ii Investment Outlook: Q3 2019

As developed and emerging markets battled, we reveal who coped best with Trump, China and Brexit in Q3.

7th November 2019 12:00

As developed and emerging markets battled for supremacy, we reveal who coped best with Trump, China and Brexit in Q3.

Market round-up

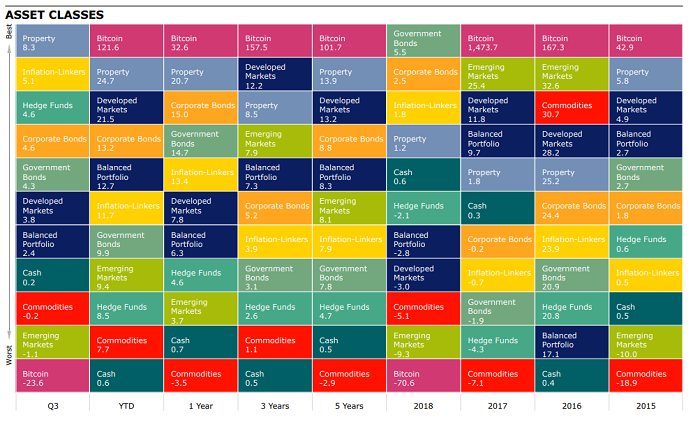

Global markets suffered a typically volatile summer quarter, pressured by any number of long-running global economic and political events.

Domestically, it looked like Brexit was approaching the end-game, as new UK Prime Minister Boris Johnson occupied himself putting together draft ideas for a new Brexit deal. At the same time, American counterpart Donald Trump continued to threaten China with an extra 10% tariff on $300 billion of goods.

Concerns about a slowing global economy, plus central bank interest rate policy and monetary easing both in the US and Europe, only increased anxiety. Added to the mix was a term which many investors may not have come across before - the inversion of the US yield curve.

An inverted yield curve infers lower inflation, or deflation and anaemic growth. It's when interest rates on short-term bonds are higher than rates paid by long-term bonds. Fear about the near-term future forces investors to pile into safer long-term investments.

Property continued its stellar performance, still fuelled by years of cheap money and rising prices, driven by strength in North America. Investors still like the sector's defensive characteristics such as sustainable dividends and strong cashflows.

And what of the final three months of 2019? Well, Trump's sabre-rattling got the fourth quarter off to a terrible start, but, as we've become used to, the rhetoric can turn on a sixpence, and hopes are now high that a 'phase one' trade deal with China will be reached soon.

For the first time in almost 100 years, the UK will hold a general election in December. In what is seen very much as a vote on Brexit, it promises to be one of the most unpredictable polls in living memory. Whatever the outcome, a no-deal Brexit appears off the table, and any certainty given should underpin sterling and improve the outlook for UK domestic stocks.

Source: Morningstar Total returns in sterling

Shares

There was a clear divide between developed and emerging markets (EM) in Q3. Japanese, US, European and UK equities all delivered positive returns in sterling terms, while a strong dollar hurt EM plays like India and Brazil, unable to recover all the losses triggered by renewed escalation in the US-China trade dispute and global growth concerns.

Japan stands out among the winners this quarter. It also fell sharply in reaction to negative trade war news, but responded far better than other markets to a thawing of US-China trade tensions through September.

This outperformance demonstrates just how closely Japan's fortunes are aligned to those of the Chinese economy. Investors wasted no time buying up cheap assets, and Japanese stocks at historic lows proved too tempting. More generous dividend payments and share buybacks helped sentiment toward the region, but the jury is still out on whether this Far East equities rally is sustainable.

There was enough uncertainty around early August to knock 9% off the FTSE 100 index over the first two weeks of month, while the S&P 500 index lost over 5% in a matter of days. The trade talks-driven recovery in September guaranteed Q3 ended on a high note for developed markets, with UK mid-caps also buoyed by Brexit hopes.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| TOPIX Japan | 6.45 | 14.13 | -0.32 | 8.25 | 12.25 |

| S&P 500 | 5.03 | 24.59 | 10.32 | 15.4 | 17.09 |

| World | 3.83 | 21.55 | 7.76 | 12.16 | 13.23 |

| FTSE 250 | 3.31 | 16.71 | 1.17 | 6.65 | 8.27 |

| Russia* | 1.84 | 33.58 | 24.89 | 19.18 | 14.04 |

| Europe Ex UK* | 1.68 | 18.93 | 5.85 | 9.22 | 9 |

| FTSE All Share | 1.27 | 14.41 | 2.68 | 6.76 | 6.79 |

| FTSE 100 | 0.98 | 14.25 | 3.23 | 6.79 | 6.47 |

| Asia Pacific Ex Japan* | -0.81 | 11.42 | 3.95 | 8.41 | 9.94 |

| FTSE Small Cap | -0.96 | 8.33 | -2.88 | 6.41 | 7.7 |

| Emerging Markets* | -1.11 | 9.44 | 3.69 | 7.85 | 8.1 |

| Brazil* | -1.45 | 14.3 | 32.73 | 13.68 | 8.32 |

| China* | -1.61 | 11.23 | 1.67 | 9.63 | 12.02 |

| India* | -2.05 | 5.57 | 10.83 | 8.42 | 9.7 |

Source: Morningstar *MSCI, Total returns in sterling

Sectors

Defensive sectors outperformed economically sensitive ones, led by a strong rally among utilities and real estate companies. The consumer staples sector also posted significant gains. Energy and basic materials declined as investors fretted about the health of the global economy.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| Utilities | 9.94 | 24.09 | 27.64 | 12.42 | 13.61 |

| Real Estate | 7.64 | 25.61 | 22.63 | 8.96 | 13.59 |

| Consumer Staples | 7.42 | 23.71 | 18.08 | 7.81 | 13.21 |

| Information Technology | 5.61 | 33.8 | 12.75 | 22.57 | 22.81 |

| Communication Services | 4.68 | 22.01 | 16.47 | 5.27 | 9.44 |

| Financials | 3.57 | 19.27 | 5.21 | 12.41 | 11.27 |

| Consumer Discretionary | 3.55 | 22.46 | 7.19 | 14.17 | 16.1 |

| Industrials | 2.58 | 22.99 | 5.42 | 11.11 | 13.43 |

| Health Care | 1.99 | 12.03 | 3.89 | 9.92 | 12.38 |

| Materials | -0.09 | 17.33 | 3.42 | 9.66 | 9.66 |

| Energy | -2.69 | 9.71 | -12.02 | 2.01 | 0.66 |

Source: Morningstar Total returns in sterling

Bonds

Bond markets rallied as central banks around the world reduced interest rates in the face of an escalating trade war.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| UK Inflation Linked | 8.04 | 16.74 | 19.09 | 5.14 | 9.86 |

| UK Gilts | 6.2 | 11.23 | 13.36 | 3.23 | 6.04 |

| Global Inflation Linked | 5.07 | 11.66 | 13.42 | 3.95 | 7.87 |

| Global Corporate | 4.55 | 13.19 | 15.01 | 5.2 | 8.77 |

| Global Government | 4.3 | 9.91 | 14.66 | 3.08 | 7.76 |

| Global Aggregate | 4.02 | 9.89 | 13.86 | 3.39 | 7.75 |

| Sterling Corporate | 3.69 | 10.23 | 10.25 | 3.25 | 5.64 |

| Global High Yield | 3.67 | 13.67 | 11.94 | 7.45 | 10.6 |

| EURO Corporate | 0.13 | 5.3 | 5.43 | 2.92 | 5.27 |

Source: Morningstar Total returns in sterling

Commodities and Alternative investments

Despite a sharp price spike in mid-September following an attack on oil infrastructure in Saudi Arabia, oil prices were down as demand concerns persisted. By contrast, gold rallied as investors moved into perceived safe haven assets.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| CBOE Market Volatility (VIX) | 11.22 | -33.97 | 41.8 | 8.81 | 5.55 |

| Gold | 8.72 | 19.96 | 33.01 | 5.7 | 10.09 |

| UK REITs | 6.43 | 16.13 | 5.3 | 4.59 | 5.1 |

| Global Infrastructure | 3.85 | 24.86 | 21.3 | 9.93 | 11.73 |

| Hedge Funds | 3.67 | 7.38 | 9.34 | 6.01 | 9.27 |

| Cash | 0.19 | 0.55 | 0.74 | 0.5 | 0.5 |

| Commodities | -0.25 | 7.69 | -3.48 | 1.05 | -2.88 |

| Global Natural Resources | -2.94 | 10.57 | -5.79 | 8.87 | 6.82 |

| Brent Crude Oil | -5.68 | 16.76 | -22.24 | 9.31 | -3.49 |

Source: Morningstar Total returns in sterling

ii Super 60 fund selections

The best-performing ii Super 60 fund over the third quarter of 2019 was iShares Physical Gold ETC (LSE:SGLN) which returned 8.8% on the back of a rally in the underlying asset as investors looked for safe havens. The second-best performing fund was TR Property (LSE:TRY) with returns of 7.2%, driven by the strong performance of real estate companies which typically have defensive characteristics and higher yields. Vanguard UK Govt Bond Index Fund returned 7%, reflecting a decline in gilt yields over the quarter caused by heightened risk aversion.

BlackRock Frontiers Trust (LSE:BRFI) was the lowest returning fund over the quarter as frontier and emerging markets felt the brunt of an escalation in US-China trade tensions and concerns over global growth. Man GLG Continental European Growth fund and TR European Growth Trust (LSE:TRG) also lost value as general political turmoil in Europe weighted heavily on investor sentiment.

All the Super 60 funds have delivered a positive absolute return over the last five years. The top performers were Legg Mason IF Japan Equity Fund, Baillie Gifford Shin Nippon (LSE:BGS) and Fundsmith Equity, which all produced an annualised return of over 20%.

Top five ii Super 60 funds in Q3

| Performance | |||||

|---|---|---|---|---|---|

| Investment | Q3 (%) | YTD | 1 Year | 3 Years | 5 Years |

| iShares Physical Gold ETC (LSE:SGLN) | 8.8 | 19.55 | 32.06 | 5.52 | 9.67 |

| TR Property (LSE:TRY) | 7.23 | 20.26 | 9.15 | 9.26 | 14.22 |

| Vanguard UK Govt Bond Index Fund | 7.02 | 12.61 | 14.84 | 3.48 | 6.42 |

| Legg Mason IF Japan Equity Fund | 6.91 | 24.99 | -1.29 | 10.51 | 23.77 |

| HSBC Japan Index | 6.34 | 14.98 | -0.01 | 7.93 | 11.74 |

Source: Morningstar Total returns in sterling

Bottom five ii Super 60 funds in Q3

| Performance | |||||

|---|---|---|---|---|---|

| Investment | Q3 (%) | YTD | 1 Year | 3 Years | 5 Years |

| BlackRock Frontiers Trust (LSE:BRFI) | -3.71 | 6.41 | 4.16 | 5.37 | 5.43 |

| TR European Growth Trust (LSE:TRG) | -3.61 | 13.38 | -8.55 | 5.91 | 13.04 |

| Man GLG Continental European Growth | -3.48 | 19.63 | -1.03 | 8.88 | 16.29 |

| Templeton Emerging Markets Smaller Companies | -3.37 | 5.41 | 1.13 | 4.18 | 8.4 |

| TB Amati UK Smaller Companies | -1.97 | 11.49 | -5.02 | 13.76 | 15.59 |

Source: Morningstar Total returns in sterling

Most-traded funds on the ii platform in Q3

Changes to the ii Super 60 list (under review/developments)

No changes were made to the interactive investor Super 60 list of investments during the third quarter of 2019.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks