Nvidia shares big news at Vegas but something’s missing

The AI chip favourite was the early highlight of this year’s consumer technology expo in the gambling mecca. Graeme Evans reveals how the CEO’s keynote speech went down.

8th January 2025 15:45

Nvidia struggled to meet the lofty expectations of investors this week after Wall Street’s second-largest company unveiled a broader range of chips and tools to accelerate artificial intelligence (AI) adoption.

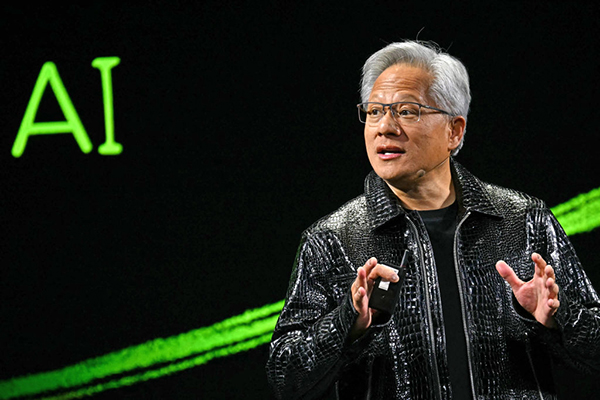

Founder and chief executive Jensen Huang, pictured above, used a 90-minute keynote address at the annual CES conference in Las Vegas to showcase new products in areas including gaming, autonomous vehicles and robotics.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

He told the 6,000 strong audience that AI has been “advancing at an incredible pace”.

Huang said: “It started with perception AI — understanding images, words, and sounds. Then generative AI — creating text, images and sound. Now, we’re entering the era of “physical AI, AI that can proceed, reason, plan and act”.

But the absence of any new information on data centers and the company’s new and more powerful Blackwell platform cooled some of Wall Street’s excitement heading into the event.

The speech took place after Monday’s closing bell, when a rise of 3.4% left NVIDIA Corp (NASDAQ:NVDA) at another all-time high market capitalisation of $3.66 trillion. The shares slumped 6% on Tuesday as the second-worst performer in the S&P 500 index before a steady start to today’s session.

Morgan Stanley said: “What ultimately makes or breaks the investment thesis at this stage is still the trajectory of the datacenter business, where management is clearly still excited about the Blackwell ramp but nothing we have not heard coming into the event.”

The shares rose by 170% in 2024 as investors looked for fresh growth momentum due to the Blackwell platform, which unlocks generative AI for the likes of Microsoft Corp (NASDAQ:MSFT), Meta Platforms Inc Class A (NASDAQ:META) and other firms building AI data centres.

Chief executive Jensen Huang told CNBC recently that demand had been “insane”.

There was no repeat of this language in Vegas, although the company did say that Blackwell is in full production, with systems up and running at every major cloud provider.

The new architecture features six technologies for accelerated computing in data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing and generative AI — all emerging industry opportunities for Nvidia.

- US stock market outlook 2025: sectors to own and avoid

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Morgan Stanley has an Overweight recommendation on the stock, with $166 price target.

Huang used his keynote address to introduce the Cosmos platform, describing it as a game-changer for robotics and industrial AI.

He also announced the DRIVE Hyperion AV platform, which is designed for delivering advanced functional safety and autonomous driving capabilities.

“The autonomous vehicle revolution is here,” Huang said. “Building autonomous vehicles, like all robots, requires three computers: Nvidia DGX to train AI models, Omniverse to test drive and generate synthetic data, and DRIVE AGX, a supercomputer in the car.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks