Why we’re adding to one of our bond funds

In the third quarter, two bond sectors outperformed most equity sectors. To take advantage, Saltydog Investor added to one of its bond fund positions.

29th October 2024 09:29

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

To help our members make sense of the vast array of funds available, we put them into our Saltydog Groups, based on the volatility of the sectors they are in.

The two least-volatile sectors are Standard Money Market and Short Term Money Market. These are in our “Safe Haven” Group. The returns that you are likely to get from these funds is closely linked to the interest rate set by the Bank of England. When interest rates were very low, in the aftermath of the financial crisis and during the Covid pandemic, these funds only just about made enough to cover their management charges, and sometimes they failed to do that.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Over the past couple of years, interest rates have been higher and so the returns have gone up. In our demonstration portfolios, we hold the Royal London Short Term Money Market fund and the L&G Cash Trust fund. They have both gone up by around 5.25% in the past year. In times of uncertainty, they are a relatively safe place to invest, but the gains will always be limited. With interest rates beginning to fall, I would also expect the returns from these funds to start to drop.

- The highest-yielding money market funds to park your cash in

- Will interest rate cuts reduce returns on money market funds?

Funds in our “Slow Ahead” Group can generate higher returns, but they are a bit more volatile. We have recently reduced the amount invested in the money market funds and added to one of the funds that we were already holding from the “Slow Ahead” Group.

The Slow Ahead Group is made up of the funds in the £ High Yield, £ Corporate Bond, £ Strategic Bond, Targeted Absolute Return, and the mixed investment sectors. There are three mixed investment sectors. Mixed Investment 0-35% Shares, Mixed Investment 20-60% Shares, and Mixed Investment 40-85% Shares.

When equity markets are performing well, I would expect the mixed investment sectors to do better than the bond sectors. I would also expect the sector that has the most exposure to the stock markets, Mixed Investment 40-85% Shares, to do better than the other mixed investment sectors.

That was certainly the case earlier this year. The Mixed Investment 40-85% Shares sector was the best-performing sector in the Slow Ahead Group in the first and second quarters of the year.

However, in the third quarter the bond sectors beat the mixed investment sectors. In fact, the £ High Yield and £ Strategic Bond sectors, outperformed all the other Investment Association (IA) sectors apart from China/Greater China and Infrastructure.

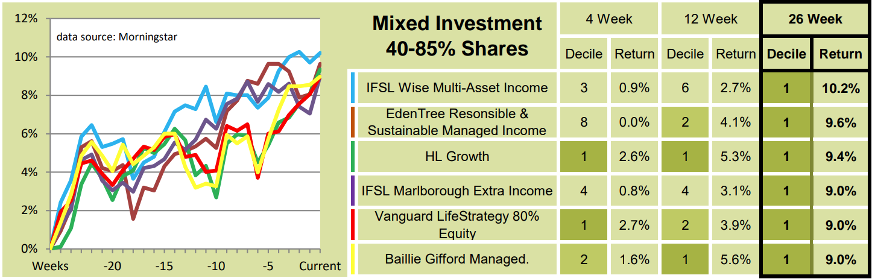

When we looked at our analysis last week, the Mixed Investment 40-85% Shares sector was back at the top of the “Slow Ahead” Group, based on its performance over four, 12 and 26 weeks.

These were the leading funds over the previous 26 weeks.

Past performance is not a guide to future performance.

During this period they had made gains ranging from 9.0% to 10.2%, but it had been a bumpy ride.

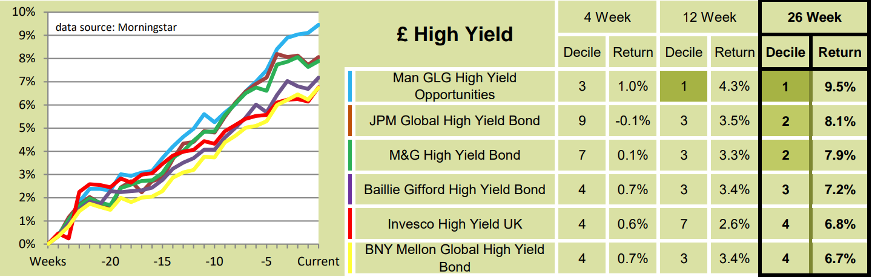

The next best-performing sector in the Slow Ahead Group was £ High Yield.

These were the top funds, based on their 26-week returns.

Past performance is not a guide to future performance.

They had risen by somewhere between 6.7% and 9.5%, which was slightly lower than the Mixed Investment 40-85% Shares sector, but they had been much less volatile.

We have held the top fund, Man GLG High Yield Opportunities, in our Ocean Liner portfolio for a little while, and have just added to our holding. Our Tugboat portfolio has now invested in this fund as well.

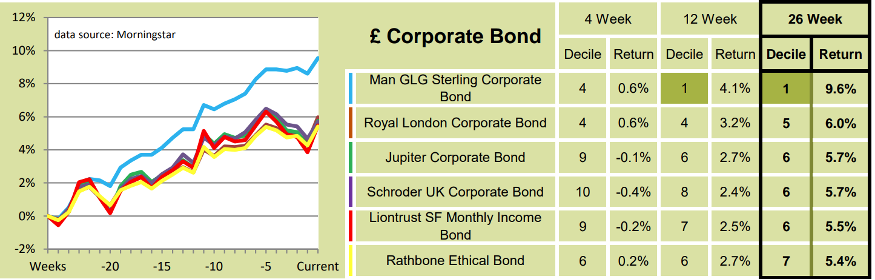

The leading funds in the other bond sectors had also continued to make steady progress.

Our Ocean Liner portfolio holds the top fund in the £ Corporate Bond sector, the Man GLG Sterling Corporate Bond fund. Last week, it was showing a 26-week gain of 9.6%, which also compared favourably with the leading funds in the £ High Yield and Mixed Investment 40-85% Shares sectors.

Past performance is not a guide to future performance.

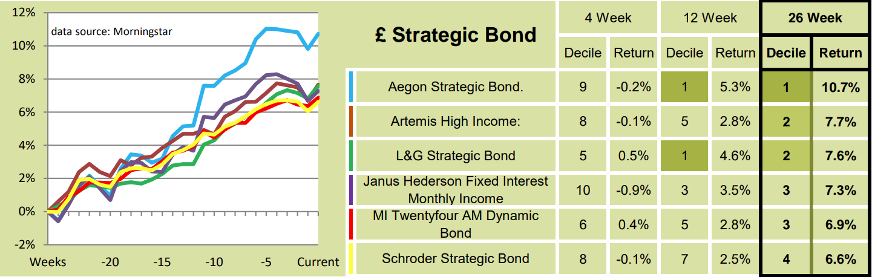

The Aegon Strategic Bond fund, from the £ Sterling Bond sector, had done even better, up 10.7% in 26 weeks, but it was slightly down over the past four weeks.

Past performance is not a guide to future performance.

We are not holding the Aegon Strategic Bond fund in any of our portfolios at the moment, but we are invested in the L&G Strategic Bond fund, which is third in the table.

With the ongoing war in Ukraine, the tensions in the Middle East, and the upcoming election in the US, I am nervous about stock markets around the world. For the time being, we are happy having most of our investments in funds from the money market and bond sectors.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks