The fund sector that ended 2024 on a high

Saltydog Investor’s sector analysis shows that, overall, December was one of the worst months of the year for fund performance. However, one fund sector bucked the trend and had a solid year overall.

7th January 2025 08:58

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

It is not unusual to see stock markets rally in the lead up to Christmas, but that was not necessarily the case in 2024.

In the US, the Nasdaq did make a small gain in December, up 0.5%, and some of the European indices also performed reasonably well. The German DAX rose by 1.4%, and the French CAC 40 made 2.0%. The largest gains were in the Far East, where the Hong Kong Hang Seng made 3.3%, and the Japanese Nikkei 225 beat them all, finishing the month up 4.4%.

- Invest with ii: Accumulation or Income Funds | Top Investment Funds | Open a Trading Account

However, closer to home, the FTSE 250 went down by 0.7% and the FTSE 100 lost 1.4%. It was not just the UK indices that struggled. In the US, the S&P 500 fell by 2.5% and the Dow Jones Industrial Average did even worse, ending the month down 5.3%.

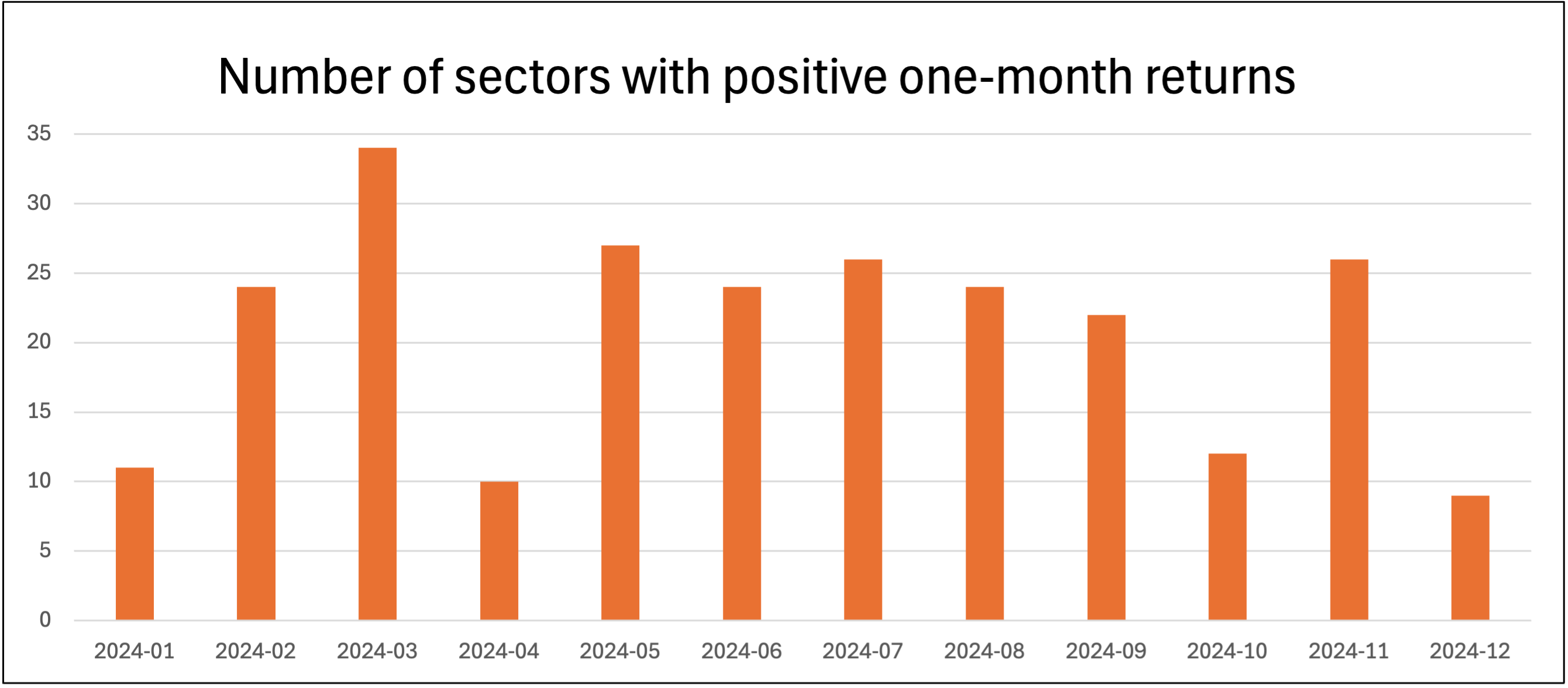

Our latest sector analysis shows that overall, it was one of the worst months of the year.

Data source: Morningstar. Past performance is not a guide to future performance.

Out of the 34 sectors that we regularly report on, only nine went up in December. That was significantly lower than the 26 that had gone up in November. It also ended up being the worst quarter we’ve seen since Q3 2023.

Before we compare the sectors, we put them into our Saltydog Groups. Which sectors go into each group is determined by how volatile they have been in the past.

Data source: Morningstar. Past performance is not a guide to future performance.

As you would have expected, the two Money Market sectors, in our least volatile “Safe Haven” group, made further gains in December. The Standard Money Market sector went up by 0.4% and ended the year with a 12-month return of 5.2%. The Short Term Money Market sector rose by 0.3% in December and made 4.6% over the year.

Just one sector in our “Slow Ahead” group, £ High Yield, posted a positive return in December, and it rose only by 0.3%. None of the sectors in our “Steady as She Goes” Group went up.

- Big macro risks the pros are watching in 2025

- Fund manager predictions for US, UK and other markets in 2025

In our “Full Steam Ahead Developed” Group, the Japan sector rose by 0.1%. All the other sectors in this group went down, with the worst, North American Smaller Companies, suffering a 6.2% one-month loss.

The best-performing sectors were in the “Full Steam Ahead Emerging” Group. The China/Greater China sector led the way, up 2.9%, followed by Technology & Technology Innovation and then Global Emerging Markets.

This is reflected in our top 10 funds for December.

Saltydog’s top 10 funds in December 2024

| Fund name | Investment Association sector | Monthly return |

| Pictet-China Equities | China/Greater China | 5.9 |

| Jupiter China | China/Greater China | 5.6 |

| Liontrust Global Technology | Technology and Technology Innovation | 4.8 |

| Liontrust China | China/Greater China | 4.8 |

| L&G Global Technology Index | Technology and Technology Innovation | 4.6 |

| Ninety One Emerg Markets Equity | Global Emerging Markets | 4.4 |

| FSSA Greater China Growth | China/Greater China | 4.3 |

| GAM Disruptive Growth | Global | 4.3 |

| UBS US Growth | North America | 4.3 |

| Ninety One GSF All China Equity | China/Greater China | 4.2 |

Data source: Morningstar. Past performance is not a guide to future performance.

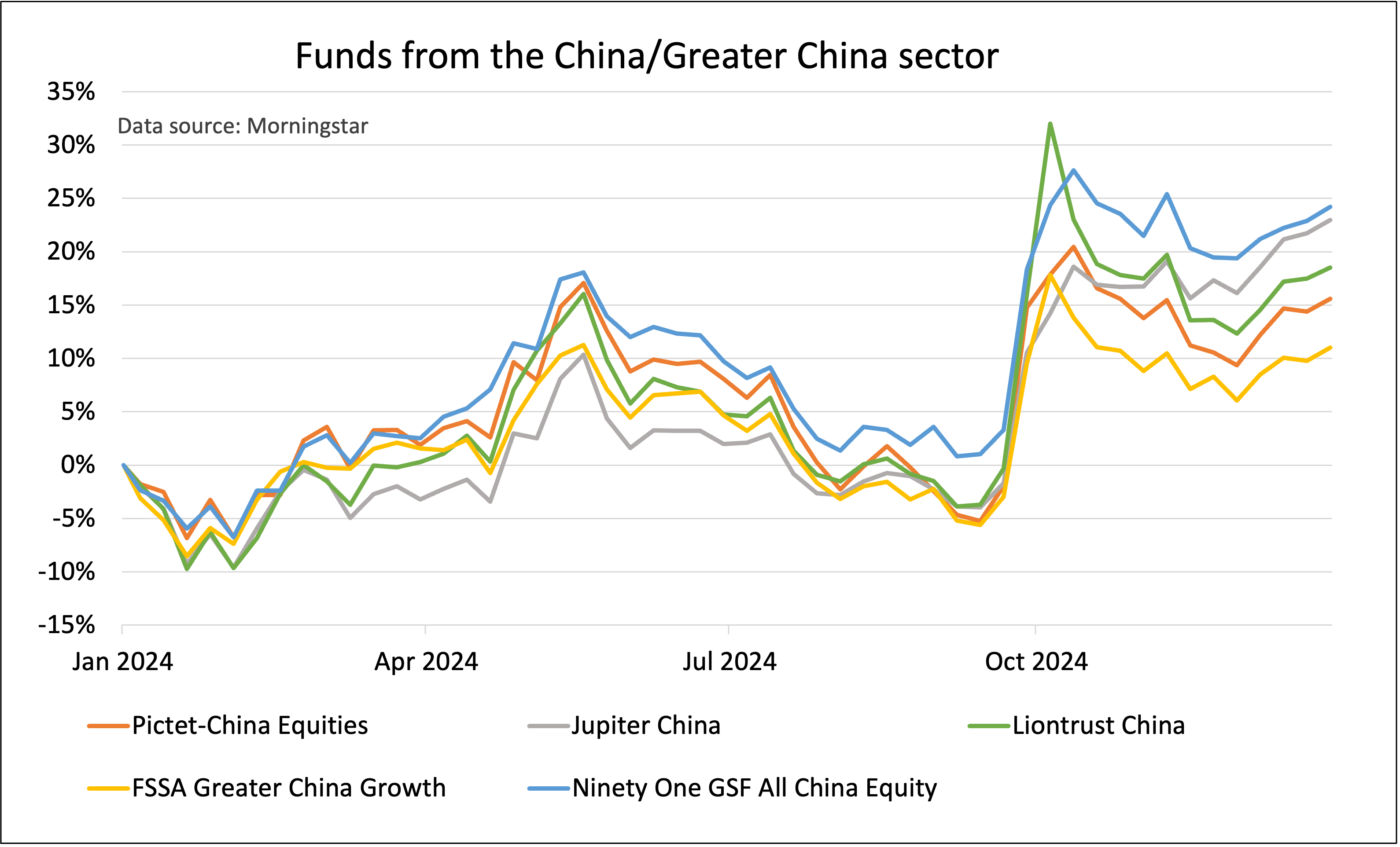

Five out of the top 10 funds are from the China/Greater China Sector. The best, Pictet-China Equities, rose by 5.9% in December.

Past performance is not a guide to future performance.

The Chinese funds had an interesting year. They went down in January, but picked up through February, March, and April. By mid-May, the leading funds were showing gains of 10% or more. However, they then started to fall and by the end of September were back to roughly where they were at the beginning of the year.

The Chinese government then unveiled a comprehensive economic stimulus package aimed at revitalizing the economy. This package, announced in late September, led to a significant rally in Chinese stocks in early October. However, the initial exuberance in the stock market was short-lived. Investors and analysts began to question whether the announced stimulus would be sufficient to address China's economic challenges. Stock markets began to fall.

However, there was a recovery at the end of the year. The sustainability of the rally now depends on the government's ability to deliver tangible fiscal stimulus and address the underlying economic issues facing the country.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks