ii investment performance review: Q1 2023

14th April 2023 10:43

Despite swings in investor sentiment, Q1 may be best remembered for the collapse of Silicon Valley Bank and the takeover of Credit Suisse.

Looking at the numbers, 2023 appears to have kicked off to a positive start especially after an incredibly painful 2022 as both equity and bond markets (GBP hedged) closed Q1 with single-digit gains. What the numbers don’t show however were the swings in investor sentiment due a plethora of factors from the implications of better-than-expected economic data and continued debates around inflation, to market panic concerning the resilience of the global banking system; all this against a volatile geopolitical and economic backdrop as nations of the world continue to wrestle with the aftermath of Covid-19 and Putin’s war in Ukraine.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

January was characterised by a renewal of risk appetite as economic growth in the US, Europe and China looked to be favourable, with some economists suggesting a shallower than expected recession or the avoidance of one entirely. This was coupled with the view at the time, that inflation may have peaked, leading to suggestions of tempered rate hikes, perhaps even rate cuts on the horizon. In China, there was the reopening of the economy following the announcement of the zero-Covid policy in late 2022.

Come February however, this enthusiasm for economic growth flipped to one of pessimism as the worry of stickier-than-forecast inflation weighed on investors, resulting in a rise in bond yields as the markets priced in a ‘higher for longer’ interest rate environment. One of the stickier areas of inflation remains that of the labour market with firms across many sectors still struggling to hire and retain staff, particularly in the services sector. Unemployment remained low in a historical context across numerous economies such as the US, Europe and the UK. Even Japan, a country that has seen extremely low rates of inflation for several decades, saw increases in salaries across a number of industries.

- What 120 years of stock market data tells us about where to invest today

- The ‘unique’ investment that protects against inflation

Despite all the market activity, Q1 may be best remembered for the collapse of US regional bank Silicon Valley Bank (SVB) in March shortly followed by the takeover of Credit Suisse (SIX:CSGN) by its competitor UBS (SIX:UBSG). These two events led to a sell-off in the US and European financial sectors as the fears of a systematic collapse of the banking sector went into overdrive. The failure of SVB was largely the result of poor risk management, however, it did highlight the general macro challenges arising from more restrictive monetary policy; something central banks ultimately must contend with in their quest to stymie inflation. While Credit Suisse was plagued by issues long before its eventual demise, its announcement of financial reporting weaknesses and recent market stress were the final nail in the coffin. Recent events in this sector may lead to a tightening of lending standards, which may constrain growth in developed economies.

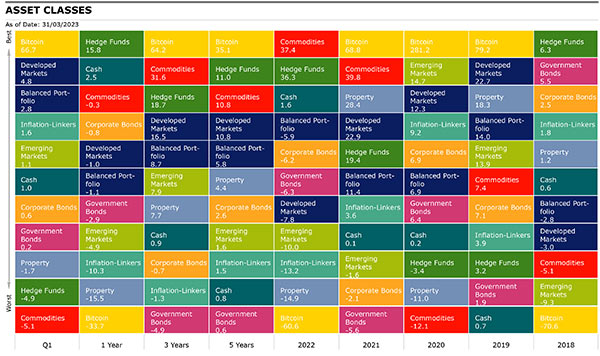

Source: Morningstar

Shares

Over Q1 2023, global equities returned 4.81% in sterling terms, as measured by the MSCI World NR Index with Developed Markets (DM) outperforming Emerging Market (EM) counterparts as EMs are typically more susceptible to US interest rate hikes. The reopening of the Chinese economy had brought about optimism in EMs (and the rest of the world), however, further deterioration of relations between US and China was a headwind.

While UK equities outperformed global markets in 2022, in part due to heavy exposure to energy stocks, the market has underperformed thus far in 2023 albeit still providing a positive return of 3.08% as measured by the FTSE All-Share Index. The FTSE 100 had reached an all-time high in February before retreating as problems began in the banking sector and fears of economic turmoil fed through to the wider market.

US equities also underperformed against DM global equities albeit marginally, the S&P 500 posted a 4.58% gain in Q1 in sterling terms. This positive return was delivered despite recent market turmoil as a result of the SVB collapse and concerns of contagion risk, which led to banking stocks tumbling over 20% in March. The largest gains were seen in technology, while healthcare and energy also detracted.

European equities outperformed global equities with the MSCI Europe ex UK Index posting an 8.89% gain in sterling terms in Q1. Real estate was the worst-performing sector in Q1 due to worries over weak occupancy rates and higher financing costs leading to decreasing valuations.

| Q1 | 1 year | 3 years | 5 years | |

| Russia | — | — | — | — |

| Europe Ex UK | 8.89 | 8.62 | 15.21 | 7.46 |

| World | 4.81 | -0.99 | 16.51 | 10.77 |

| S&P 500 | 4.58 | -1.74 | 18.72 | 14.03 |

| FTSE 100 | 3.55 | 5.39 | 14.25 | 5.56 |

| TOPIX Japan | 3.40 | 2.76 | 7.66 | 3.63 |

| FTSE All Share | 3.08 | 2.92 | 13.81 | 5.04 |

| China | 1.87 | 1.45 | -2.55 | -1.55 |

| Asia Pacific Ex Japan | 1.28 | -3.00 | 8.91 | 3.64 |

| Emerging Markets | 1.14 | -4.91 | 7.93 | 1.63 |

| FTSE 250 | 0.97 | -7.88 | 10.34 | 1.99 |

| FTSE Small Cap | -1.27 | -9.00 | 16.01 | 4.91 |

| Brazil | -5.80 | -13.41 | 14.21 | -1.27 |

| India | -8.89 | -6.47 | 22.33 | 8.86 |

Source: Morningstar, Total Returns (GBP) to 31/03/2023.

Sectors

At the global sector level, technology, communications and consumer discretionary were the best-performing sectors over the quarter. In the US, and consequently in global equities, we saw a significant rebound in technology stocks with the most notable gains attributed to NVIDIA (NASDAQ:NVDA), Meta Platforms (NASDAQ:META), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL); these names accounted for roughly half the performance of the S&P 500 in Q1. Optimism surrounding the progress of artificial intelligence coupled with a decline in bond yields boosted valuations. UK and Europe also saw strong returns in their respective technology sectors. Outperformance of consumer discretionary in the UK and Europe in particular, reflected the resilience of those economies and improving consumer confidence as the cost of energy began to subside.

As mentioned already, financials particularly bank stocks, had been the biggest detractor in performance over Q1, which fed through to real estate, which also underperformed partly due to the likely reduced access to credit. Other sectors that underperformed were energy and utilities due to the considerable fall in wholesale energy prices, while healthcare also detracted.

In terms of style, perhaps unsurprisingly, growth saw a reversal in trend compared to 2022 as the MSCI World Growth Index gained 11.98% given the sectors that outperformed, while the MSCI World Value Index saw a -1.82% return over the quarter. Large-caps outperformed their mid and small-cap counterparts as they often tend to do in periods of economic uncertainty.

| Q1 | 1 years | 3 years | 5 years | |

| Information Technology | 17.81 | -0.66 | 21.80 | 19.80 |

| Communication Services | 14.85 | -11.44 | 8.36 | 7.66 |

| Consumer Discretionary | 13.29 | -7.54 | 17.12 | 10.75 |

| Industrials | 4.16 | 5.53 | 18.00 | 8.79 |

| Materials | 3.17 | -1.79 | 21.60 | 9.97 |

| Consumer Staples | 0.66 | 7.27 | 11.04 | 9.37 |

| Real Estate | -2.05 | -14.74 | 6.42 | 4.60 |

| Utilities | -2.23 | 0.70 | 8.66 | 9.72 |

| Financials | -4.27 | -4.41 | 17.32 | 5.77 |

| Healthcare | -4.27 | 2.56 | 12.77 | 12.93 |

| Energy | -6.04 | 14.94 | 34.98 | 8.78 |

Source: Morningstar, total Returns (GBP) to 31/03/2023.

Bonds

The Bloomberg Global Aggregate Index gained 0.21% in sterling terms in Q1 as the year began with optimism on economic growth with the reopening of China, falling energy prices and indications that inflation may have peaked. However, February saw a rise in yields as markets priced in ‘higher for longer’ interest rates and enthusiasm for economic growth turned to concerns of stickier-than-forecast inflation. The collapse of SVB in March led to rally in government bonds as investors sought to de-risk.

- Benstead on Bonds: best and worst bond sectors since rates began rising

- Bond Watch: what does a bond fund manager actually do all day?

UK 10-year yields fell from 3.71% to 3.49% and the UK 2-year yields saw a drop from 4.07% to 3.44% over the quarter as UK gilts and UK inflation linked bonds returned 2.05% and 4.30% respectively. US government bonds saw a 0.19% gain on the quarter as US 10-year Treasury yields fell from 3.92% to 3.47% with the 2-year falling from 4.82% to 4.03%. In terms of corporate bond returns, UK corporates gained 2.38% and US corporates were up 0.69% for Q1.

Over the quarter, central banks continued their rate hikes as the Federal Reserve announced two 25bps increases, the Bank of England announced hikes of 50 and 25bps respectively, while the European Central Bank announced two 50bps hikes.

| Q1 | 1 year | 3 years | 5 years | |

| UK Inflation Linked | 4.24 | -27.58 | -8.07 | -3.45 |

| Sterling Corporate | 2.37 | -10.27 | -3.06 | -0.80 |

| UK Gilts | 2.05 | -16.27 | -9.12 | -3.06 |

| Global Inflation Linked | 1.64 | -10.31 | -1.35 | 1.50 |

| Global High Yield | 0.78 | 1.84 | 4.74 | 4.23 |

| EURO Corporate | 0.73 | -4.09 | -2.07 | -1.30 |

| Global Corporate | 0.57 | -0.84 | -0.70 | 2.55 |

| Global Government | 0.24 | -2.85 | -4.86 | 0.58 |

| Global Aggregate | 0.21 | -2.10 | -3.34 | 1.18 |

Source: Morningstar, Total Returns (GBP) to 31/03/2023.

Commodities & Alternatives

The S&P GSCI fell 7.52% in the quarter with energy and livestock being the largest detractors. Wholesale energy prices fell, with a mild winter and substantial reserves in Europe being cited as the main reasons for the decline. In sterling terms, industrial metals also saw negative performance (small positive in USD terms), while gold returns were positive as inflationary pressures remained elevated.

| Q1 | 1 year | 3 years | 5 years | |

| Gold | 6.22 | 9.51 | 7.34 | 11.14 |

| Global Infrastructure | 1.12 | 2.81 | 15.71 | 8.58 |

| Cash | 0.98 | 2.50 | 0.91 | 0.82 |

| UK REITs | -1.35 | -31.04 | 0.13 | -2.97 |

| Global Natural Resources | -2.15 | 1.15 | 27.87 | 10.58 |

| Hedge Funds | -4.95 | 15.76 | 18.69 | 10.97 |

| Commodity | -5.11 | -0.34 | 31.64 | 10.85 |

| Brent Crude Oil | -9.67 | -21.28 | 52.13 | 5.19 |

| CBOE Market Volatility (VIX) | -16.05 | -3.15 | -29.53 | 1.22 |

Source: Morningstar, Total Returns (GBP) to 31/03/2023.

Most-traded shares on the ii platform in Q1 2023

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks