Nvidia is among these four stocks I still rate a buy

A couple of stocks powering the tech revolution remain among analyst Rodney Hobson’s favourites. He also gives an update on Nvidia and one of the world’s most famous companies.

27th August 2025 07:34

American energy companies have seen only modest rises in their share prices as all the focus has been on tech outfits and the spread of artificial intelligence. Yet the surge in AI and cloud computing will demand enormous amounts of electricity, so energy will be high on the agenda for years to come.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

One cannot overestimate this phenomenon. Technology is so important to the United States economy that even President Donald Trump dare not create too much disruption. He has already fallen out with erstwhile supporter Elon Musk and must keep the other megatechnophiles onside. Trump has even had to swallow his anti-China rhetoric to keep supplies of chips moving in both directions.

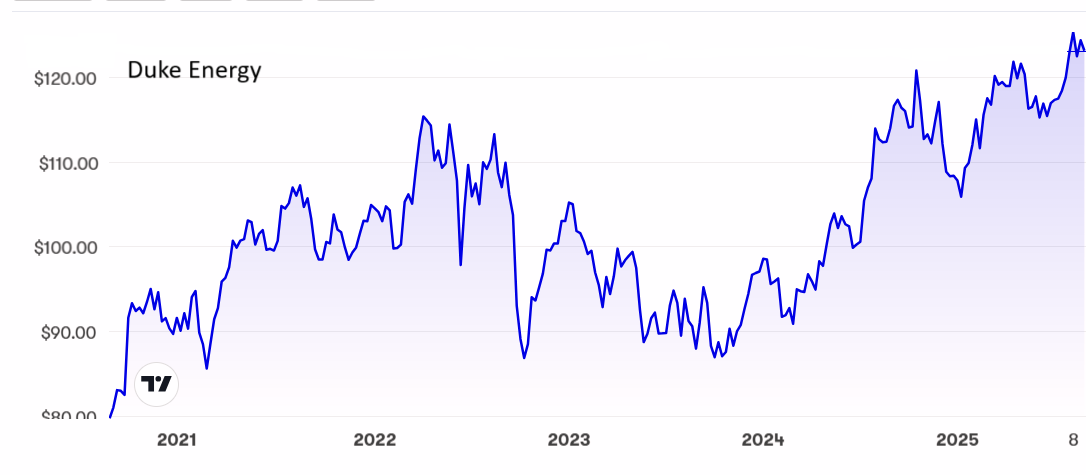

Duke Energy Corp (NYSE:DUK) stands out as one of the largest and most successful electricity companies in the US with more than 8 million customers in six states, with natural gas supplies as a bonus. It is far from overvalued at a price/earnings (PE) ratio of around 20 and a yield at 3.4%.

The shares currently stand at $123, having touched $126 earlier this month. The upward trend over the past two years is set to resume.

Source: interactive investor. Past performance is not a guide to future performance.

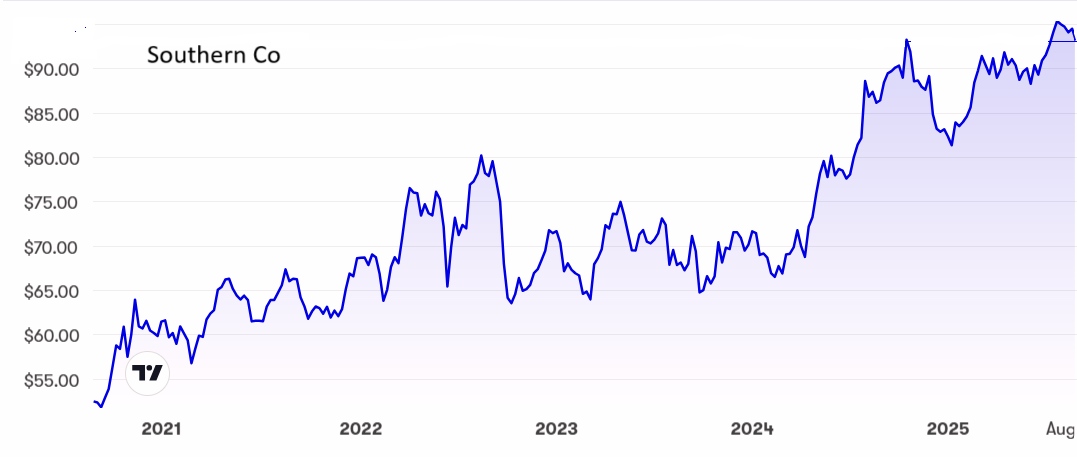

A decent alternative is Southern Co (NYSE:SO), which has 9 million electricity customers across three states and natural gas distribution utilities in four states. The share price has not been as consistent in its rises as with Duke and it has slipped somewhat from its recent $96 peak to around $93.

The PE is not quite so appealing at 24.4 and the yield is a little lower at 3.1%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have long been a fan of Duke Energy as a solid component of any long-term portfolio. Investors have enjoyed modest share price rises since I first suggested buying at $87 just over six years ago, with a steady dividend on top. The shares are still a buy, certainly up to the all-time high of $126 which is just sitting there waiting to be broken.

I first tipped Southern at $54, also in 2019, and stuck to that rating as recently as May when the stock traded just under $90. While I prefer Duke of the two, Southern remains a buy.

Updates: Half-year results for AI chipmaker NVIDIA Corp (NASDAQ:NVDA) are due out today. All investors, even those light on tech stocks, should study the figures carefully. The stock, which constitutes 6.5% of the S&P 500 index, has become the bellwether for the entire tech sector and an indicator for how the AI revolution is progressing.

Analysts have high hopes for Nvidia, but the company has developed a knack for beating even the customary optimistic forecasts. In the previous quarter, revenue tripled year-on-year to more than $26 billion, with data centre sales surging 400%. More growth should be registered in the latest results.

- Watch our video: Polar Capital Technology: best and worst AI stocks

- How Nvidia can convince investors to keep buying stock

The shares have soared from $95 in April to $182 now but they are still only $30 up from the previous peak, being held back by trade wars between the United States and China. Despite all the political bluster, it is in the interests of both countries to reach some kind of accommodation. AI is not only here to stay, it is here to grow exponentially with Nvidia leading the way. The shares remain a buy for the long term.

I pointed out two weeks ago that good figures from The Walt Disney Co (NYSE:DIS) had been greeted with an inexplicable fall in the share price to $113. The stock has picked up a little since then to $117 but there is surely more upside to come for a company with a wide geographic spread and a good range of activities. Leisure is increasingly important to the many who are not, despite newspaper headlines, feeling the pinch. It is not too late to consider a purchase, especially if the shares slip again.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks