Five takeaways from T. Rowe Price’s 2025 outlook

The big Baltimore-based money manager calls out the key themes that you’ll want to watch and explains why the start of the year will be different from the end.

6th December 2024 09:22

- Economic challenges are likely to persist early in the new year, but things could rebound later, particularly in Europe, thanks to lower interest rates and pent-up consumer demand

- International value stocks and small caps – long overshadowed by growth stocks – are poised for a comeback. Low valuations, plus increased capital expenditures in sectors like industrials and energy, position these stocks for strong gains as the global economy recovers

- Breakthroughs in obesity drugs, AI cancer screening, and robotics have set the stage for a "golden age" for healthcare innovation

- In the US, small caps and financials stand out with rate cuts and economic recovery likely to drive growth. But AI and cyclical stocks may lose momentum.

This year has been a wild ride for stocks, with their impressive gains and plenty of twists and dips. And next year, with its political shake-ups and tech transformations, is likely to deliver more of the same. So that makes this a prime moment to reassess your strategies and position yourself for growth.

Fortunately, asset management firm T. Rowe Price’s 2025 Global Market Outlook has just laid out some of the key themes that are expected to move US and international stocks in 2025.

1) Growth momentum will likely pick up in late 2025

The global economy is likely to hit a rough patch early next year, with China’s challenges already creating some wide-reaching ripple effects. According to T. Rowe Price, the impact of higher interest rates have been softened in many places by heftier government spending – and that’s allowed economies to weather rate hikes better than anticipated. But, with some of those outlays now tapering, those still-higher interest rates are starting to hit a bit harder.

That makes for a tricky environment, but Europe, for one, shows the potential for a swift recovery. The European Central Bank (ECB) – having kept its interest rates high – now has room to cut them quickly if needed. Cheaper borrowing could unleash a wave of spending from European households, many of whom have built up substantial savings since the pandemic. That spending boost could drive much-needed growth, particularly if geopolitical tensions, such as the Russia-Ukraine conflict, ease.

This improving outlook could also revive manufacturing – which has lagged behind services for years. And that long-overdue shift could happen, T. Rowe Price says, because of these three factors:

- Pent-up demand. Interest-rate-sensitive goods – big-ticket items like vehicles and major appliances – could see a resurgence as lower rates make financing more attractive

- Infrastructure investment. The push for renewable energy and AI-driven advancements demands massive infrastructure upgrades, and that’s already creating growth opportunities in the industrials and energy sectors

- Supply chain reshuffling. Companies are relocating their manufacturing operations to more stable, "friendly", countries to avoid supply chain vulnerabilities.

While these trends will unfold over the long term, T. Rowe Price expects their impact to start to bite by late 2025, as manufacturing begins to take center stage in the global economic recovery.

2) US ‘exceptionalism’ will probably persist, but policy risks loom

The US is poised to maintain its streak of economic resilience in 2025. Recent cuts to interest rates are expected to bolster consumer demand at home and abroad, in what will undoubtedly be a welcome contrast to the past few years. And, as T. Rowe Price rightly points out: those kinds of cuts – or monetary easing – don’t typically happen outside of a global recession. So that’s likely to create a unique window of growth opportunities.

That said, potential policy changes could complicate the picture. Proposed tariff hikes in the US, for instance, could lead to a temporary spike in consumer prices, depending on how much of the cost increases businesses pass on. And a more pressing risk lies in the president-elect's plans to tighten immigration policies. Restricting the flow of workers could shrink America’s labor pool, making it harder – and therefore more expensive – for businesses to fill jobs. While tariffs might result in price increases for just a year, a tighter labor market could have longer-term consequences, driving up wages and inflation. That’s something to keep in mind: you’ll need to navigate these challenges carefully as you weigh the opportunities ahead.

3) Value stocks appear poised for a global comeback

Value stocks in international markets have long been overshadowed by growth stocks, but they’re poised for a revival now as global economic conditions shift. While valuations alone don’t guarantee returns, they do offer a useful starting point for identifying long-term opportunities. T. Rowe Price sees the surge in non-tech capital expenditures (or capex, basically spending on big assets such as land, factories, and office space) as a game-changer for value-oriented sectors like industrials, energy, and materials.

That shift reflects a growing demand for tangible assets, driven by trends like manufacturing automation and the relocation of supply chains to more stable regions. And it marks a sharp contrast to the previous era dominated by the growth of intangible assets, particularly in the tech sector.

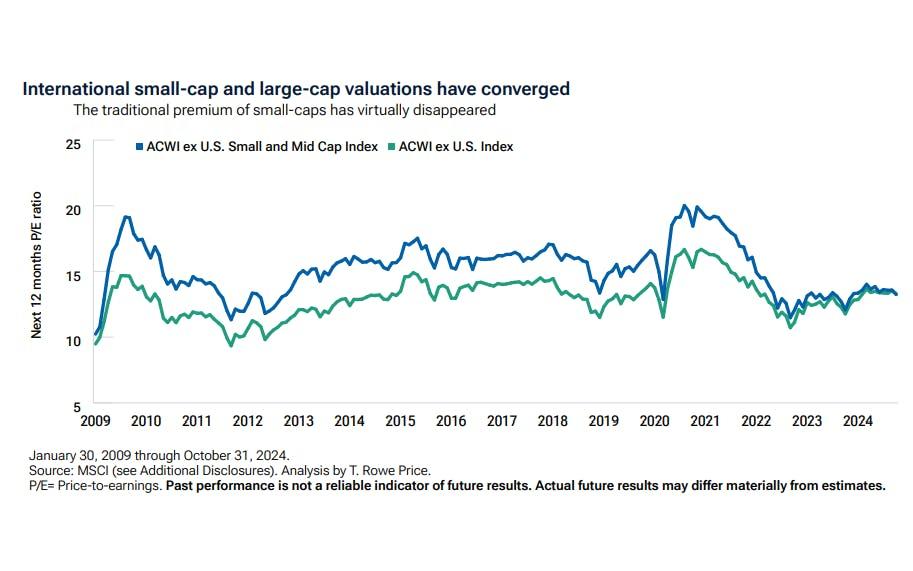

Small-cap international stocks could also present a promising opportunity. Historically, small caps have outperformed big caps after periods of earnings decline. And with valuations for small caps currently at extreme lows, T. Rowe Price estimates that these stocks are uniquely positioned for strong gains as the global economy recovers. This combination of low valuations plus the potential for earnings growth makes small caps an attractive choice for patient investors who are looking to capitalize on improving market conditions.

The 12-month forward price-to-earnings ratio of an international small-cap index (blue) and a big-cap index (green) over time. Source: T. Rowe Price, MSCI.

4) In US markets, small caps and financials stand out

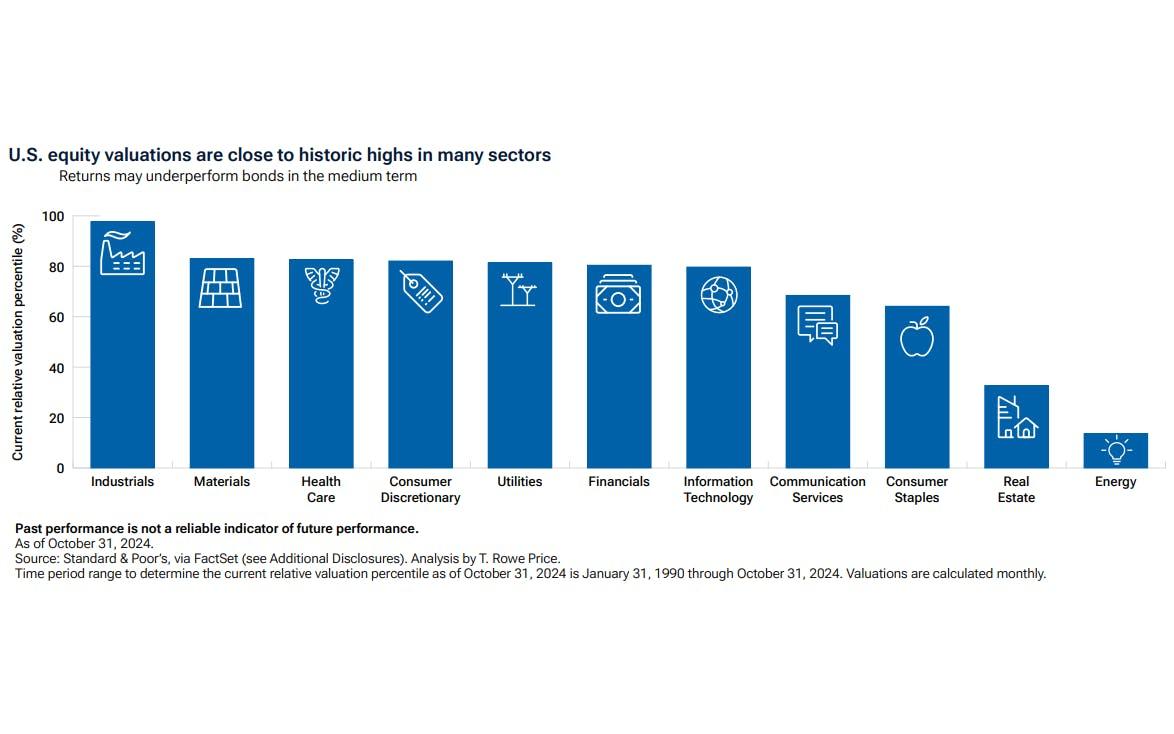

This year, US stocks have been dominated by three key trends: the rapid rise of AI-related stocks, the outperformance of cyclical stocks ahead of expected interest rate cuts, and soaring valuations for perceived “safe bets”. But next year, those themes could reverse, creating fresh opportunities for investors.

- AI growth could slow. Increased competition in AI infrastructure could temper its rapid growth, creating a more balanced environment for tech investments

- Cyclical stocks could face challenges. After their strong performance in 2024, cyclical stocks now trade near all-time high valuations, with limited room for further gains

- Small caps could gain ground. US small caps, which currently trade at a steep discount to the big caps, could benefit from continued interest rate cuts and a strengthening economy.

But, aside from all that, the energy sector also presents a multiyear investment theme. As capex increases in energy production and infrastructure, small caps could play a pivotal role in driving growth. Financials – yep: another beaten-down sector – is poised for a comeback. Sure, banks and real estate investment trusts (REITs) were hard hit by rate hikes in 2024, but rate cuts in 2025 could provide much-needed relief, improving their prospects.

US relative valuation percentile by sector. Source: T. Rowe Price.

5) And it’s time for a golden age in healthcare

After years of underperformance, the healthcare sector is on the verge of a spritely recovery. Rising costs and declining revenues have weighed heavily on the sector, but innovations are changing the game. The introduction of GLP-1 drugs that effectively target obesity and diabetes has brought a seismic shift, offering massive growth potential for drugmakers and a broader ripple effect across the entire healthcare system.

Beyond GLP-1s, other breakthroughs include AI-driven cancer screening, robotic surgery, therapeutic advancements, and managed healthcare solutions. Together, these developments are setting the stage for what T. Rowe Price calls a "golden age" for healthcare – where cutting-edge technologies improve patient outcomes and open up significant opportunities for investors.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks