A passage out of this India fund

Saltydog Investor explains why its stance has changed towards an investment that has generated exciting returns.

4th November 2024 14:10

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As part of our weekly analysis, we study the performance of stock markets all around the world. We regularly monitor a dozen indices, which gives us a good sense of the current market trends.

Most are showing year-to-date gains, but last month was disappointing. Only one, the Japanese Nikkei 225, ended the month higher than it was when it started. The worst-performing index was the Indian Sensex, which fell by 5.8% in October.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

| Stock Market Indices | 2024 | |||||

| Index | Q1 | Q2 | July | August | September | October |

| FTSE 100 | 2.8% | 2.7% | 2.5% | 0.1% | -1.7% | -1.5% |

| FTSE 250 | 1.0% | 2.0% | 6.5% | -2.4% | -0.2% | -3.2% |

| Dow Jones Ind Ave | 5.6% | -1.7% | 4.4% | 1.8% | 1.8% | -1.3% |

| S&P 500 | 10.2% | 3.9% | 1.1% | 2.3% | 2.0% | -1.0% |

| NASDAQ | 9.1% | 8.3% | -0.8% | 0.6% | 2.7% | -0.5% |

| DAX | 10.4% | -1.4% | 1.5% | 2.2% | 2.2% | -1.3% |

| CAC40 | 8.8% | -8.9% | 0.7% | 1.3% | 0.1% | -3.7% |

| Nikkei 225 | 20.6% | -1.9% | -1.2% | -1.2% | -1.9% | 3.1% |

| Hang Seng | -3.0% | 7.1% | -2.1% | 3.7% | 17.5% | -3.9% |

| Shanghai Composite | 2.2% | -2.4% | -1.0% | -3.3% | 17.4% | -1.7% |

| Sensex | 2.0% | 7.3% | 3.4% | 0.8% | 2.3% | -5.8% |

| Ibovespa | -4.5% | -3.3% | 3.0% | 6.5% | -3.1% | -1.6% |

Data source: Morningstar. Past performance is not a guide to future performance.

I have written about India’s investment landscape on several occasions, highlighting its wealth of natural resources, youthful demographic, and rapidly growing middle class. These factors contribute to a robust domestic market, complementing its export-driven revenue. Most forecasts indicate that its economy will continue to grow robustly in the near term, with projections for the current fiscal year falling between 6.8% and 7.0%.

Since 2014, Prime Minister Narendra Modi and the Indian government have introduced several initiatives aimed at fostering economic growth, including the National Infrastructure Pipeline, the Make in India campaign, and the Startup India initiative. These policies appear to be having a positive effect.

Earlier this year, there was a general election in India and more than 600 million citizens cast their votes. The incumbent Prime Minister Narendra Modi's party, the Bharatiya Janata Party (BJP), was expected to win with a clear majority, but that was not the case. Although they secured the most seats, they failed to gain a majority. The National Democratic Alliance, a coalition led by the BJP, maintained its control over the Indian parliament, but the prime minister’s position is not as strong as it was.

- Fund Battle: are there alternatives to Jupiter India?

- Are Indian stocks still worth buying?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Immediately after the election, the Indian stock market fell sharply but soon recovered. However, in the past few weeks, it has started to fall again.

As is often the case, it is hard to pinpoint the exact reason why, and there are probably several contributing factors. At the beginning of last month, we saw geopolitical tensions rising in the Middle East with fears that the current conflicts could escalate into a full-blown war between Israel and Iran. This weighed heavily on global stock markets. India was particularly affected due to its strong economic ties with the Middle East, which is an important trade partner and a significant export market. India is also one of the world's largest oil importers, sourcing about 85% of its crude oil needs from abroad, with a significant portion coming from the Middle East.

You may also recall that at the end of September, the Chinese central bank announced an enormous stimulus package, the largest since the Covid-19 pandemic. Stock markets reacted instantly, with the Shanghai Composite and Hong Kong Hang Seng posting gains of over 17% in September. It seems likely that this would have shifted fund flows away from other emerging markets, like India, in favour of China.

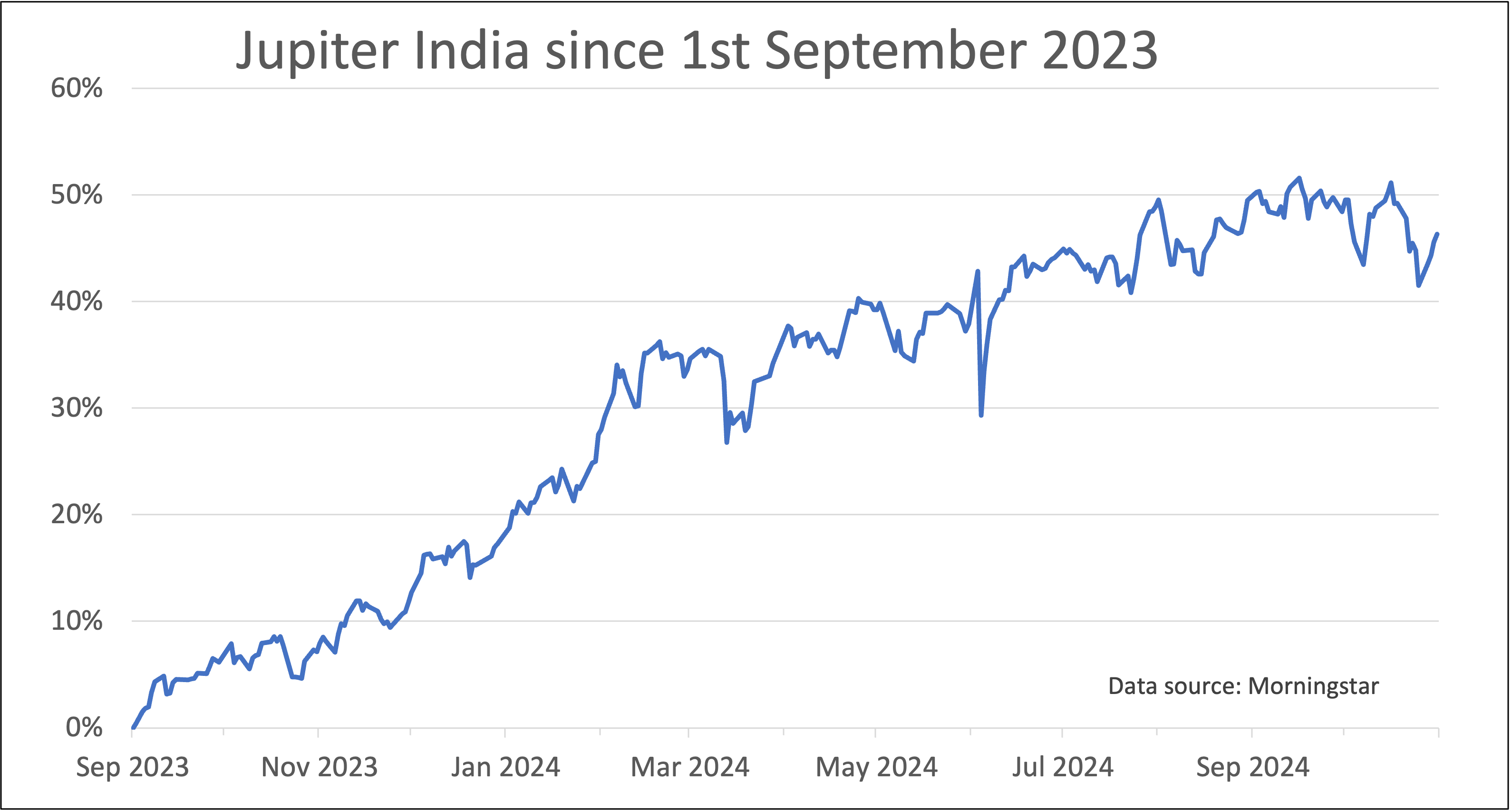

For the past year, both our demonstration portfolios have held the Jupiter India fund. Our Ocean Liner portfolio invested at the end of August 2023, and the Tugboat portfolio followed a couple of weeks later.

Since then, it has gone up by more than 40%.

Past performance is not a guide to future performance.

However, over the past few months its performance has levelled off, and we saw quite a significant fall a couple of weeks ago. It has recovered from drops like this in the past, but after such a strong run it may need time to consolidate its position before moving on.

Last week, we decided to sell up and take profits. With the ongoing war in Ukraine, the fighting in the Middle East, and the imminent election in the US, now might be a good time to have a little less exposure to the equity markets. This fund may well recover over the next few weeks, in which case we can always go back in again. Until then, we would rather be safe than sorry.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks