BP share price drop attracts bargain hunters

The price of oil has tumbled over the summer, dragging oil company stocks with it. Here’s what the experts think about the situation and potential for recovery.

5th September 2024 16:00

The cheapest BP (LSE:BP.) shares in two years today led to more strong buying interest among retail investors, despite this week’s fall in the Brent crude price to a 2024 low.

BP this morning ranked second on interactive investor’s list of most-traded stocks, with 89% of dealings by ii customers buy orders for the heavyweight FTSE 100 company.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Their belief that BP trades in bargain territory follows the 23% reverse for shares since April, a run that has left the stock 19% cheaper than this time last year at near to 415p.

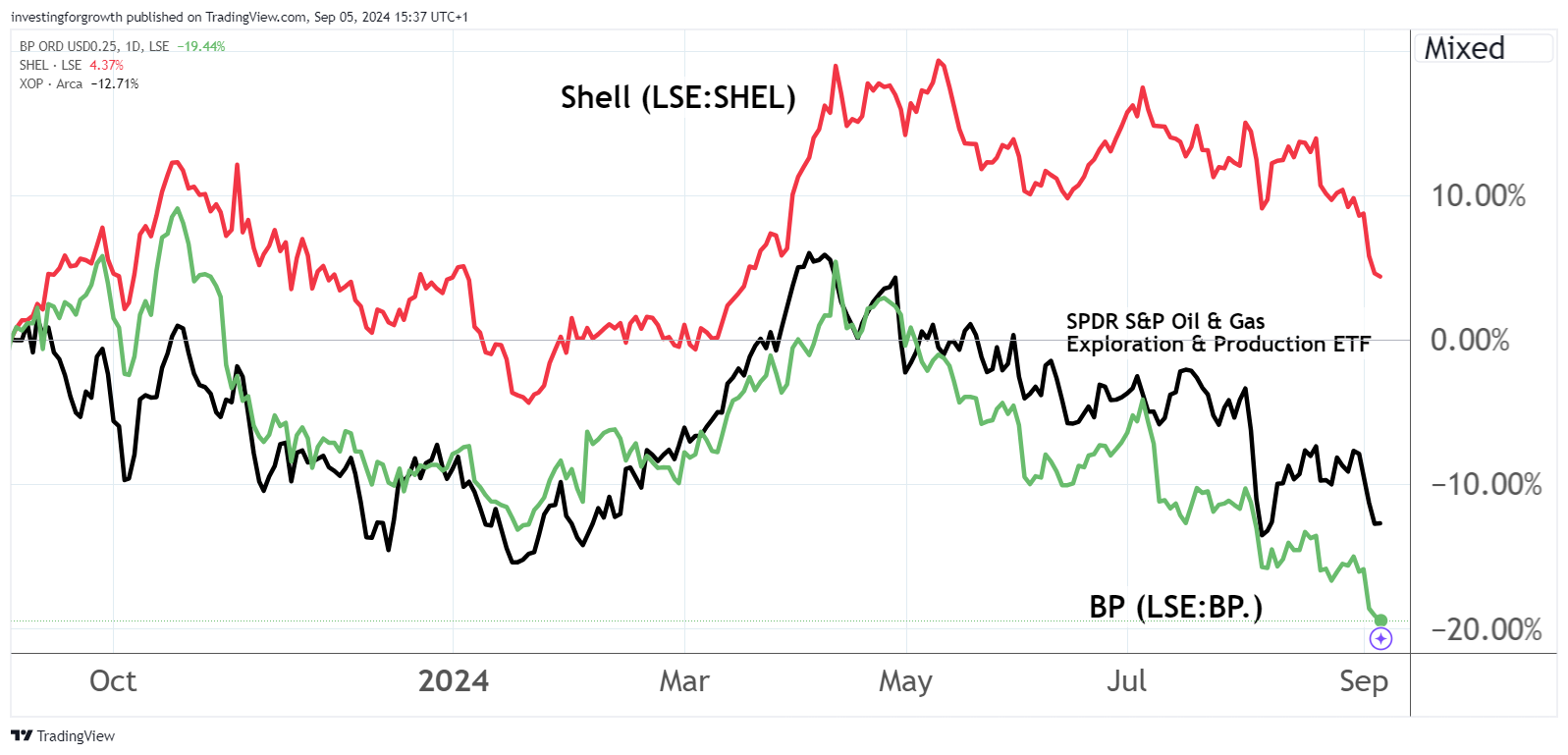

Over the same one-year period, rival Shell (LSE:SHEL) shares are up almost 5% while the wider benchmark that tracks the global oil industry has fallen by just under 13%.

Source: TradingView. Past performance is not a guide to future performance.

BP’s weakness comes despite increased shareholder returns, with a lower share count helping to drive a 10% rise in the 20 September dividend to eight US cents a share.

Having seen quarterly operating cash flows reduce net debt to $22.6 billion, BP has extended its share buyback commitment with another $3.5 billion due in the second half of 2024.

Finance director Kate Thomson said the move reflected confidence in BP’s performance and outlook for cash generation. She added: “We are maintaining a disciplined financial frame and remain committed to growing value and returns for BP.”

- Lloyds Bank among FTSE 100 stocks paying £14bn in dividends

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- ii view: BP underlines focus on shareholder returns

The share price pressure reflects City disappointment over April’s below-par first-quarter results and then July’s warning of headwinds that included weak gas price realisations, significantly lower realised refining margins and refinery impairments.

Morgan Stanley returned its recommendation to Equal Weight and cut its price target by 17% to 540p, warning that several quarters of weak earnings had put 2025 guidance at risk.

Bank of America said in July that it favoured TotalEnergies SE (EURONEXT:TTE) and Shell at a time when rangebound oil and gas prices, little organic volume growth and weaker refining margins put the industry’s aggregate cash flows under pressure.

It warned BP’s buyback commitments looked unsustainable assuming $80 a barrel next year.

The Brent crude price yesterday fell for the fourth day in a row to $72.70 a barrel, a reverse driven by a potential deal in Libya that would allow the country to bring back disrupted supply.

This followed speculation that OPEC+ may stick to its plan to increase monthly production by a modest amount of 180,000 barrels per day starting in October.

- ASOS shares surge 20% following Topshop deal

- 24 UK stocks to benefit from buoyant economy

- ii view: lower costs help Shell profits exceed City forecasts

UBS Global Wealth Management said yesterday: “The market reaction to these supply stories shows how weak sentiment in the oil market is currently.

“Yet supply from the eight OPEC+ countries that have agreed to voluntary cuts has not changed — the earliest increase will come in October — and Libyan production remains low. So in our view, the oil market is still just as tight as it was a week ago.”

The bank described overall demand growth as healthy, with weakness in China following a robust 2023 offset by strength in India as well as in European countries like Italy and Spain.

UBS believes a return above $80 a barrel is probable: “While prices are likely to stay volatile in the near term, we retain a positive outlook and expect prices to recover from current levels over the coming months.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks