Why we’ve dipped our toes back into Baillie Gifford American

Saltydog Investor looks at how US funds have performed since the election, which has prompted a small allocation to an old favourite.

18th November 2024 15:02

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There have been numerous elections around the world this year, but the most important, from a global economic perspective, has been the recent presidential election in the US.

While commentators predicted that it would be too close to call, in the end Donald Trump secured a resounding victory. Not only did he secure the most electoral votes, 312 compared with Kamala Harris’ 226, but he also won the popular vote. The Republican Party now has a majority in the Senate and the House of Representatives, giving him a strong mandate to push through his policies.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

Love him or loathe him – and there does not seem to be much middle ground – there is no denying that he ran a very effective campaign. He kept his message very simple. He would “Make America Great Again”. To do this, he would take an “America First” approach to foreign policy and trade, enforce stricter immigration policies and border security, and implement economic policies aimed at job creation and prosperity.

In polls, the economy was often ranked as the top issue by voters. A key part of Trump’s messaging was the use of the question famously posed by Ronald Reagan during his 1980 campaign against incumbent Jimmy Carter: “Are you better off now than you were four years ago?” Trump encouraged voters to compare his previous term with the Biden-Harris years, drawing attention to recent issues such as high inflation, energy prices, and the cost of living.

- The sectors the pros are watching after US election

- Trump wins – what does it mean for sustainability?

- What the US election result means for investors

Many Americans are still struggling after the highest inflation in 40 years, and are dissatisfied with the nation's economic progress. Trump’s vision for the economy appears to have been a significant factor in his recent victory. Whether he can deliver is yet to be seen.

US stock markets rose immediately after the result, anticipating a low-tax, regulation-light, and pro-business environment for the next few years. On the day that his victory was confirmed, the S&P 500 rose by 2.5%, the Nasdaq went up by 3.0%, and the Dow Jones Industrial Average gained 3.6%. All three indices closed at all-time highs.

At the same time, the dollar strengthened. Before the election, a UK pound would have bought you around $1.30, now you will only get $1.26.

Our latest fund analysis also reflects this renewed confidence in US stocks.

In the first three months of this year, the leading sector was Technology & Technology Innovation, with a three-month return of 11%. Although they do not have to, most funds in this sector are invested in some, if not all, of the large US technology companies such as Amazon.com Inc (NASDAQ:AMZN), Apple Inc (NASDAQ:AAPL), Alphabet Inc Class A (NASDAQ:GOOGL), Microsoft Corp (NASDAQ:MSFT), Facebook-owner Meta Platforms Inc Class A (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA) and Tesla Inc (NASDAQ:TSLA) – the so-called Magnificent Seven. The next best performing sector was North America, up 10.8%.

In the second quarter, the India/India Subcontinent sector led the way, up 10.6%, followed by UK Smaller Companies, which rose by 7.3%. The North America sector went up only by 1.7%, and the North American Smaller Companies sector went down by 3.3%.

- Fund managers explain what Trump victory means for US markets

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: a tax warning for UK and US investors

The sectors focusing on the US also struggled in the third quarter of this year. North American Smaller Companies went up only by 1.5%, while North America fell by -0.1%, and Technology & Technology Innovation lost -4.8%.

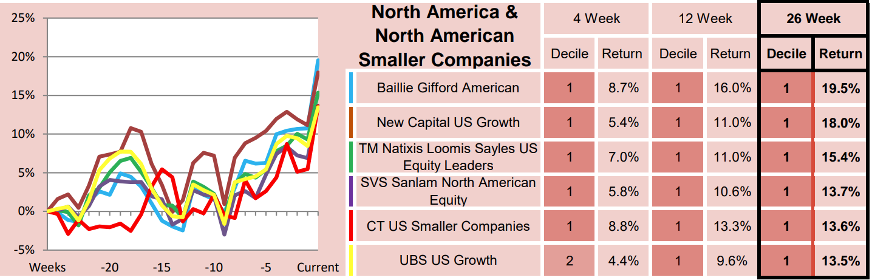

However, when we looked last week, our combined North America & North American Smaller Companies sector was once again the clear leader over the past four weeks. It had risen by 5.2% in four weeks, 8.2% in 12 weeks, and 9.4% in 26 weeks. Some of the best-performing funds had done much better.

Past performance is not a guide to future performance.

At the top of the table, based on its performance over the past 26 weeks, was the Baillie Gifford American fund.

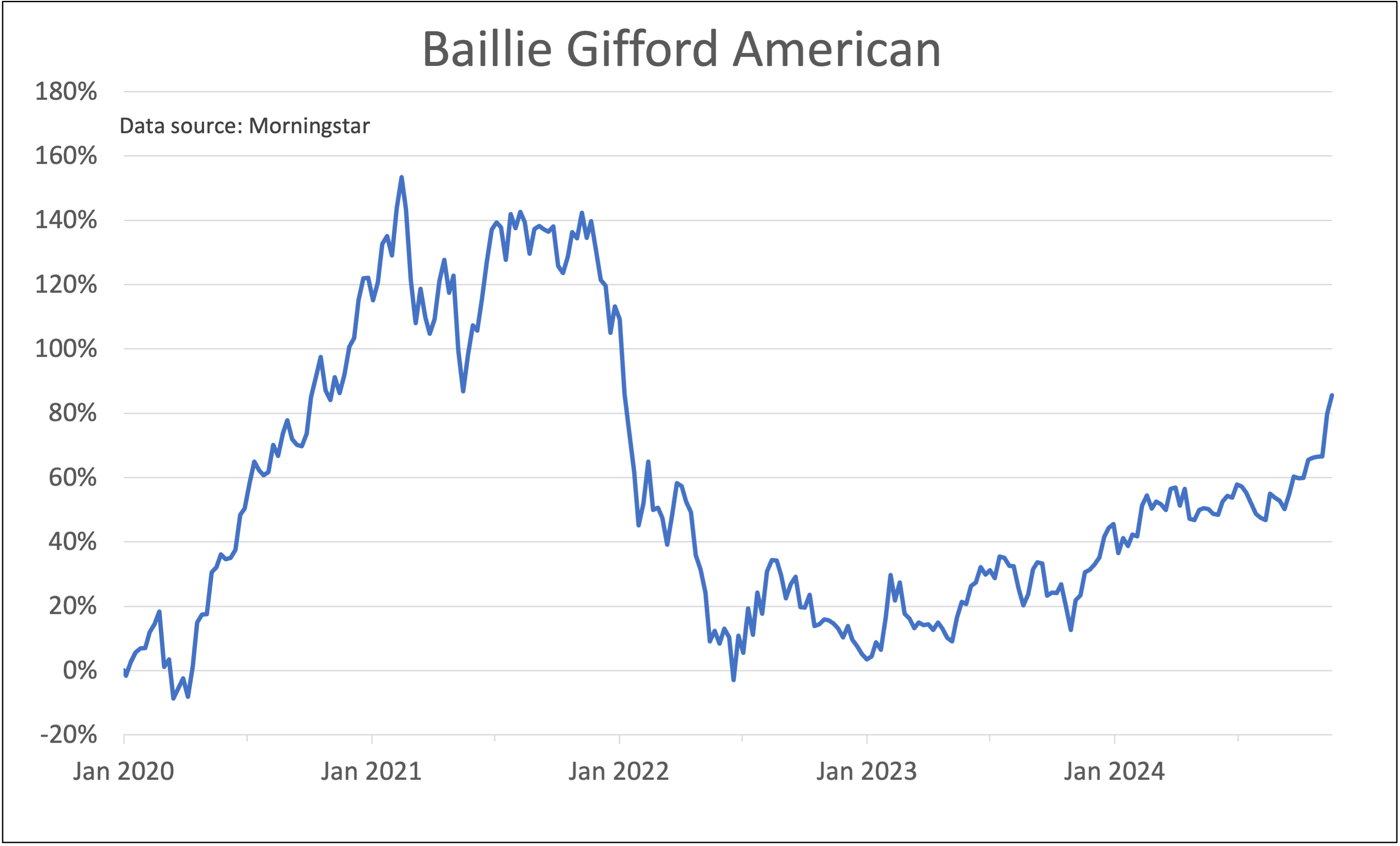

This is an old favourite of ours. We know that it can be very volatile, but when it does well it does really, really well. It was the best-performing fund in 2020 with a one-year return of 121%. However, it then fell by -3% in 2021 and -51% in 2022.

Past performance is not a guide to future performance.

Our concern is that having gone up so quickly in the past few months, the Baillie Gifford American fund might now run out of steam.

However, it has also still got a long way to go to get back to where it was when it peaked in 2021. Last week, one of our demonstration portfolios made a small investment in this fund. We will be watching it closely.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks