Why investors should tread carefully with thematic funds

In the latest monthly article, a Morningstar analyst provides an overview of thematic funds, highlighting which themes are the most popular and examining performance.

20th November 2024 08:57

Thematic funds have grown in size, number, and prominence in every major fund market globally over the past five years, and despite recent underperformance, they appear to be here to stay.

These funds offer investors the opportunity to capitalise on emerging megatrends such as artificial intelligence, ageing populations, and alternative energy, while mitigating the concentration risk of individual stock bets. However, these funds often come with higher costs, increased volatility, and unique complexities that require additional due diligence.

- Invest with ii: Top Investment Funds | Index Tracker Funds | What is a Managed ISA?

Below, we highlight some of the key takeaways from the latest instalment of Morningstar’s Global Thematic Fund Landscape.

Thematic assets have tumbled from 2021 peaks

Europe is home to the largest market for thematic funds. Assets invested in thematic funds domiciled in the region have more than doubled to $280 billion in the five years to mid-2024, although this growth has been far from linear.

The post-pandemic bull market proved particularly supportive of thematic funds, which were some of the best-performing funds of any stripe. From the market trough in March 2020 to its peak at the end of 2021, assets in European thematic funds more than tripled to a record $477 billion (£376 billion). This rise was supported by $215 billion in net inflows.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Thematic funds: winners, losers and the importance of timing

However, these funds were also among the hardest hit during the subsequent “tech reckoning”, with assets plummeting by more than 40% from the end of 2021 to June 30 2024.

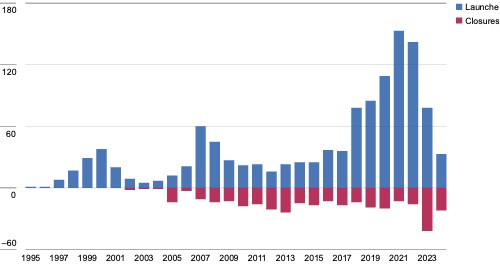

Thematic launches are highly cyclical

After the boom years of 2021-22, the number of new thematic fund launches in Europe has fallen, while fund closures have increased, although the former still outnumber the latter, indicating a lingering optimism among fund providers.

Source: Morningstar Research. Data as of 30 June 2024.

This broadly conforms to the historic pattern of thematic launches being a bull-market phenomenon. The number of thematic fund launches has been positively correlated with the performance of the broader equity markets.

The number of new thematic launches rose in the run-up to, and peaked immediately prior to, both the dot-com bubble and the global financial crisis before trailing off in the years that followed.

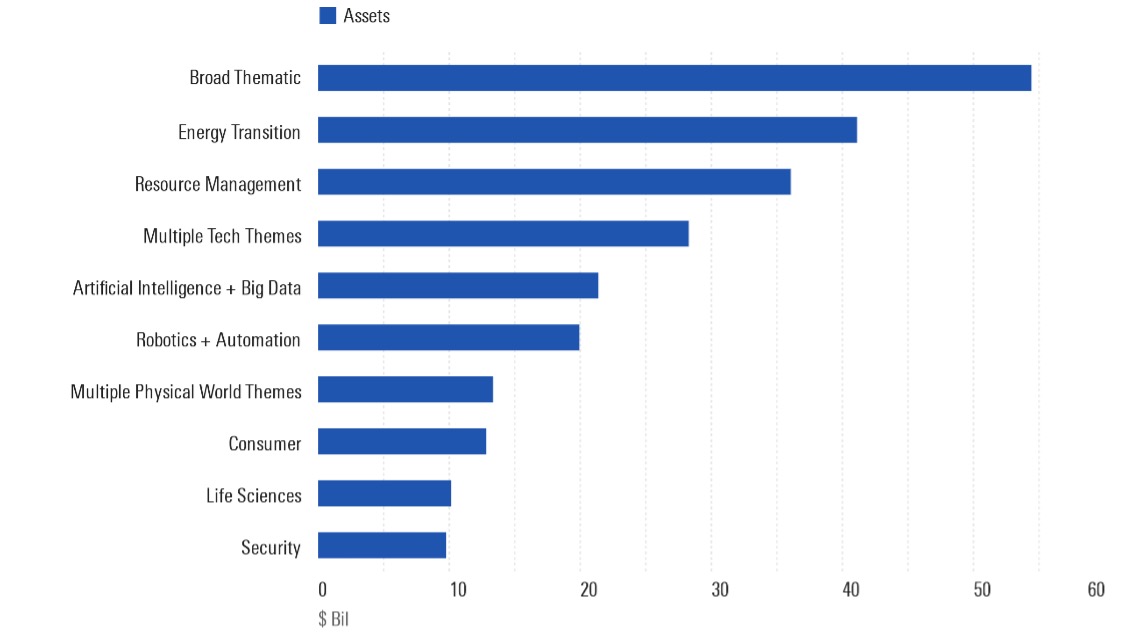

Investors spreading bets by favouring broad thematic funds

Accounting for $54 billion in assets under management, broad thematic funds remain the most popular theme grouping in Europe, which includes the largest thematic fund in Europe: Pictet-Global Megatrend Selection.

European Thematic AUM by Theme (USD Billion)

Source: Morningstar Research. Data as of June 30, 2024.

The booming popularity of environmental, social and governance (ESG) funds in Europe has spilled over into the world of thematic investing. In early 2020, the European Union Commission approved the European Green Deal, a set of initiatives to foster the transition of the EU's economies to carbon neutral by 2050. This, together with the huge government spending plans announced in late 2020 by the newly elected Biden administration in the US, prompted massive inflows into funds with an energy transition theme.

Despite significant outflows in the year to the end of June 2024, funds seeking to profit from the transition away from hydrocarbon-based energy sources, such as alternative energy funds, remain the second-most popular theme grouping in the region.

Most thematic funds exhibit a growth bias

Two-thirds of funds with an equity style have a growth tilt, meaning the style and size breakdowns of European thematic funds resemble those of their global counterparts. Notably, tumbling valuations for some themes have seen the percentage of funds with a value bias more than double to 14%, since the last instalment of Morningstar’s Global Thematic Landscape study in 2022.

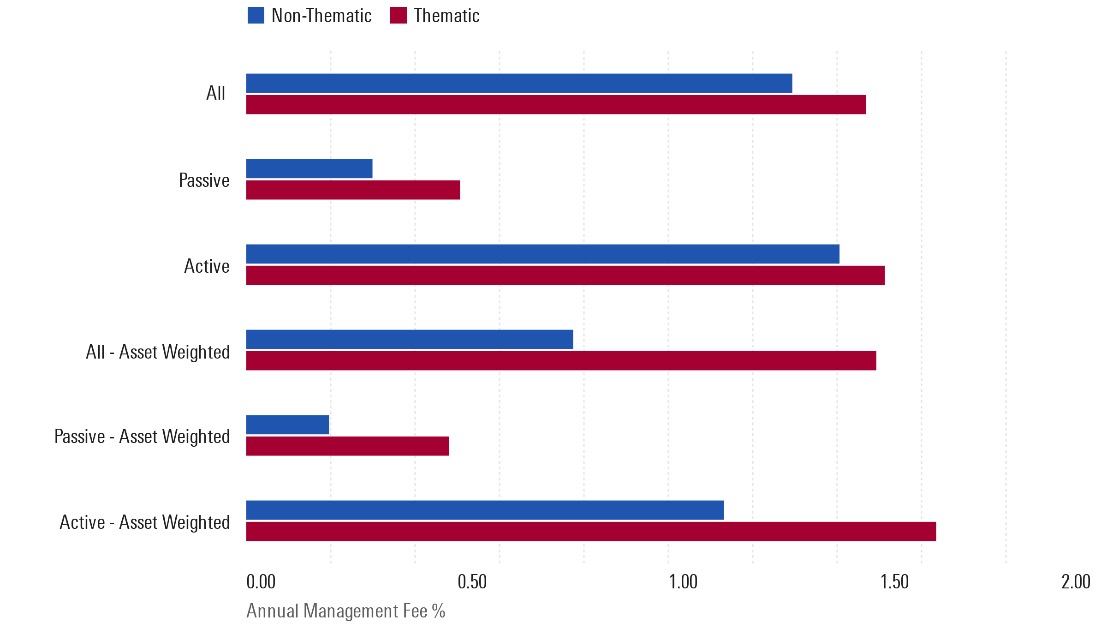

Thematic funds charge more

On average, both active and passive European thematic funds levy higher average management fees than their non-thematic counterparts. The difference is particularly striking when we look at asset-weighted fees, which highlight how popular thematic funds charge fees many multiples higher than those of the most popular non-thematic funds.

Source: Morningstar Research. Data as of June 30, 2024.

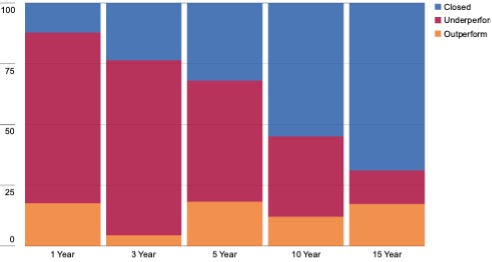

Most thematic funds have struggled to outperform

While thematic funds have experienced bursts of exceptional outperformance, longer-term returns have been poor. An astonishing 69% of the funds that existed in Europe in mid-2009 had closed by mid-2024. This attrition rate severely limited the chance of an investor picking a winner over this period. In fact, just 17% of funds survived and outperformed global equities over the period.

High relative fees compounded over many years contribute to the low success ratios versus a costless index.

In conclusion, despite recent performance challenges thematic funds have carved out a significant niche in the global investment landscape and appear here to stay.

While investors are often attracted by strong narratives and the promises of outsized returns, elevated fees and high attrition rates have contributed to low long-term success ratios versus a broad equity index and suggest investors should tread carefully.

Kenneth Lamont is senior manager research analyst at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks