Stockwatch: a well-timed takeover underlines appeal of gold

This tip just five months ago has returned around 20% following a bid approach, but what should shareholders do? Analyst Edmond Jackson talks through the deal and its implications for the sector.

13th September 2024 10:53

Does a mining asset takeover – by way of recommended offer by Anglogold Ashanti (NYSE:AU) for UK mid-cap Centamin (LSE:CEY) – imply industry belief that gold prices are likely to remain strong, or is it just another episode of consolidation of London-listed gold mining equities, as large-caps see takeovers as the chief means of growth?

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

Headquartered in South Africa but with international operations, AngloGold is an $11.8 billion (£9.0 billion) company, valuing Centamin at £1.9 billion if the deal consummates. It is mainly in new AngloGold shares, the $0.125 cash element equating to less than 10p of the 163p bid, according to the offer details, and versus a current market price of about 156p.

It continues London’s depletion of gold mining assets after Randgold merged with Barrick Gold and various Russian-based miners de-listed. Petropavlovsk, once a popular stock, fell into administration when unable to repay a debt - its financial assets frozen in a sanctioned Russian bank. It’s unclear whether limiting supply versus growing demand (if gold prices remain high) helps squeeze stocks up, but it does leave Endeavour Mining (LSE:EDV) as the largest at £3.9 billion priced around 1,600p.

Capitalising on prospect of high gold prices

Mining is often operationally geared and, when commodity prices also swing, the effects on profit and loss can be startling. They’re two fundamental reasons why such equities are volatile.

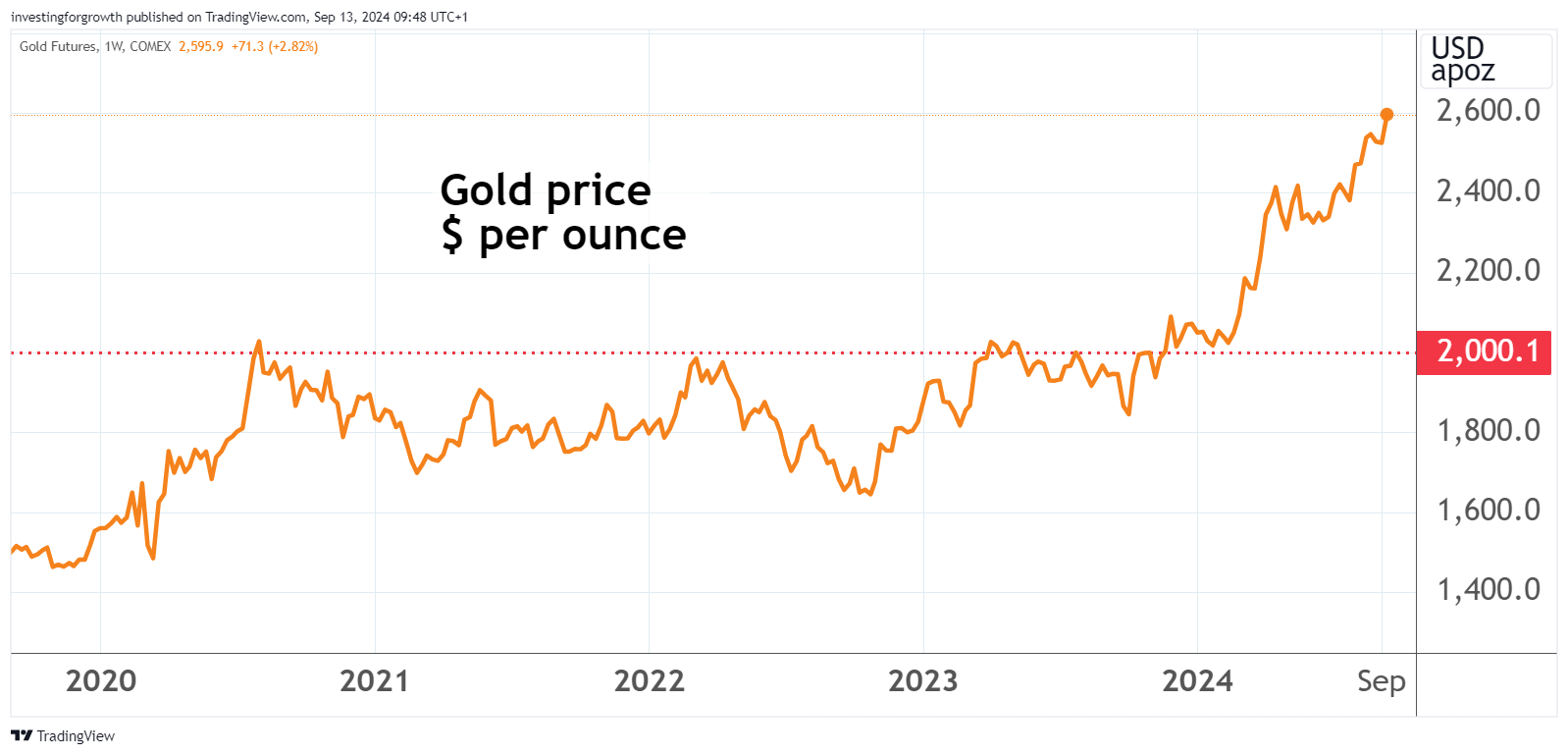

So, it helps how gold prices have risen from around $2,000 an ounce last March to over $2,500 currently.

Source: TradingView. Past performance is not a guide to future performance.

When I drew attention to Centamin as a “buy” at 131p in April (which followed a previous buy tip at 103p in 2021), it was due to being one of the best London-listed gold mining stocks – in a context of rising gold prices, stoked by global tensions such as the Middle East. Half a dozen central banks had been key buyers of gold, and another supportive story I cited is US public debt running out of control.

The Ukraine conflict is becoming something of an East/West proxy war, as Western military equipment and finance supports action on Russian territory, and the Iran/China/North Korea axis provides arms to Russia. The US presidential election campaign has cited the alleged eating of dogs in Ohio but is yet to address public debt.

- Glencore and Rio Tinto among FTSE 100 miners hit by downgrades

- 24 UK stocks to benefit from buoyant economy

In a macro financial context, gold prices are historically shown to rise when interest rates fall, while a weaker dollar also tends to support gold because dollar pricing makes it cheaper to buy. So, if rates ease over the next six to nine months, and US public debt fears worsen, a lower dollar should sustain demand for gold.

Things are looking up at company level

Centamin is towards the end of a multi-year stripping programme (where overburden to a resource is removed), with benefits set to accrue after such capital expenditure.

This and the rising gold price mean Centamin’s volatile-sideways stock trend over the summer bears little relation to intrinsic value.

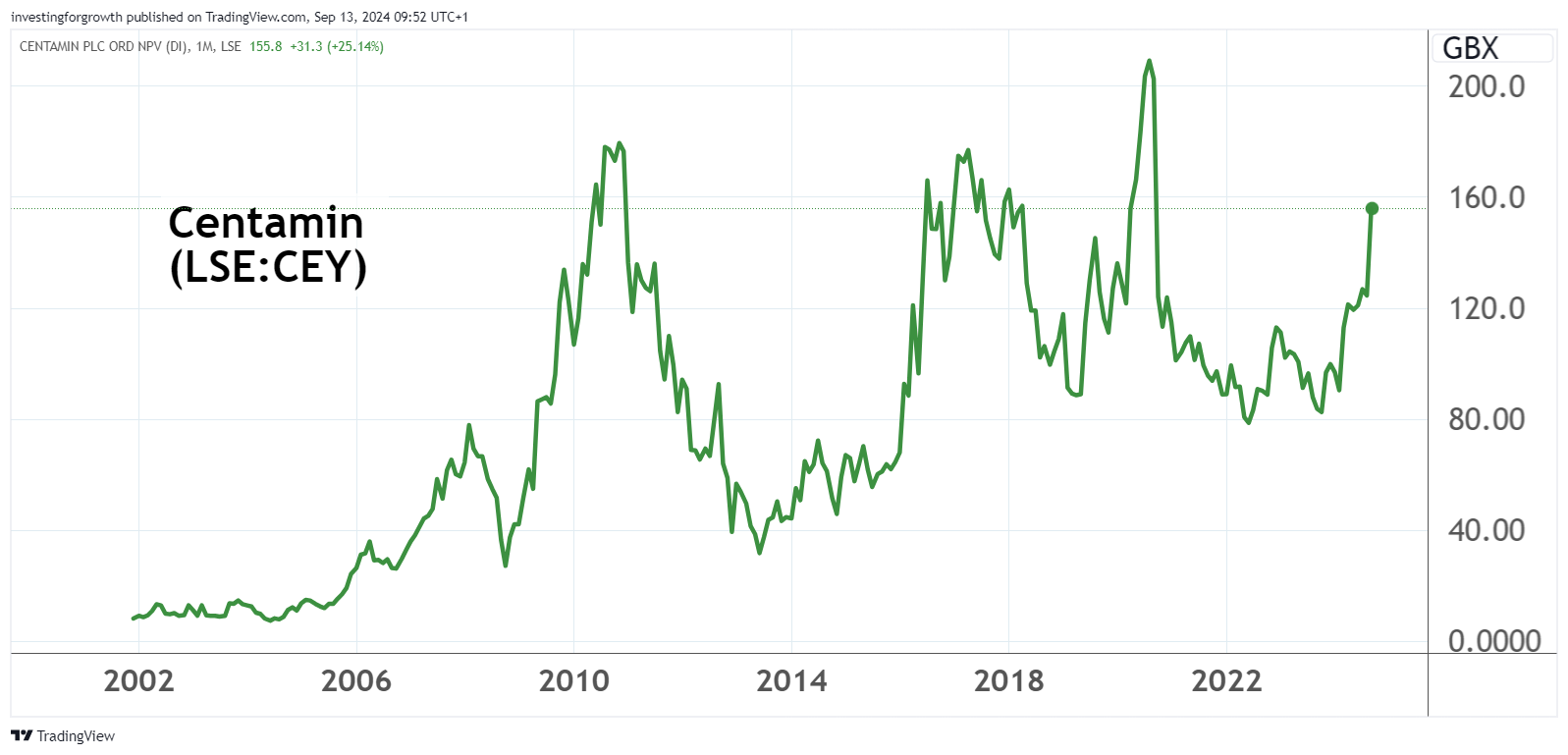

Source: TradingView. Past performance is not a guide to future performance.

AngloGold has also timed its offer well – to gain acceptances - ahead of third-quarter results which came out on 19 October last year. These should be strong given a trading update with last Tuesday’s offer details cited “positive operational momentum” – with strong production and cost discipline helping to capitalise on high gold prices.

Free cash flow in the first two months of the third quarter has been 77% higher than the entire first half. Cash and liquid assets were $244 million at 31 August, ahead of paying out $26 million as an interim dividend.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Stockwatch: a FTSE 100 share worth owning for near 10% yield

Yet Centamin shares were just below 120p when the takeover was announced, enabling the offer to be framed as a substantial premium of near 37% on the basis AngloGold’s stock price holds up.

Any mining share can be quite a roller coaster around fair value, but I think it important to note that Centamin hit 180p in 2010, and again in 2017. Its all-time high was 210p in mid-2020.

Source: TradingView. Past performance is not a guide to future performance.

Yes, the company’s 10-year underlying financial record is sideways-volatile, but the macro and micro contexts here led me to target this stock to re-rate to over 180p on a medium-term view. This is why AngloGold reckons on buying now.

Centamin - financial summary

year end 31 Dec

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover - $ million | 473 | 508 | 687 | 676 | 603 | 652 | 829 | 733 | 788 | 891 |

| Operating margin - % | 17.3 | 11.5 | 38.8 | 30.7 | 25.3 | 26.5 | 38.0 | 21.0 | 21.7 | 21.9 |

| Operating profit - $m | 81.6 | 58.4 | 267 | 207 | 153 | 173 | 315 | 154 | 171 | 195 |

| Net profit - $m | 81.6 | 51.6 | 266 | 96.4 | 74.8 | 87.5 | 156 | 102 | 72.5 | 92.3 |

| Reported EPS - cents | 7.1 | 4.4 | 18.5 | 8.3 | 6.4 | 7.5 | 13.5 | 8.7 | 6.2 | 7.8 |

| Nomalised EPC - cents | 12.9 | 8.5 | 20.6 | 11.9 | 10.7 | 10.0 | 13.5 | 10.7 | 6.2 | 8.1 |

| Operating cash flow/share - cents | 9.7 | 16.0 | 31.6 | 29.1 | 19.2 | 21.5 | 39.1 | 26.7 | 25.0 | 30.0 |

| Capital expenditure/share - cents | 7.7 | 6.1 | 9.2 | 7.1 | 7.6 | 8.1 | 12.0 | 20.7 | 23.6 | 17.2 |

| Free cash flow/share - cents | 2.0 | 9.9 | 22.4 | 22.0 | 11.6 | 13.4 | 27.1 | 6.0 | 1.4 | 12.8 |

| Dividend/share - cents | 2.9 | 2.9 | 15.5 | 12.5 | 5.5 | 4.0 | 15.0 | 9.0 | 5.0 | 4.0 |

| Earnings cover - x | 2.5 | 1.5 | 1.2 | 0.7 | 1 | 1.9 | 0.9 | 1.0 | 1.2 | 2.0 |

| Cash - $m | 126 | 200 | 400 | 360 | 283 | 285 | 291 | 208 | 102 | 93.3 |

| Net debt - $m | -126 | -200 | -400 | -360 | -283 | -285 | -291 | -208 | -102 | -93.3 |

| Net assets/share - cents | 116 | 118 | 125 | 117 | 111 | 112 | 112 | 115 | 114 | 118 |

Source: Historic Company REFS and company accounts.

Does AngloGold’s pitch - and implied lower-risk share - stack up?

Within the offer details published so far, the pitch to Centamin shareholders is effectively to lock in 160p or so a share, based on AngloGold’s market price, and retain exposure to high gold prices albeit with a more diversified, hence less risky, spread of interests.

Whereas, and like I pointed out in April, despite Centamin having a few other – primarily West African – interests, it is largely a “one-project company” based on Sukari, Egypt’s largest gold mine.

This has over 11 million ounces of resource and at least 11 years of production ahead, therefore currently attractive for takeover. But a sceptic might say that on a standalone basis Centamin shares therefore have a half-life to 2030 before starting to suffer a discount – unless there is radical progress elsewhere in the group – yet by this point the company will appeal less to an acquirer.

Holders should therefore be realistic rather than greedy in weighing up acceptance of AngloGold’s offer.

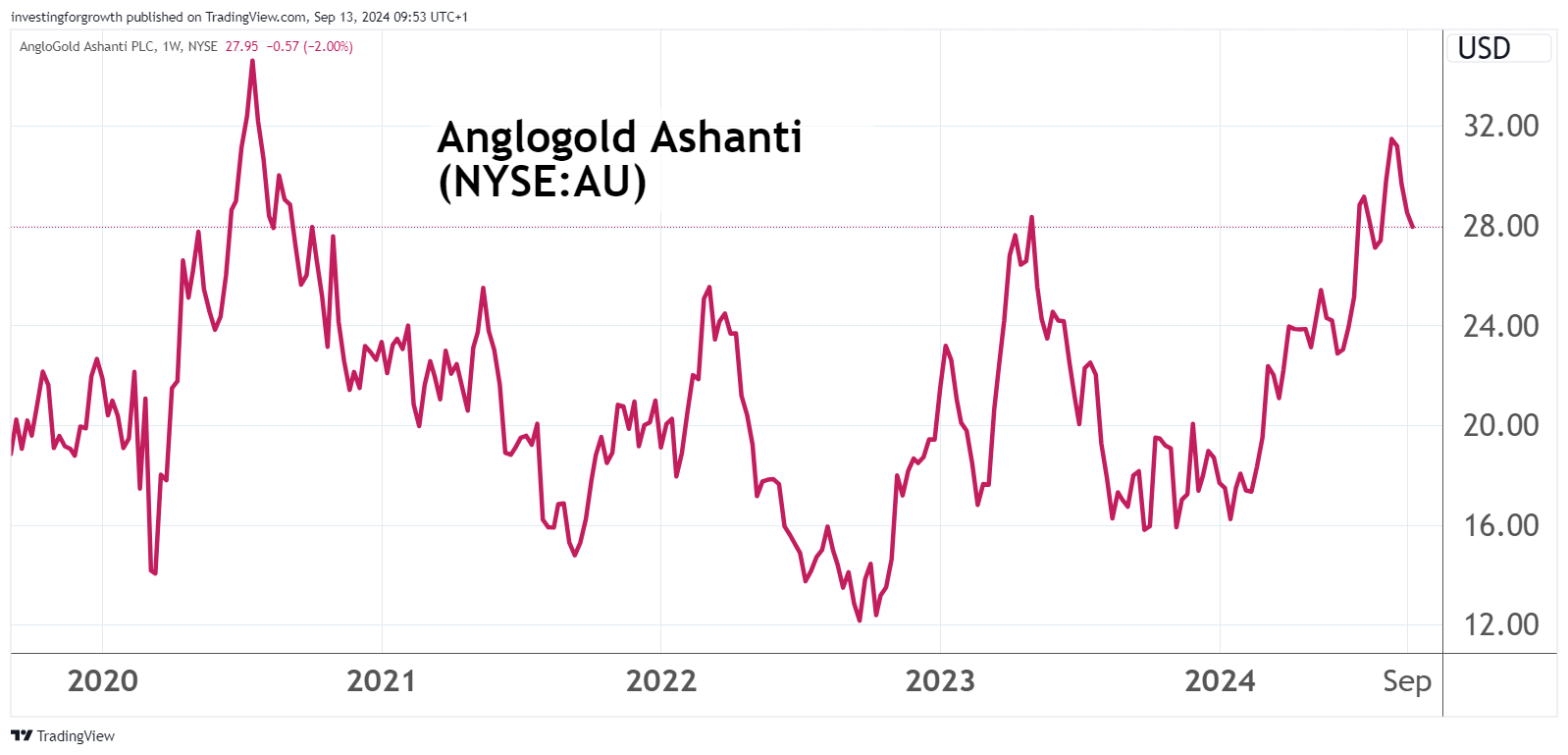

Yet AngoGold’s five-year chart has equally been volatile-sideways, hence in terms of technical analysis, is similarly risky as Centamin.

Admittedly, it has nearly doubled throughout 2024, if perhaps showing how industry majors with relatively more liquid shares are sought by investors when they recognise a commodity trending. Such a theory would explain the less-liquid Centamin lagging relatively this year.

Source: TradingView. Past performance is not a guide to future performance.

Buy or sell: Centamin’s risk/reward profile?

In response to offer news, the stock initially see-sawed around 150p in apparent heavy selling (as if trade indicators are much guide) as holders sensed possibly 30p downside risk versus circa 10p near-term upside.

AngloGold’s price has been a significant factor: slipping nearly 5% after the deal was announced then rising 2% yesterday, which explained Centamin’s 3% rise to 154p. With gold hitting record highs, the stock has added 2p this morning.

The situation does meet classic takeover arbitrage criteria – of agreed terms – rather than speculating on a “possible offer” like we have seen at various UK listed companies this year. If issues were to arise in due diligence, there might just be a minor price adjustment given the deal makes overall sense to both sides.

- UK banks are biggest boost as global dividends break records

- The Income Investor: lower rates to boost this stock’s dividend

Meanwhile, it is possible that rivals are jolted into competing for Centamin as a means of exposure to Egypt’s principal gold mine.

The main risk of offer failure appears to be shareholder rejection of the deal, given the 10 September announcement cites a scheme of arrangement procedure. UK takeover rules require at least a 75% majority compared with a contractual offer being declared unconditional at 50% acceptances.

Centamin directors own less than 0.2%, so this is all down to shareholders – with only one key institution, US investment manager VanEck holding near 10%. Otherwise, another US fund has 5% and a few others around 3%. No large holders appear to have been “sounded out” given there is no indication of their provisionally accepting offer terms.

So it is tricky to predict the behavioural outcome for a 75% threshold within the 60 days normally required.

If holding Centamin shares, I would be somewhat miffed as an individual investor who ends up with US equity (hence administrative complications for some) and no firm chart evidence that AngloGold is any better were gold prices to soften. If they stay strong however, it offers pragmatic means of retaining exposure.

For investors preferring a clean approach, should no rival offer appear in the weeks ahead, it is probably better to sell.

Otherwise, continue to hold and accept the offer unless you want to crystallise capital gains if you believe Labour will hike that tax at the end of October. Take your time though, relative to the offer schedule.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks