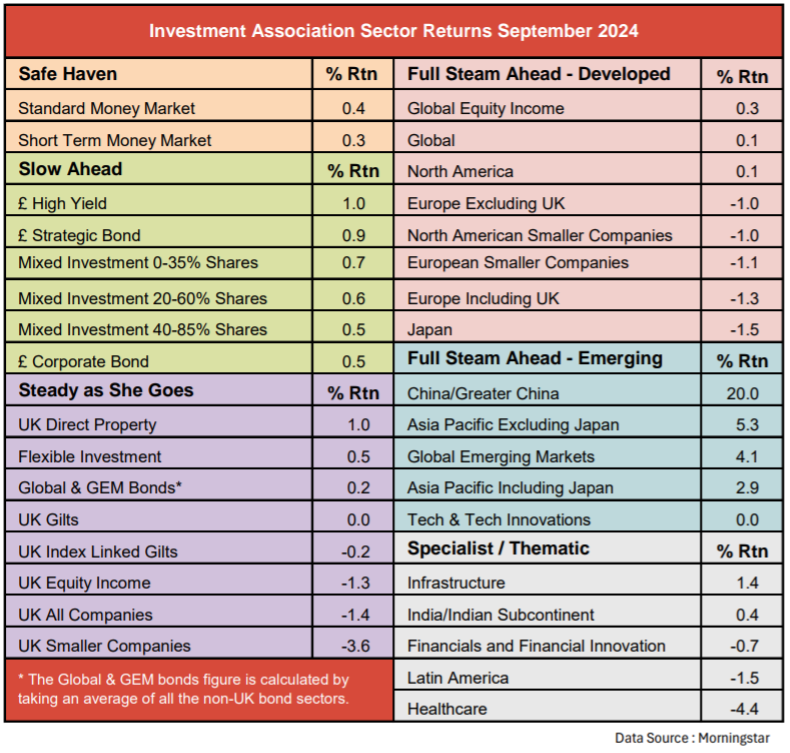

In some months, there’s not much difference in performance between the leading sectors, while in others there’s a clear winner. Last month, the China/Greater China sector was in a league of its own.

It posted a one-month gain of 20%. The next best-performing sector was Asia-Pacific Excluding Japan, up 5.3%, and then the Global Emerging Markets sector, which had risen by 4.1%.

- Invest with ii: Buy Global Funds | Top Investment Funds | What is a Managed ISA?

Past performance is not a guide to future performance.

The dominance of the China funds is also reflected in our top 10 funds for last month.

Saltydog’s top 10 funds in September 2024

| Fund name | Investment Association sector | Monthly return |

| Matthews China | China/Greater China | 30.1 |

| JPM China | China/Greater China | 25.6 |

| FSSA China A Shares | China/Greater China | 25.4 |

| GAM Star China Equity | China/Greater China | 25.2 |

| abrdn-All China Sustainable Equity | China/Greater China | 23.3 |

| Fidelity China | China/Greater China | 22.9 |

| Liontrust China | China/Greater China | 22.0 |

| Baillie Gifford China | China/Greater China | 21.5 |

| Veritas China | China/Greater China | 21.1 |

| Pictet-China Equities | China/Greater China | 20.8 |

Data source: Morningstar. Past performance is not a guide to future performance.

In the previous month, the top 10 funds came from six different sectors. There were two “gold” funds from the Specialist sector, three Japanese funds, two Financial & Financial Innovation funds, one Property fund, one Global Emerging Markets fund, and one Healthcare fund. The best fund, WS Ruffer Gold, had made a one-month gain of 5.1%.

Our latest top 10 funds, based on their performance last month, are all from the China/Greater China sector.

This represents a significant change in fortune for these funds.

In 2022, nearly all the Investment Association (IA) sectors went down. China/Greater China was not the worst, but it was towards the bottom of the table with an annual loss of 15.9%. The following year, most sectors bounced back. The most notable exception was China/Greater China, which fell by a further -20.4%.

This year it did not start particularly well either. In January, China/Greater China dropped by 9.7%, making it the worst-performing sector that month. It had a good February, but a disappointing March, and was one of the few sectors that ended up posting a loss in the first quarter of the year.

In the second quarter it did better. It was the eighth best-performing sector, with a three-month gain of 3.0%.

However, the third quarter got off to a slow start. In July, the worst-performing sector was Technology & Technology Innovation, down -4.4%, and then it was China/Greater China, with a one-month loss of -3.9%. The Chinese sector then lost a further 2.4% in August, and after the first few weeks of September it was still struggling. With a week to go till the end of the month, it was showing a month-to-date loss of -0.8%, but by the end of the month it was up 20.0%.

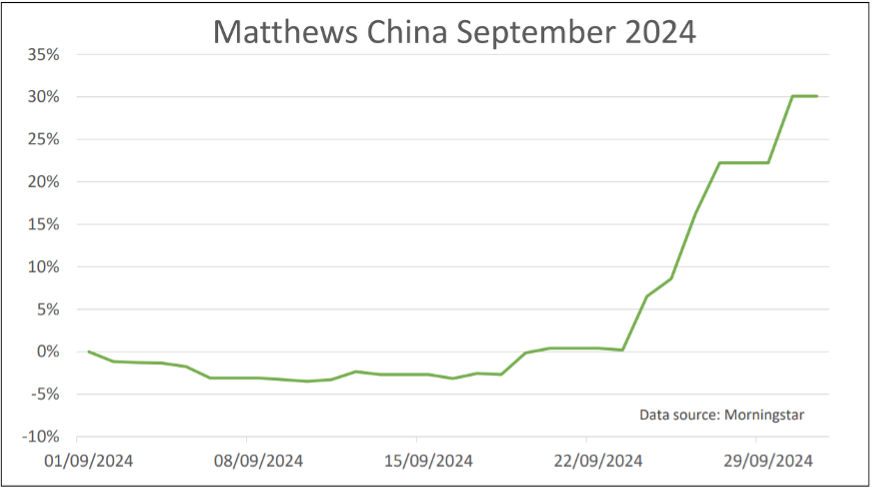

Here is a graph showing how Matthews China, our top fund in September, performed during the month.

Past performance is not a guide to future performance.

As you can see, all the action took place in the final week of the month.

When there’s such a dramatic movement, it’s usually in response to a specific event, and if it affects a whole sector, or even the entire markets, then it’s probably something geopolitical.

I believe that it was Martin Zweig, a US investor and market forecaster, who popularised the now-common market axiom: “Don’t fight the Fed”. Apparently it featured in his book, Winning on Wall Street, which was published in the 1980s.

Zweig realised that the Federal Reserve’s monetary policy had a significant impact on the stock market, and proposed that by understanding and aligning with the Fed’s actions, investors could position themselves for better returns.

This was true when the chair of the Federal Reserve Paul Volker was raising interest rates to combat inflation, and it’s been relevant in recent years. For example, with the low interest rate and quantitative easing programmes introduced after the global financial crisis, and then extended during the Covid pandemic. Then with the raising of interest rates, in response to inflation soaring to 40-year highs, and more recently, the timing of interest rate reductions as inflation fell and the threat of a US recession started to weigh on investor sentiment.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Why China just gave these FTSE 100 stocks a shove higher

I'm not going to get into an argument about whether governments and central banks should interfere with market forces, but it’s fairly clear that at the moment they do.

And, it’s not just the Fed. The decisions of the Bank of England and European Central Bank also influence the markets, along with other central banks.

At the end of July, the Bank of Japan unexpectedly increased interest rates. The Nikkei 225 fell by almost -20% in a couple of days, and there were knock-on effects in stock markets all around the world.

This time, the recent rise in the China funds has been in response to the country’s central bank announcing its largest stimulus package since the pandemic.

Towards the end of last month, in response to disappointing macroeconomic data, the bank rolled out several significant supportive measures that went further than the general investment community was expecting.

Here is a breakdown of their latest key initiatives:

Capital Market Support

The People’s Bank of China (PBOC) is facilitating a new avenue for funding, allowing investment firms, funds and insurance companies to access central bank financing for stock purchases via security swaps. The initial funding allocated for this programme is RMB 500 billion (over £50 billion). Additionally, a RMB 300 billion re-lending facility will be established, enabling listed companies and major shareholders to buy back their shares, with commercial banks playing a critical role in facilitating these transactions.

Reserve Requirement Ratio Cut

The Chinese central bank has dropped the reserve requirement ratio by 0.5%. This reduces the amount that Chinese banks need to hold with the PBOC. This change is expected to release approximately RMB 1 trillion in long-term liquidity into the banking system. Further cuts of 0.25% to 0.5% may follow later this year.

Policy Rate Reduction

The seven-day rate, the interest rate at which the PBOC lends money to commercial banks, has been lowered from 1.7% to 1.5%.

Support for the property market

In a bid to stimulate the real estate sector, banks have been “encouraged” to reduce existing mortgage interest rates by an average of 0.5%. The down payment requirement for second-home purchases will also decrease from 25% to 15%, aligning it with the conditions for first-home buyers.

Furthermore, funding support for affordable housing through a re-lending programme will see an increase from 60% to 100%.

How this boosted China’s stock market

As a result of these changes the Shanghai Composite went up by nearly 13% in the last week of September and ended the month up 17.5%. It then closed for Golden Week, celebrating the founding of the People’s Republic of China in 1949, and is due to reopen on 8 October.

It’s clear that the markets have already priced in the expected consequences of this recent policy announcement, but it is hard to know whether they have under-reacted, over-reacted, or got it spot on. Only time will tell.

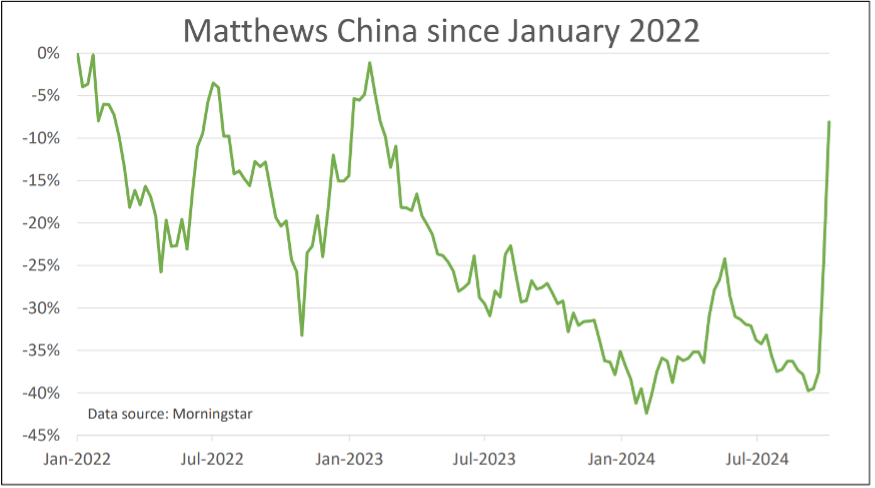

To put the recent upturn in the Matthews China fund into context, here is another graph, this time showing its performance since the beginning of 2022.

Past performance is not a guide to future performance.

It has still got a little bit further to go to get back to where it was when it peaked in January 2023, but I would be surprised to see it going much higher than that without some evidence that the latest measures are having the desired effect.

Having said that, it is still over 30% lower than the all-time high, which it set in February 2021.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks