The reasons why gold funds are flying

Saltydog Investor runs the performance numbers for October, which reveal that gold funds shone once again.

11th November 2024 14:30

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Each month, we look back to see which were the best-performing funds and what sectors they were from.

In August, the top ten funds came from six different sectors. There were two funds from the Specialist sector, three Japanese funds, two Financial & Financial Innovation funds, one Property fund, one Global Emerging Markets fund, and one Healthcare fund. The leading fund was WS Ruffer Gold, with a one-month gain of 5.1%.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Then, in September, we saw the Chinese funds sweep the board with the top-performing fund, Matthews China Fund, posting a one-month return of just over 30%.

However, last month we saw the WS Ruffer Gold fund return to the top spot, up 7.9%, followed closely by Jupiter Global Financial Innovation and BlackRock Gold and General.

In our top ten, there were three funds from the Specialist sector, two from Financials & Financial Innovation, three from Technology & Technology Innovation, one from North America, and one from Commodities & Natural Resources.

Saltydog's top 10 funds in October 2024

| Fund Name | Investment Association Sector | Monthly Return |

| WS Ruffer Gold | Specialist | 7.9 |

| Jupiter Global Financial Innovation | Financials and Financial Innovation | 7.9 |

| BlackRock Gold and General | Specialist | 7.9 |

| Janus Henderson Global Financials | Financials and Financial Innovation | 7.7 |

| Ninety One Global Gold | Specialist | 6.8 |

| Jupiter Merian North Ameican Equity | North America | 6.5 |

| Liontrust Global Technology | Technology and Technology Innovation | 6.3 |

| BGF World Energy | Commodities and Natural Resources | 6.1 |

| Janus Henderson Global Tech Leaders | Technology and Technology Innovation | 6.1 |

| AXA Framlington Global Tech Fund | Technology and Technology Innovation | 5.9 |

Source: Morningstar.

Every three months we also update our ‘6 x 6 Report’. This is where we trawl through all the funds in search of the ones that have consistently delivered strong returns over the last three years. We are hoping to find funds that have gone up by at least 5% in each of the last six six-month periods. It is a challenging target, but sometimes we do find one or two.

In our latest analysis, we have not uncovered any funds that have achieved the elusive ‘six out of six’.

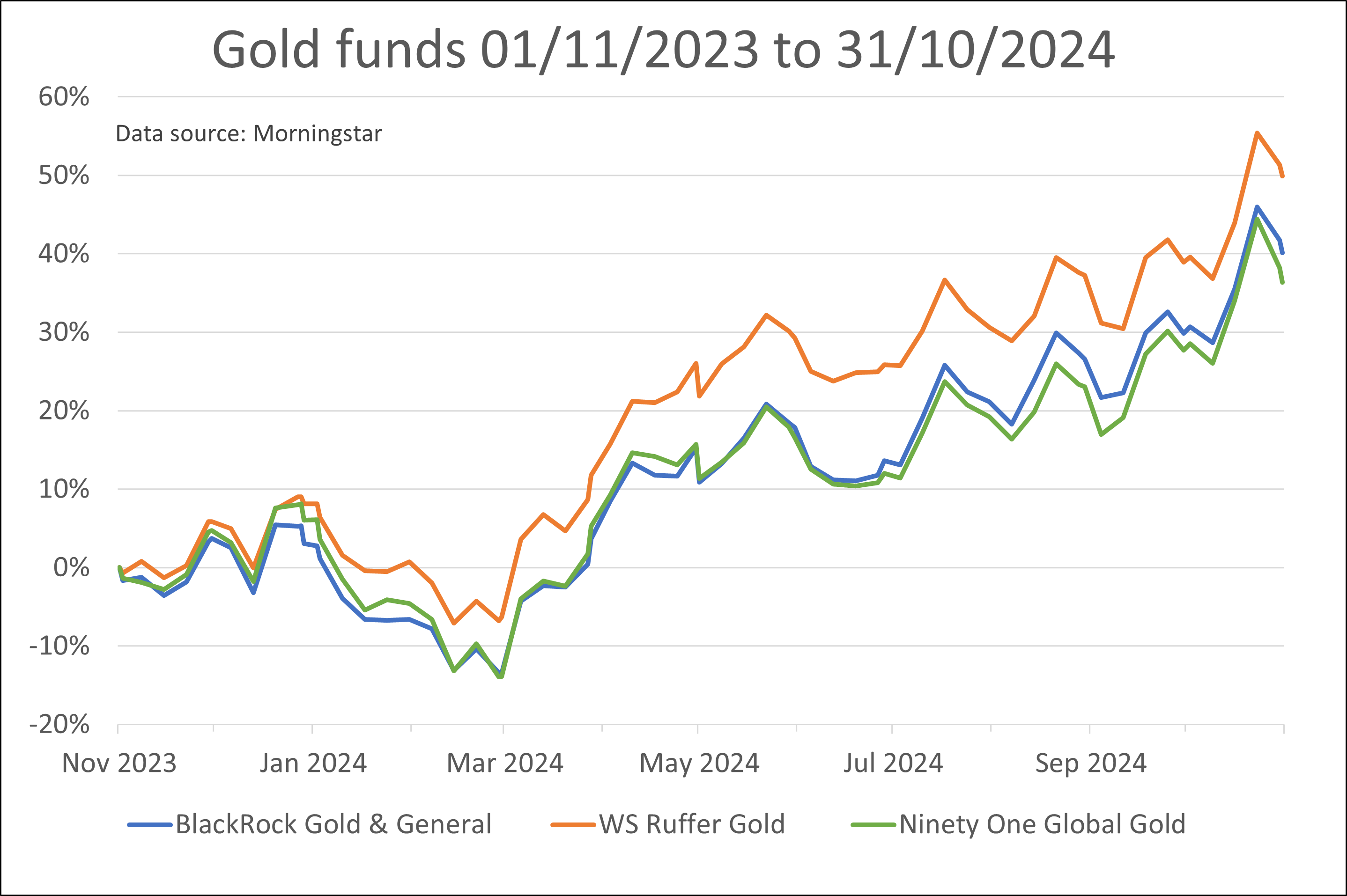

There are then nearly 40 funds that have beaten the target on four occasions. Out of these, the leading three funds, ranked by their most recent six-month performance, are BlackRock Gold & General, WS Ruffer Gold and Ninety One Global Gold.

Here is a graph showing their performance over the last 12 months.

Gold is usually considered a safe investment due to its long-term reputation as a store of value, but it can be volatile in the short term. It is also important to understand that these funds do not just hold physical gold, they invest in the companies that mine and process gold and other precious metals. However, their overall performance does tend to be closely correlated to the price of gold.

The price of gold often rises in times of political instability. Therefore, the war in Ukraine, and the tensions in the Middle East, could be part of the reason why it has gone up in recent years. This year we have already seen the gold price increase from less than $2,100 per oz to over $2,700, although it did drop a little last week.

Central banks, especially China, have also been adding to their gold reserves. By increasing the amount of gold, and reducing the value of US Treasuries that they hold, they lower their dependency on the US dollar.

We have also seen interest rates around the world starting to fall. As interest rates go down, the opportunity cost of holding non-yielding assets like gold decreases. This means investors give up less potential interest income by choosing gold over interest-bearing assets like bonds. In low interest rate environments, there are often concerns about future inflation. Gold is traditionally seen as a hedge against inflation, making it all the more appealing,

If demand for gold remains strong, it should benefit the companies mining and processing it, which will, in turn, be reflected in the performance of the funds investing in them.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks