Fund Spotlight: this fund taps into a powerful long-term trend

The ii Research Team offers an update and view on a fund poised to benefit from future smart energy trends.

16th October 2024 09:00

Global energy demand is expected to more than double in the next 25 years, coinciding with the urgent need for decarbonisation. Renewable energy use is projected to surge from 26% today to 90% by 2050, with the demand for smart energy solutions growing exponentially.

Smart energy refers to the use of advanced technology and systems to manage, produce, distribute and consume energy more efficiently, sustainably and reliably. This shift toward sustainable solutions offers significant long-term investment opportunities.

Adding to this momentum, the Inflation Reduction Act (IRA), signed by President Joe Biden in 2022, is a landmark US law aimed at reducing inflation and boosting the clean energy sector. The IRA allocates more than $369 billion (£282 billion) to energy security and climate change initiatives, with more than half the funding dedicated to US investments.

The act offers tax incentives, rebates and subsidies to encourage the development of renewable energy, electric vehicles (EVs), and energy-efficient technologies. By promoting domestic manufacturing and reducing reliance on fossil fuels, the IRA is expected to significantly accelerate the transition to smart energy in the US.

The Biden administration also recently finalised the increases to Chinese tariffs, and irrespective of whether the Republicans or the Democrats win next month’s election, it seems that the US government’s protectionist stance on trade with China is likely to stand. These tariffs include a 100% tax on EVs, 25% on lithium-ion EV batteries, 50% on photovoltaic solar cells, and a 50% tariff on semiconductors starting in 2025. This development provides a structural advantage for investors focusing on smart energy solutions, particularly within the US market and outside China.

The Polar Capital Smart Energy I Acc fund aims to capitalise on these favourable trends, with more than half the portfolio allocated to the US, investing in companies driving the transition to smart energy through technological innovations and services. The fund’s core focus is on decarbonisation and electrification, seeking long-term capital growth by investing in businesses aligned with the global shift towards a more sustainable energy sector.

The £250 million fund is managed by seasoned expert Thiemo Lang, who brings more than 20 years of experience in the alternative energy space. Supported by a highly specialised thematic equity team, Lang combines his engineering background with deep technical knowledge to identify investment opportunities.

What does the fund invest in?

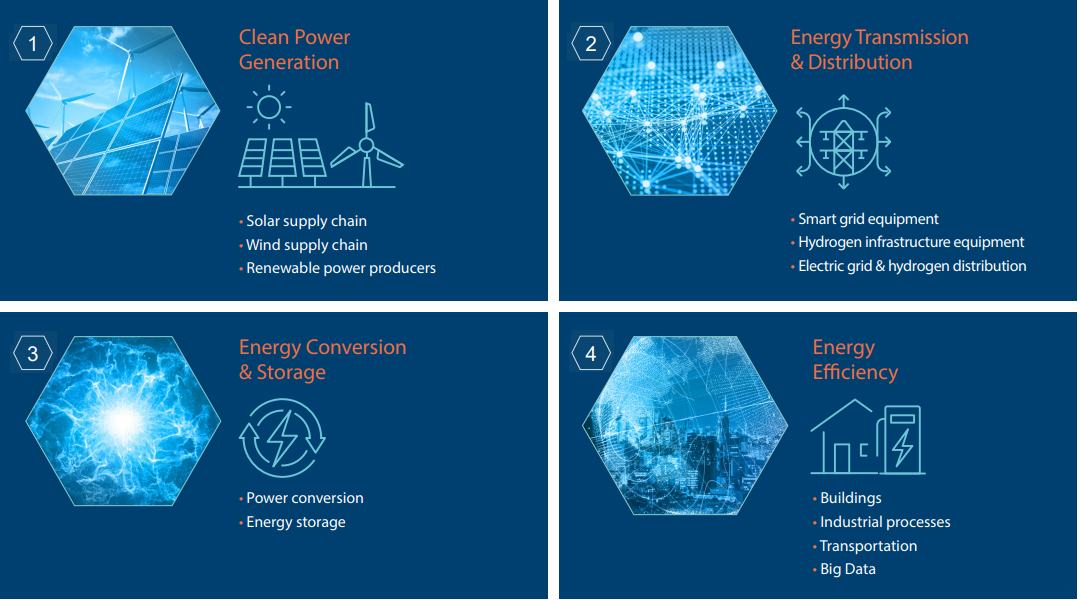

The fund employs rigorous fundamental research to identify high-quality growth companies trading at attractive valuations. These companies must align with one of the four investment clusters identified in the smart energy sector: clean power generation, energy transmission and distribution, energy conversion and storage, and energy efficiency.

The latter constitutes between 40%-50% of the fund’s holdings, reflecting the focus on optimising the entire smart energy value chain.

The team begins with an investable universe of around 250 stocks, conducting detailed analysis on roughly 80 of them. The final portfolio typically holds between 40 to 80 stocks and currently includes 47. This specialised approach allows for thorough research and high conviction in the selected stocks.

The fund’s top 10 holdings account for 40% of its assets, demonstrating strong conviction in its positions. Geographically, 51% of the portfolio is allocated to the US, with 10% in Japan and a relatively small 2% allocation to China, despite China’s significant role in global clean energy.

In terms of sectors, the portfolio is heavily overweight in technology, at 57% versus the MSCI All Country World Index’s (ACWI) 25%, with additional exposure to industrials (28%), basic materials (8%), and utilities (7%).

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Royal London Sustainable Leaders’ Mike Fox: three ‘world-leading’ UK shares we’ve owned for over a decade

A notable focus for the team is investing in energy efficiency to address the rising energy demands of advanced computing and artificial intelligence (AI). One example is Vertiv Holdings Co Class A (NYSE:VRT), which represents 3% of the portfolio and specialises in building data centres and implementing energy-efficient solutions, such as thermal management and chip cooling.

Throughout 2024, the fund has avoided major EV names such as Tesla Inc (NASDAQ:TSLA), given the sector's dominance by China. Instead, it has focused on companies within the EV supply chain, such as power semiconductor manufacturers, which have higher barriers to entry and offer better profit margins, as well as increased diversification of customer across the portfolio.

How has the fund performed?

Although the fund has a shorter track record (having launched in September 2021), Lang’s 14-year experience managing a similar strategy at Robeco lends credibility to the approach. Three of Lang’s analysts moved to Polar Capital with him, bringing the time-tested approach with them.

One significant factor in the fund’s performance has been its high active share of 97%, meaning it looks completely different from the MSCI ACWI benchmark. This makes comparisons with the benchmark less relevant. Despite market volatility, the Polar Capital Smart Energy Fund has outperformed its peers over the last two years, delivering a three-year return of 4.6%, compared to the Alternative Energy Sector’s -21% return.

Low returns in recent years can be attributed to the interest-rate sensitivity of the sectors the fund invests in. High global interest rates have driven up the cost of capital, hindering growth in alternative energy businesses. The sector has also experienced sentiment-driven swings, with investor optimism boosting returns in previous years, followed by more recent declines due to market pessimism.

| Investment | 01/10/2023 - 30/09/2024 | 01/10/2022 - 30/09/2023 | 01/10/2021 - 30/09/2022 | 01/10/2020 - 30/09/2021 | 01/10/2019 - 30/09/2020 |

| Polar Capital Smart Energy | 3.1 | 6.7 | -4.9 | ||

| MSCI ACWI NR USD | 19.9 | 10.5 | -4.2 | 22.2 | 5.3 |

| Alternative Energy Equity Sector | -2.0 | -17.2 | -2.3 | 27.5 | 38.1 |

Source: Morningstar Total Returns (GBP) to 30/09/2024. Past performance is not a guide to future performance.

Why do we recommend this fund?

The global shift towards electrification and renewable energy is inevitable, and the Polar Capital Smart Energy Fund is well-positioned to capitalise on this trend. By focusing on companies at the forefront of smart energy innovation, the fund taps into both regulatory support and long-term industry tailwinds, particularly with its heavy bias towards the US.

The fund’s sectoral concentration may contribute to heightened volatility, and it has encountered short-term performance challenges due to tough macroeconomic conditions. However, the fund’s forward-looking strategy and strong emphasis on sustainability position it as an attractive option for investors looking to tap into the expanding alternative energy market, especially as elevated global interest rates begin to ease. The fund holds a spot on ii’s ACE 40 list as a specialist choice.

Please find the latest factsheet here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks