Economic woes mean bonds are finally worth investing in

6th July 2022 08:56

After years of rock-bottom yields, investors can now get a respectable return on their cash lending to governments and companies.

Bond investors are worriers – they want to make sure that they get paid back when they buy the debt of companies or governments and that their income is not destroyed by inflation. On the other hand, stock investors concentrate on the ‘upside’ – predicting how much a company could grow in the future.

This means that the bond market is hypersensitive to changes in the economic outlook. And boy is it worried at the moment. Weighing up rising interest rates, slowing economic growth and high inflation – somewhat of a perfect storm for fixed income – investors have been dumping bonds.

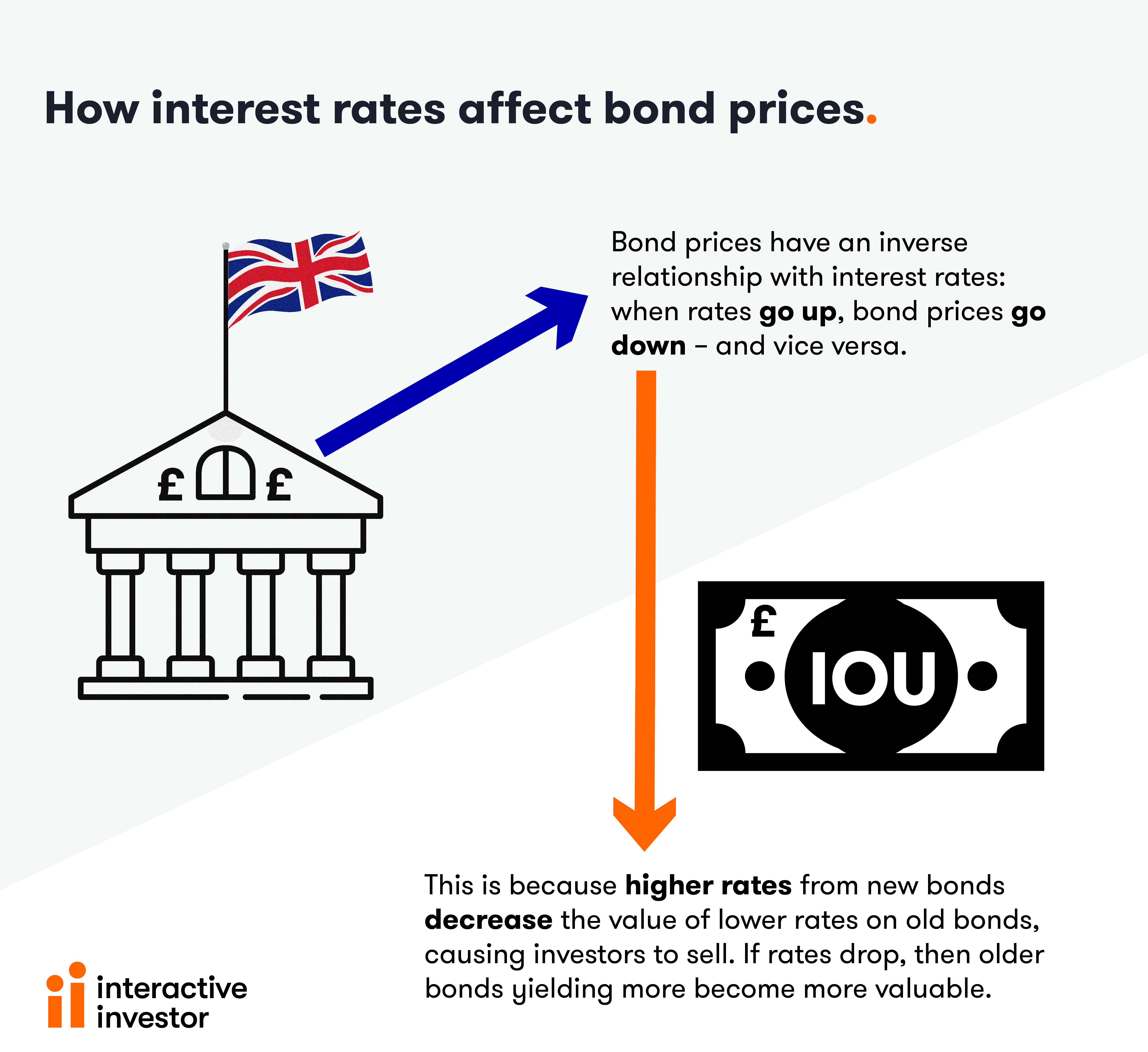

Yields, which move inversely to price, have therefore shot up. US government bonds with a 10-year maturity now yield around 3%, about six times the yield than in summer 2020. In the UK, 10-year gilts are at around 2%, 20 times higher than the 0.1% they yielded in July 2020, their low point.

Corporate bond yields, and how much they return over the “safe” government bond rate, known as the spread, have also risen. Investors can now get about 4% from the safest corporate credit, known as investment grade, while high-yield or “junk” bonds yield just under double that.

- Why bonds are back after a record-breaking sell-off

- Recessions are becoming more likely – here’s how to invest

- Why bonds are at a major turning point, according to veteran investors

This means that bond prices have fallen in tandem with stock prices this year, rather than providing a protective buffer in difficult markets. For UK investors, this has meant a 12% drop this year in the value of the typical bond fund.

Investors should interpret the bond market sell-off as a warning sign that economic pain is around the corner. This means higher inflation for longer, more defaults on the debt of companies, and higher interest rates that will put the brakes on economic growth.

It is hard to say if this means a recession, or how deep one might be if it happens, or exactly what inflation will peak at. But it says that the most sophisticated investors are predicting bad news and are not confident that central banks will get a grip on inflation without hurting the economy.

However, the intensity of the bond market sell-off, even before interest rates have risen much, means that there could now be some value there for investors.

If inflation comes down next year, as it is likely to do due to commodity prices now falling, then locking in a 4% yield from a safe company bond may look like a savvy move.

What this means for 60/40 portfolios

For investors blending stocks and bonds, returns this year will come as an unpleasant surprise. In a typical market crash, a higher weighting of bonds to stocks normally produces a better return. But in the sell-off this year, more bonds has meant worse returns.

Taking Vanguard’s popular LifeStrategy range so far this year, its 20% Equity (to 80% bond) fund has lost 11.5%, its 40% Equity lost 11%, 60% Equity lost 10%, 80% Equity lost 9.5%, and 100% Equity dropped 9%.

But despite this, owning bonds to protect a portfolio is not a defunct strategy. The sell-off in bonds means they now yield more, so that income will bolster returns for a mixed portfolio.

Moreover, the selling could have gone too far, with investors pricing in too much inflation and too many interest hikes. If central banks turn more dovish because they want to avoid a recession - pausing further rate hikes or even cutting them - then bond prices could rise again, providing investors with capital returns.

Finally, if central banks are now willing to raise interest rates following more than a decade of stubbornly low borrowing costs, then cycles of rising and falling interest rates as economies ebb and flow will return.

This means that bonds could suffer when the economy (and stock market) is healthy as central banks should be raising rates. But when the economy slows and stocks fall, then central banks will be willing to step in and cut rates, which is good for bonds. This “uncoupling” of the stock and bond markets should serve investors well in the future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks