Pound-cost averaging versus lump-sum investing

We look at how making small regular contributions stacks up against lump sum investing.

10th March 2025 11:22

We look at how making small regular contributions stacks up against lump sum investing.

Most of us have few opportunities in our lifetime to invest large lump sums in one go. But if you do have some spare income, monthly direct debits from your current account into a regular saving scheme are a practical, painless and hassle-free way to get into an investing habit. And the fact is that many small contributions can build into a sizeable pot.

So, what are the advantages and drawbacks of a regular investing strategy?

Pound-cost averaging

One key argument for regular investing is the effect of pound-cost averaging. Simply put, pound-cost averaging allows savers to benefit from market volatility over the long term by investing a small amount regularly, because it allows them to buy units more cheaply on average.

Say you invest £100 a month. In the first month, the share price of whatever you are investing in is £5, allowing you to buy 20 shares. If the share price falls to £4 in the following month, you will buy 25 shares, leaving you with 45 shares and a smile on your face when the share price rises again.

If you initially spent a lump sum of £200 on the shares, you would now have just 40 shares. In a volatile market, the average price per share tends to work out lower when you save regularly – in this case, the price per share is £4.44 against £5.

Pound-cost averaging is sometimes also touted as an investment strategy for people in a position to choose between investing everything in one go, or drip-feeding cash into an investment to avoid the pain of full exposure to a market downturn. However, as with most aspects of investing, there are several factors to consider.

Yes, regular investing can ease the effects of downward share price movements, but it also limits gains in a booming market. If you invested that £200 only to see the £5 share price double over the next month, you would be sitting pretty, with 40 shares now worth £10 each, a total of £400.

In contrast, a regular investor's £100 monthly contribution would have bought 20 shares at £5 in the first month but only 10 at £10 in the following month, a total of 30 shares worth £300.

This suggests that the “lump sum versus regular investing” debate hinges on market conditions when you invest your money.

It is notoriously difficult to time the market, and impulsive investing is, statistically speaking, one of the worst money habits you can have. Lump-sum investors tend to take a more impulsive, market-timing approach to investing that can be counterproductive.

In contrast, regular investors develop the habit of investing money each month regardless of market conditions.

One of the factors that benefits investments most is time in the market: investing for the long term is one of the most rewarding habits you can acquire. So are you better off investing a lump sum for many years than drip-feeding the same amount overall into the market over time?

Lump sum investing wins out long term

Unfortunately for regular investors, the data suggests you are. Several studies of various portfolios over different periods have found that leaving a lump sum invested will, in most cases, net you a greater return than you would get investing fractions of that sum regularly over the same period.

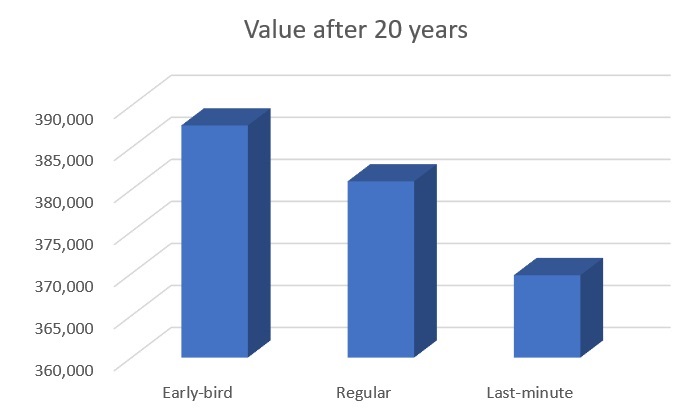

Research by interactive investor (ii) showed that over a 20-year period*, investors who paid in the full amount to their ISA each year would have invested a total of £206,560. Achieving the FTSE All Share total return, excluding charges, so-called early-bird investors (those investing their lump sum at the beginning of each tax year) would now have a portfolio worth £387,629. Regular investors would be sitting on £380,979, while last-minute investors would have £369,812.

Our analysis confirmed other studies that show lump-sum investing is the most profitable route to success – as your money is invested for longer. But the difference over 20 years is not as great as you might expect, and most of us do not have £20,000 to invest in one go at the start of the tax year. What it does show is that investing in the markets is typically beneficial.

Over the past couple of decades, we have seen the dot-com bubble burst, the financial crisis and a pandemic – yet, despite these spectacular market events, investors have seen their money grow significantly.

So, whether you are lucky enough to have a lump sum, or are investing one month at a time, investing something is likely to be beneficial to your long-term wealth.

Distinct advantages

That the disparity seems more pronounced over time shows that lump-sum investors enjoy two big advantages. One is that their entire investment is in the market for longer, and because stocks tend to go up over the long term, fully investing as early as possible means their entire investment is exposed to this upside.

The second big positive is that the power of compound returns on the whole sum means your capital growth rolls up quicker than it does with incremental injections of cash. Plus, more reinvested capital gets straight to work, generating further returns.

An additional potential advantage with lump-sum investing relates to cost. Regular trading can erode your capital significantly over the long term.

That said, many platforms – such as ii – offer free trading on regular investing. If you take a bit of time to ensure you use the platform best suited to your investment style, costs might not be a major problem. Also, many platforms accept minimum regular investments as low as £25 a month.

Despite the relative downsides of regular investing, there are some plus points, not least the impact on our psychological wellbeing.

The security that comes with a safer approach might give some investors more peace of mind. A portfolio bought with a lump sum rises and falls with the markets, while an incremental portfolio tends to see a smoother – if slower and less impressive – rise in value.

Time is of the essence

The above examples are based on longer periods. If you are trying to decide between investing annually or monthly, the advantages of front-loading may not apply, as markets can be more volatile over one year than over a decade.

Remember, the key factor is time in the market. There is no sense in saving to invest a lump sum later, rather than investing what you can immediately.

In the end, if you have the money to invest a sizeable sum for the long term, the statistics suggest you will be better off investing it all immediately, as you are likely to benefit from time in the market.

But if you would rather avoid the stress of risking the whole sum or the regret you might feel if markets fall, incremental investment may suit you better.

*the 20 years to 5 April 2019.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks