What I’d do with Netflix and Tesla stock now

A transformation at the TV streaming giant has been dramatic and its share price is up sixfold. There’s more newsflow from Tesla too. Analyst Rodney Hobson gives his view on both.

9th July 2025 09:02

First we were lured on to the internet with the promise that everything was free. Then we discovered that there is no such thing as a free lunch. Now we accept that stuff has to be paid for and are willing to pay monthly subscriptions that we rarely get round to cancelling. Internet providers are increasingly coming into their own – at the consumers’ expense.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

It has, admittedly been a difficult transformation for the likes of streaming service Netflix Inc (NASDAQ:NFLX), which has vacillated between charging advertisers so it could provide films for free and charging the customers for cutting out the adverts. It has realised that it can make money happily at both ends.

The unhappy period when it had to soak up criticism for breaking its word on never taking adverts and stand an exodus of unhappy subscribers is over. Viewers have accepted the reality of paying for whichever service they select.

And while all subscription services will suffer to a greater or lesser extent from churn, the big bonus (from the supplier’s point of view) of subscriptions that run until you get round to cancelling them is that inertia or forgetfulness on the part of consumers keeps the cash rolling in indefinitely.

Revenue was up 16% in the first quarter and another substantial increase in the second quarter is likely to be announced later this month. Netflix has warned analysts that their forecasts of just under $11 billion could be $500 million too low, thanks to continued high revenue from subscriptions, still the main source of income.

- US results preview Q2 2025: tariff turmoil hits growth forecasts

- Why dollar collapse is opportunity for UK investors

Just over half of new subscribers are opting for the service that includes advertising, which is slightly disappointing as that is the cheaper version, but it does mean that advertisers will be more inclined to book space. Advertising revenue for the full year could double to $3 billion.

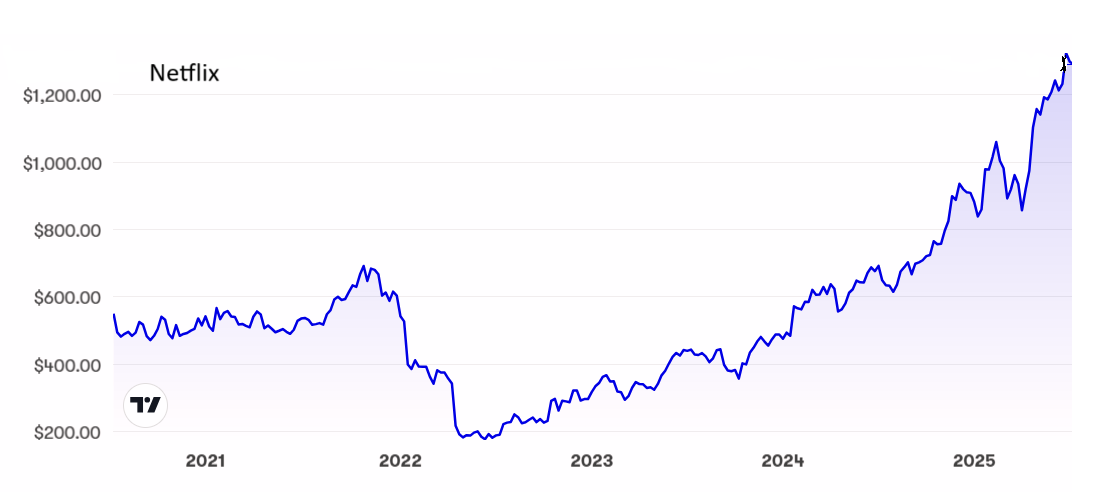

Netflix shares dipped below $200 just over three years ago when the outlook seemed very bleak indeed. They are now worth more than six times as much, but the momentum shows little signs of grinding to a halt.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: A lot of good news is already in the share price, with the price/earnings (PE) ratio at a massive 60-plus and it is always dangerous to buy just before results, but the rating has to be buy. For existing holders, there is no reason to take profits yet but there is undeniably an opportunity to cash in, say, half the holding and play on for free with the other half. Do be careful, though. Three years ago, many experts, including me, were unduly pessimistic. Overoptimism may have got the better of us this time.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- eyeQ: outlook for this favourite cyber security stock

Update: Just how much bad news can electric vehicle manufacturer Tesla Inc (NASDAQ:TSLA) take? Sales collapsed by almost 60% in Germany in the first half of this year to only 8,890 cars despite a 35% increase in electric vehicle sales in the country. Tesla’s decision to build a major factory there looks increasingly reckless as it now commands only 0.6% of the market.

Germany is only one disappointment among many. Although sales picked up a little in the UK in June, they were 1.7% lower in the first half. As in Germany, electric vehicle sales as a whole were markedly higher in Britain. Worldwide, the US carmaker produced 410,233 vehicles in the second quarter of this year, down 0.1% from a year earlier.

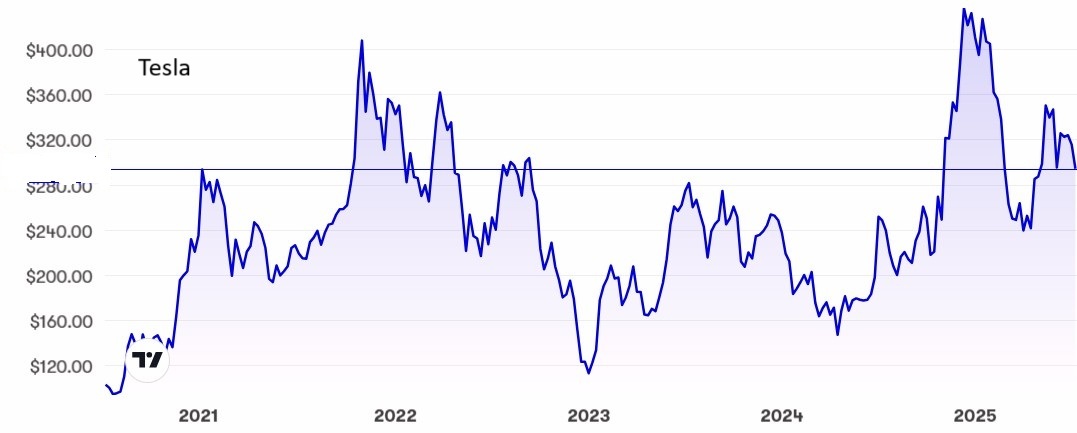

Source: interactive investor. Past performance is not a guide to future performance.

Tesla boss Elon Musk has decided to risk more wrath – and possibly sanctions – from US President Donald Trump by setting up a new political party to rival Republicans and Democrats. This will be another distraction for the mercurial Musk just when Tesla needs his full attention.

At just over $300, the shares are still well above levels seen earlier this year. I advised long-term investors to sell last month at $340. It is not too late to sell at the current lower price. There could be a dead cat bounce when numerous short sellers decide to get out, but the basic problems will remain. My previous comment that Tesla will present plenty of opportunities for short-term traders is still valid.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks