US funds top performance charts in November

Saltydog Investor looks at which funds have been performing well lately, with a certain type of US fund leading the way.

3rd December 2024 10:43

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

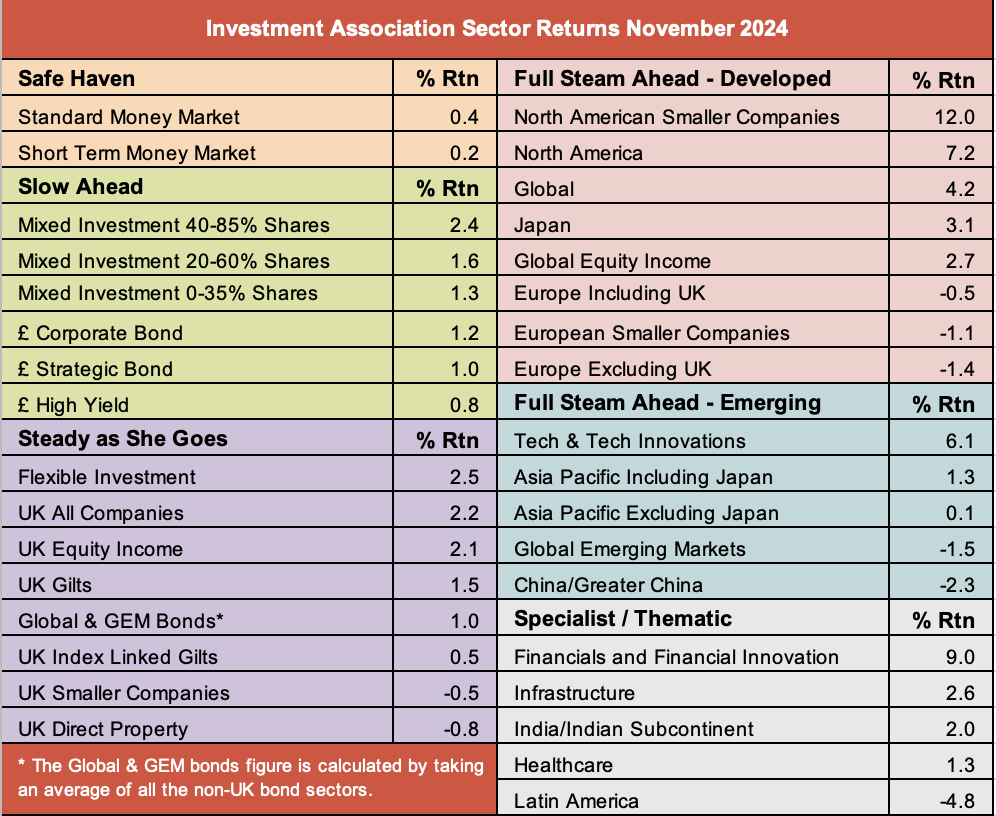

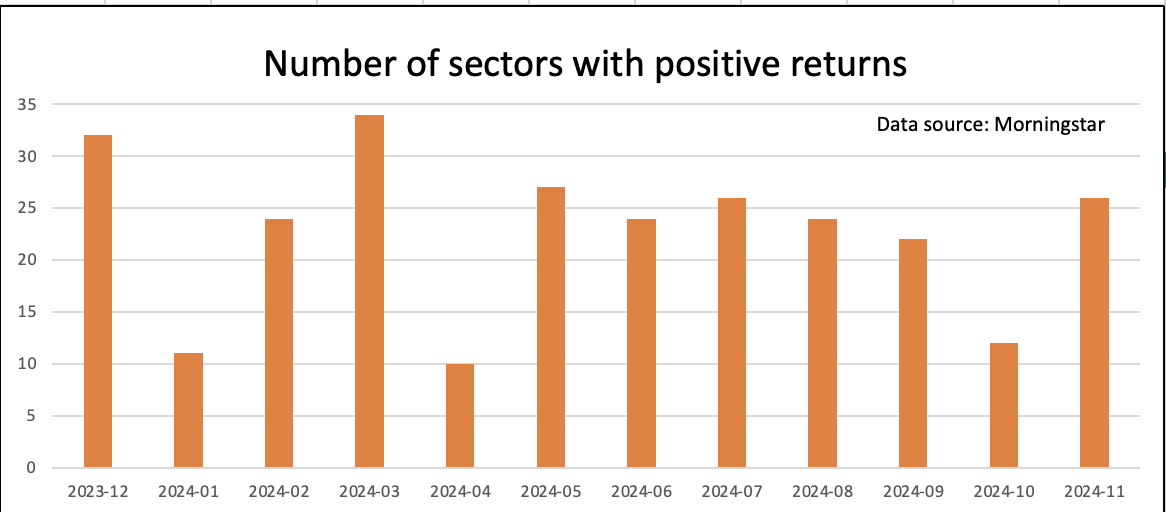

The overall number of sectors making one-month gains fell during the third quarter of 2024.

In July, 26 out of the 34 sectors that we track went up, a pretty good start. However, in August the number dropped to 24, and in September it fell to 22.

- Invest with ii: Accumulation or Income Funds | Top Investment Funds | What is a Managed ISA?

October was even worse, with only 12 sectors ending the month ahead of where they were when it started.

The best-performing sector was Financials & Financial Innovation, up 5.1%, followed by Technology & Technology Innovation, North America, and North American Smaller Companies.

The biggest losses were in the European sectors, but the UK Gilt and UK equity sectors did not do much better.

Last month, we saw a significant improvement, with 26 sectors posting positive one-month returns.

Data source: Morningstar. Past performance is not a guide to future performance.

The North American Smaller Companies sector led the way with a 12.0% gain. Then it was the Financials & Financial Innovation sector, up 9.0%, followed by Technology & Technology Innovation, and then North America.

The top four sectors in November were the same ones as in October, but in a slightly different order.

It is nice to see that the UK All Companies and UK Equity Income sectors have improved since October. Unfortunately, the UK Smaller Companies and the European sectors made further losses.

Data source: Morningstar. Past performance is not a guide to future performance.

When the US and Technology sectors are at the top of our tables, the Baillie Gifford American fund normally performs well. It was the top fund in November, with a one-month return of nearly 15%.

Saltydog’s top 10 funds in November 2024

| Fund name | Investment Association sector | Monthly return |

| Baillie Gifford American | North America | 14.9 |

| Schroder US Smaller Companies | North American Smaller Companies | 13.1 |

| CT US Smaller Companies | North American Smaller Companies | 12.6 |

| FTF Royce US Smaller Companies | North American Smaller Companies | 12.3 |

| JPM Emerging Europe Equity | Specialist | 11.4 |

| CT American Smaller Companies | North American Smaller Companies | 10.6 |

| JPM US Small Cap Growth | North American Smaller Companies | 10.5 |

| Fidelity American Special Situations | North America | 9.9 |

| Schroder US Mid Cap | North America | 9.6 |

| VT Argonaut Absolute Return | Targeted Absolute Return | 9.5 |

Data source: Morningstar. Past performance is not a guide to future performance.

As I mentioned a couple of weeks ago, Baillie Gifford American is an old favourite, but it can be very volatile. It was the best-performing fund in 2020, with a one-year return of 121%. However, it fell by -3% in 2021 and -51% in 2022.

One of our demonstration portfolios recently invested in this fund. After the first couple of days it had lost 3.7%, but a week later it was showing an overall gain of 3.2%. We had braced ourselves for a bumpy ride, and so far have not been disappointed.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks