Stock pickers strike back as value investing returns

Do value stocks in the UK, Europe and Asia offer better returns over the long term than growth shares in America? Analyst John Ficenec discusses the merits of value investing right now.

28th August 2025 13:36

Stock pickers who follow value investing principles are beating the market this year as volatility returns and higher interest rates put pressure on debt-laden companies. And despite expectations that rates in the US and the UK will fall in the coming months, hopes of a growth rally look overdone and there is every reason why value and stock picking will continue to shine.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Value back in fashion

This year has shown the strongest signs yet of a long-awaited return of value investing. Value-focused funds have almost doubled the returns on the wider market this year, and stock pickers who follow the same principles have enjoyed equally strong returns.

The iShares Edge MSCI World Value Factor ETF $Acc GBP (LSE:IWFV), which looks for undervalued companies around the world, has jumped 24% so far this year, and the iShares Edge MSCI USA Value Factor ETF $ Acc (LSE:IUVL), which does the same for American companies, has risen 12%, outpacing the US tech index the Nasdaq, which is up 9%, and the wider S&P 500, up 8% so far in 2025.

Source: TradingView. Past performance is not a guide to future performance.

Funds run by investors who follow similar value principles have also done well. Sir Chris Hohn’s hedge fund, The Children’s Investment Fund (TCI), has reported gains of 21% to the end of July, a strong comeback having spent the past three years struggling to beat the index.

Debt bites

The reason value is back in fashion has to do with higher interest rates and political instability from tariff policy, which have all given rise to market volatility and risk aversion. When the future is uncertain investors are less willing to hand over their cash on the promise of future returns. Under these market conditions investors want companies with strong balance sheets and regular dividend income now, rather than debt and the promise of growth.

This is a marked change from the status quo after the 2008 financial crisis when rates were cut to the floor and a huge money printing programme lifted all boats. This wave of monetary stimulus crushed all before it, and the most profitable strategy in the face of such action was to follow the momentum and “buy the dip” any time that share prices corrected even slightly.

- Watch our video: shares I’m backing to play the UK value revival

- Watch our video: value veteran on banks, defence, and an undervalued sector

Growth stocks soared as the borrowing needed to fuel growth cost almost nothing, and any companies in financial trouble were encouraged to “pretend and extend” by lenders who didn’t want to recognise losses. The fundamentals of stock valuation didn’t matter as the wall of money looked for a home.

This put pressure on the true value investor who was becoming an endangered species. Value fund managers were left in the wake of growth, and any underperformance from the index would be severely punished as a proliferation of exchange-traded funds (ETFs) offered easy access to follow the momentum crowd. Fund managers who pursued value or contrarian strategies, such as Hugh Hendry who famously made strong returns during the 2008 crisis, shuttered his fund by 2017 and went surfing and skateboarding in the Caribbean.

What next, value or growth?

The latest statements from Jerome Powell, chair of the Federal Reserve, at the Jackson Hole economic conference, took a more doveish tone and hinted that rates would be cut if the labour market remained weak. Markets cheered and the probability of a rate cut soared, with expectations of up to 100 basis points, or 1%, of cuts within the next 12 months. However, his ability to cut rates is hamstrung by persistently high inflation and a resilient US economy that doesn’t warrant drastic action.

The other element is how far rates would fall. The US rate is currently in the range 4.25 to 4.5%, and a 1% cut would take that down to 3.25 to 3.5%, which is still a long way above the 0.1% level of rates between 2008 and 2016, and the 0.05% rates were cut to in 2020 to 2022. So, the level of support for debt that fuelled the boom in growth between 2010 and 2020 would not be the same.

Value over growth

Given that rates don’t have as much room to fall, and the money supply is still lower than it was at the end of 2023, according to the latest figures from the St. Louis Federal Reserve tracking of US Monetary Base, then it seems there isn’t the explicit support present for a strong growth rally that we saw post 2008 and 2020.

Investor caution is also worth considering as an indicator of risk appetite. Using the gold price as a rough proxy for investors looking for security, it has remained elevated at around $3,373 an ounce, just off from the all-time high of $3,500 an ounce in April 2025 during the tariff turmoil.

Against this backdrop, even if rates fall in the US next month and in the UK again later this year, it looks like value would be the beneficiary rather than another strong growth rally.

What is the meaning of value?

This isn’t a philosophical question; value investing is all about looking at the fundamentals of a company, its earnings, share price and balance sheet to try and identify opportunities.

Two of the key metrics to start with are the price/earnings (PE) ratio and the price-to-book (PB) ratio. The PE is calculated by dividing the share price by the earnings per share (EPS). A high PE indicates a potentially overvalued, or high growth company, whereas a low PE can suggest an undervalued or low growth company.

- The great investment strategies: value investing

- How to invest like the best: Benjamin Graham

- How to invest like the best: Warren Buffett

The PB ratio is reached by dividing the share price by the net assets per share on the balance sheet. A high PB ratio indicates either high growth or overvalued, whereas a lower PB ratio can suggest an undervalued share. The PB ratio also gives you an idea of the level of safety in the share price, as the closer it is to 1 means that in theory if the business closed tomorrow and all the assets were sold they’d equal the share price.

One of the most famous exponents of the art has been Warren Buffett who has followed the principles of value investing with his Berkshire Hathaway Inc Class B (NYSE:BRK.B) fund. He himself was taught by the godfather of value investing Benjamin Graham at Columbia University.

Is anything good value?

With US and UK markets at all-time highs, it’s worth asking the question if you should even be investing at the top; surely the only way is down? But Henry Allen, macro strategist at Deutsche Bank, thinks there are reasons to be optimistic: “It’s understandable why many are saying that markets are ‘priced for perfection’, given the strength across risk assets with further cuts already priced in. But the reality is we’ve heard a similar narrative at several points in this cycle, even as markets have continued to post further gains.”

- Should you invest when markets are at all-time highs?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Mr Allen outlines how two important drivers could give markets the impetus they need in the second half of the year. The US economy could surprise investors again with its resilience after a wobble following the latest US jobs report for July. The second is if inflation fears begin to ease, it would clear the way for more interest rate cuts. So, while it is right to be cautious, there is also every reason to look for returns in good value sectors and regions.

History is on the side of value. While growth may have held sway from 2010 to 2020, over the long term value investing has been the most profitable strategy. Growth has only delivered during exceptional market conditions with near-zero interest rates and huge monetary stimulus. A return to historical norms of rates, inflation and money supply should see value win out.

Where in the world is value?

The regions of the world economy that look attractive right now are Europe, the UK and Asia. Purely on a valuation basis the UK FTSE 100 forward PE ratio is currently around 12 times, below its long-term average of 15, while in Europe the EuroStoxx 600 index of blue-chip continental companies is at around 14 times and below its long-term average of 17. Meanwhile, in the US the S&P 500 is trading at 22 times and above its long-term average of 17 times.

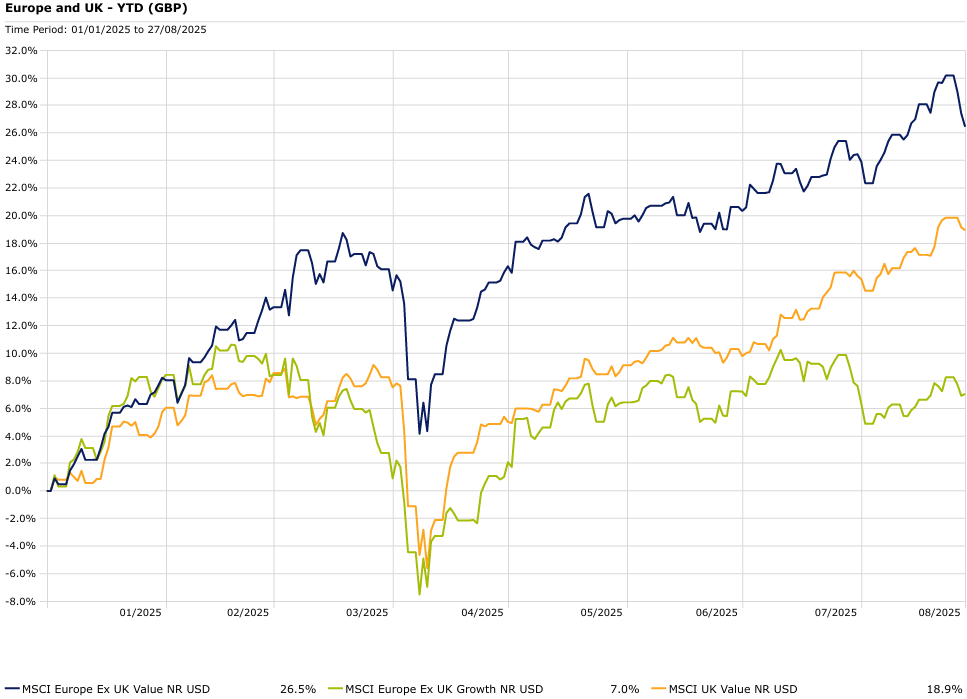

The index performance so far this year also shows how value principles have benefited. The MSCI Europe Ex UK Value index is up 24%, well ahead of its growth partner up 6%, while not far behind is the MSCI UK Value up 15%, ahead again of its growth version up 12%.

Source: Morningstar. Past performance is not a guide to future performance.

Long-term value ideas

While I’m not advocating dumping US and tech stocks, it looks sensible that when funds become available then allocation towards value in UK, Europe and Asia could potentially offer better returns over the long term than growth shares in America.

There are a few different ways to access this theme. There are ETFs that focus on large and mid-cap companies which look undervalued based on measures such as PE and PB.

Options include iShares Edge MSCI World Value Factor ETF $Acc (LSE:IWVL), which is weighted 37% US, 23% Japan, 10% UK and 20% Europe, or something more Europe-focused such as the iShares Edge MSCI Europe Value Factor ETF €Acc (LSE:IEVL), weighted 25% UK, 22% Germany, 20% France, 6% in both Spain and Italy, and the balance the rest of Europe.

Or there’s the emerging markets option, iShares Edge MSCI Emerging Market Value Factor ETF USD Acc (LSE:EMVL) weighted 35% China, 15% in both Taiwan and Korea, 12% India and 9% Brazil.

In terms of individual names, in the UK its companies such as tobacco giants British American Tobacco (LSE:BATS), and Imperial Brands (LSE:IMB), banks such as HSBC Holdings (LSE:HSBA) and Barclays (LSE:BARC), oil majors Shell (LSE:SHEL) and BP (LSE:BP.), and healthcare groups GSK (LSE:GSK) and Smith & Nephew (LSE:SN.), and utilities like Centrica (LSE:CNA), SSE (LSE:SSE) and National Grid (LSE:NG.). Others also on low ratings include BT Group (LSE:BT.A), Vodafone Group (LSE:VOD) and miner Rio Tinto Ordinary Shares (LSE:RIO.

- Watch our video: two value buys – and why banks are still a bargain

- Fund Spotlight: a way to play value being back in vogue

Looking to the Continent, it’s similar themes such as utilities such as Engie SA (EURONEXT:ENGI), Enel SpA (MTA:ENEL) and RWE AG Class A (XETRA:RWE), chemicals and materials giants like Basf SE (XETRA:BAS), ArcelorMittal SA New Reg.Shs ex-Arcelor (EURONEXT:MT), Heidelberg Materials AG (XETRA:HEI) and Holcim Ltd (SIX:HOLN), tech groups Nokia Oyj (EURONEXT:NOKIA) and Telefonaktiebolaget L M Ericsson Class B (OMX:ERIC B).

Thera are also industrials such as Siemens AG (XETRA:SIE), Vinci SA (EURONEXT:DG), Compagnie de Saint-Gobain SA (EURONEXT:SGO) and Deutsche Post AG (XETRA:DHL), healthcare giants Novartis AG Registered Shares (SIX:NOVN), Sanofi SA (EURONEXT:SAN), Bayer AG (XETRA:BAYN) and Merck KGaA (XETRA:MRK), financials like Banco Santander SA (LSE:BNC), BNP Paribas Act. Cat.A (EURONEXT:BNP) and Deutsche Bank AG (XETRA:DBK), oil majors Eni SpA (MTA:ENI), TotalEnergies SE (EURONEXT:TTE) and Repsol SA (XMAD:REP), and auto giants Bayerische Motoren Werke AG (XETRA:BMW) and Volkswagen AG Vorz-Inhaber-Akt ohne Stimmrecht (XETRA:VOW3).

If we have a situation where inflation is persistent and rates fall slower than expected, combined with some surprises on the resilience of the US or UK economy, then value looks like a decent home to allocate some funds in a balanced portfolio. A more cynical view could be that governments need, or even want, to maintain persistent inflation to deal with the record debt burdens. If that is the case, then value will deliver for investors.

John Ficenec is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks