Trump wins – what does it mean for sustainability?

Green stocks wobbled as Donald Trump won the US presidential election. Here’s what a second Trump term could mean for sustainability.

13th November 2024 11:10

Ann Meoni, Nick Gaskell, Nancy Hardie and Andrew Mason from abrdn

What is the issue?

Donald Trump is not known for being progressive on sustainability issues. He has previously promised to withdraw US participation in the Paris climate accord. But in terms of markets, what are the potential implications across sustainability themes from his second term in office?

Climate

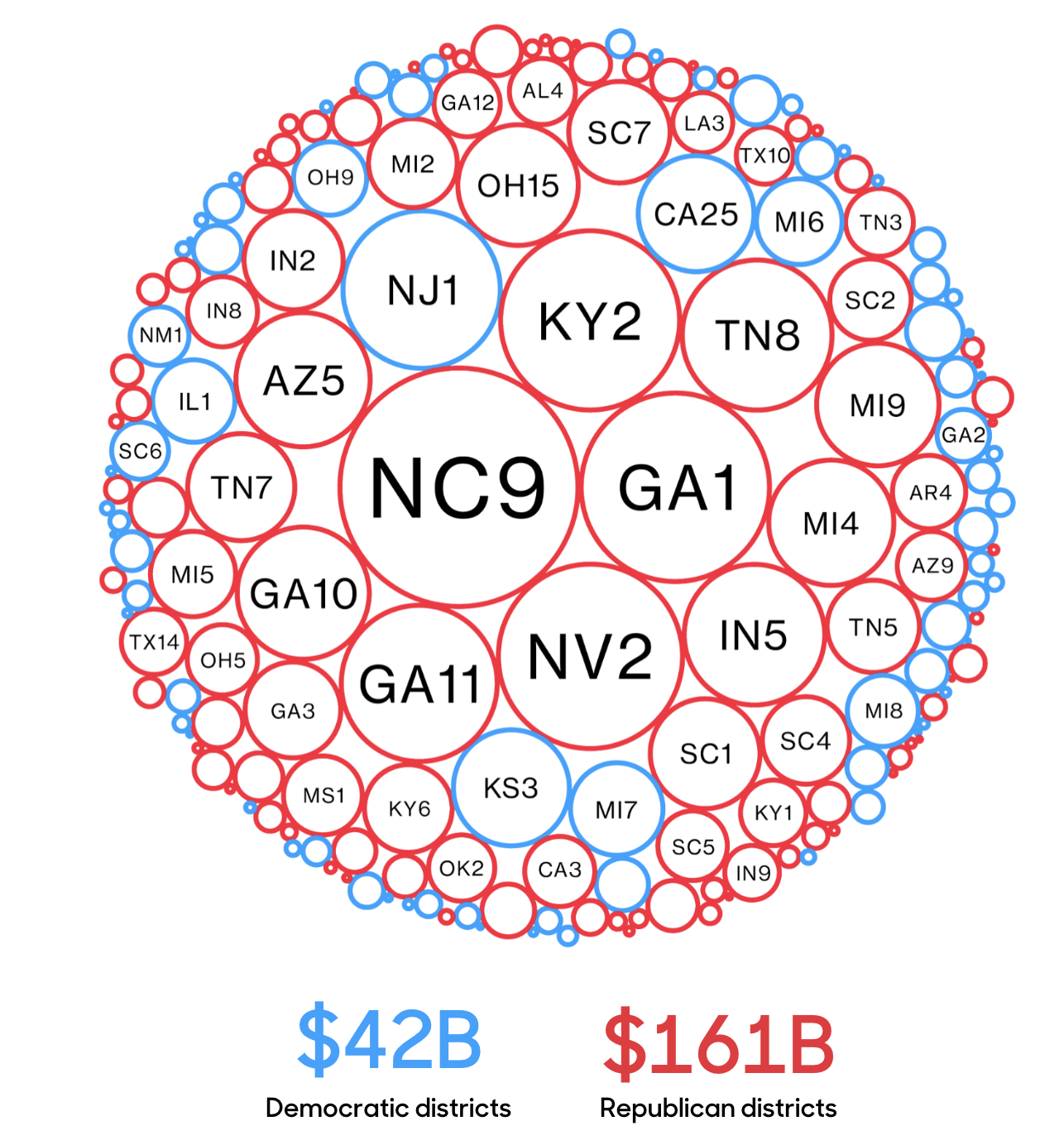

There have been concerns that the Inflation Reduction Act (IRA) will be one of the first things to go. But we don’t expect a full repeal; reforms are most likely. This is partially because the IRA mainly benefited red states (see below). It’s also because Trump is pro-energy and investment, but he’s agnostic on the energy source. He has pledged to increase oil and gas licenses on federal land, which could happen quickly through an executive order. This also increased under Biden, but the rate is likely to accelerate.

Investment in clean tech by voting district* during the Biden Harris Administration as of 10.31.24

Source: Bloomberg Opinion Article, Biden Is Giving Red Districts an Inconvenient Gift: Green Jobs, Published June 20, 2024, accessed 06/04/2024.

*Colour represents the voting of the 2022 House Representatives Elections.

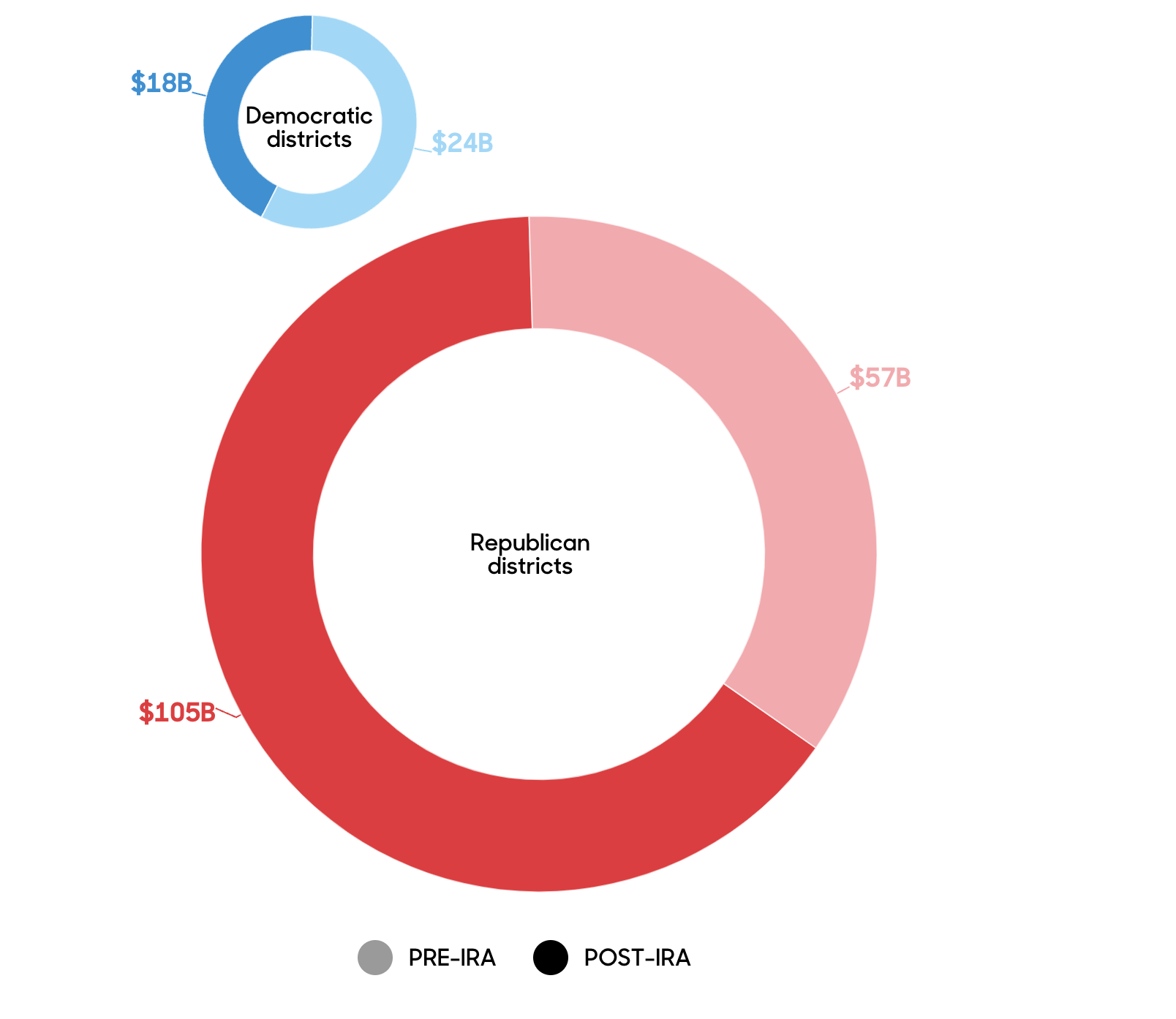

Investment in Republican (red) and Democratic (blue) districts pre and post the Inflation Reduction Act

Source: Bloomberg Opinion Article, Biden Is Giving Red Districts an Inconvenient Gift: Green Jobs, Published June 20, 2024, accessed 06/04/2024.

We expect that the US will withdraw from the Paris climate accord again. This won’t happen at COP29 next week, but it will likely affect the US’s ambition at the talks.

During his campaign, Trump promised to end the "EV (electric vehicles) mandate", even though no such federal mandate exists [1]. We think a rollback of Biden's pro-EV policies, including sections of the IRA that incentivise EV production and adoption, are likely. On the surface, this would be potentially negative for his strong supporter Elon Musk who owns Tesla. Tesla’s scale and scope could be an advantage over other EV producers if subsidies were removed. Tesla’s stock was up almost 15% on Wednesday 6 November.

Reforms to the IRA we think are likely:

|

More likely to stay intact |

Less likely to stay intact |

|---|---|

|

• Domestic-critical, mineral-processing support |

• EV consumer sales credits (who is chosen on the administration will be important here) |

|

• Clean-energy manufacturing tax credit, and renewable-energy production tax credits |

• Environmental Protection Agency’s (EPA) auto greenhouse gas targets |

|

• Nuclear energy tax credits |

• Residential clean-energy efficiency credits (e.g. heat pumps) |

|

• Under a full US IRA repeal scenario, projects under construction are likely to be granted safe harbour to secure tax credits |

• Methane leakage fines |

|

|

• Clean hydrogen production and carbon capture storage tax credits* |

|

|

• Sustainable aviation fuel credits |

*This one is highly complex and could go either way. On one side, continued funding will be highly lobbied by the energy sector. But on the other, Trump is not pro big-government and large tax-payer-funded projects, especially those with low technology readiness. Therefore, we are cautious. However, the funding mechanism that flows through the EPA could become an issue. As the agency’s funding is likely to be cut significantly, this will make the final distribution of the funding slow.

We also expect increased tariffs on imported clean tech (especially EVs), but not at the level Trump has stated.

Nature

The Biden administration strengthened several nature-related regulations, like the Endangered Species Act, and pollution regulations. These should be safe in the short term, as they are unlikely to be an initial focus area. But the likely defunding of the EPA will take the teeth out of the regulations. Alongside the overturning of the Chevron deference (which gave federal agencies powers to interpret laws and decide the best ways to apply them), this will severely weaken the powers of the EPA.

One area that benefited under the last Trump administration was the superfund (the fund set up to help remediate the nation’s worst polluted areas). There are clean-tech names working in remediation that could benefit, such as Tetra Tech, if a similar thing happens in his second term.

Social

This could become challenging for corporations, as they were previously pressured by employees to make statements opposing government stances during Trump’s first administration. Diversity, equity and inclusion are likely to be at risk. Investors looking for greater transparency and action are also likely to face increased scrutiny.

Abortion rights were a key campaign topic, but this was more likely to see change under a Harris administration. Given the Republican win, the dynamics of the Supreme Court, and Trump’s stated view that abortion rights should be decided on at a state level, we don't expect federal changes. Additional states might implement bans that could lead to repercussions for women’s health and wellbeing, and their productivity in the workforce. Interestingly, abortion protections were on the ballots at this election and in many states these passed. Investee companies have faced pressure via resolutions tabled at annual general meetings (AGMs) to refuse employee healthcare benefits to those seeking abortion.

A unified Republican Congress is likely to pass the H.R 2 bill. This would require employers to verify whether employees have the legal right to work in the US. If passed, the bill is likely to reduce the undocumented workforce and the flow of new arrivals into the US. It’s therefore probable that the migrant workforce will be smaller under Trump, resulting in a negative shock to the labour market.

Governance

This year, the Securities and Exchange Commission (SEC) introduced new rules mandating company disclosures on climate-related risks. Under a new Republican SEC chair, we expect these requirements to be removed. The SEC also eased restrictions on resolutions at AGMs, leading to a surge in proposals advocating for environmental, social and governance (ESG) issues – particularly climate and employee rights. This has been met with ‘anti-ESG’ resolutions questioning the allocation of resources to ESG matters and political advocacy, such as women’s health rights. The new rules were not unanimously supported and could be reversed, potentially resulting in a rise of ‘anti-ESG’ resolutions at AGMs. We do not anticipate significant changes to board standards.

Final thoughts

The initial reactions affecting clean-tech stocks are subtle. The trajectory and implications for sustainability and specific stocks will become clearer once the administration’s nominations are announced.

Ann Meoni is senior sustainable investment manager at abrdn.

Nick Gaskell is sustainable investment manager at abrdn.

Nancy Hardie is sustainable investment analyst at abrdn.

Andrew Mason is head of active ownership at abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks