2025’s going to be a hotter year for IPOs: here’s how to make the most of it

Here’s a look at some of the stock debuts lining up for this year, and how you could turn the odds in your favour.

3rd January 2025 10:13

- The outlook is looking a lot more exciting for IPOs this year, with companies from an eclectic mix of industries and geographies looking to make their debuts

- Unfortunately, IPOs tend to deliver poor long-term returns for investors, and they generally underperform the broader market

- But you can do five things to turn the odds in your favor if you want to get in on an IPO: avoid SPACs, go for companies that have big sales, avoid buzzy firms that aren’t profitable, favor VC-backed firms, and prioritize firms in the tech sector.

The past year wasn’t exactly a breakout year for initial public offerings (IPOs). While there were some standout stock launches in the US and India, the global scene stayed pretty quiet. That could change in the year ahead, though. Stock markets have been rising, inflation and key interest rates have been cooling, and the US president-elect has hinted at some business-friendly changes – and that all suggests a warmer, more welcoming IPO climate. So, after a few chilly years, some companies look ready to dive in and make a splashy debut.

How is the IPO pipeline looking for 2025?

More than 300 companies are expected to go public worldwide in 2025 – with about 180 of them expected to list in New York. European fintech favorites Klarna and Revolut could be among the new names on Wall Street’s “big board”. And India – which stole the IPO spotlight in 2024 with a 149% surge in IPO value – is set for another record-breaking year, with heavyweights like Reliance Jio and Tata Passenger Electric Mobility expected to float their shares.

Now, none of these launches are a sure thing at this point, but here are some of the most-talked-about IPO possibilities for 2025 – and why these firms are making a buzz:

ChatGPT creator OpenAI is looking to scale its tech while managing massive computing costs, making its potential IPO a test of whether generative AI can be profitable. (OK, this one’s a bit more of a wildcard, but I had to start with the most exciting prospect to kick things off.)

In fintech, Stripe processes over $1 trillion in payments annually, and Klarna has moved beyond the “buy now, pay later” service that made it a star and pushed into subscription services and AI-driven credit.

And in India, there’s Reliance Jio, a digital services giant with a half-billion users, and Tata Passenger Electric Mobility with its goal of dominating India’s EV market.

In cloud and AI infrastructure, CoreWeave provides alternatives to Big Tech’s cloud dominance, and Databricks powers AI-driven data insights for enterprises.

Meanwhile, SpaceX’s Starlink is transforming rural internet access, and Shein continues to redefine global fast fashion economics with its supply chain model.

But if you ask me, some of the most exciting IPOs might come from the more niche corners of the market. Cerebras Systems, for example, is a standout in AI hardware, pushing the boundaries of machine learning with its cutting-edge processors. There’s also Circle, the fintech powerhouse behind the USDC stablecoin: it’s primed to ride the blockchain and crypto wave into mainstream financial systems.

Neo4j, a pioneer in graph database technology, is quietly revolutionizing how businesses uncover insights from complex data relationships – think everything from fraud detection to recommendation systems.

Meanwhile, Plaid has become the unsung hero of fintech, seamlessly connecting apps like Venmo and Robinhood to traditional banks, with the potential to drive even deeper financial integration.

And finally, Turo – which has been dubbed the "Airbnb for cars" – is bringing a fresh take to mobility, enabling peer-to-peer car rentals in a way that feels tailor-made for today’s sharing economy.

Is it time to get your IPO dancing shoes on, then?

IPOs can be exhilarating – with their buzzy young companies, massive growth potential, and the thrill of being part of the next big thing. And the success of recent high-profile listings like Reddit Inc Class A Shares (NYSE:RDDT) might even have you thinking IPOs are a one-way ticket to riches.

But here’s the thing: the hard data paints a less glamorous picture and shows that excitement doesn’t always mean a smart investment. See, despite those first-day trading spikes, research by “Mr. IPO” Jay Ritter suggests that IPOs tend to have a poor long-term track record for investors. From 1980 through 2022, the majority of IPOs lost money over the three- and five-year periods that followed their debut, with 37% losing more than half their value over three years. He found that the average IPO stock bought at the publicly available closing price on the first trading day returned about 6% annualized over three years. Meanwhile, an index of all US-listed stocks returned about 11% annualized over the same period. Put more simply, you’d have been better off simply buying the index.

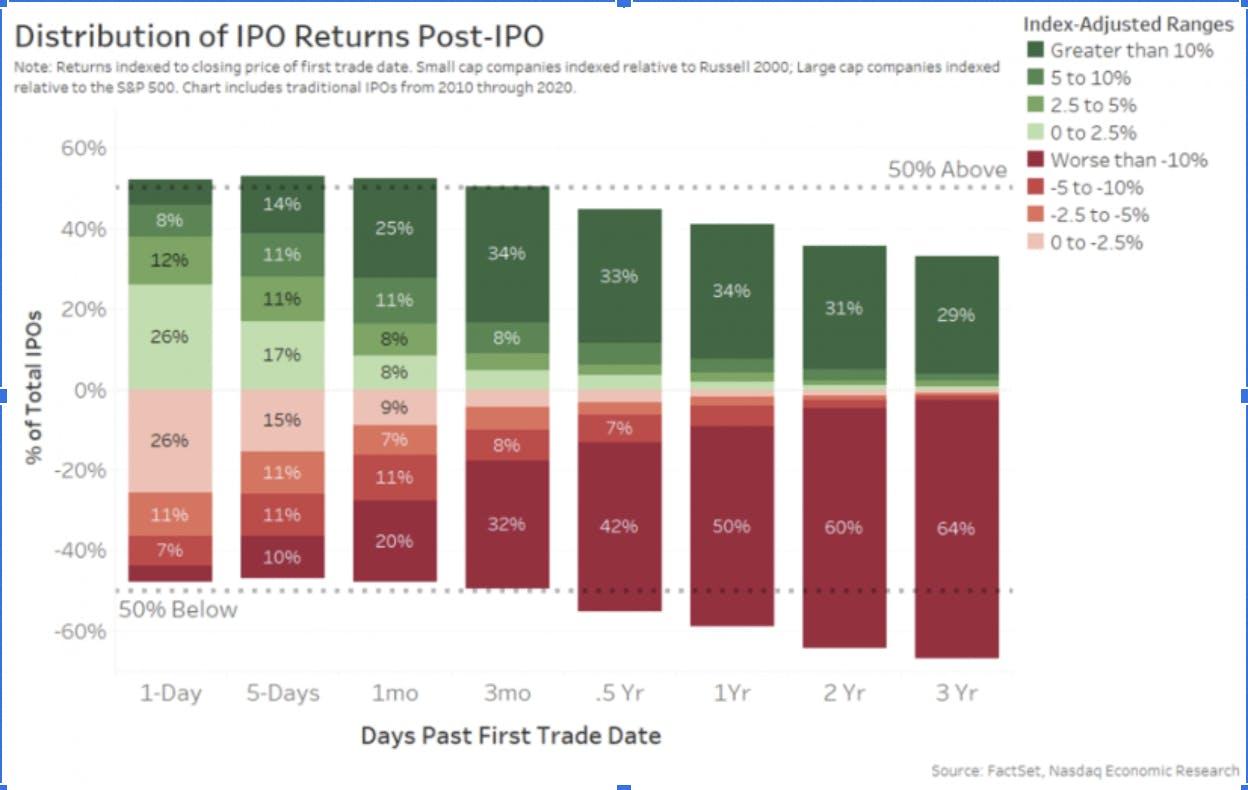

Research by Phil Mackintosh at Nasdaq found similar results.

The longer the holding period, the more disappointing. Sources: FactSet, Nasdaq Economic Research.

And, look, there are a couple of reasons why IPOs don’t live up to the hype. For starters, most retail investors can’t buy in at the offer price. These shares are typically reserved for big institutional players and maybe some select retail investors who are sitting on piles of cash and have the right connections. For the average Joe or Jane, getting in at this stage just isn’t possible. And, usually, by the time these stocks make their grand entrance on the open market, their prices have already spiked. So if you’re a regular retail investor, you’re probably buying in at a price that’s way less juicy. And that can have a huge effect on your returns: Ritter found that jumping in at the first day’s closing price, rather than the initial offer price, can slash your three-year returns by nearly half.

Another reason is the existence of lock-up risk: bigwigs like founders, employees, and early bird investors are usually handcuffed from selling their shares for a few months post-IPO. And once that lock-up period ends, there’s often a mad dash to sell, flooding the market with shares and – you guessed it – driving the price down. And don’t forget about the tug-of-war in interests, with venture capitalists, underwriters, and early investors itching to cash out big at the IPO.

Last, new kids on the stock block often come with limited info and trading history, meaning their early prices are more easily driven by sentiment, rather than fundamentals. That makes it more of a popularity contest than anything else. And behavioral biases increase the risk of an overhyped company trading above its fundamental value. After all, many investors forget that for every Tesla Inc (NASDAQ:TSLA), there is at least one WeWork (the company lost 99% since its 2021 debut and recently filed for bankruptcy). There’s a reason why legendary investor Warren Buffett has called investing in IPOs “a stupid game”.

So, what’s the opportunity?

The sad truth is that the IPO playing field isn’t exactly level. But that doesn’t mean every IPO is a no-go for the everyday investor. Picking the right one can still be a win. Now, don’t expect any secret sauce or magic formulas here. However, I’ve dug deep into Ritter’s data, and I’ve discovered four simple things you can do to tip the scales in your favor:

Get in at the offer price, if you can. That’s obvious – and easier said than done – but not impossible. So try all avenues: check with your broker, see if the company has a direct allocation program, join an investment club, or check out IPO-specific platforms. It’s a case-by-case hustle, but snagging shares at the offer price could be a game-changer for your long-term returns.

Steer clear of SPACs. Think of a SPAC as a “blank-check” firm, set up to raise capital through an IPO, to acquire a private company. They’re known for being more efficient and facing fewer regulatory hurdles than traditional IPOs. However, SPACs are often not great investment choices. From 2012 to 2020, there were 451 SPAC IPOs – and the average investor saw losses of 45% after one year and losses of 57% after three years. That’s a tougher hit than you’d get with traditional IPOs.

Go for VC-funded companies. Firms backed by venture capital (VC) investors still underperformed the broader market on average, but they tend to perform better than non-VC-backed ones after three years. And if you can snag shares at the offer price, even better: VC-backed firms have boasted much higher first-day pops than non-VC-backed ones.

Watch those sales figures. Companies raking in over $100 million in sales usually fare better post-IPO (with the exception of the biopharm startups). VC-backed companies with sales over $100 million do significantly better. So it’s worth remembering that the smaller the company, the riskier – and less profitable – it tends to be.

And keep an eye on profitability. Companies that are already profitable when they go public tend to do better. On average, unprofitable firms have shown barely any returns over three years, while profitable ones have notched an average of 34% gains. And that’s far better, but it’s still below general market performance.

Tech is your friend. Historical stock data leans pretty favorably toward tech sector companies. They’ve generally outperformed those in other sectors after the debut day.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks