How are trusts navigating a stock market colossus?

Kepler looks at how investment trusts in the global equity sector, including Scottish Mortgage, are positioned on Nvidia as the AI mega-trend marches on.

20th September 2024 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

If the Magnificent Seven (Alphabet, Amazon, Apple Inc (NASDAQ:AAPL), Microsoft, Meta Platforms, NVIDIA, and Tesla Inc (NASDAQ:TSLA)) dominated market returns in 2023, this year has so far been mostly about NVIDIA Corp (NASDAQ:NVDA), which briefly became the world’s most valuable company in June. The GPU maker is up 148% year-to-date at the time of writing, outpacing its Magnificent Seven peers, which have returned on average 37% (simple average).

- Invest with ii: Buy Investment Trusts | Top UK Shares | What is a Managed ISA?

Given NVIDIA’s dominance on the returns of the US and global indices, here we look at how the investment trusts in the AIC Global sector are positioned on this specific stock relative to their benchmark and what managers think of it.

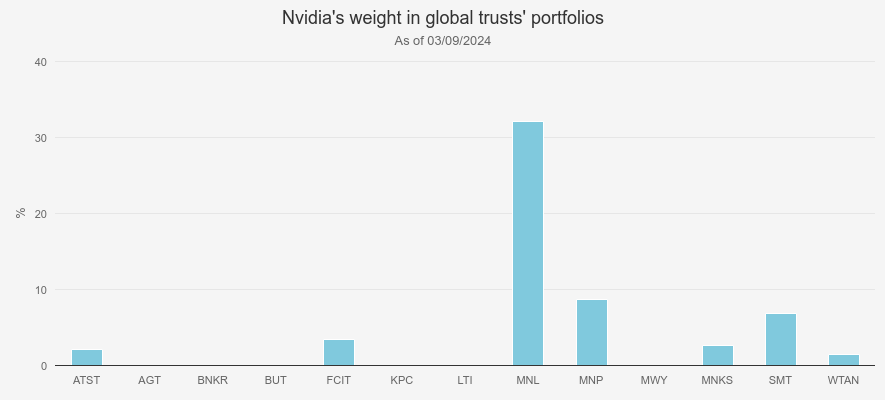

The chart below shows the weight of trusts in the AIC Global sector in NVIDIA. We have also included Manchester & London Ord (LSE:MNL), which is not an AIC member, but has a global mandate.

Interestingly, only three out of the 13 global investment trusts are overweight NVIDIA: MNL, Martin Currie Global Portfolio Ord (LSE:MNP), and Scottish Mortgage Ord (LSE:SMT).

Conversely, some trusts simply do not hold the stock in their portfolio, including AVI Global Trust Ord (LSE:AGT), Bankers Ord (LSE:BNKR), Brunner Ord (LSE:BUT), Keystone Positive Change Investment Ord (LSE:KPC), Lindsell Train Ord (LSE:LTI), and Mid Wynd International Inv Tr Ord (LSE:MWY).

NVIDIA ABSOLUTE-WEIGHT

Source: company factsheets

Of the three trusts that are overweight NVIDIA, MNL is the one taking the biggest bet on the stock, with the GPU maker accounting for 32.1% of the portfolio. This punchy allocation to NVIDIA has led MNL to be the only global investment trust to outperform the MSCI ACWI year-to-date to 31 August 2024. We selected the MSCI ACWI as the reference index in this research, as it is the most commonly used benchmark in the sector. Even though NVIDIA has done incredibly well, Mark Sheppard, the manager of MNL, has indicated that he has no intention to take profits on NVIDIA yet.

In comparison, MNP and SMT have relatively more ‘modest’ overweight positions in the American chip maker, at 8.6 % and 6.8% respectively, compared to a 3.9% weight in the MSCI ACWI , which hasn’t been enough to keep pace with the index. Both trusts have other large overweight positions that have made low double-digit returns year-to-date to 30 August 2024 or that have been loss-making, diluting NVIDIA’s three-digit returns.

Zehrid Osmani, portfolio manager of MNP is still enthusiastic about NVIDIA. He believes that the market still underestimates the longevity of the company’s growth. In a recent meeting, he highlighted that doing business with sovereign states and government contracts could be further tailwinds for the business. During NVIDIA’s earnings call for the second quarter of 2025, Colette Kress, the company’s chief financial officer and executive vice-president, said that NVIDIA’s sovereign AI revenue could reach the low double-digit billions this year. Jensen Huang, NVIDIA’s CEO, also highlighted sovereign AI as a growth opportunity, underpinned by countries’ desire to develop their own generative AI.

AI is a theme that Zehrid aims to capture in MNP’s portfolio, as he thinks it will be a major driver of innovation and disruption. As a result, AI plays an important role in his portfolio, with significant positions not only in NVIDIA but also in other AI enablers and beneficiaries, including Microsoft Corp (NASDAQ:MSFT), ASML Holding NV (EURONEXT:ASML), and Adobe Inc (NASDAQ:ADBE).

Similarly to NVIDIA, we would categorise ASML as a ‘pick and shovel’ stock, as it produces ultraviolet lithography systems that are needed for chip production. Adobe, on the other hand, would primarily fall into the AI-beneficiary bucket, as the company integrates AI into its suite of products such as Acrobat, Premiere Pro, and Photoshop. In our view, Microsoft falls into both categories: as a pick and shovel through Azure AI Services, which offers both pre-built and custom AI models, and as an implementer through the AI-powered features in its search engine, Bing.

SMT has held NVIDIA since 2016, although it sold down some of its position before the stock really took off in 2023. The trust’s manager, Tom Slater, expects NVIDIA to continue doing well, but recently trimmed his allocation to the stock, citing its recent outperformance and potential cyclicality. Tom’s decision may have been well-timed, as the stock has struggled in recent months, in particular after the company’s latest earnings report.

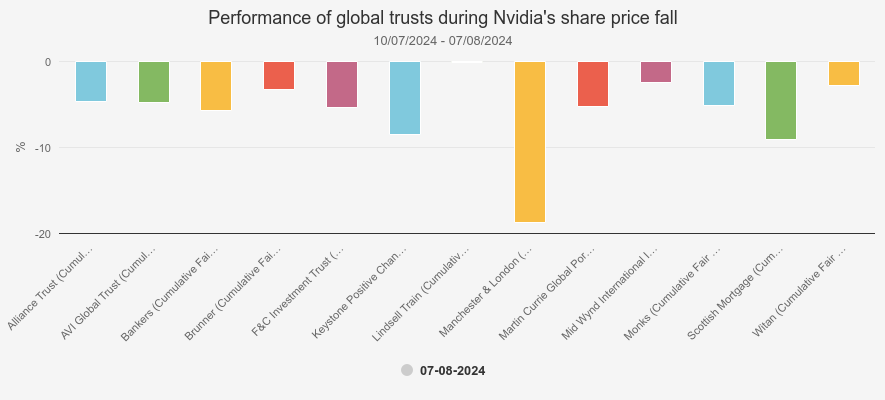

NVIDIA saw a large sell-off of 17.5% between 10 July 2024 and 07 August 2024, when the markets were hit by multiple factors such as the unwinding of the yen carry trade, worries about the US economy, and profit-taking. As the bar chart below shows, being overweight NVIDIA proved detrimental in that period, with the median share price across our custom global sector declining by 5.2%.

PERFORMANCE OF GLOBAL TRUSTS

Source: Morningstar. Past performance is not a reliable indicator of future results

However, some trusts with no exposure to NVIDIA, such as BUT, LTI, and MWY were relatively unscathed. Below, we explain why the managers of those trusts do not hold this stock and what they have been focusing on instead. We note that BNKR and KPC still experienced a decline greater than the sector average. We will discuss the reasons why we think this occurred later in this research.

MWY does not hold NVIDIA, as the former managers of the trust were worried about the concentration in the benchmark, with a handful of US tech companies dominating total returns. MWY saw a change in management in October 2023, with Barnaby Wilson and Louis Florentin-Lee of Lazard Asset Management replacing Simon Edelsten and Alex Illingworth of Artemis.

To realign MWY with the Lazard Global Quality Growth strategy, Barnaby and Louis have substantially rotated the portfolio, adding 35 new names in the portfolio between 01 October 2023 and 31 December 2023, while only retaining 6 of the 41 stocks inherited from Artemis. Data from Morningstar indicates that the stock was not introduced into the portfolio.

Recently, the new managers expressed concerns that there is too much exuberance surrounding AI and that valuations have become unsustainable for certain stocks. They think the market is overly focused on NVIDIA, overlooking other companies well positioned to benefit from the technology.

MWY remains overweight the technology sector relative to the MSCI ACWI through stocks such as Alphabet Inc Class A (NASDAQ:GOOGL), Microsoft, and Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM). Therefore, we believe the trust could provide a cautious exposure to global equities, including the information technology sector, while eliminating the risk of a potential reversal of fortune for NVIDIA. Typically, Barnaby and Louis focus on high-quality names with strong competitive advantages and the ability to generate high returns on capital. They aim to identify businesses that can compound growth over time and that they believe are underestimated by the market.

Similarly, Christian Schneider and Julian Bishop, the managers of BUT, do not hold NVIDIA. They think more time is needed to determine if the company’s moat is big enough to maintain its profitability, although they acknowledge its impressive performance.

Generally, they argue it is still too early to judge who the winners and losers of the AI revolution will be. This does not mean that BUT is completely AI-agnostic either. Instead, Christian and Julian get their exposure to the theme through companies such as Microsoft, Adobe, Accenture Class A (NYSE:ACN), and TSMC, which they see flourishing regardless of how the AI technology evolves.

BUT has still delivered positive returns this year, with Microsoft being one of the main contributors, alongside Novo Nordisk AS ADR (NYSE:NVO) whose shares rose following the success of its weight-loss drug Wegovy, and lesser-known stocks such as Greek retailer Jumbo SA. We note that the trust uses a composite index comprising 70% FTSE World ex UK and 30% FTSE All-Share, meaning that the trust keeps a significant exposure to domestic equities. After a challenging decade, UK equities are now trading at a discount to international peers. Therefore, we believe BUT offers an interesting compromise, providing exposure to the growth in global equities while maintaining a sizeable allocation to the cheaper UK market, which could be a source of outperformance if the valuation gap with international peers narrows.

LTI, another global trust that is not invested in NVIDIA, was even less impacted, just falling 0.2%. The trust has perennially been underweight the information technology sector and the US, relying instead on the compound earnings growth of defensive stocks, primarily in the UK consumer defensive sector. We think this is the most likely explanation for this resilience amid NVIDIA’s slump. However, we note that ignoring US tech has been detrimental to performance over the past five years, as LTI is significantly behind the MSCI ACWI.

Despite not holding NVIDIA, BNKR fell more than the sector average during its recent slump. In our opinion, we would argue this can be attributed to the trust's significant exposure to Japan, making up around 14% of the portfolio, compared to 5.2% for the MSCI ACWI.

Fears of a slowdown in the US economy combined with expectations that the Bank of Japan might continue raising rates following its first hike in 17 years, in March 2024, saw Japan’s stock market struggle. The rate hike triggered a surge in the yen’s value against the US dollar, prompting many investors to unwind their carry trades, where they had borrowed in Japan's low-interest environment to invest in higher-yielding US assets. The hike also made Japanese export-dependent stocks less attractive because a higher yen, in theory, means that exporters, which account for a decent portion of Japanese large-caps, will see lower-than-expected profits because they are converting foreign cash into a stronger home currency.

Nonetheless, BNKR has made positive returns so far this year, and its Japanese holdings were among the main contributors, more particularly those in the financials sector, as banks can potentially increase their revenue when interest rates are on the rise.

Technology has also been a significant contributor to performance and the trust recently added Alphabet, Amazon.com Inc (NASDAQ:AMZN), and Meta Platforms Inc Class A (NASDAQ:META) to the portfolio. The reason why the manager, Alex Crooke, does not hold NVIDIA is that he is concerned that new orders may start to plateau, which would lead to price pressure that may ultimately impact share price.

Similarly, KPC fell more than the sector’s median despite not holding NVIDIA. However, we note that the trust holds several stocks plugged into the AI theme and/or related to NVIDIA. For example, TSMC manufactures NVIDIA’s chips, while ASML produces the machines used by TSMC to manufacture chips. As a result, we believe KPC was indirectly exposed to NVIDIA, which impacted its NAV performance.

We note that AGT does not hold NVIDIA either. Given the manager, Joe Bauernfreund, seeks to exploit dislocations between potential investee companies’ underlying values and their share prices, focussing on investment trusts, holding companies, and asset-backed special situations, the absence of NVIDIA is not surprising.

There is a middle ground between being overweight in NVIDIA and not holding the stock at all: maintaining a market-weight or underweight position. This approach allows for potential further gains, albeit to a lesser extent, while also mitigating risks by avoiding over-reliance on a single stock.

We believe Alliance Trust Ord (LSE:ATST) is a case in point. The managers of the trust only appoint stock pickers and weigh them to ensure that the overall factor exposure of the portfolio aligns with the index. Interestingly, the outcome of this process is currently an underweight position in NVIDIA. In a recent meeting, Craig Baker — one of the managers — explained that he does not want the portfolio to be too reliant on the Magnificent Seven, whether on the way up or down, and highlighted NVIDIA’s volatility.

While this underweight position has led ATST to lag global indices year-to-date, returns are still in positive territory. US tech companies, including NVIDIA, were among the main contributors but companies outside of Silicon Valley also supported the performance, including General Electric (industrials), Safran SA (EURONEXT:SAF) (industrials), and MercadoLibre Inc (NASDAQ:MELI) (consumer cyclical).

The boards of ATST and Witan Ord (LSE:WTAN) have agreed to combine, as the manager of the latter investment trust, Andrew Bell announced his retirement. The combination is still subject to shareholder approval. If the combination goes through, the future Alliance Witan will have assets likely exceeding £5 billion. We believe this will make the trust more attractive to a boarder pool of investors, including institutions. The size of the combined trust should also be enough to enable its promotion into the FTSE 100, thereby gaining more visibility and increasing liquidity in its shares. Also, lower charges and increased dividends have already been announced if the combination goes through. We will be publishing an updated note on the trust in the coming weeks.

F&C Investment Trust Ord (LSE:FCIT), which also employs a multi-manager strategy, is slightly underweight NVIDIA. The manager Paul Niven, who oversees the overall strategic and tactical allocation of the portfolio, is mindful that the Magnificent Seven, including NVIDIA, are vulnerable to slowing momentum. Regarding AI more broadly, Paul remains cautious, as he thinks the technology is still in its infancy, and that most companies are not yet able to generate value through it for now.

Monks Ord (LSE:MNKS) is also underweight NVIDIA, but managers Spencer Adair, Helen Xiong and Malcolm MacColl only added the stock in the portfolio in late 2023 alongside other AI ‘pick and shovel’ plays such as Samsung Electronics Co Ltd DR (LSE:SMSN) and Advanced Micro Devices Inc (NASDAQ:AMD). The managers believe that NVIDIA’s revenue could grow by 40% per annum over the next five years, potentially doubling its share price by 2028. While the managers may have missed some of the early gains, MNKS will benefit if NVIDIA continues its strong performance, while any trend reversal would likely not be too harmful as the trust is not yet heavily exposed to the stock.

Conclusion

Predicting NVIDIA’s future trajectory is a tough call, as reflected in the contradictory opinions among the different managers in our custom global sector. While we do not know any better, we can’t help but notice that NVIDIA has been particularly volatile in recent weeks.

Moreover, the media has recently reported that the US Department of Justice is investigating NVIDIA for its quasi-monopoly in the AI chip market and has issued a subpoena to the company, although NVIDIA has denied this report. While the situation is unclear, it is worth noting that antitrust investigations are not uncommon; for example, Microsoft was investigated in 2001 when the US government accused it of monopolising the web browser market for Windows.

In spite of this, we think there are still reasons to be optimistic over the long term. If the AI mega-trend proves as potent as some of the managers in the global sector anticipate, then NVIDIA may continue to outperform. Notwithstanding the potential investigations, we are not aware of any competitor likely to challenge NVIDIA’s position in the GPU market in the foreseeable future.

Discounts have narrowed in the AIC Global sector over the past year as some optimism has returned to markets — and as investors prepare for rate cuts. However, we think there is still plenty of value in the shares, which provides some cushion against the risks to NVIDIA’s success and the market as a whole.

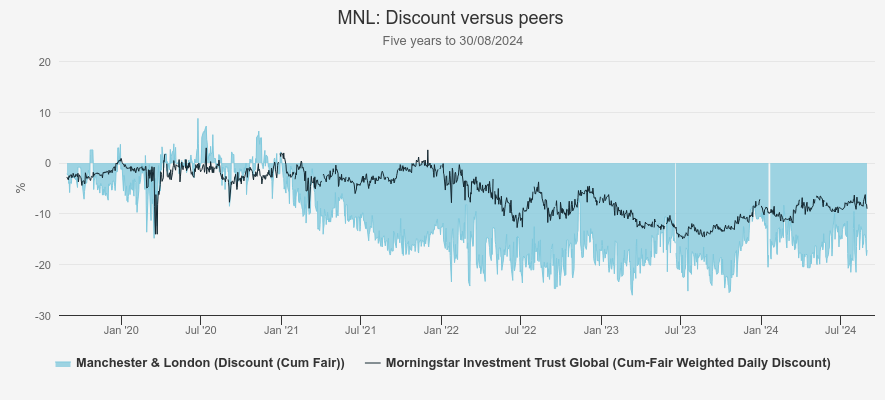

For example, MNL is trading at a 17.3% discount as of 30 August 2024, as indicated in the chart below. This might offer a margin of safety if NVIDIA should struggle going forward. At the same time, the trust is also well positioned to benefit if NVIDIA continues to outperform, as it is, in our view, the closest thing to a proxy play on this stock in the global sector.

FIVE-YEAR DISCOUNT

Source: Morningstar. Past performance is not a reliable indicator of future results

MNL has an extremely concentrated portfolio which some investors will not want. For those who prefer a more conservative approach, we think BUT, MWY, and ATST stand out. All offer a more risk-conscious approach to NVIDIA and AI, with some exposure but diversification. They trade on relatively modest discounts, however, of circa 2%, circa 1%, and circa 6% respectively. The contrast in the discounts between these trusts and MNL suggests to us that the average investment trust investor is more wary of NVIDIA than the market. FCIT offers a similarly diversified approach with a modest allocation to NVIDIA but sits on a wider discount of circa 9%.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Editor's Picks