A US small caps rebirth?

After a prolonged period of underperformance relative to large caps, a look at how initial signs may point to a potential uptick in US small-cap stocks.

7th November 2024 11:53

For too long – a decade and a half – large-cap stocks have significantly outperformed small caps, and with good reason. We delve into why that might no longer be the case.

Large-cap stocks outperformed small caps during the 2007-08 global financial crisis. The subsequent zero-interest-rate policy also gave larger companies access to long-term, low-cost funding.1 Recently, the largest companies, collectively known as the Magnificent Seven, have been pioneering future technologies.2 They’ve delivered exceptional earnings, driving blue-chip markets to record highs.3

While this dominance continued throughout 2024, market breadth narrowed considerably. During the first half of the year, the Magnificent Seven accounted for more than half of the S&P 500’s total return.4,5 However, with recent volatility across equity markets revealing signs that new leadership might be on the horizon, we dare to ask …

Is now the right time to get back into US small caps? We provide three reasons why we believe all signs may be pointing to yes.

Benefiting from a soft landing

The US economy remains resilient. Incoming data and the US Federal Reserve’s (Fed) recent interest rate cut suggest inflation might be in the rearview mirror. It appeared the Fed, much to its credit, had successfully engineered a soft landing.

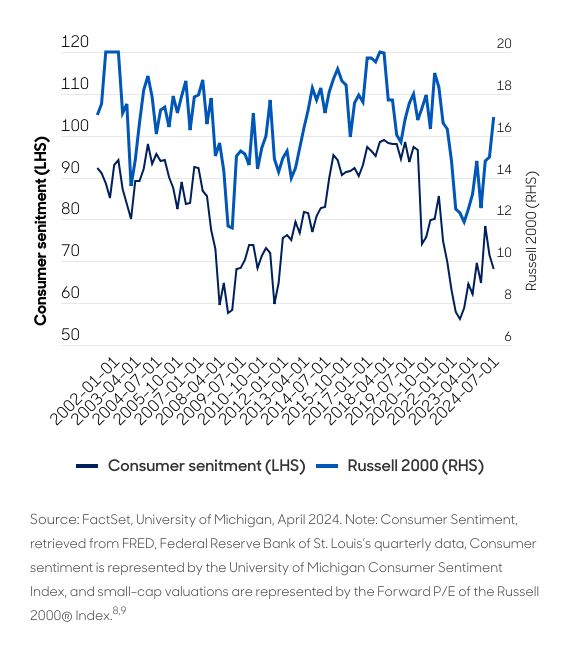

Why is this vital information? Since 80% of small-cap revenues are derived from domestic sources, their earnings potential is closely tied to the health of the US economy.6,7 This relationship is evidenced by the strong correlation between consumer sentiment and small-cap valuations (Chart 1).8

Chart 1. Small-cap value closely follows US consumer sentiment

The US economy's resilience is remarkable, especially when many developed countries are struggling with stagflation. This strength is anticipated to persist due to substantial investments in domestic industries, especially artificial intelligence. If economic growth remains strong, the earnings of small-cap companies could exceed those of large-cap companies beginning in 2025.

Not only are fundamentals expected to improve during this period, but this strength is also anticipated to align with the Fed’s easing cycle. While we expect the long end of the yield curve to remain anchored, short-term interest rate cuts will provide relief to some smaller companies with floating-rate debt (Chart 2).

Chart 2. Small caps rely more on floating or variable debt

Trading at a significant discount

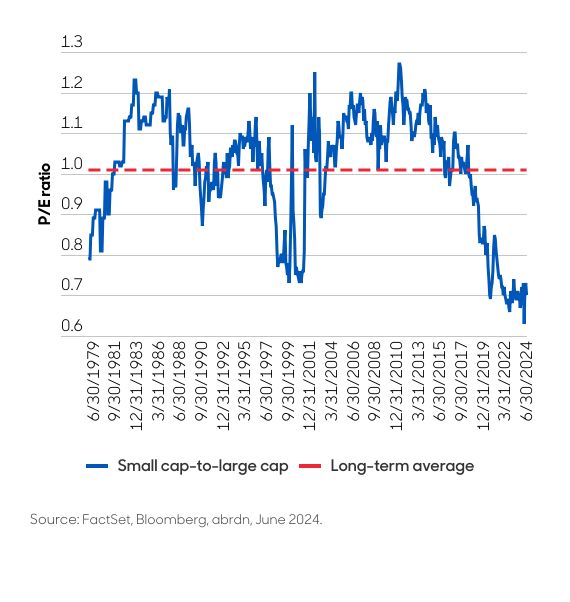

And then there are valuations. Historically, investors have paid higher multiples for small-cap growth potential. However, this trend has reversed due to large-cap tech stocks' soaring performance and valuations. For some time, smaller US companies have traded at a significant discount to large caps (Chart 3). Even with the recent shift in performance toward small caps since July, there remains a lot of room to go in the catch-up trade.

Chart 3. Relative valuations for small caps near all-time lows

Undervalued small caps have been reliable performers over the long term. Over the last 22 years, for example, small caps have delivered an average total return of 8.1% per year. Of those years, only seven were negative; in half of the years, the asset class posted a total return greater than 10%.10

Accessing a broader opportunity set

Small caps also offer exposure to a broader range of industries and sectors than large caps. About 40% of the S&P 500’s weight is concentrated in just two sectors: information technology and communication services (Chart 4).11

Chart 4. Tech performance less of a factor with small-caps

By contrast, these sectors only account for 15.6% of the Russell 2000's total value.9 The dominance of these sectors, which has recently benefited large caps, may soon become a headwind — particularly as tech-related companies face increasing regulatory scrutiny, especially with the upcoming elections.

The world of small-cap stocks is more diverse and receives less attention from research analysts compared to large-cap stocks. On average, large-cap stocks are each covered by 22 analysts, while small-cap stocks are covered by six. Due to the limited amount of information available, small-cap stocks are more likely to be mispriced. Additionally, there is typically more variation in their performance and valuations. This presents greater potential to identify companies that may outperform through thorough research and active management on more of a case-by-case basis.

While interest rates are falling, they remain above pre-pandemic levels. The Fed has also signalled it will move with caution. This should favour high-quality companies over their lower-quality peers. These are the companies we seek to hold in our own strategies.

Christopher Colarik is small-cap portfolio manager at abrdn.

Tom Harvey is senior equity specialist at abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

1 The zero Interest-Rate Policy refers to a macroeconomic concept where the central bank sets extremely low nominal interest rates – often at 0% – for its short-term benchmark.

2 The Magnificent Seven refers to a group of seven large companies in the US markets: Microsoft, Apple, NVIDIA, Alphabet, Amazon, Meta Platforms, and Tesla.

3 "Magnificent 7 Stocks Propel S&P 500, Nasdaq 100 To Record Highs As Jobs Data Fuels Rate Cut Bets; Gold Miners Rally: What's Driving Markets Friday?" Yahoo! Finance, July 2024. https://finance.yahoo.com/news/magnificent-7-stocks-propel-p-174519123.html.

4 The S&P 500® Index is an unmanaged index considered representative of the US stock market.

5 "Charted: The Surging Value of the Magnificent Seven (2000-2024)." Visual Capitalist, August 2024. https://www.visualcapitalist.com/cp/charted-the-surging-value-of-magnificent-seven-2000-2024/.

6 "A New Era for Small Caps?" Neuberger Berman, July 2024. https://www.nb.com/en/global/insights/insights-a-new-era-for-small-caps.

7 FactSet, August 2024.

8 The University of Michigan Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan.

9 The Russell 2000® Index is an unmanaged index considered representative of small‐cap stocks. The Russell 2000 Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co.

10 Russell and Columbia Threadneedle Investments, August 2024.

11 "9 Stocks Powered 40% Of The S&P 500's Surge To A New High." Investor's Business Daily, January 2024. https://www.investors.com/etfs-and-funds/sectors/sp500-stocks-powered-40-percent-of-surge-to-a-new-high/.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks