Stockwatch: is takeover target a buy?

Amid a spate of UK shares attracting bids, analyst Edmond Jackson assesses a mid-cap firm with an impressive profile.

13th June 2025 11:30

The situation at mid-cap Spectris (LSE:SXS) merits attention even if the shares in the scientific instruments maker were off your radar before a current possible offer – at a near 90% premium to where they traded only a month ago.

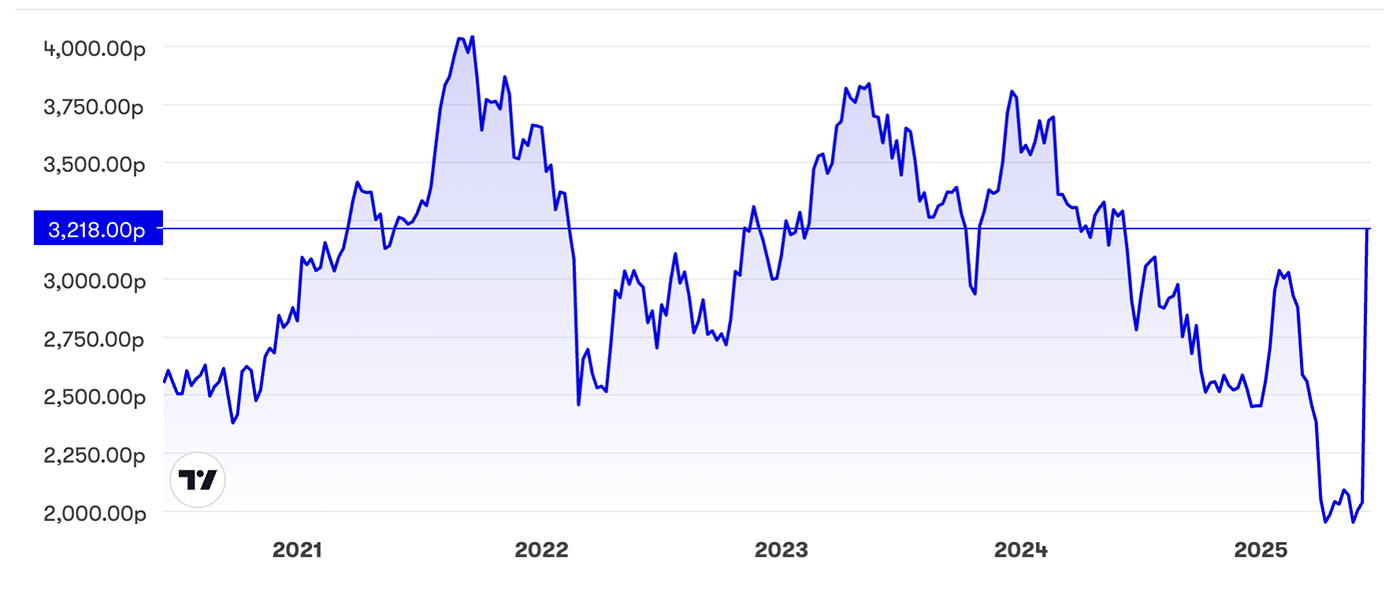

Around 3,200p, the market price is at a 15% discount to the fully cash-based offer that is mooted, including an interim dividend. It did jump initially near 3,500p on the 9 June news but settled back, finding support around 3,200p.

I suspect shareholders are weary here, partly after management touted a better 2024, only for that first-half year to disappoint.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Source: TradingView. Past performance is not a guide to future performance.

This company has an impressive profile by way of narrative and a global reach with its products, which enjoy high barriers to entry; although the financial story has been broadly static profit for more than a decade.

Management says it has bolstered prospects with three intelligent acquisitions last year. If the markets served continue to improve like they did earlier this year, the urgency of private equity investor Advent International to gain control is understandable.

More cautiously, Spectris qualifies for a short-selling financial screen considering the James Montier C-Score (a tool that highlights companies that have an increased risk of earnings manipulation). Two global investment managers have recently featured over the 0.5% disclosure threshold: JP Morgan Asset Management closing out this trade promptly after the approach was declared; albeit AQR Capital Management still short 0.5% of the issued share capital.

So, do the shares rate a “buy” given that an offer does appear probable and the Spectris board is minded to unanimously recommend terms? Or was the market justified in selling off Spectris to the extent that it did, as implied by the short-selling rationale and actions?

As ‘possible’ offers go, this one looks firmer than most

Advent has past form here. In 2018, and in conjunction with Bain Capital, it eventually backed off from making an offer, due to uncertainties following Brexit. That decision looks astute given that Spectris’ all-round financial performance went nowhere and its shares were volatile-sideways. But intent looks serious from the way Advent has implicitly raised its terms after engaging the board.

The matter is down to due diligence, Advent having until 5pm on 7 July to decide whether to make an offer. It may be that acquisitions are bolstering accounts but the underlying businesses are weaker. It seems possible, but I think Advent should have an overall grasp whether they offer long-term advantage. Uncertainties over tariffs are a dilemma given that North America represents 29% of revenue but Advent was aware throughout April and May yet kept raising its offer.

- These UK companies are attractive takeover targets

- Stockwatch: why I’m downgrading my view on this share

The chief risk to capitulation would seem, as sometimes is the case in house sales, that Advent is entertaining a knock-out “offer” to get access for a survey, but which commits it to nothing and could be used to negotiate the price down or give it an excuse to walk away.

But private equity houses are replete with capital and have to make it work.

Reminding us how UK share ratings are prone to takeovers, yesterday came news of global engineering consultants Ricardo (LSE:RCDO) being acquired by a similar Canadian firm at a circa 30% premium.

Even if the accounts have had some massaging, Spectris should not have anything like the underlying problems of oil services company John Wood Group (LSE:WG.), where a Dubai-based suitor backed out of an offer last August after due diligence.

Do the accounts present more financial risk than is apparent?

According to the Montier C-Score, shares with a score over 5x and a price/sales ratio over 2x tend to generate a negative absolute return of 4% annually. Indeed, shares have not done well from 3,775p at end-2023, but the trend has essentially been volatile-sideways since 2018 when Advent previously engaged.

I note below how Spectris complies with a short-selling screen and, yes, acquisitions may have complicated the picture. But there are two counters to a theory of high financial risk.

First, a new chief financial officer joined last September, but in preparation of the 2024 annual accounts had not seen fit to blow the whistle. Second, nor did the auditors make any qualification to the accounts when published last 21 March.

James Montier’s screen says to beware receivables growing faster than sales; declines in depreciation on property, plant and equipment; and high growth in assets, which may distort earnings.

The 2024 balance sheet shows under current assets, trade receivables up 9% to £347 million versus revenue down 10% to £1,299 million or by 7% on a like-for-like basis. A disposal was involved but there were also acquisitions.

Note 9 to the accounts cites a small fall in depreciation from £32.8 million to £31.7 million, if quibbling.

Acquisitions explain a big jump in goodwill and intangibles: up 106% to £1,509 million and help explain 128 million negative net tangible assets. Or, you respect that technology-driven businesses principally do have intangible value relative to the 26% increase in property, plant and equipment to £171 million.

I tend to think that Advent should have picked up if any such concerns were material at the initial screening stage. Unless the real test they seek is by way of due diligence, but implicitly they believe it worthwhile.

While the long-term financial summary shows free cash flow per share often lagging normalised earnings per share (EPS), this is an industry requiring significant R&D, hence capital expenditure.

Moreover, cash generated from operations is more often ahead of EPS, which puts earnings manipulation in doubt.

Spectris has a sound record of annual dividend growth of around 5% which underlines cash generation.

Spectris - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 1,346 | 1,526 | 1,604 | 1,632 | 1,336 | 1,163 | 1,327 | 1,449 | 1,299 |

| Operating margin (%) | 2.9 | 18.5 | 14.5 | 17.7 | -1.4 | 31.5 | 13.0 | 12.1 | 23.7 |

| Operating profit (£m) | 38.3 | 283 | 233 | 289 | -18.9 | 366 | 173 | 176 | 308 |

| Net profit (£m) | 10.3 | 235 | 185 | 234 | -17.0 | 347 | 402 | 145 | 234 |

| Reported earnings/share (p) | 8.6 | 189 | 156 | 202 | -14.6 | 304 | 294 | 106 | 139 |

| Normalised earnings/share (p) | 131 | 119 | 145 | 164 | 142 | 138 | 121 | 126 | 189 |

| Operating cashflow/share (p) | 181 | 159 | 151 | 207 | 195 | 140 | 111 | 187 | 92.2 |

| Capital expenditure/share (p) | 24.0 | 62.1 | 82.2 | 74.6 | 37.1 | 30.9 | 41.5 | 23.7 | 51.1 |

| Free cashflow/share (p) | 157 | 97.2 | 68.7 | 133 | 158 | 109 | 69.3 | 163 | 41.0 |

| Dividend/share (p) | 52.0 | 56.5 | 61.0 | 65.1 | 68.4 | 71.8 | 75.4 | 79.2 | 83.2 |

| Covered by earnings (x) | 0.2 | 3.4 | 2.6 | 3.1 | -0.2 | 4.1 | 1.4 | 1.8 | 2.8 |

| Return on capital (%) | 2.7 | 19.2 | 13.9 | 19.1 | -1.4 | 26.7 | 11.3 | 12.6 | 14.2 |

| Cash (£m) | 83.5 | 138 | 73.1 | 213 | 222 | 168 | 228 | 139 | 106 |

| Net Debt (£m) | 151 | 50.6 | 297 | 27.0 | -65.7 | -102 | -163 | -75.8 | 626 |

| Net assets per share (p) | 896 | 1,010 | 1,067 | 1,123 | 1,049 | 1,138 | 1,375 | 1,294 | 1,397 |

Source: historic company REFS and company accounts.

Discerning risk/reward in the development trend

The 28 February prelims proclaimed three “highly synergistic” acquisitions which, together with a profit improvement programme, “will underpin a significant increase in profit in 2025 and 2026”. That appears a significant motivator for Advent versus Spectris shares falling thereafter.

Management were hopeful that like-for-like order growth of 6% in the final quarter of 2024 could be sustained. A first-quarter update on 30 April, however, cited this moderating to 4% like-for-like, and group sales 2% lower at constant currency.

Against this, £30 million savings are on course for 2025, rising to at least £50 million in 2026. It would seem to need quite a revenue dent to compromise profits recovery. Market consensus implies a 12-month forward price to earnings (P/E) of 19 around the current share price, which, yes, prices in a good extent of expected recovery. Yield support is only 2.75%.

The 30 April update cited being “well prepared to mitigate against the impact” of trade tariffs, which still implies a hit to some extent.

- Share Sleuth: trading resumes with a top-up

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Were Advent to walk away, I doubt the downside would be back to around 2,000p, as the possible offer price has highlighted Spectris’ dramatic undervaluation relative to perceived “worth to a private owner”. Moreover, the shares were static throughout April and May despite many rebounding over 30%.

The converse of 15% upside from the mooted offer price would be a similar extent of fall to around 2,725p. I think this would be a fair expectation.

The market therefore has risk and reward in fair balance at around 3,200p. But you could also reason that the odds of a favourable conclusion are higher than 50%, therefore a modest speculative “buy” stance is justified.

The outcome will be an interesting test of such reasoning and for weighing up takeovers generally.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks